Executive Summary

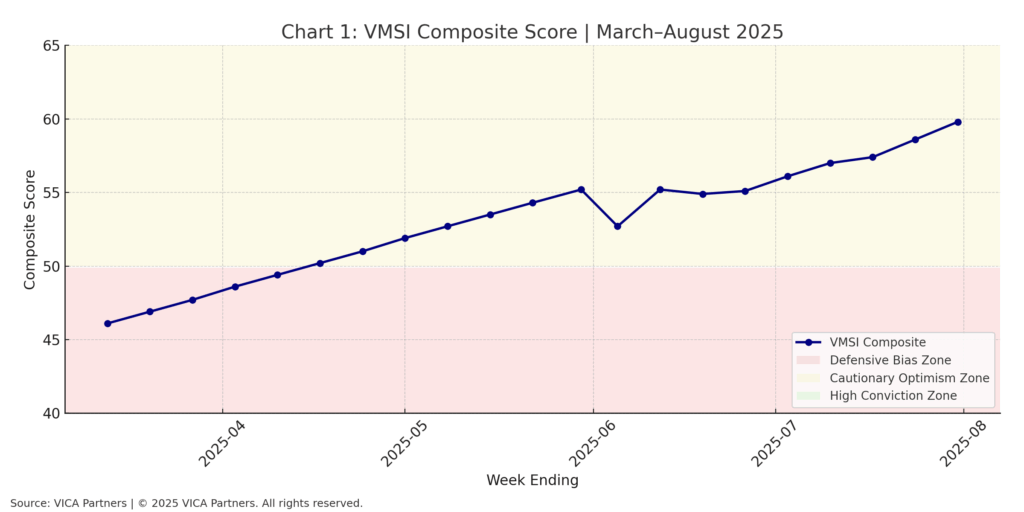

As of August 1, 2025, the VMSI® composite score sits at 59.8, its highest level since Q1. Institutions are steadily expanding into risk—without chasing it. Capital momentum is deliberate. Volatility is easing. Hedging demand is receding. But behavioral signals tell a different story on the retail side: loss aversion, recency bias, and framing continue to distort positioning.

This piece fuses Kahneman’s behavioral finance insights with VICA’s Newtonian Market Inertia framework, which models capital movement through force, mass, acceleration, and time friction (ƒₜ). And now, it adds a critical layer: how institutions internalize these principles to move early and with conviction—while retail continues reacting late and emotionally.

Chart 1 Takeaway — Composite Score Reflects Disciplined Re-Risking

VMSI’s rise from 46.1 to 59.8 signals structured, conviction-based risk-taking by institutions. Rather than reacting to volatility, they moved as liquidity improved and hedging eased. This aligns with Newtonian momentum and Kahneman’s insight: institutions buy into fear, retail sells into it. The signal isn’t reactive—it’s predictive.

1. Institutional Behavior Is Informed by Kahneman, Not Bound by Him

| Kahneman Principle | Retail Behavior | Institutional Counterplay |

| Loss Aversion | Panic selling at local lows | Buys quality as volatility peaks and hedges are unwound |

| Framing Effect | Overreacts to negative headlines | Looks through media noise to internal liquidity signals |

| Anchoring | Stays sidelined based on outdated valuations | Reweights forward based on current return thresholds |

| System 1 Reactivity | Acts on emotion and immediacy | Uses volatility to test entry levels and scale with precision |

| Recency Bias | Projects past volatility forward | Treats dislocations as temporary, not trend-defining |

- Institutions behave like disciplined probabilists.

- Retail trades like pattern-recognizing emotionalists.

2. Loss Aversion vs. Capital Mass Resilience

Kahneman Insight: Investors overweight losses—exiting strong names too early.

VMSI Signal: Vol/Hedging dropped from 61.7 in June to 56.4 by July 31—showing recalibrated risk appetite.

Newtonian Model:

- Mass is sticky. Institutions remained invested.

- Force = Mass × Acceleration explains why forward flows are building off stability.

Tactical Edge: Quality growth sold under fear is now rebounding under institutional demand.

3. Framing Bias vs. Liquidity Acceleration

Kahneman Insight: Sentiment shifts based on how events are presented—not what they are.

VMSI Signal: Liquidity rose from 38.2 to 51.2—capital is moving, regardless of media tone.

Newtonian Model:

- Acceleration confirms that institutions are reallocating beneath the surface.

Tactical Edge: Accumulate names where narrative pessimism diverges from actual institutional flow.

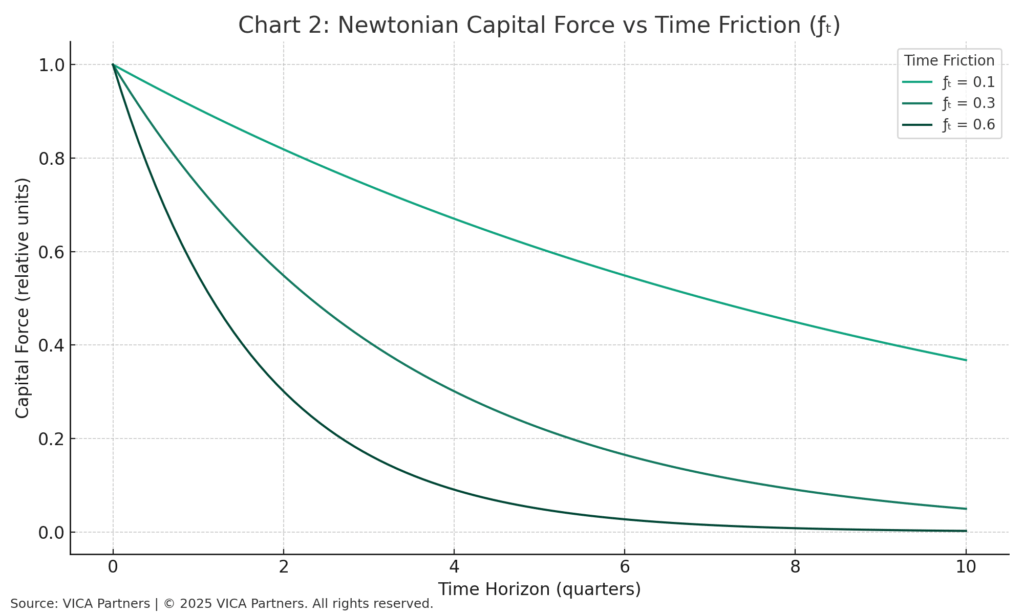

4. System 1 Reactivity vs. Time Friction (ƒₜ)

Kahneman Insight: Emotionally reactive trades focus on “now,” not risk-adjusted payoff timing.

VMSI Signal: Momentum rose from 46.3 (June 5) to 60.0 (July 31)—a clear shift to forward positioning.

Newtonian Model:

- Time Friction (ƒₜ) is a capital filter—institutions need payoff visibility to deploy fast.

Chart 2 Takeaway — Capital Is Selective, Not Static

As time friction (ƒₜ) increases, institutions demand faster, more visible payoffs to justify deployment. This explains why capital isn’t chasing everything—it’s moving with precision into assets that meet return thresholds within compressed time frames. The Newtonian decay curve visualizes this discipline: risk-taking persists, but timing is now a filter, not an afterthought.

Tactical Edge: Prioritize sectors with visible catalysts inside a two-quarter horizon.

5. Anchoring & Emotional Inertia vs. Confirmed Capital Force

Kahneman Insight: Investors overvalue recent events, underweight structural trends.

VMSI Signal: Safe-haven demand down from 69.5 to 59.6—capital is exiting fear zones.

Newtonian Model:

- Force is compounding directionally. Capital isn’t static—it’s methodically progressing.

Tactical Edge: Rotate into financials and defensives where capital inertia now outweighs sentiment drag.

Summary Matrix: Where Emotion Distorts and Institutions Advance

| Behavioral Bias | Newtonian Signal | VMSI Confirmation | Tactical Advantage |

| Loss Aversion | Mass stable | Hedging unwind in progress | Accumulate high-quality laggards |

| Framing Bias | Acceleration rising | Liquidity turning positive | Buy underpriced cyclicals vs media tone |

| System 1 Reflex | ƒₜ rising | Momentum expanding | Focus on near-term payoff opportunities |

| Anchoring Bias | Force building | Safe-haven demand receding | Rebalance into forward-driven sectors |

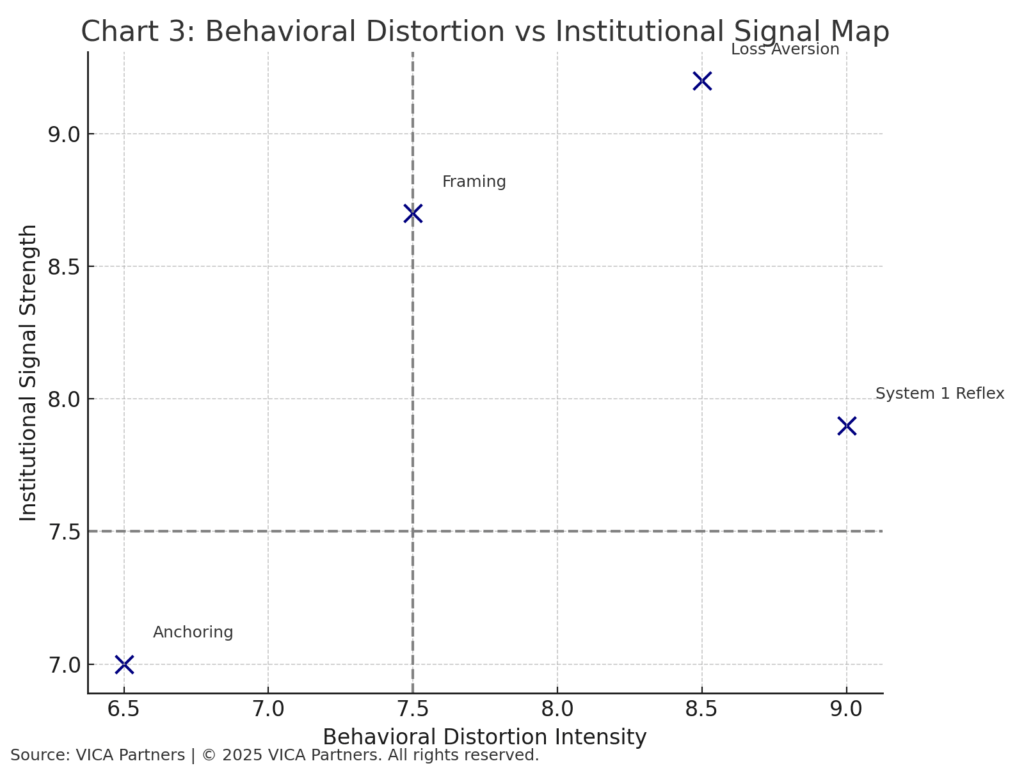

Chart 3 Takeaway — Alpha Emerges Where Emotion and Conviction Collide

This map shows that the most actionable opportunities occur where behavioral distortion is high and institutional conviction aligns. Loss aversion and System 1 reactivity remain dominant sentiment drivers, yet these are also where institutions allocate with confidence. That divergence is the opportunity: when fear peaks and professional signal strengthens, dislocation creates asymmetry worth capturing.

Conclusion

Institutions are not immune to behavioral signals.

They’re just aware enough to price them in—and profit from them.

Kahneman gives us the blueprint for where markets misprice risk. VMSI and Newtonian force metrics reveal how institutions move first—measured, conviction-weighted, and time-filtered.

With a VMSI of 59.8, this is not euphoria. It’s intelligent acceleration.