Stay Informed and Stay Ahead: Market Watch, August 13th, 2024.

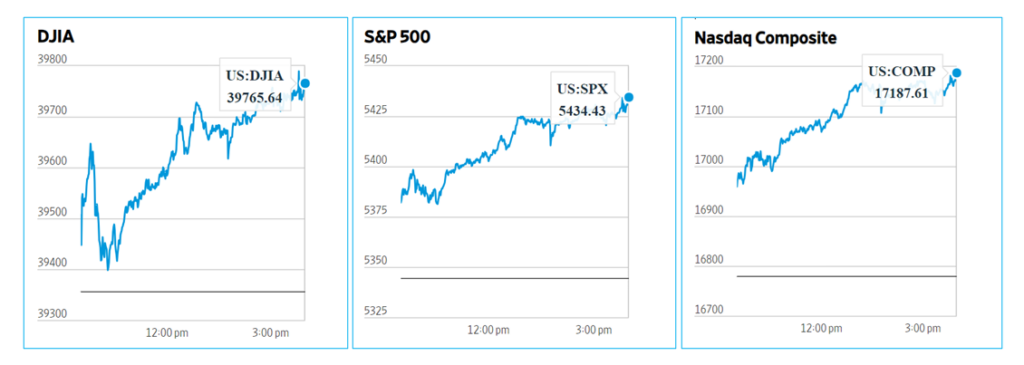

Early-Week Wall Street Markets

Key Takeaways

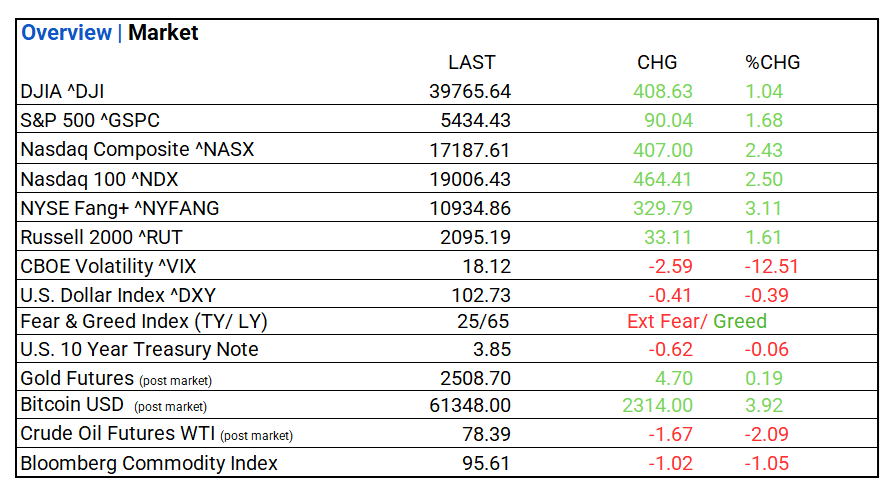

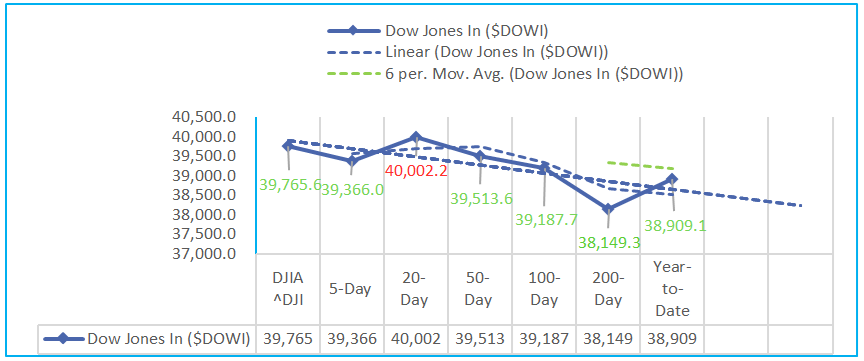

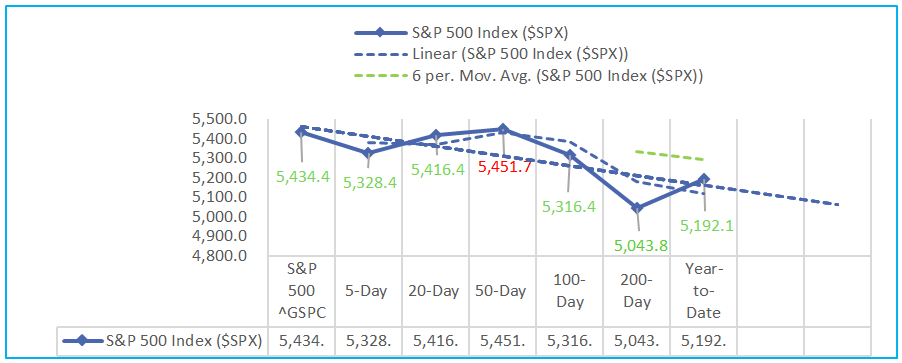

- Markets: DOW, S&P 500, and NASDAQ gain; VIX normalizes. Tech leads, Energy lags. Top industry: Semiconductors.

- Inflation: PPI pulls back and exceeds expectations; CPI report upcoming.

- Yields & Commodities: Yields fell, with short-term notes seeing larger declines. Commodities mostly lower, except gold, natural gas, and wheat. Bloomberg Commodity Index decreased.

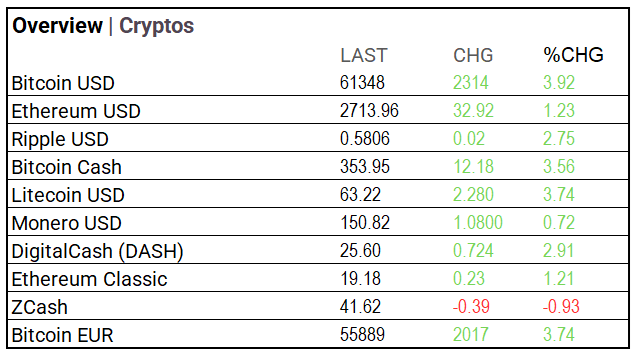

- Crypto & ETFs: Bitcoin up to $61,348; Direxion Daily Semiconductor Bull 3X Shares rose 12.32% on 102.4M volume.

Market Summary

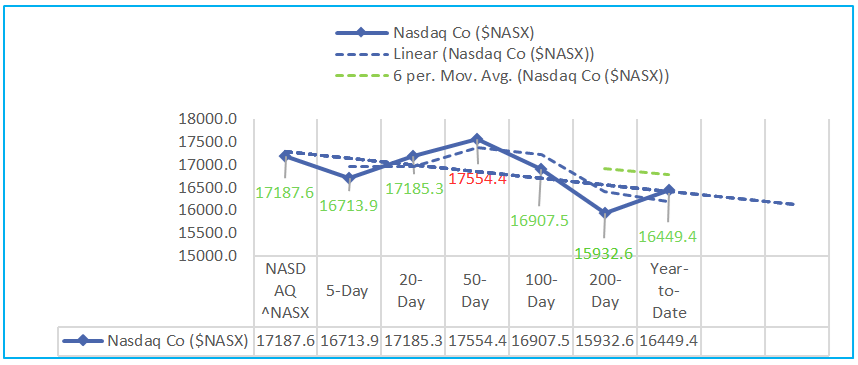

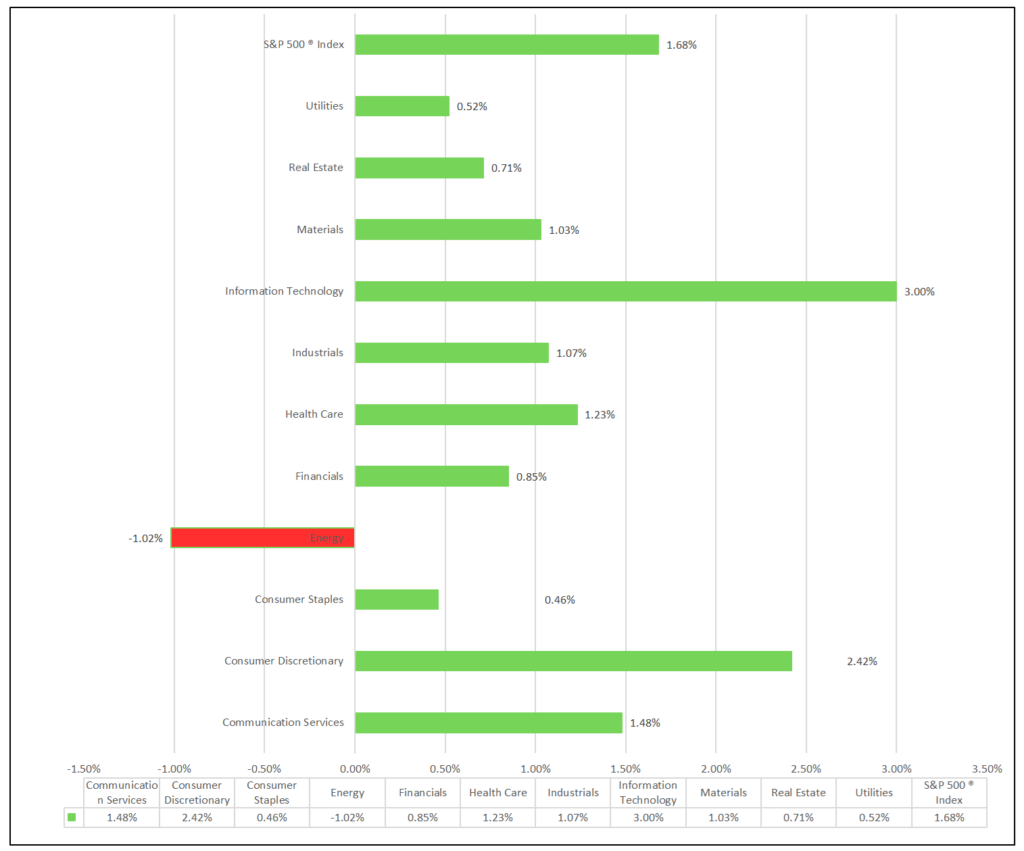

Indices & Sectors Performance:

- DOW, S&P 500, and NASDAQ rose. All but Energy sectors advanced, with Semiconductor & Equipment (+5.45%), Automobiles (+4.75%), and Textiles (+3.78%) leading.

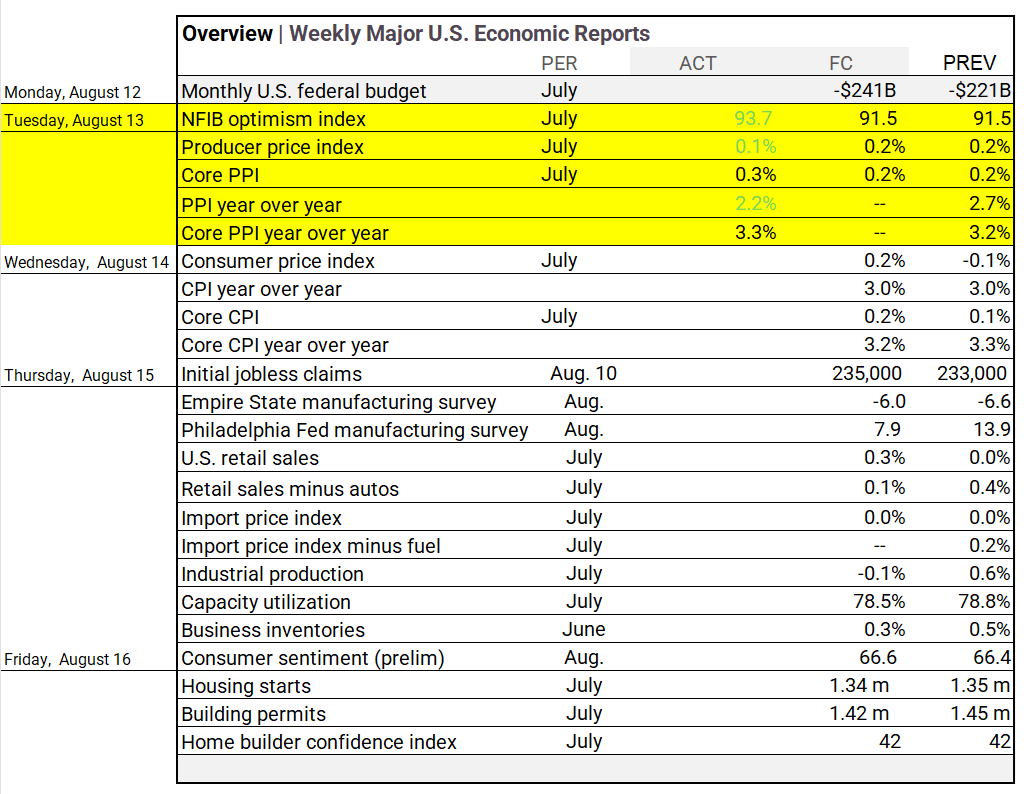

Economic Highlights:

- PPI rose 0.1% in July, below 0.2% expected; core PPI up 0.3%. Year-over-year PPI was 2.2%, core PPI at 3.3%. NFIB optimism index increased to 93.7

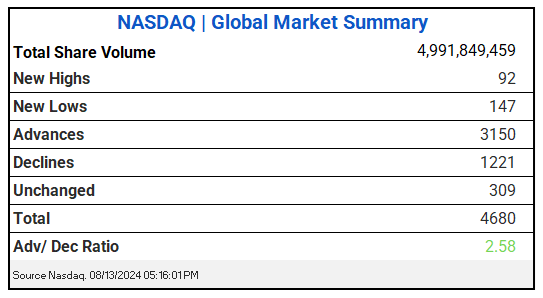

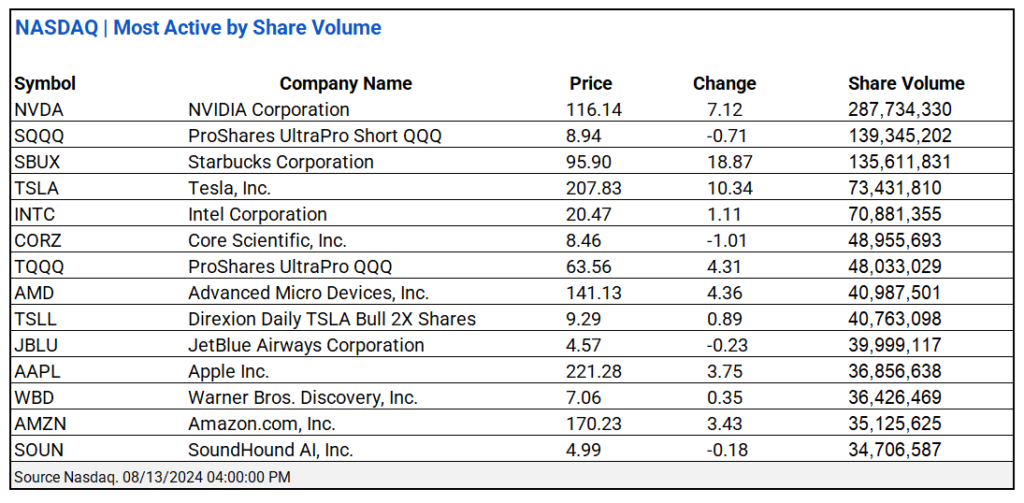

NASDAQ Global Market Update:

- NASDAQ saw 4.99B shares traded with a 2.58 advance/decline ratio. NVIDIA and ProShares UltraPro ^SQQQ led.

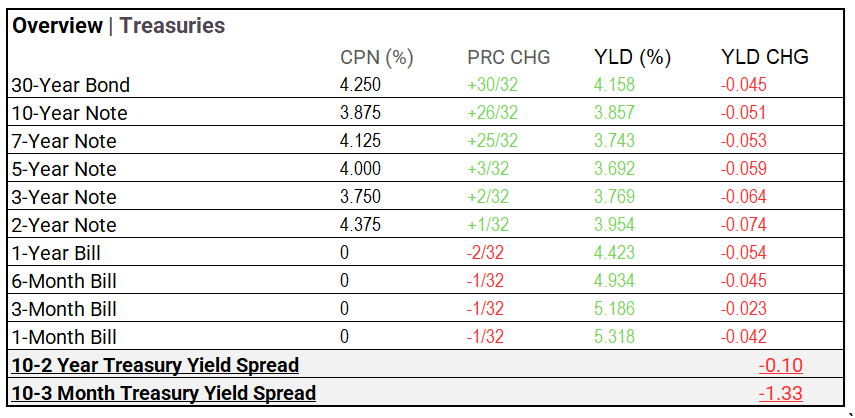

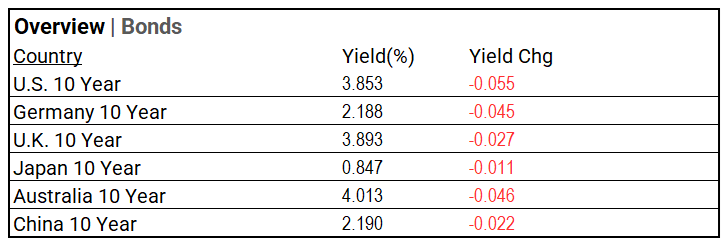

US Treasuries & Bond Markets:

- Yields fell across most maturities, with notable declines in short-term notes. The 3-Year Note had the largest drop.

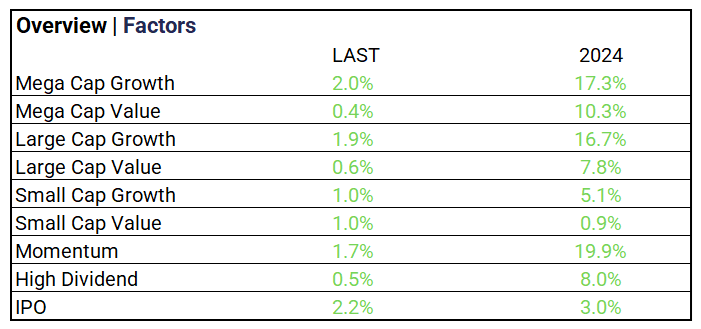

Market Factors:

- Mega Caps, Growth, and IPOs led trading.

Volatility:

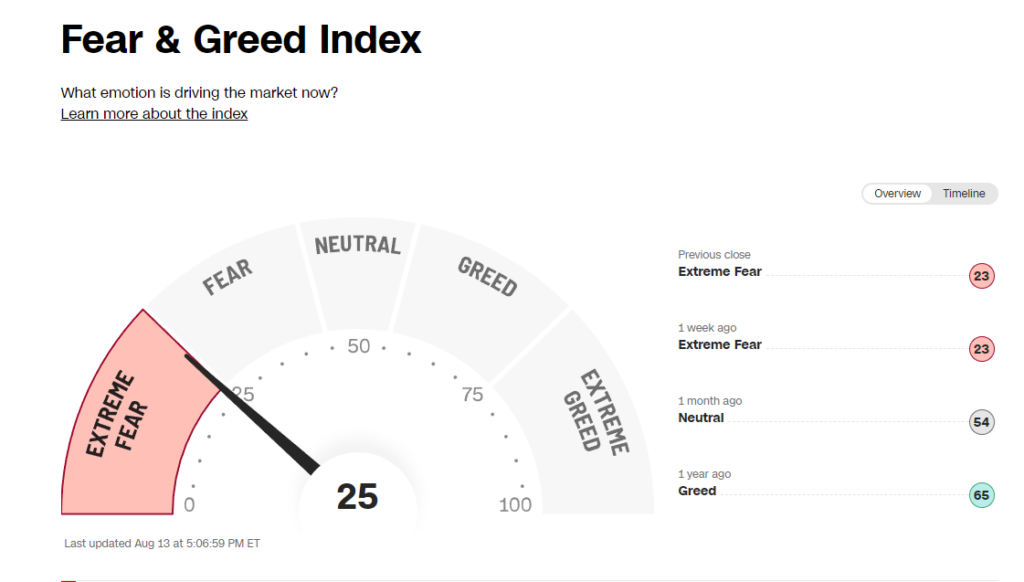

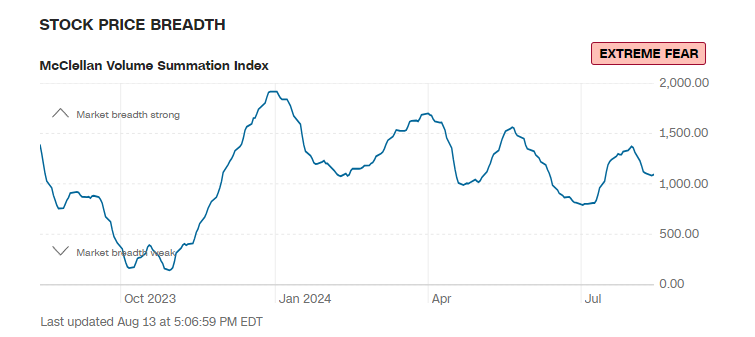

- VIX normalized to 18.12 (-12.51%). Fear & Greed Index moved from “Greed” to “Extreme Fear.”

Commodities & ETFs:

- Commodities mostly lower, except gold, natural gas, and wheat. ETFs: GraniteShares 2x Long NVDA Daily ETF rose 13.05%, Direxion Daily Semiconductor Bull 3X Shares up 12.32%.

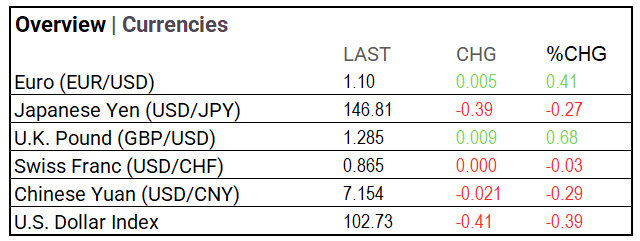

Cryptocurrency & Currency:

- Bitcoin rose 3.92% to $61,348. Gains in Bitcoin Cash (3.56%) and Litecoin (3.74%), while Ethereum (1.23%) and Ripple (2.75%) also increased. ZCash fell 0.93%.

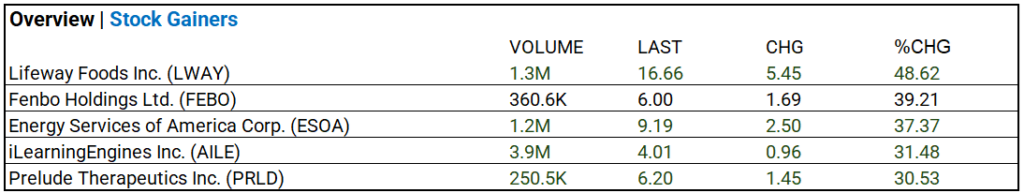

Stocks:

- Lifeway Foods Inc. (LWAY) surged 48.62% with 1.3M volume.

Notable Earnings:

- Home Depot, Nu Holdings, Flutter Entertainment, and Nidec beat estimates. Sea, Tencent Music, and ChipMOS missed. Flutter Entertainment up 9.57% after hours.

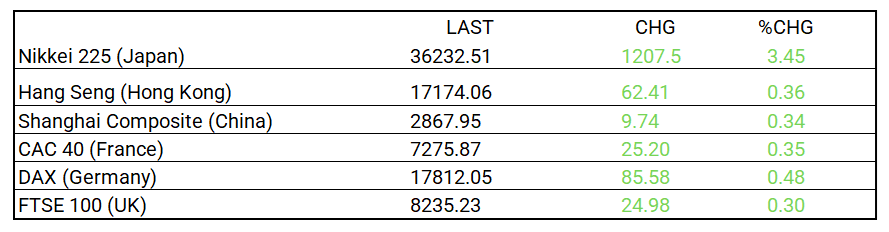

Global Markets Summary:

- Asian indices: Japan’s Nikkei 225 up 3.45%, modest gains for Hong Kong and China. European indices: CAC 40, DAX, and FTSE 100 slightly up.

Strategic Investment Adjustments:

- Focus on long-duration bonds as rates potentially cut. Nasdaq/Tech and growth sectors show strong long-term potential. Diversify with Russell 2000 ETFs and bank index ETFs. Election years historically boost market performance.

In the NEWS:

Central Banking, Monetary Policy & Economics:

- U.K. Wage Growth Eases in Boost for Bank of England – WSJ

- US Producer Prices Rise Less Than Forecast, Dragged by Services – Bloomberg

- US Inflation Data to Show Another Modest Increase, Cementing Fed Cut – Bloomberg

Business:

- Paramount to Close TV Studio Amid Restructuring – WSJ

- Starbucks Looks to India for Growth With Tiny Cups, Masala Chai – Bloomberg

China:

- Guangdong’s AI industry reaches US$25 billion as province competes with Beijing, Shanghai – SCMP