Executive Summary

April 2025 marks a critical inflection point in the U.S. housing market. After years of constrained supply, inventory is rising sharply—up 11% year-over-year.

More homes are hitting the market in 2025. Inventory is up 11% as mortgage lock-ins fade, younger generations downsize, and builders deliver new homes. Rising costs and future fears are pushing sellers to act. More listings mean more choices—and smarter pricing ahead.

Key catalysts: Easing of the mortgage “lock-in” effect, macroeconomic pressures, demographic shifts, and increased new home deliveries.

A major valuation risk now looms as CPI-adjusted housing prices, inflated during the COVID-19 era, begin to face repricing pressure. These dynamics carry material implications for capital markets, lending portfolios, and asset valuation strategies.

Structural Drivers of the Supply Shift

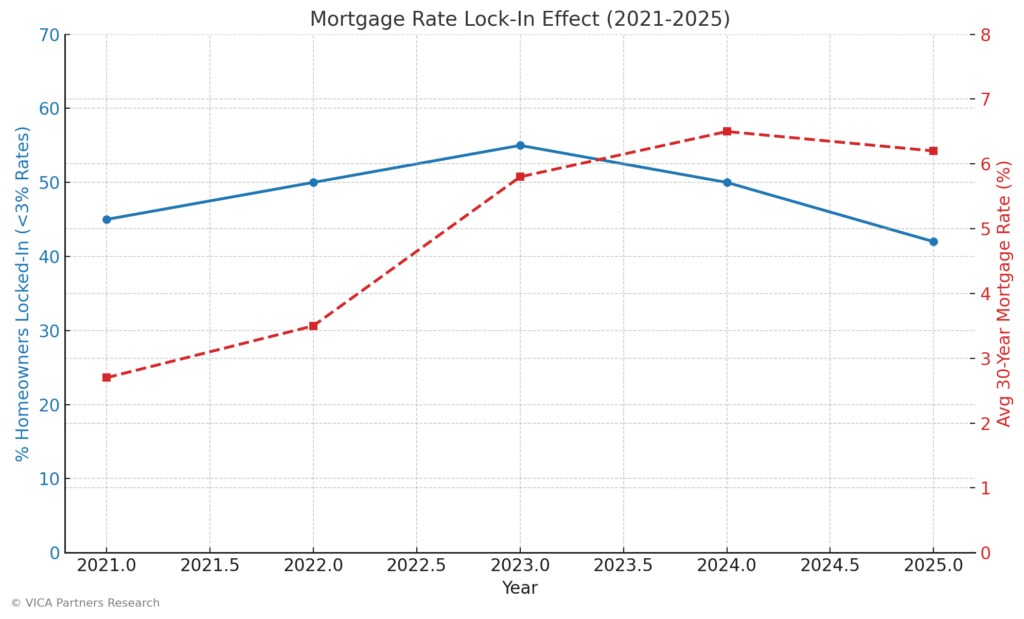

- Mortgage Rate “Lock-In” Erosion

Homeowners historically anchored to sub-3% mortgage rates are now adapting to a higher rate environment (~6%), driven by:

- Personal mobility needs

- More aggressive lender programs

This behavioral shift is unlocking latent supply.

Mortgage Rate Lock-In Effect (2021-2025)

- Illustrates how sub-3% locked-in rates are fading as mortgage holders adapt to 6%+ rates.

- Key Takeaway: The release of locked-in sellers is expanding inventory supply, alleviating prior structural constraints.

Source: VICA Research, Freddie Mac Primary Mortgage Market Survey

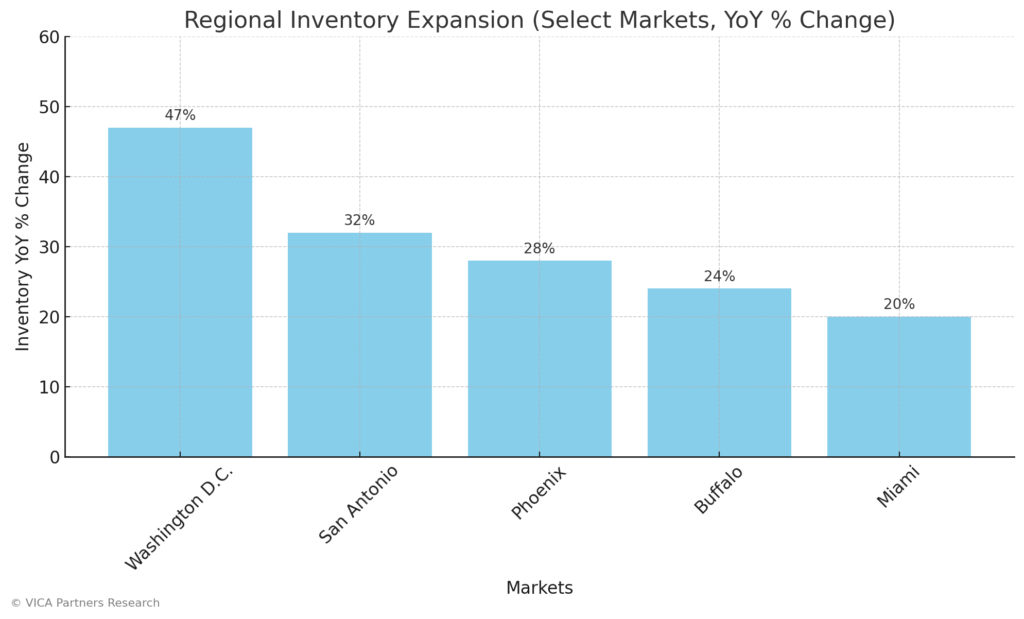

- Macroeconomic and Demographic Pressures

Pressure points accelerating listings include:

- Federal workforce reductions and return-to-office mandates (e.g., D.C. listings +47% YoY)

- Insurance premium spikes across coastal and high-risk zones

- Baby boomer downsizing accelerating across secondary markets

The convergence of these forces is dismantling prior seller inertia.

Regional Inventory Expansion (Select Markets, YoY % Change)

- Highlights disproportionate inventory increases in select metros (e.g., D.C., San Antonio, Phoenix).

- Key Takeaway: Inventory expansions are geographically concentrated, exposing regional market vulnerabilities.

Source: VICA Research, MLS Data, Redfin Housing Report

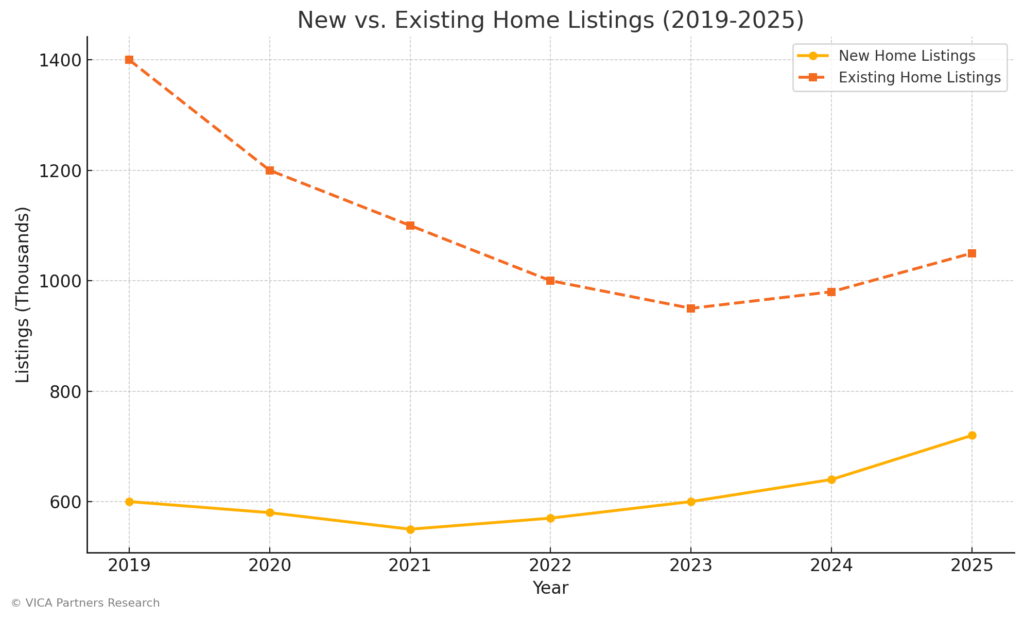

- Homebuilder Supply Pipeline Hitting Market

New home completions, delayed by 2022-2023 supply chain disruptions, are now being delivered at scale. National new home listings are up 16% YoY, creating competitive pressure on existing inventory.

New vs. Existing Home Listings (2019-2025)

- Displays the increase in builder-delivered supply compared to resale inventory trends.

- Key Takeaway: Builder-driven supply expansion is intensifying downward pressure on resale property valuations.

Source: VICA Research, U.S. Census Bureau New Residential Sales Report

Strategic Implications and Repricing Risk

Market participants must recognize the emerging liability embedded in CPI-adjusted valuations. Pandemic-era price increases, when viewed through an inflation-adjusted lens, are increasingly unsustainable.

Normalization unfolding: Significant repricing risk is anticipated across overheated markets.

Key Considerations

- Buy-Side: Expect enhanced selection, stronger negotiating posture, and localized price volatility.

- Sell-Side: Pricing discipline is critical; days-on-market metrics are extending.

- Investment Strategy: Regional performance divergence will widen; active management and underwriting recalibration are advised.

The post-COVID freeze in housing liquidity is breaking—and with it, both risk and opportunity are recalibrating sharply.

Report compiled by VICA Research — April 28, 2025.