Stay Informed and Stay Ahead: Research, December 18th, 2024

The Federal Reserve’s final decision to further reduce interest rates today represents a critical juncture for credit markets, reflecting the central bank’s nuanced approach to addressing slowing growth and tempering inflation. Market participants, who had already priced in a 90% likelihood of this move, were well-prepared for the outcome, underscoring its anticipated nature and its potential to significantly influence the broader financial landscape.

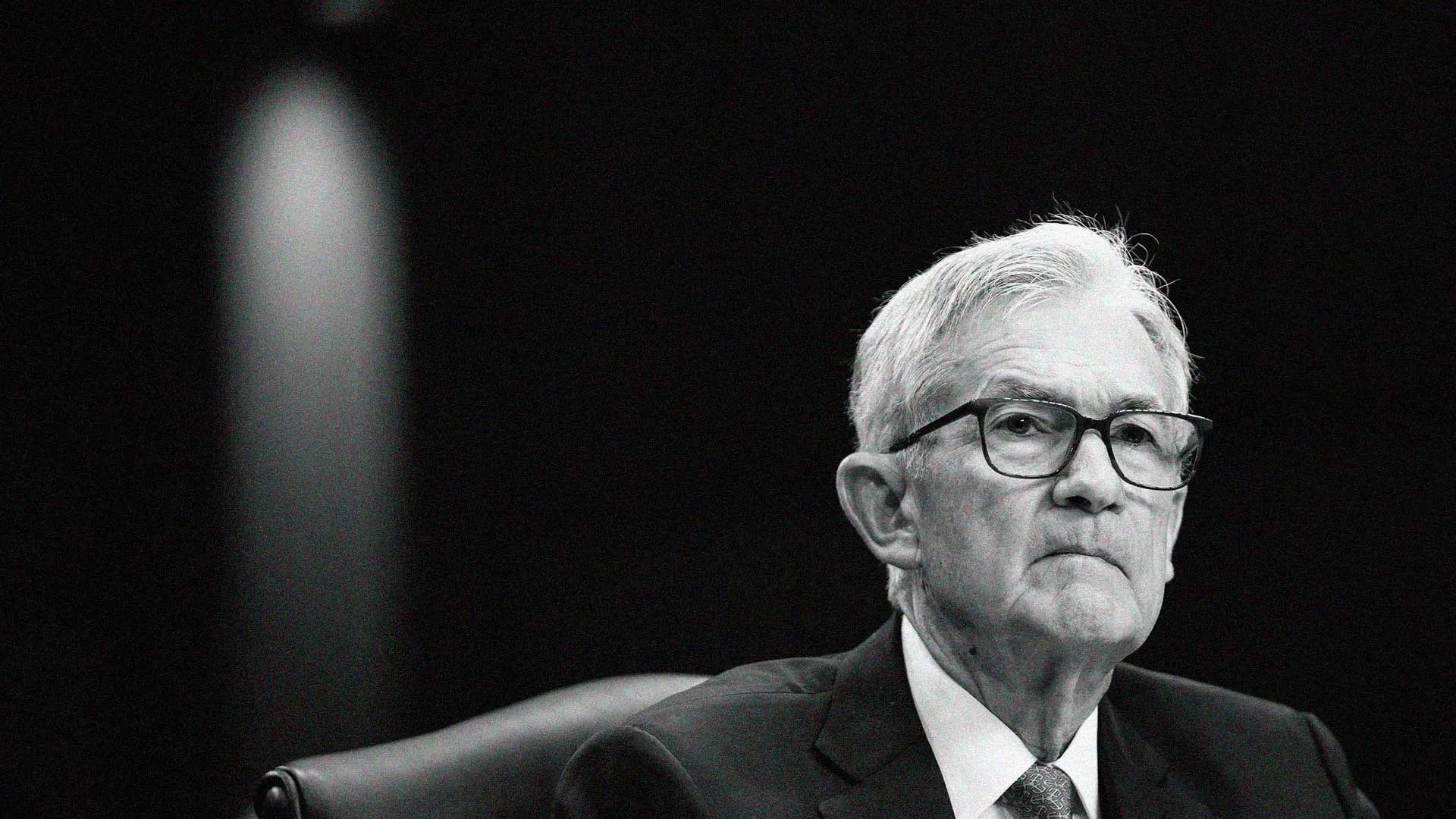

Liquidity and Credit Accessibility

This chart illustrates how lower interest rates enhance liquidity by spurring activity in high-yield bonds, emerging market debt, and SME lending. It highlights the cascading effects of monetary policy on credit markets.

- Lower interest rates traditionally catalyze enhanced liquidity within credit markets. Institutional investors, motivated by the search for yield, may shift toward riskier assets such as high-yield bonds and emerging market debt. This reallocation broadens funding access for corporations and governments while emphasizing the delicate balance of risk and return.

- Small and medium-sized enterprises (SMEs), heavily reliant on commercial lending channels, stand to benefit significantly. Historically, rate cuts have spurred lending activity as financial institutions leverage the cost benefits of deploying capital. For example, during the 2008 financial crisis, similar interventions stabilized SME credit flows, reinforcing their essential role in economic growth.

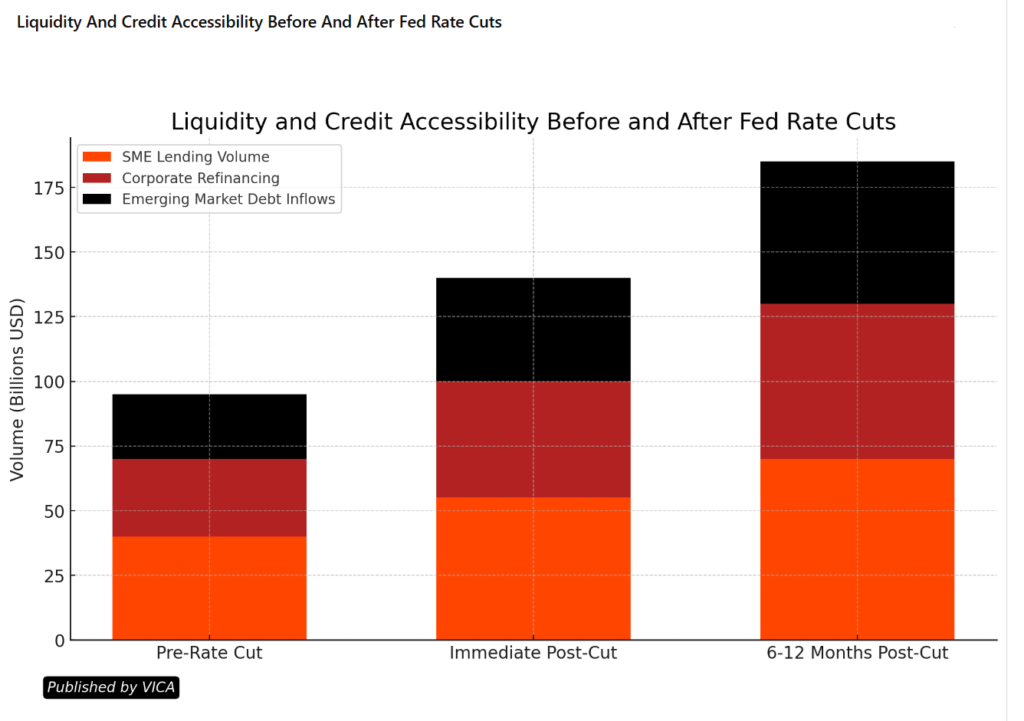

How Institutional Funds and Investors Can Respond

This pie chart demonstrates recommended post-rate cut portfolio allocations for institutional investors, emphasizing fixed income, equities, and alternatives to balance returns in a low-rate environment.

- Institutional funds and investment managers are uniquely positioned to adapt to the implications of the Fed’s rate cut. Strategic reallocation toward fixed-income instruments, particularly high-yield corporate bonds and mortgage-backed securities, offers the potential to lock in attractive spreads before market adjustments fully materialize.

- Equities in sectors such as real estate, utilities, and technology are likely to outperform, given their sensitivity to reduced borrowing costs. Investment managers may also explore opportunities in international markets, particularly emerging economies, where a depreciated dollar could enhance local asset valuations. Hedge funds and alternative asset managers might find value within distressed debt markets, where reduced rates improve refinancing scenarios and recovery prospects.

Challenges Ahead

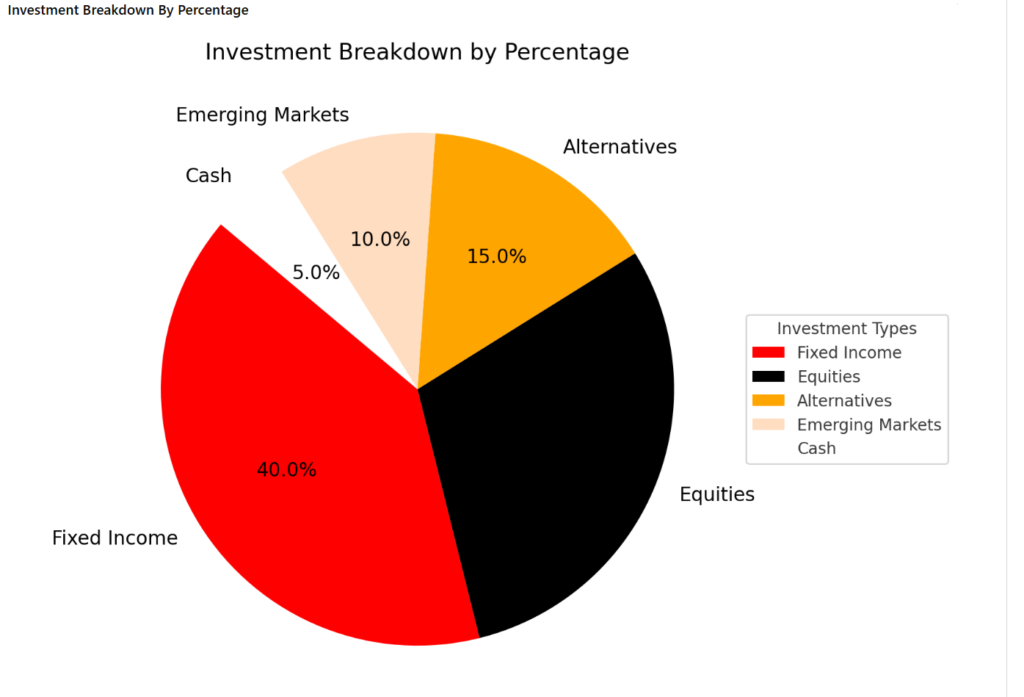

This chart compares the U.S. dollar index trends before and after rate cuts in 2019 and 2024, showcasing the effects of monetary easing on currency valuation and capital flows.

- Despite the Fed’s intent to stimulate economic activity, the risks of prolonged low interest rates persist. Asset bubbles, particularly within real estate and equities, remain a critical concern. For instance, the post-pandemic housing market surge underscored the fragility of valuations in a persistently low-rate environment.

- In their pursuit of yield, investors may overextend into higher-risk credit products, exacerbating systemic vulnerabilities. The 2011 European sovereign debt crisis offers a stark example, where low-rate environments encouraged risk-taking, culminating in market destabilization.

- The rate cut’s impact on the U.S. dollar warrants close scrutiny. A weaker dollar reduces the appeal of U.S. assets for foreign investors, potentially affecting capital flows and credit market liquidity. Historical instances, such as the 2019 rate reductions, highlighted the interconnectedness of currency movements and credit dynamics, a pattern likely to recur.

Long-Term Considerations

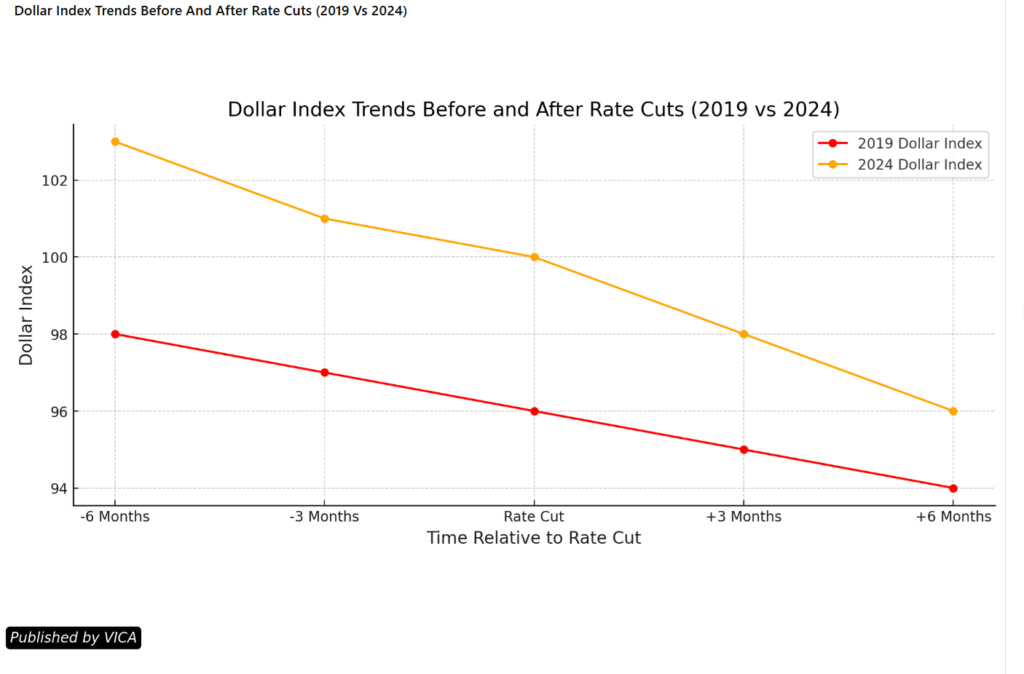

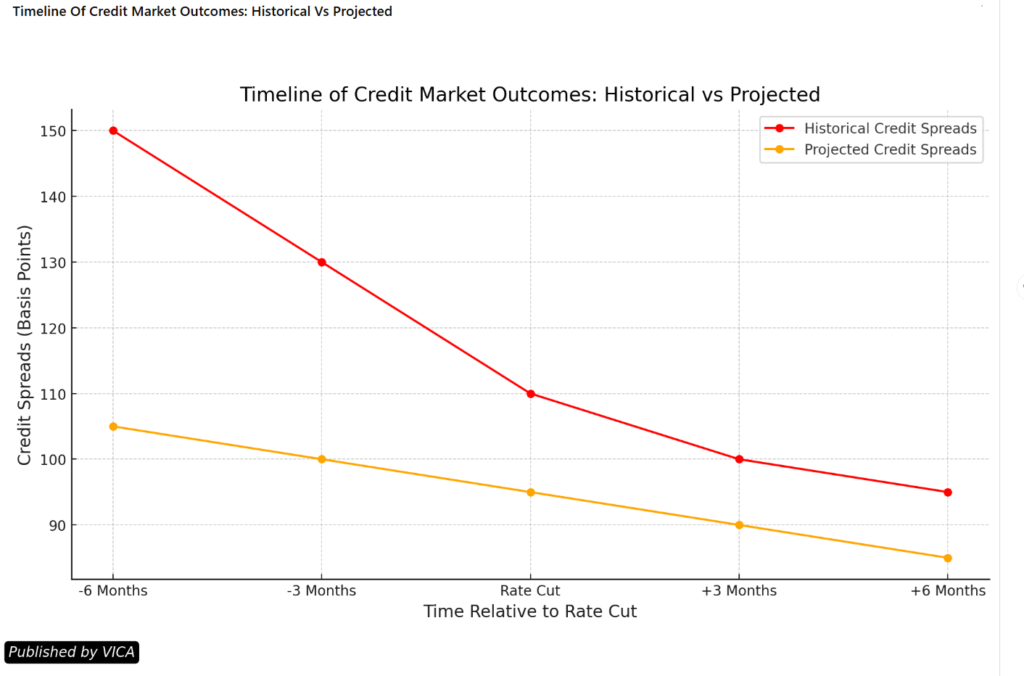

This timeline combines historical and projected credit spread data, providing a forward-looking perspective on credit market outcomes over six months after rate cuts.

- From a macroeconomic perspective, the 0.25% reduction underscores the Fed’s commitment to fostering economic stability while promoting growth. By reducing borrowing costs, the central bank aims to sustain economic expansion while mitigating risks of a sharp downturn. However, achieving this balance necessitates vigilance in monitoring both domestic and global financial conditions.

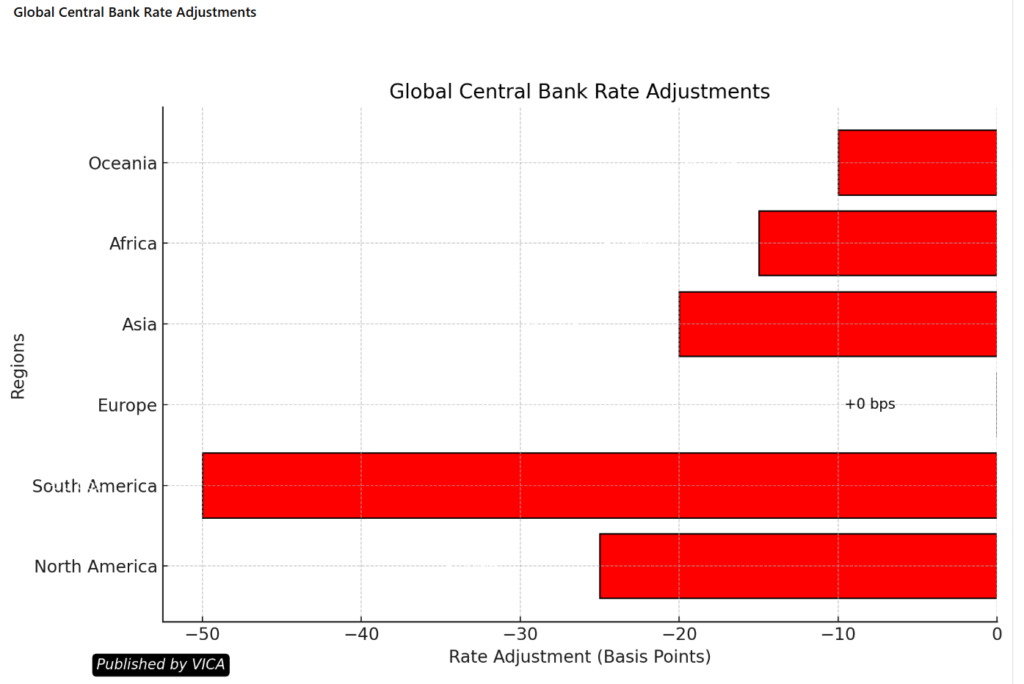

- The rate cut may influence monetary policy decisions beyond U.S. borders. Emerging economies, often aligned with U.S. policy shifts to maintain currency stability, could adjust their rates in response, reshaping global capital allocation and economic trajectories.

- For credit markets, this decision underscores the importance of maintaining a disciplined approach to risk management and adaptive investment strategies. Both policymakers and market participants must remain attuned to the evolving risk landscape inherent in persistently low-rate environments.

Conclusion

The Federal Reserve’s rate cut represents a calculated intervention aimed at enhancing economic resilience in a complex financial landscape. For credit markets, it introduces both opportunities and challenges, lowering the cost of capital while amplifying systemic risks. As markets adapt, pivotal questions emerge: Will the Fed successfully balance growth and stability, or will its actions give rise to unforeseen vulnerabilities? The coming months will provide critical insights into the effectiveness of this pivotal policy shift.

Final Note on Graphs

Thematically, all the charts underscore the interplay between monetary policy and financial markets, illustrating how interest rate changes influence liquidity, investment strategies, currency dynamics, and credit spreads. Together, they offer a comprehensive visualization of the far-reaching impact of rate cuts on economic stability and growth trajectories.