WALL STREET DOESN’T FUND COLLEGE — IT PROFITS FROM IT

ABSTRACT

As both a parent and a professional operating at the highest level of understanding institutional ROI strategy, this is not anecdotal advice — it’s capital logic. While most families treat tuition as a sentimental cost, Wall Street treats it as a structured revenue engine. From student debt securitization to REIT syndication, institutions are extracting multi-layered profit from the same college economy parents fund emotionally. This breakdown shows where that profit lives — and how families can pivot with precision, segmentation, and ROI-based clarity before tuition becomes a liquidity crisis.

In the current environment of market instability, tariff-driven inflation, and global capital realignment, this strategy is more urgent than ever — and you will not hear it from traditional financial advisors. This is the playbook institutional capital uses. It’s time families had access to it too.

1. COLLEGE IS A CAPITAL TRANSACTION — NOT A PURCHASE

Most families save. Institutions allocate. Most parents liquidate. Institutions compound. Most households react. Wall Street prepares.

College tuition is often the second-largest capital event a household will face. Yet it’s rarely treated as one. As equity markets fluctuate and global shocks hit liquidity windows, universities run investment models — and Wall Street captures the cash flow.

2. MACRO SHIFT: TARIFFS, TIGHTENING, AND TUITION STRAIN

The global economic structure is shifting:

-

Tariffs are raising costs across the board — including education.

-

Debt servicing pressure is reducing state-level education support.

-

Global student enrollment is declining, impacting institutional revenue.

Universities are adjusting portfolios. Families remain exposed to the market within months of disbursement deadlines.

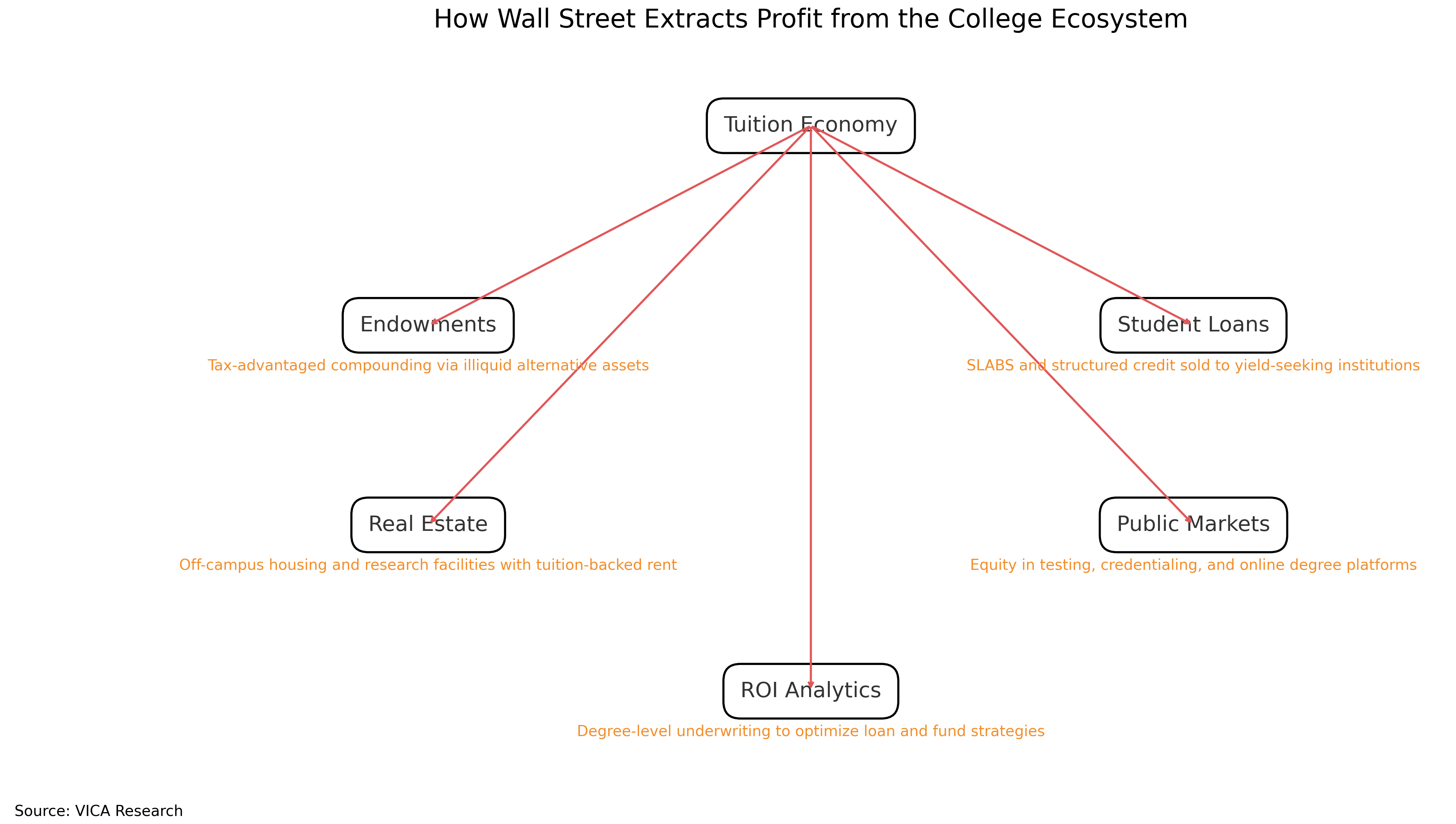

3. WHERE WALL STREET PROFITS FROM THE COLLEGE ECONOMY

A. ENDOWMENT ARBITRAGE Universities manage their endowments like institutional portfolios:

-

Leveraging low-cost tax-exempt debt

-

Allocating to alternatives, private equity, and illiquid income streams

-

Investing tuition cash flows into higher-yield strategies

Returns from these models often exceed what the university charges in annual tuition.

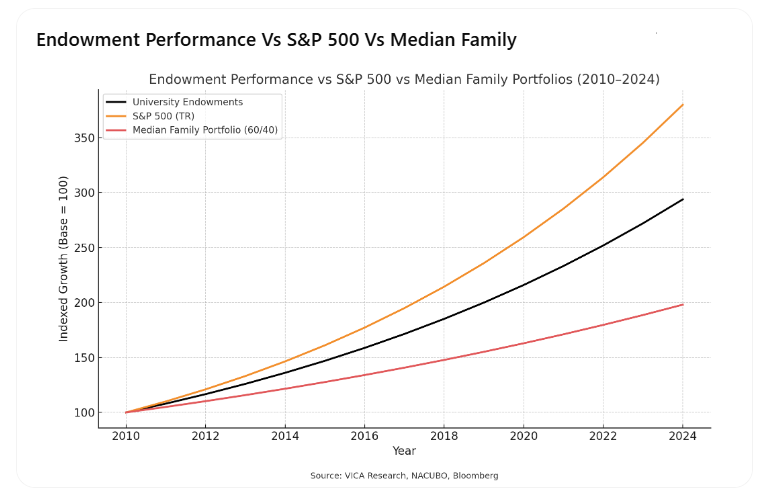

Endowment Performance vs S&P 500 vs Median Family Portfolios (2010–2024)

What This Chart Shows: Endowments grow with more consistent compounding than the S&P or household portfolios. Institutions win on risk segmentation and access to illiquid alpha. Families trail due to static 60/40 models and reactive selling.

B. STUDENT DEBT AS STRUCTURED YIELD Private student loans are repackaged into high-yield securities, known as SLABS. These securities:

-

Generate consistent cash flows with low default rates

-

Are underwritten based on major, career path, and GPA

-

Are sold into income-focused portfolios including pensions and asset managers

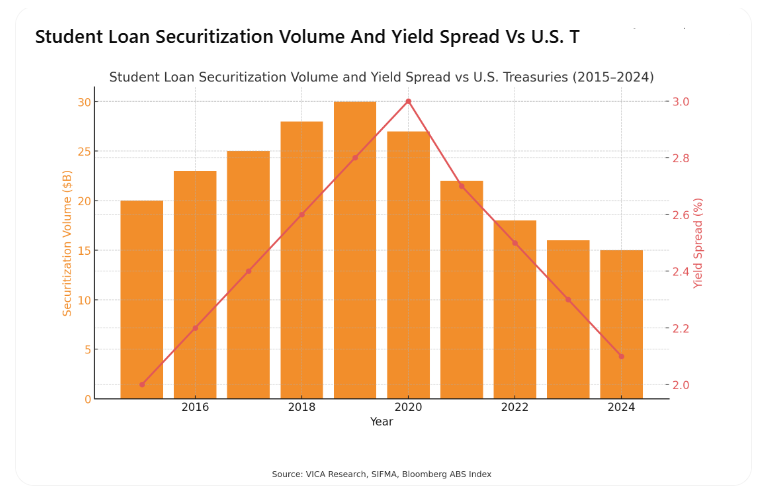

Student Loan Securitization Volume and Yield Spread vs U.S. Treasuries (2015–2024)

What This Chart Shows: Volume of SLABS has declined, but yield spreads remain attractive. Institutions are still extracting premium income from education debt while parents liquidate assets to pay for it.

C. COLLEGE REAL ESTATE AS CASH FLOW Wall Street owns:

-

Off-campus housing portfolios

-

Lab and research facilities near major universities

-

Commercial zones built for student-centered economies

These are tuition-backed, recurring revenue streams. They operate at scale, often with little correlation to broader housing market volatility.

D. EQUITY MARKET EXPOSURE TO EDUCATION Select fund managers take positions in:

-

Testing and credentialing providers

-

Online education and skills-based platforms

-

University-affiliated hospital networks and specialized programs

These assets perform well under constrained federal support, increased demand for outcomes, and global credential migration.

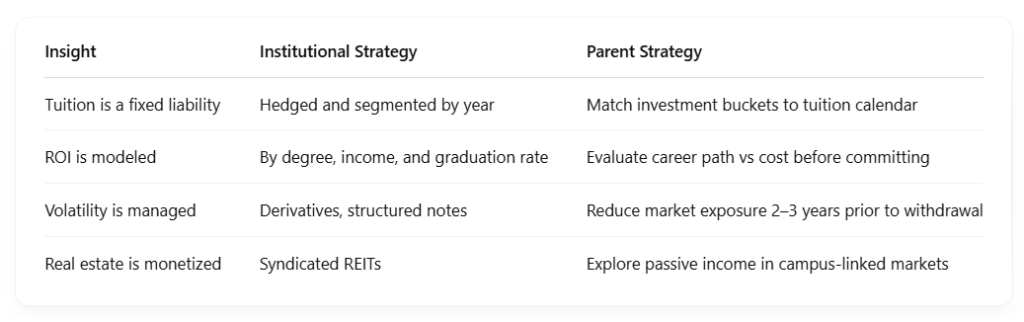

4. TACTICAL FRAMEWORK FOR PARENTS

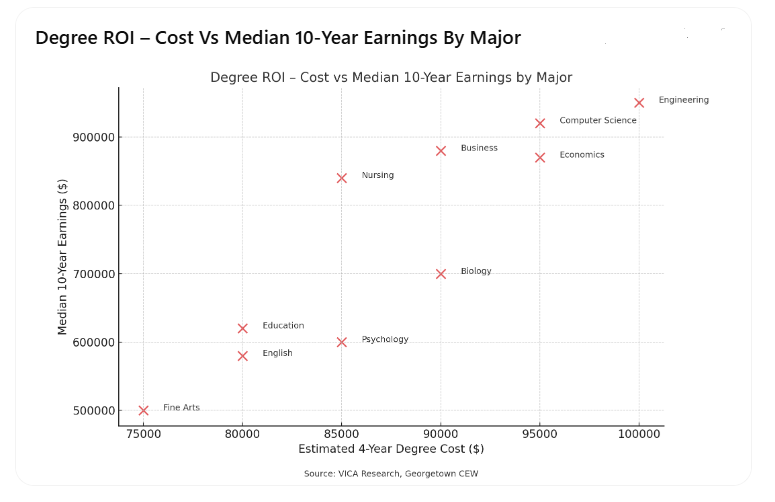

Degree ROI – Cost vs Median 10-Year Earnings by Major

What This Chart Shows: Tuition ROI varies dramatically by field. STEM and business degrees show positive return-on-investment within 5–10 years. Humanities and lower-earning disciplines often do not.

5. TUITION INFLATION IS OUTPACING REALITY

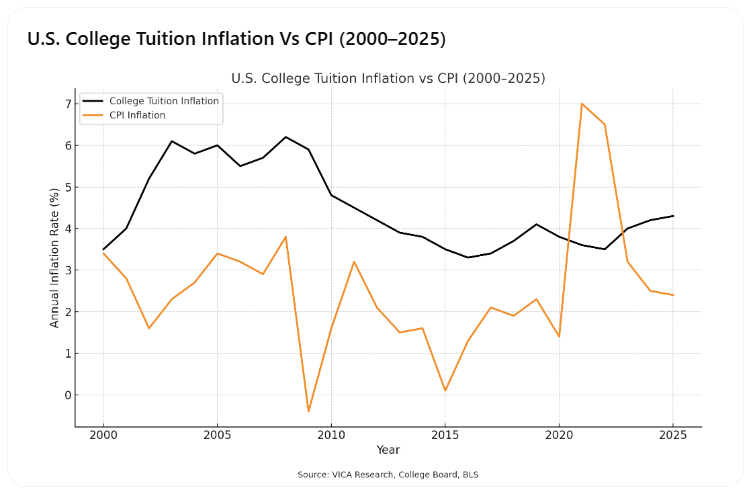

Since 2000, tuition has outpaced core inflation by over 2x. In a protectionist environment, education costs are increasingly unlinked from economic productivity and tightly correlated to structural inefficiencies, debt servicing, and labor shortages.

College Tuition Inflation vs CPI (2000–2025)

What This Chart Shows: College costs have risen steadily even as CPI fluctuated and remained low. Tuition is a structurally inflating asset class — and families must account for that premium in long-range planning.

6. CONCLUSION: THINK LIKE AN ALLOCATOR, NOT A DONOR

Wall Street does not approach education emotionally. It approaches it as a financial structure — one that produces returns if managed with precision.

Tuition must be treated like any capital event:

-

Segment liquidity by year

-

Model return expectations

-

Evaluate investment risk based on outcome probability

-

Allocate defensively, with built-in buffers

Traditional advisors don’t talk about tuition this way — because most don’t manage capital at this level. Families should stop thinking like payers and start thinking like portfolio architects.

#InstitutionalStrategy #CollegeEconomics #CapitalAllocation