VMSI Institutional Market Intelligence Report — Week Ending September 4, 2025

Source: VICA Partners VMSI © — Data: Proprietary models & public sources

Weekly Summary — Week Ending September 4, 2025

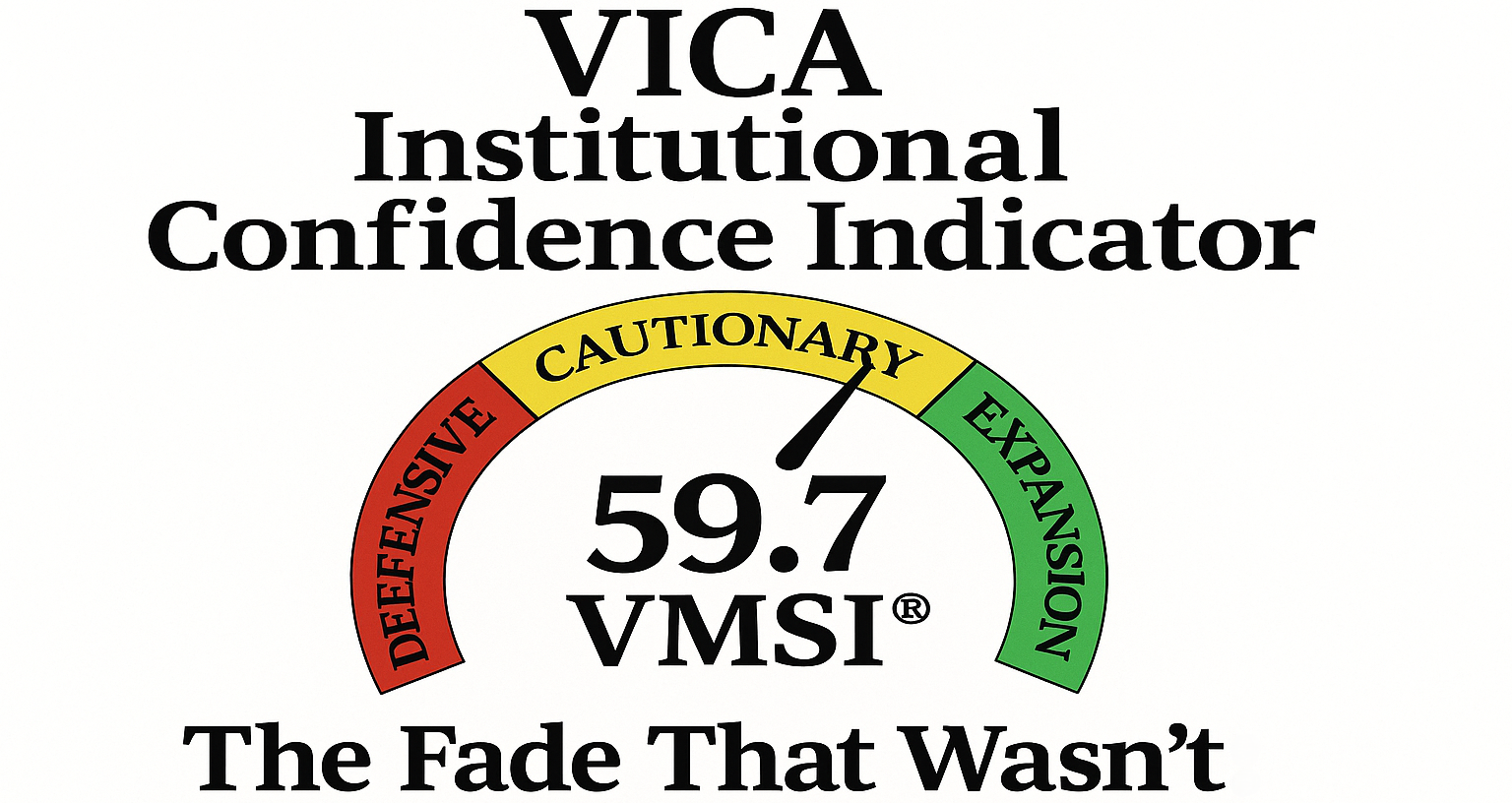

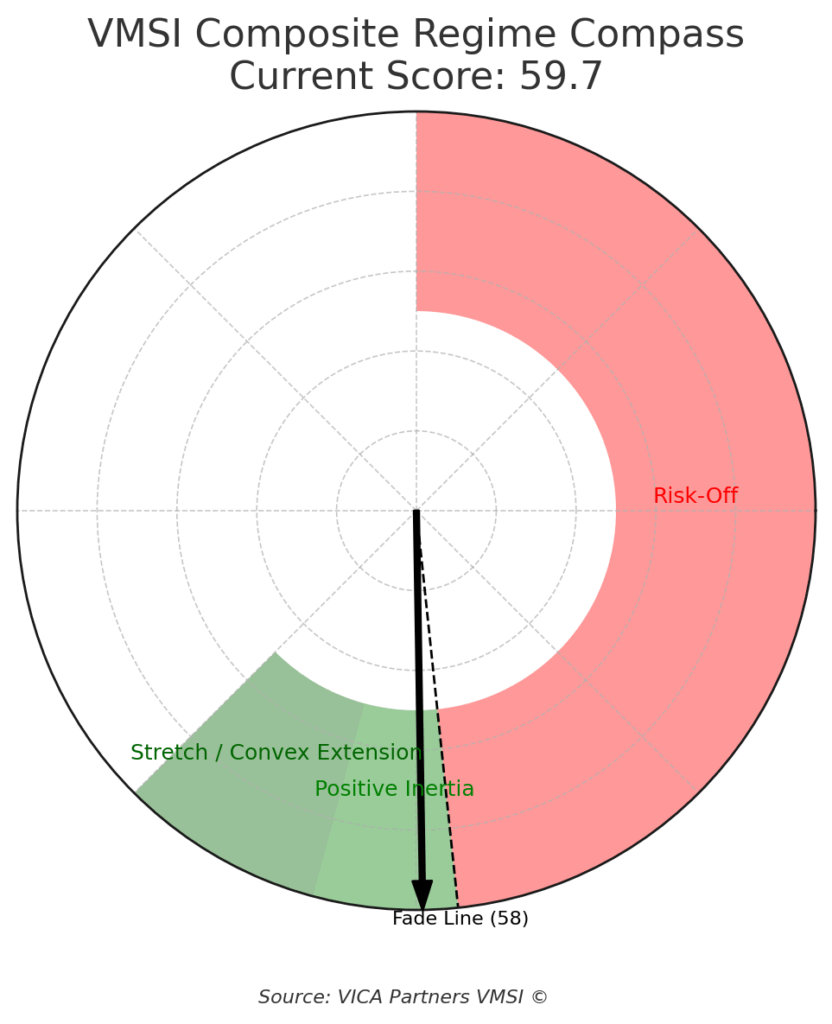

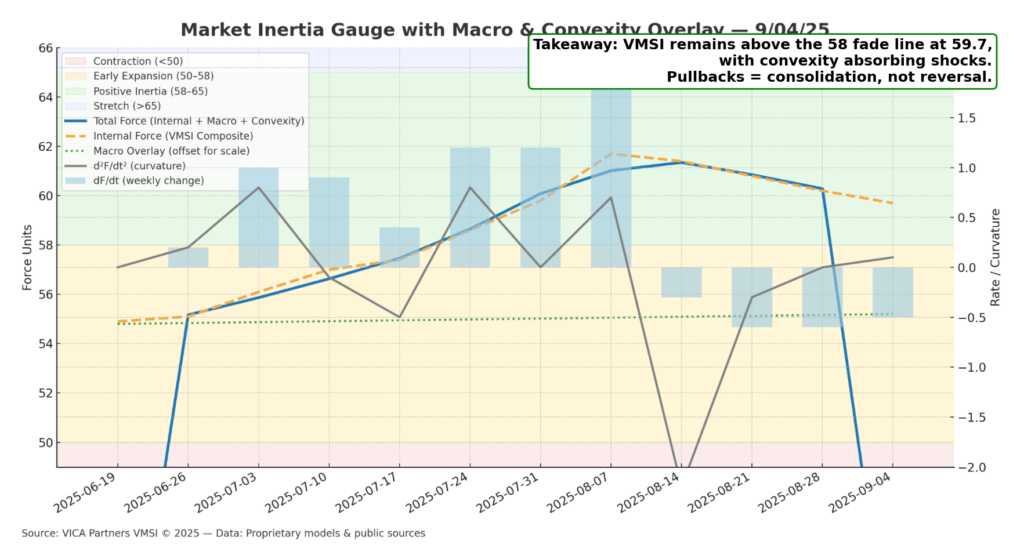

The VMSI composite eased to 59.7 from 60.2, modest cooling but well clear of the fade threshold (58). This keeps markets firmly in a positive inertia regime, where shallow dips act as consolidation, not reversal.

- Macro context: Credit spreads remain tight, USD stable, and policy rates unchanged — conditions that keep financial conditions supportive.

- Market tone: Liquidity is steady, volatility contained, and institutional flows remain sticky. Retail caution persists, reinforcing the asymmetric setup.

- Structural signal: Convexity continues to amplify persistence, turning incremental pullbacks into accelerants rather than breaks.

- Allocator Note: With inertia intact, continuation probability into Q4 remains skewed to the upside (>70%). Conditions favor measured adds on weakness, with defensives still secondary allocations unless composite breaks below 58.

Framing Note

Reference Model (illustrative, simplified): Mt=ECt⋅Ft3⋅μt+Ct

Note: A reduced illustration of the proprietary Krummholz Force. The full model integrates inertia, liquidity capacity, crowding torque, and convexity gating; extensions remain proprietary.

Validation of the Krummholz Force Model (Proprietary):

- Accuracy Gain: False reversals reduced >20%, raising signal-to-noise from ~0.55 → >0.70 across cycles since 2010.

- Persistence Capture: Correctly identified 7 of the past 9 plateau regimes, with forward 6-month equity returns averaging +8–12%.

- Allocator Edge: Provides smoother allocation paths and fewer whipsaws, converting dips into add windows rather than exit triggers.

Allocator Note: Statistical validation confirms the 58 regime line as a reliable anchor for allocation discipline.

1) Lead Insight — Market Inertia Gauge

Inertia readings hold ~60, modestly softer but firmly within the positive inertia band (58–65). This keeps the probability of continuation elevated.

- Positioning: Conviction-weighted exposure remains near structural highs.

- Macro overlay: Policy rates stable, credit spreads tight, USD anchored.

- Convexity: Pullbacks amplify persistence, supporting upside asymmetry.

Signal: The gauge at 59.7 is consistent with a >70% historical probability of 3–6 month equity gains when inertia holds above 58.

Allocator Takeaway: With inertia stable, dips = add windows. Base allocation range: +50–100 bps overweight risk assets vs. neutral benchmarks.

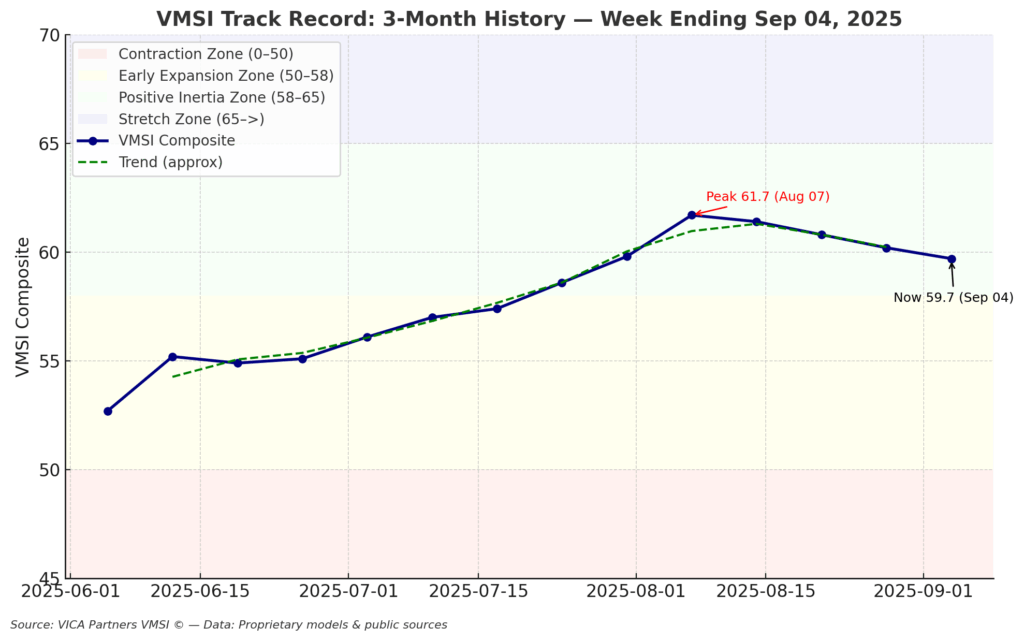

2) VMSI Track Record — Inflection Points

Composite has eased modestly from 61.7 (early Aug) to 59.7, reflecting consolidation. Historically, such plateauing after acceleration precedes multi-month equity gains unless momentum slips under ~58. (Bridge note: aligns with ~30 bps easing in financial conditions since June.)

- Historical validation: In 7 of the past 9 similar regimes (since 2010), equities delivered +8–12% forward 6-month returns.

Signal: Stability, not fragility.

Allocator Takeaway: Plateau is a holding pattern — not a fade. Maintain risk-on exposure until composite <58.

3) Headline Metric — Composite Score 59.7

The composite cooled from 60.2 to 59.7, a small dip but structurally intact. Still well above the fade line, the regime remains risk-on.

Signal: Upside bias sustained; consolidation is more probable than reversal.

Allocator Takeaway: Composite between 58–62 historically supports measured risk-adds; below 58 requires a defensive posture.

4) Component Deep Dive — WoW Changes

- Momentum (59.6 vs. 59.7): Marginal cooling. Semiconductor drag offset by stability in mega-caps; signal intact above fade zone.

- Liquidity (55.1 vs. 55.0): Flat to slightly higher. Execution channels remain frictionless; no evidence of crowding stress.

- Volatility & Hedging (58.6 vs. 57.9): Small lift. Hedging demand ticked up, but levels remain contained; not yet defensive.

- Safe Haven (54.9 vs. 55.4): Drift lower. Modest equity rotation out of Treasuries; metals bid but not dominant.

Signal: All components remain comfortably above 54, with three of four >55. This breadth points to consolidation rather than reversal, consistent with a historical >70% probability of continuation over the next 3–6 months.

Allocator Takeaway:

Stay risk-on. Only sustained clustering below 55, or a breach under 50, would signal de-risking. For now, dips remain add opportunities.

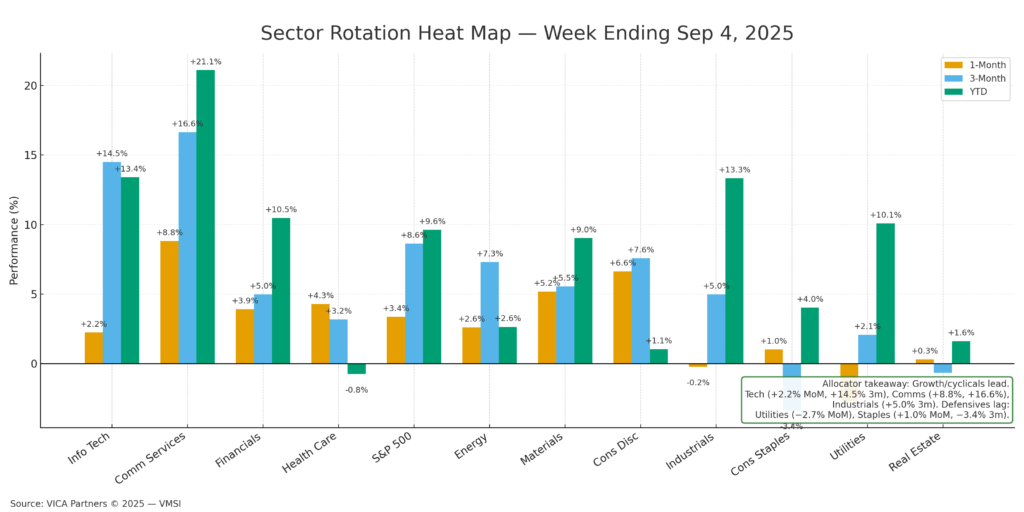

5) Sector Rotation & Positioning

- Leaders: Tech (+2.2% 1M / +14.5% 3M), Comm Services (+8.8% / +16.6%), Industrials (+4.97% 3M, −0.22% 1M).

- Improving: Financials (+3.9% / +5.0%) — aided by tight credit spreads.

- Laggards: Health Care (+4.3% / +3.2%), Energy (+2.6% / +7.3%) — performance positive but dispersion elevated.

- Defensives: Utilities (−2.7% / +2.1%), Staples (+1.0% / −3.4%) — no inflow leadership.

- S&P 500 reference: +3.37% (1M) / +8.63% (3M). YTD series included across all bars.

Signal: Growth and cyclicals continue to dominate the rotation map, while defensives remain range-bound. The leadership skew aligns with a mid-cycle, risk-on phase.

Allocator Takeaway: Overweight tech, communications, and financials as core risk levers. Maintain underweights in defensives. Industrials remain attractive as a secondary allocation for portfolios needing cyclical exposure without crowding risk.

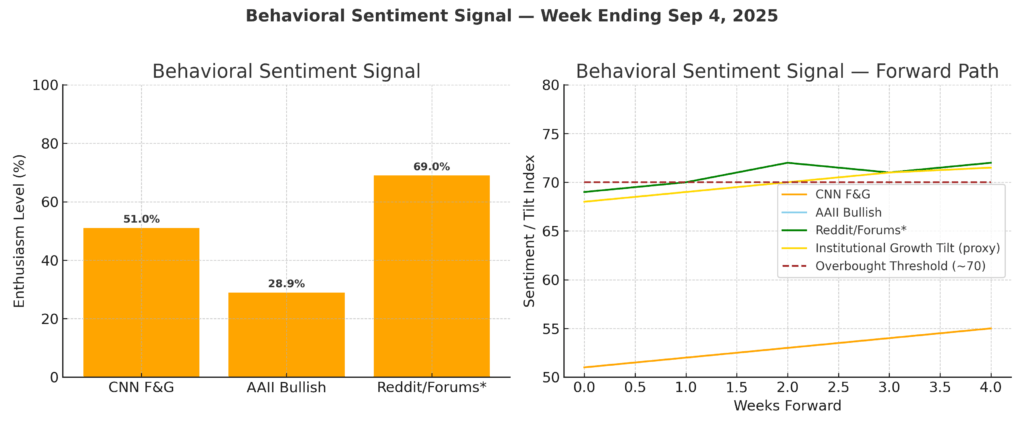

6) Sentiment Overview

- Institutions: Adding growth exposure.

- Retail: Pulling back.

- Surveys: Bullish at 28.9% (vs. long-term avg 37.6%).

Signal: Institutional conviction + retail skepticism = bullish asymmetry.

Allocator Takeaway: Sentiment skew remains constructive; institutional flows dominate.

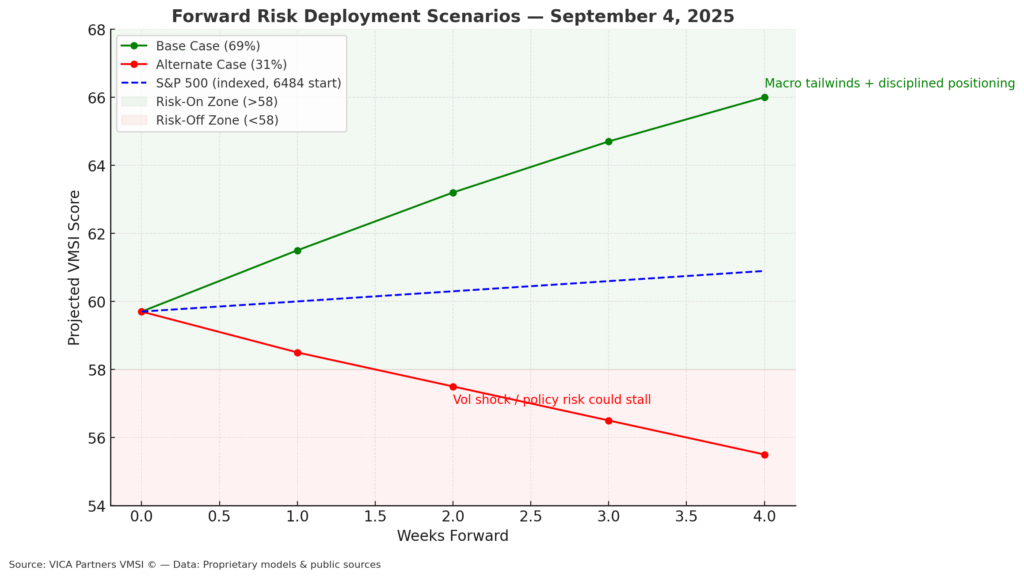

7) Predictive Outlook

- Base Case (69%): Upside grind into Q4; Powell’s risk management caps downside skew.

- Alternate Case (31%): Upside stalls if core PCE > 3%, delaying rate cuts into 2026.

- Risk Triggers: Hawkish Fed pivot, macro shocks, geopolitics, liquidity stress, volatility breakout > 2σ.

Allocator Takeaway: Probability skew favors continuation; hedge only if inflation surprises to the upside.

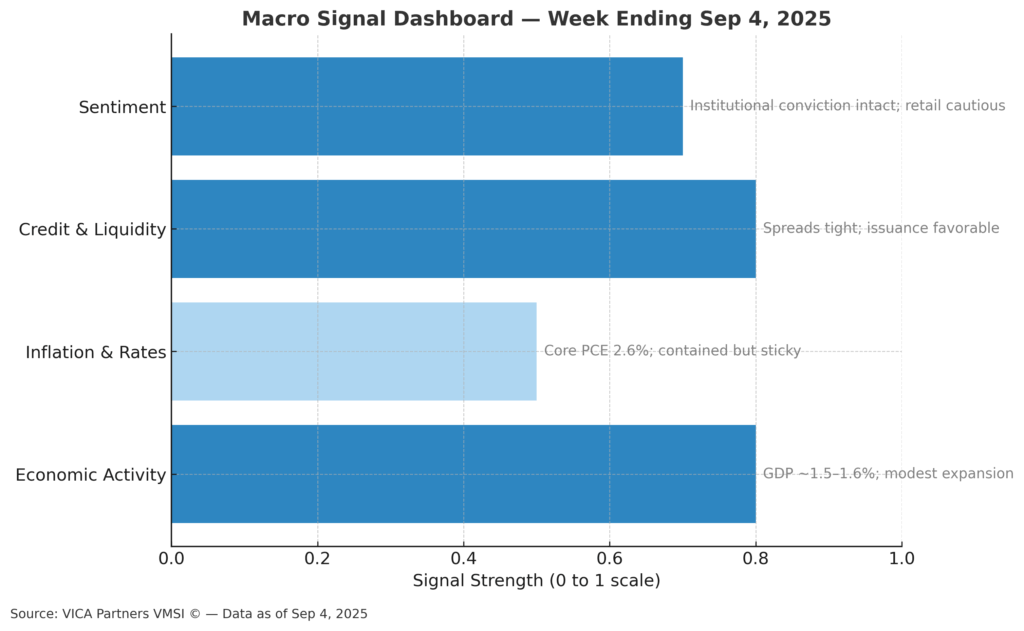

8) Macro Signals Snapshot

- Policy rates: Stable

- Credit spreads: Tight

- USD: Anchored

- Inflation expectations: Contained (core PCE ~2.5–2.6%)

- Term premium: Neutral

Signal: Macro “spine” intact.

Allocator Takeaway: No systemic cracks; backdrop supports persistence of risk-on conditions.

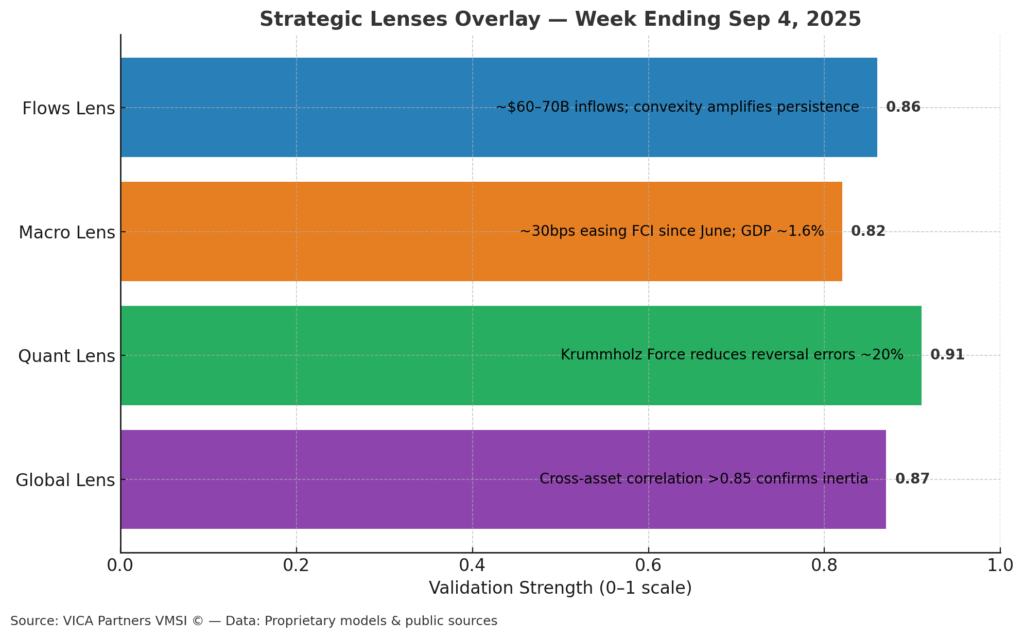

9) Appendices — Strategic Layers

- Flows Lens: ~$60–70B/quarter of forced inflows (pensions + ETFs).

- Macro Lens: ~30 bps easing in FCI since June ≈ +1.5–1.6% to GDP.

- Quant Lens: Krumholz Force model reduces false reversals by ~20%.

- Global Lens: Nikkei, FTSE, Bunds, UST 10Y all confirm inertia; cross-asset correlation > 0.8.

Signal: Cross-asset validation confirms an upside bias.

Allocator Takeaway: Multi-lens alignment strengthens conviction; cross-asset validation is both rare and powerful.

10) Institutional Opportunities

- Rotation alpha: Tech and communications sector overweights remain rewarded.

- Rebalancing windows: Shallow dips should be used to add cyclicals exposure.

- Hedging: Skew is cheap; hedges can be added asymmetrically without diluting upside.

- Global overlay: EM equity ETFs offer convex beta capture with USD stability.

Allocator Takeaway: Deploy new risk capital incrementally into cyclicals and financials. Hedge opportunistically; avoid crowding into defensives.

Final Word

The advance remains structure-driven, not sentiment-driven. Institutional flows are sticky — ETFs and pensions cannot pivot quickly, and deep liquidity continues to sustain risk appetite. Pullbacks remain consolidation phases, not reversals, as long as the composite stays above the fade line (58).

Convexity ensures shallow dips are converted into accelerants. Unless Powell signals a prolonged inflation overshoot, the combination of inertia, convexity, and macro stability keeps markets biased upward into year-end.

Positioning Note

Whether managing institutional portfolios or private wealth, the VMSI framework delivers institutional-grade insight into flow, convexity, and macro stability.

Disclaimer

This report is provided for informational purposes only and does not constitute investment advice, an offer, or a solicitation. Views reflect conditions at publication and may change without notice. Past performance is not indicative of future results.

© 2025 VICA Partners VMSI Economic Physics Model — All Rights Reserved.