MARKETS

Today software services are driving Weekly index gains as Quarterly profits are beating Wall Street expectations. Last week Goldman Sachs lead earning leaders as the Financial Sector looks poised to support the recovery story.

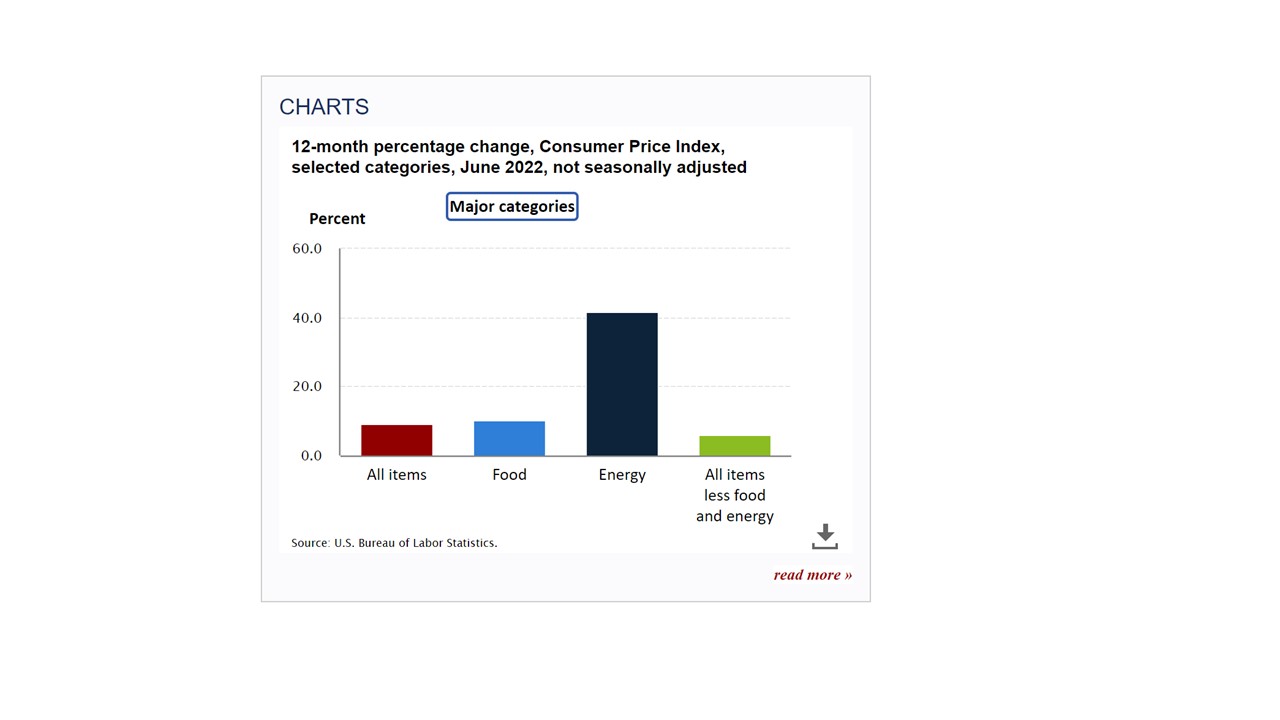

Consumer Price Index data is key

Consumers rose 1.3 percent, seasonally adjusted, and rose 9.1 percent over the last 12 months, not seasonally adjusted. The index for all items less food and energy increased 0.7 percent in June (SA); up 5.9 percent over the year (NSA).

July 2022 CPI data are scheduled to be released on August 10, 2022, at 8:30 A.M. Eastern Time.