Stay Informed and Stay Ahead: Market Watch, August 23rd, 2024.

Late-Week Wall Street Markets

Key Takeaways

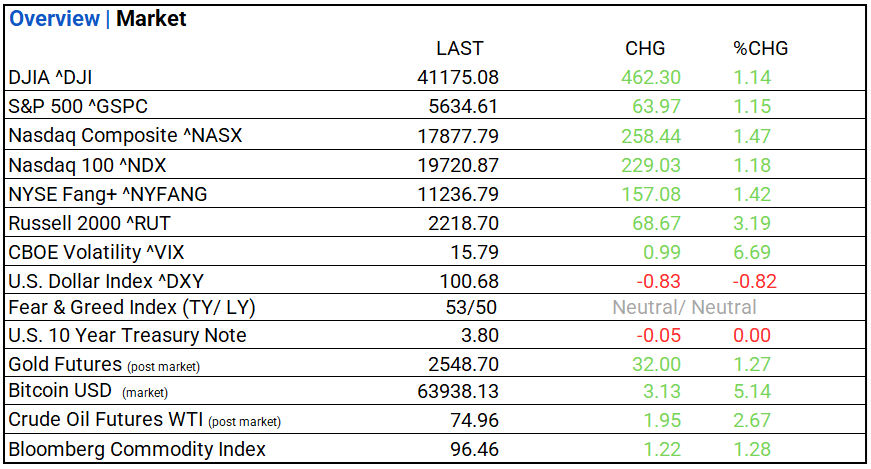

- Markets: DOW, S&P 500, and NASDAQ gain; VIX moderately volatile. Real Estate leads, Consumer Staples lags. Top industry: Automobiles.

- Inflation: U.S. leading indicators fell 0.6%, jobless claims rose. Powell signaled a September rate cut.

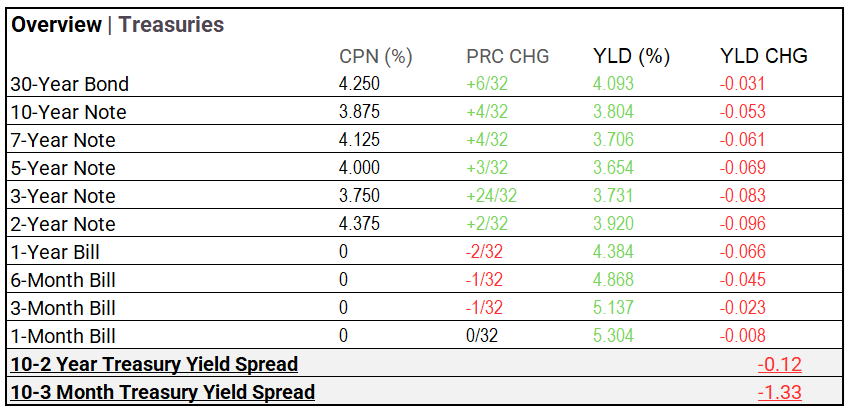

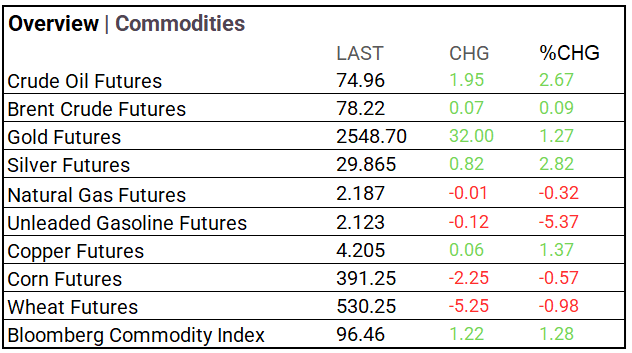

- Yields & Commodities: The 30-year bond yield fell 0.031% as prices rose, signaling a decrease in long-term rates. The 2-year note also declined. Crude oil rose 2.67% to $74.96; gold and silver gained. The Bloomberg Commodity Index was up 1.28%.

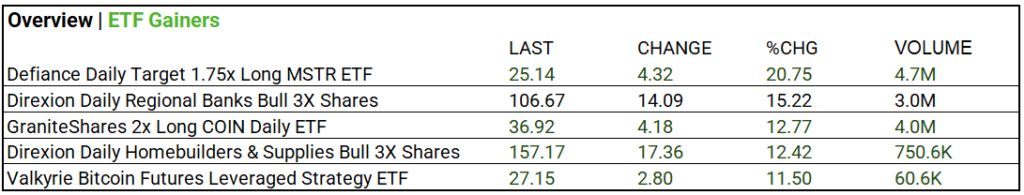

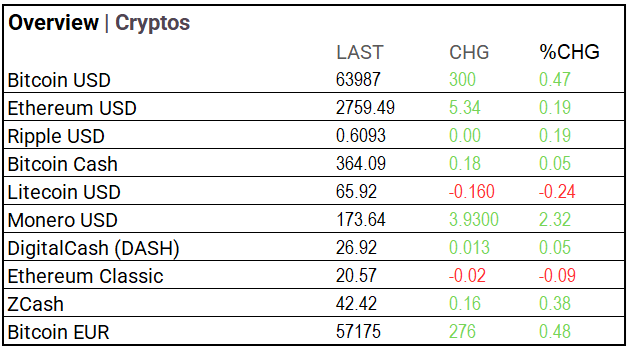

- Crypto & ETFs: Bitcoin USD rose 5.14% to $63,987. Monero gained, while Litecoin and Ethereum Classic declined. ETF Gainers: Defiance Daily Target 1.75x Long MSTR ETF rose 20.75% ; Direxion Daily Regional Banks Bull 3X Shares up 15.22%.

Market Summary

Indices & Sectors Performance:

- DOW, S&P 500, and NASDAQ rose. 8 of 11 sectors advanced, Real Estate leads, Consumer Staples lags. Automobiles (+4.50%), Passenger Airlines (+3.74%), and Semiconductor & Semiconductor Equipment (+3.59%) leading.

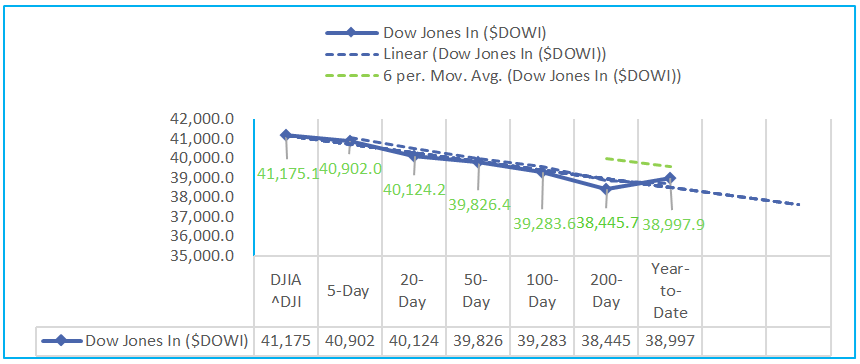

- The Dow shows steady growth across all periods, with moderate short-term gains and substantial long-term increases. The index shows a strong upward trend, particularly over the 50-day (+6.36%) and 200-day (+20.76%) periods, reflecting sustained market strength. This suggests overall market confidence and resilience.

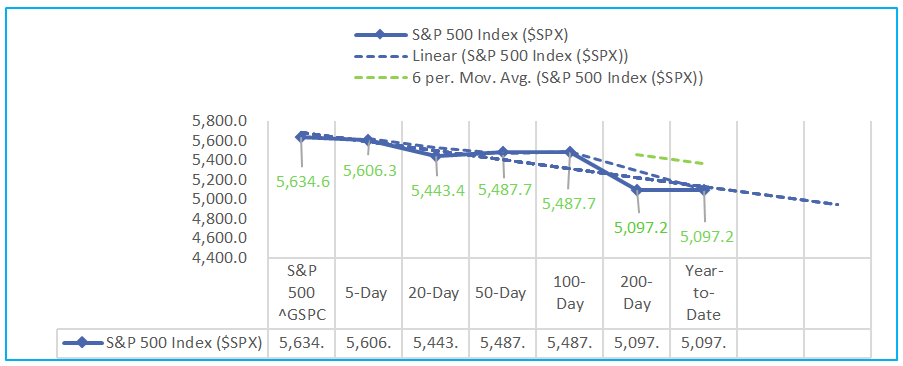

- S&P 500 has a strong and consistent upward trend, with increasing gains over time. Short-term growth is moderate, but the long-term rise is significant, particularly with a 29.06% increase over 200 days. This reflects a robust market performance and positive investor sentiment.

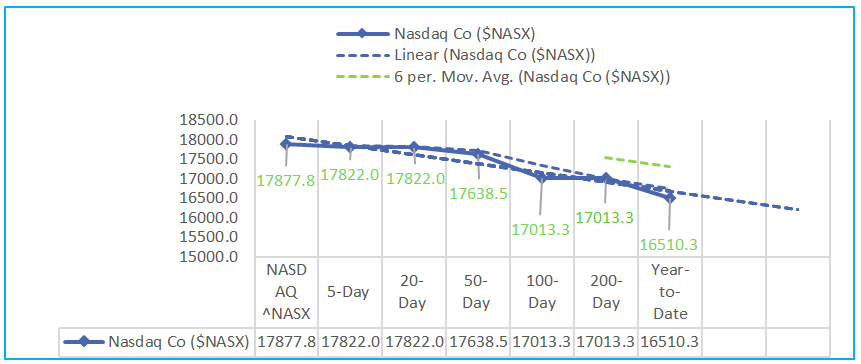

- The NASDAQ shows strong growth, especially over longer periods. While short-term gains are moderate, with a 1.40% increase over 5 days and 3.00% over 20 days, the index sees a significant 10.08% rise over 100 days and an impressive 32.24% gain over 200 days. Year-to-date, the NASDAQ is up 19.10%, reflecting a robust performance and strong market momentum.

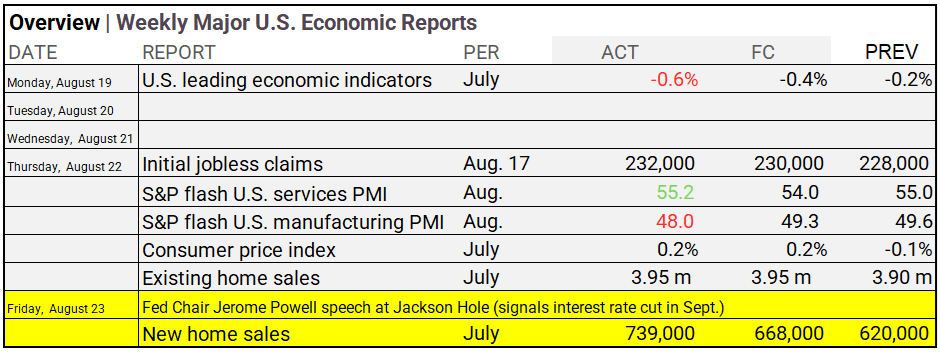

Economic Highlights:

- U.S. leading indicators fell by 0.6%. Initial jobless claims rose slightly. S&P services’ PMI improved, but manufacturing PMI declined. CPI held steady at 0.2%. Existing and new home sales rose. Powell signaled a September rate cut.

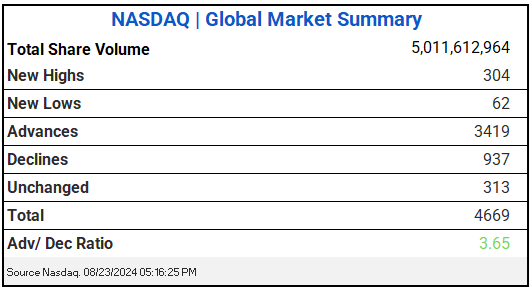

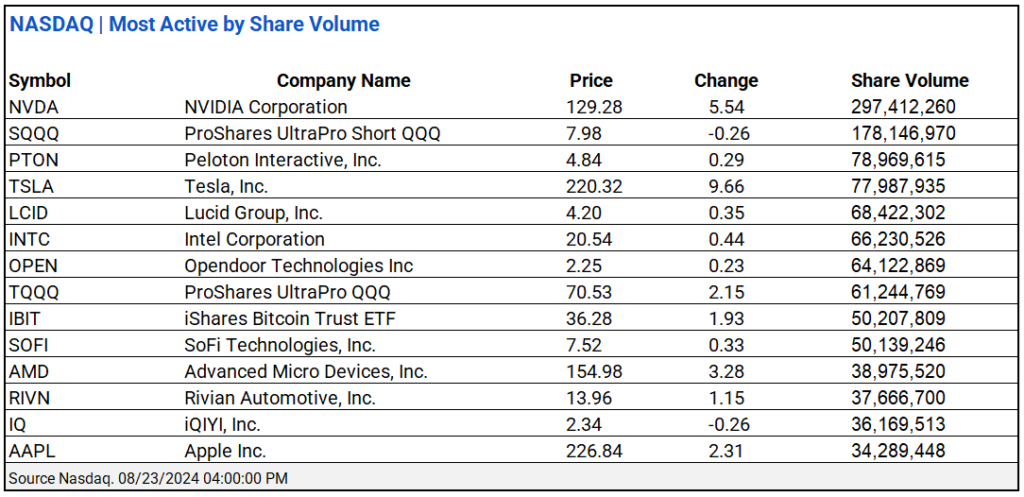

NASDAQ Global Market Update:

- NASDAQ saw 5.01B shares traded with a 3.65 advance/decline ratio. NVIDIA and ProShares UltraPro Short ^SQQQ led actives.

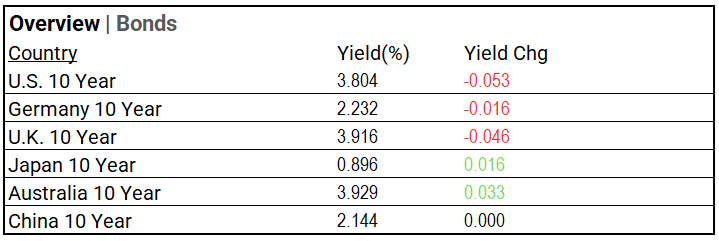

US Treasuries & Bond Markets:

- The 30-year bond yield fell by 0.031% as prices rose, indicating a slight decrease in long-term interest rates. Other Treasury yields also declined, with the 2-year note down 0.096%.

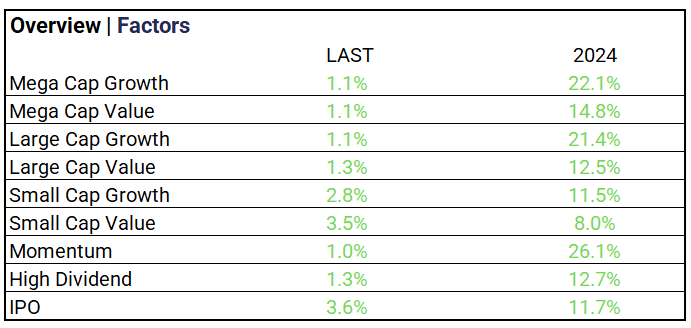

Market Factors:

- Small and IPO stocks led gains: Small Cap Value +3.5%, IPOs +3.6%. Others were stable.

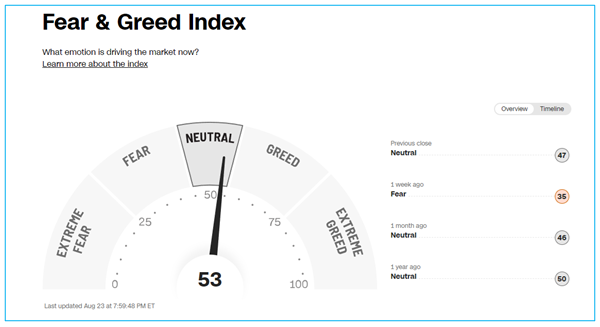

Volatility:

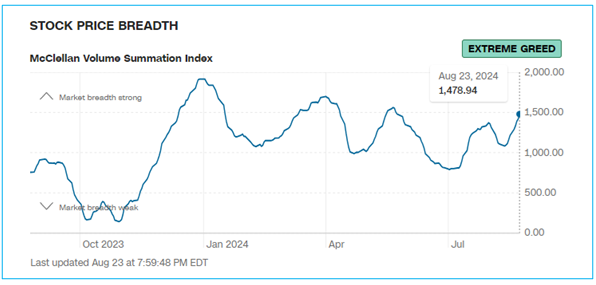

- VIX at 15.79 (+6.69%); Fear & Greed Index shifted to “Neutral”

Commodities & ETFs:

- Crude oil futures rose 2.67% to $74.96, while Brent crude was nearly unchanged. Gold and silver gained 1.27% and 2.82%, respectively. Natural gas and unleaded gasoline fell, with the Bloomberg Commodity Index up 1.28%. ETF Gainers: Defiance Daily Target 1.75x Long MSTR ETF rose 20.75%; Direxion Daily Regional Banks Bull 3X Shares up 15.22%.

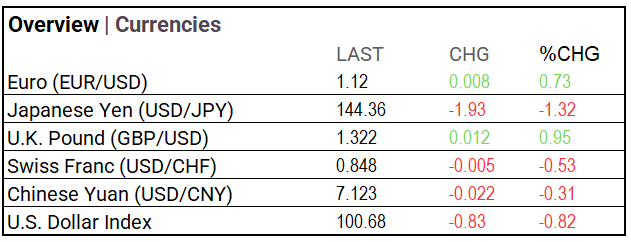

Cryptocurrency & Currency:

- Bitcoin USD rose 5.14% to $63,987. Other cryptocurrencies showed mixed results, with Monero gaining and Litecoin and Ethereum Classic declining.

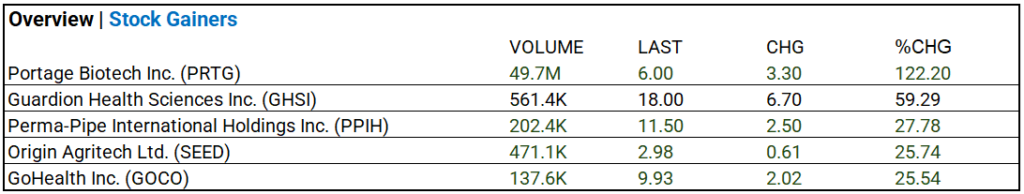

Stocks:

- Portage Biotech (PRTG) surged 122.20% to $6.00 with 49.7M volume.

Notable Earnings:

- Hafnia (HAFN), Buckle (BKE) beat estimates. Ubiquiti (UI) missed.

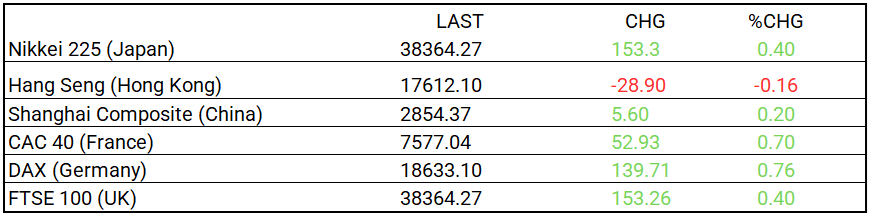

Global Markets Summary:

- Asian indices: Japan’s Nikkei 225 up 0.40%, with minor gains for China’s Shanghai Composite and a slight decline for Hong Kong’s Hang Seng. European indices: CAC 40, DAX and FTSE 100 rise.

Strategic Investment Adjustments:

- Focus on long-duration bonds with leveraged ETFs like ZROZ (PIMCO 25+ Year Zero Coupon U.S. Treasury Index ETF) and EDV (Vanguard Extended Duration Treasury Index ETF) to gain on potential rate cuts. Nasdaq/Tech and growth sectors show strong long-term potential. Diversify with Russell 2000 ETFs and bank index ETFs. Election years historically boost market performance. Top Small-Cap ETFs Poised to Benefit: Vanguard Small-Cap Growth ETF (VBK), iShares Russell 2000 Growth ETF (IWO), iShares S&P Small-Cap 600 Growth ETF (IJT).

fed-rate-cuts-on-long-duration-treasury-etfs-performance

small-cap-etfs-key-opportunities-for-fall-2024

In the NEWS

Central Banking, Monetary Policy & Economics:

- Fed’s Powell Declares ‘Time Has Come’ for Rate Cuts – WSJ

- Major Central Banks Now Aligned as Powell Signals Fed Cuts Ahead – Bloomberg

Business:

- The Seagram Heir Who Wants to Buy Paramount – WSJ

- Hedge Funds Boost Bullish Wagers on Gold to Four-Year High – Bloomberg

China:

- China spends big on Samsung, SK Hynix chips in first half amid US sanctions fears – SCMP