VICA Market Sentiment Index (VMSI) Report

March 2025 | VICA Research

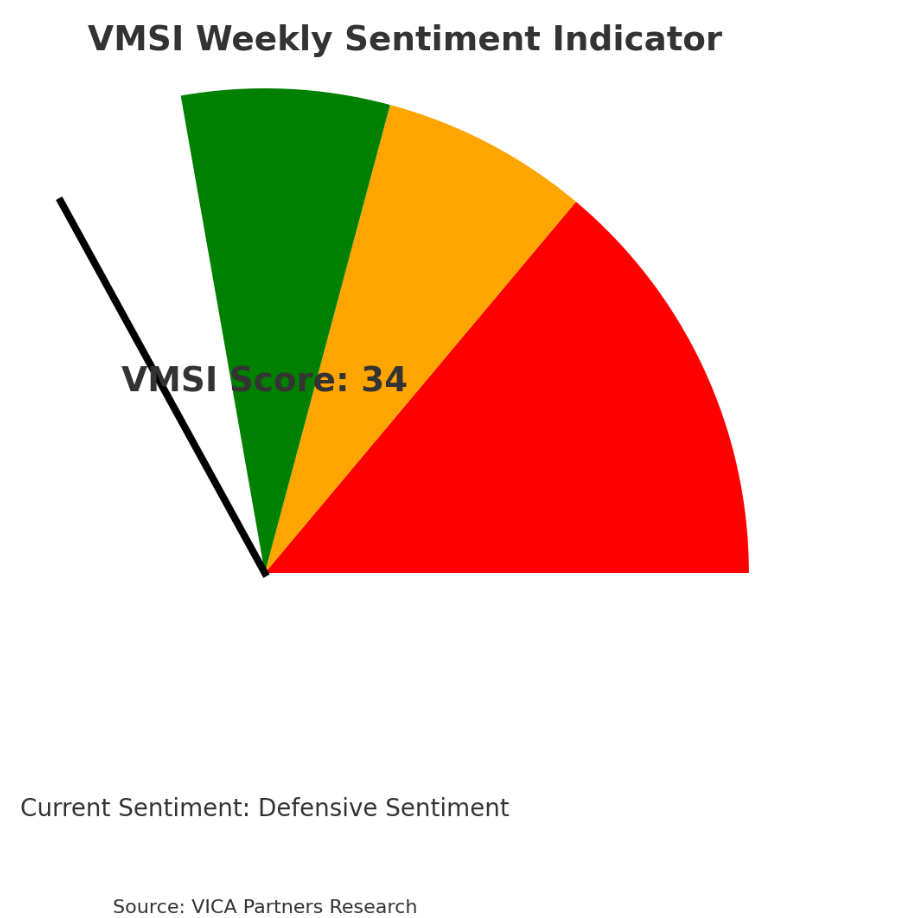

Current Market Sentiment: Caution Zone

VMSI Score: 34 (Defensive Sentiment)

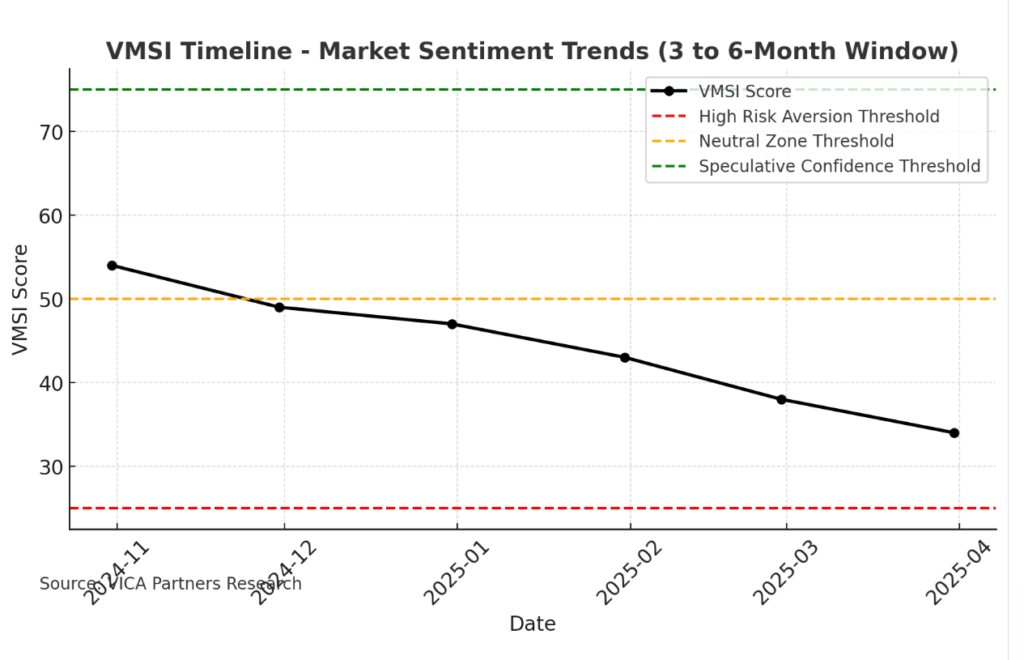

VMSI Timeline

- Previous Close: 36

- 1 Week Ago: 41

- 1 Month Ago: 54

- 1 Year Ago: 72

Last updated: March 7 at 10:29 AM EST

VMSI Timeline Chart with Threshold Markers

VMSI Indicator Breakdown

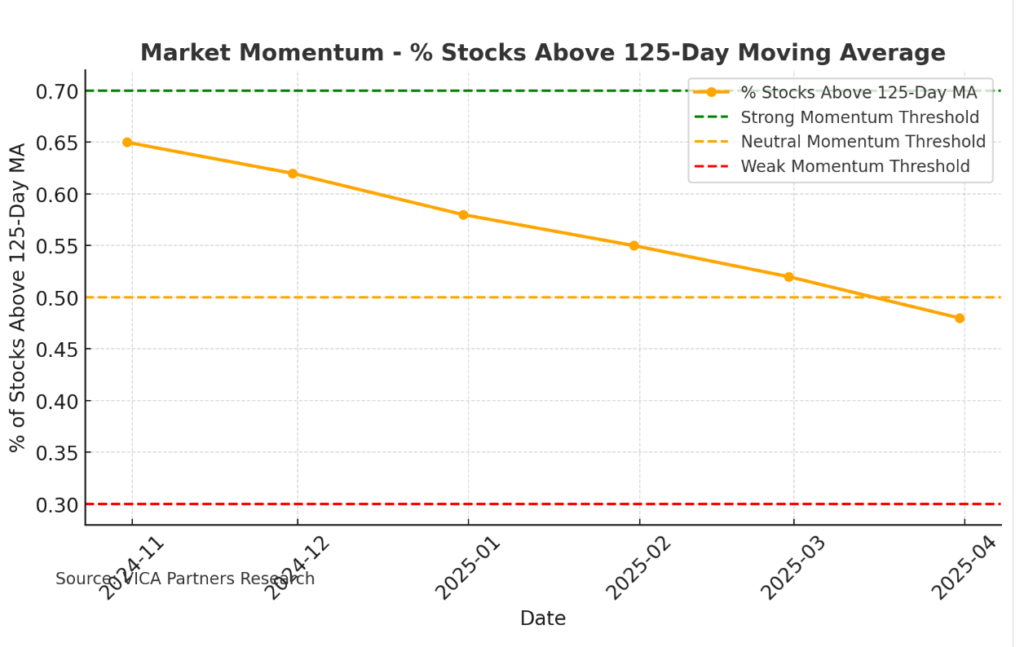

- Market Momentum (Institutional Accumulation)

Status: Caution Zone – Broad selling patterns emerging, with declining participation in key momentum stocks.

Market Momentum

Market Momentum - Breadth & Divergence (Market Health)

Status: Caution Zone – New 52-week lows outnumber 52-week highs by a growing margin. - Liquidity Flows (Leverage & Risk Appetite)

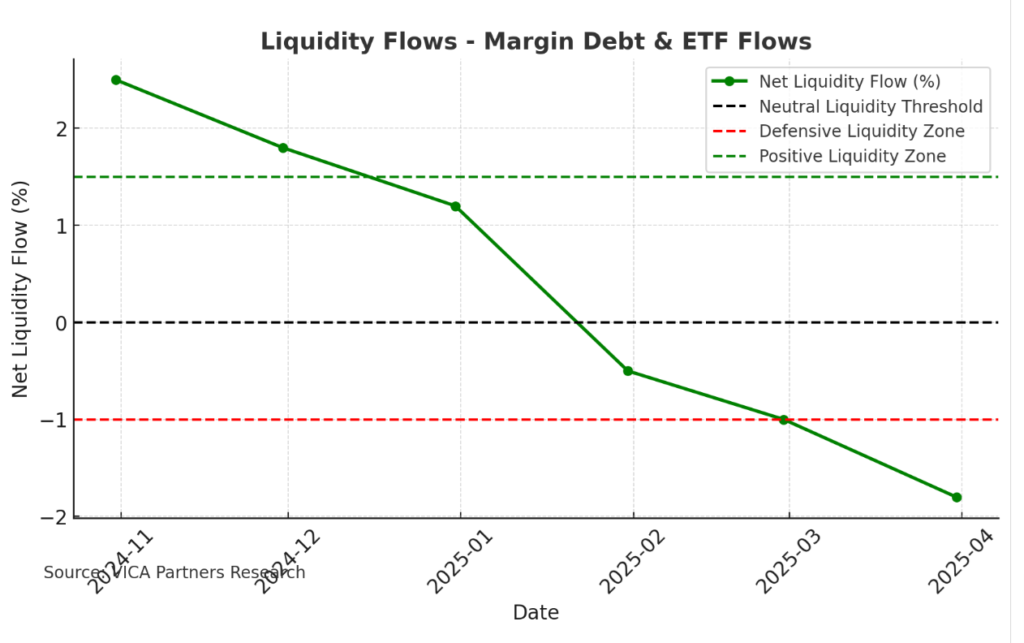

Status: Caution Zone – Margin debt is declining as investors reduce exposure to riskier assets.

Liquidity Flows

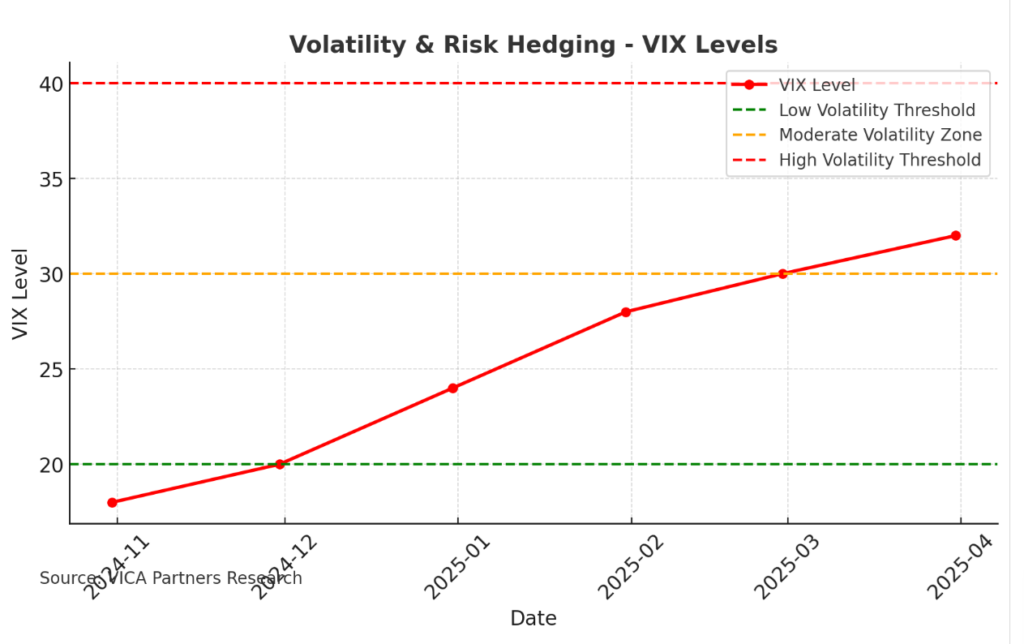

Liquidity Flows - Volatility & Risk Hedging (VIX & CDS Spreads)

Status: High Risk Aversion – VIX levels have surged above their 50-day average, signaling heightened volatility concerns.

Volatility & Risk Hedging

Volatility & Risk Hedging - Options Market Sentiment (Put-Call & Gamma Exposure)

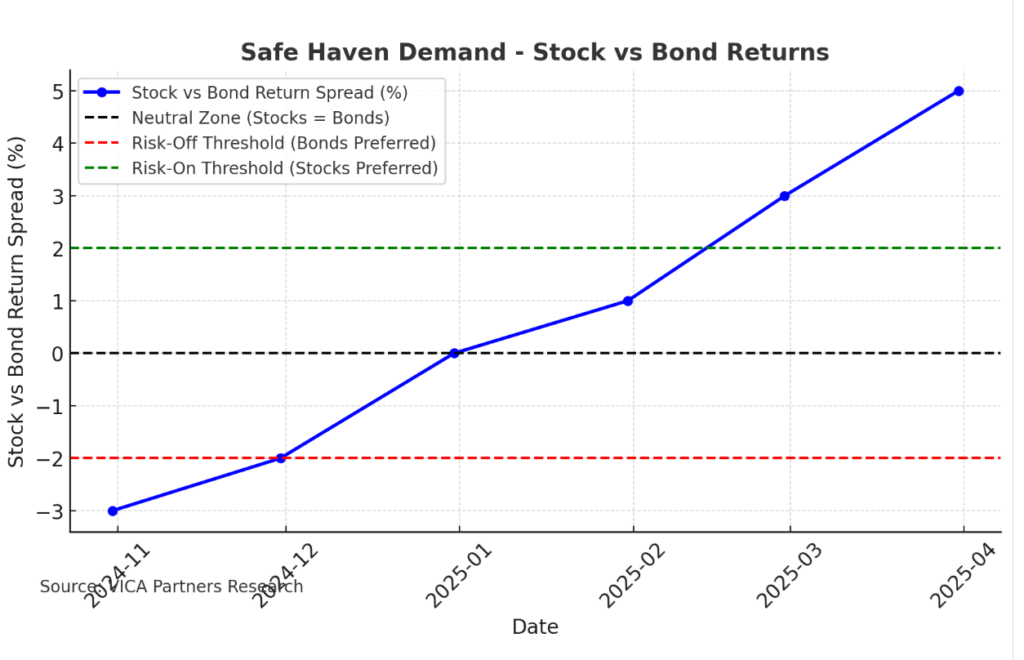

Status: Defensive Sentiment – Rising put-buying patterns show investors increasingly hedging portfolios. - Safe Haven Rotation (Stock vs. Bond Demand)

Status: Caution Zone – Bonds continue to outperform equities as investors prioritize capital preservation.

Safe Haven Demand

Safe Haven Demand - Credit Market Risk Premiums (Junk Bond Spreads)

Status: Growth Sentiment – Narrowing spreads indicate some investors are still willing to take on calculated credit risk.

Key Takeaways

🟧 Cautious Institutional Behavior: Hedge funds are reducing equity exposure as volatility remains elevated.

🟧 Liquidity Drain: Outflows from ETFs and declining margin debt signal defensive positioning.

🟧 Bond Demand Rising: The rotation to bonds is accelerating, reinforcing a risk-off sentiment.

Investor Takeaways

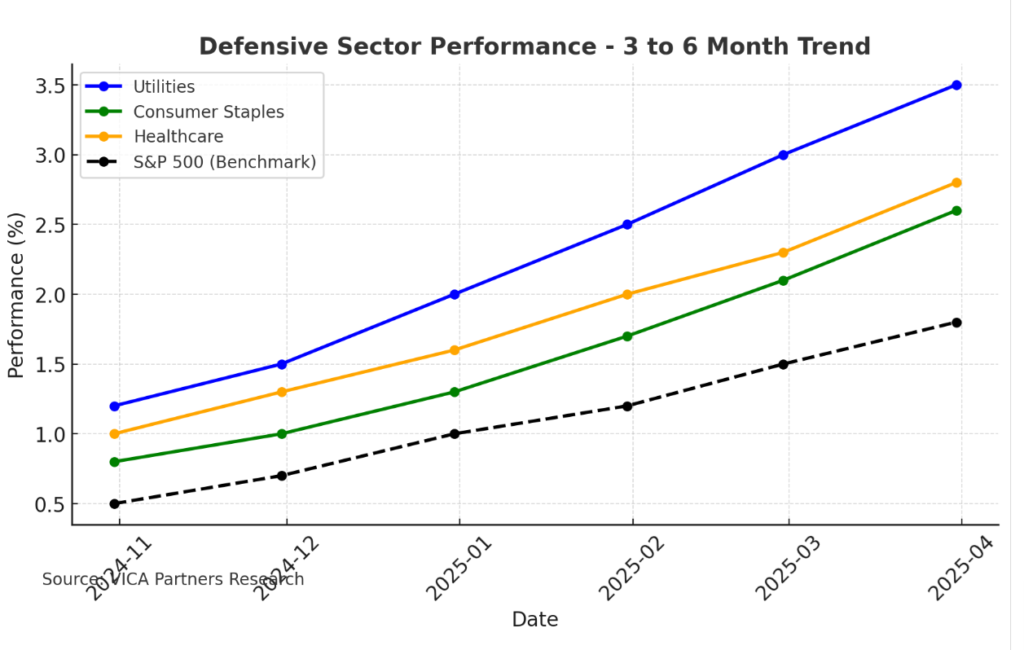

Defensive Sector Performance

Defensive Sector Performance

- Focus on Utilities, Consumer Staples, and Healthcare for defensive stability.

- Consider maintaining cash reserves for tactical market entries.

- Investment-grade bonds may offer improved risk-adjusted returns.

- Limit exposure to speculative or high-beta stocks until volatility stabilizes.

Tactical Focus: This week, bond laddering strategies may offer strong income potential as demand for safer assets rises.

For personalized portfolio strategies tailored to your investment goals, contact our research team.

Conclusion

With a VMSI score of 34, the market currently reflects Defensive Sentiment, as risk appetite contracts and volatility spikes. Investors are increasingly seeking safe-haven assets amid shifting macroeconomic conditions.

For tailored insights and strategic guidance, follow VICA Research for real-time updates on the VMSI.

Disclaimer:

This report is for informational purposes only and should not be considered financial advice. Investors are encouraged to consult with a qualified professional before making any investment decisions. Market conditions are subject to change, and past performance is not indicative of future results.