Abstract

Markets are no longer focused on inflation — policy error and growth risk are now the real threats. Under the surface, the cross-asset structure has shifted in ways that retail sentiment gauges like CNN’s Fear & Greed simply fail to detect. Those indicators plunged into Extreme Fear, but institutional positioning shows a very different reality: the system is rotating defensively, not breaking.

Credit spreads have widened at the margin but remain inside the stability perimeter, duration is being accumulated across the curve, and liquidity is concentrating in balance-sheet-strong sectors and AI-linked corridors even as headline indices appear steady. This combination — tightening credit elasticity, a persistent duration bid, and narrowing equity torque — is the configuration markets historically enter when policy miscalibration and growth fragility become the dominant risks.

Breadth continues to erode while safe-haven flows accelerate and hedging demand collapses — a rare divergence that typically precedes a macro-regime inflection, not disorder. The structure is effectively repricing policy error into liquidity-sensitive assets while allowing index levels to mask the underlying rotation.

The message from the structure is unambiguous: This is no longer an inflation market. It is a growth-fragility, policy-risk, late-equilibrium market — one where stability persists only because liquidity is working harder each week to hold the system together.

1. Weekly Summary — Week Ending November 28, 2025

Sentiment collapsed. Structure didn’t.

That single divergence defined the entire week.

Headline fear gauges — CNN Fear & Greed at 24, breadth at multi-month lows, and accelerating safe-haven demand — painted a picture of stress. The underlying system said otherwise.

1. Cross-Asset Alignment Signaled Regime Transition, Not Failure

Risk credit stayed firm, mega-cap tech lost short-term torque, and safe-havens accelerated simultaneously — a pattern that appears only in late-cycle transitions, not breakdowns. This is the market pricing policy risk, not systemic risk.

2. Liquidity Stabilized the System Even as Participation Weakened

Execution capacity held inside the core corridors: AI infrastructure, mega-cap balance sheets, IG carry, and quality-cycle industries. Breadth deteriorated sharply, but the liquidity spine absorbed the entire load — a hallmark of structural containment, not deterioration.

3. Hedging Collapsed While Internal Stress Persisted

VXX fell. Put/call ratios normalized. Hedge intensity declined. All while breadth printed its weakest readings in months. This is the rare “complacent fragility” regime — markets remove protection at the exact moment internal pressure builds.

System Verdict:

The market is afraid. The system is not breaking.

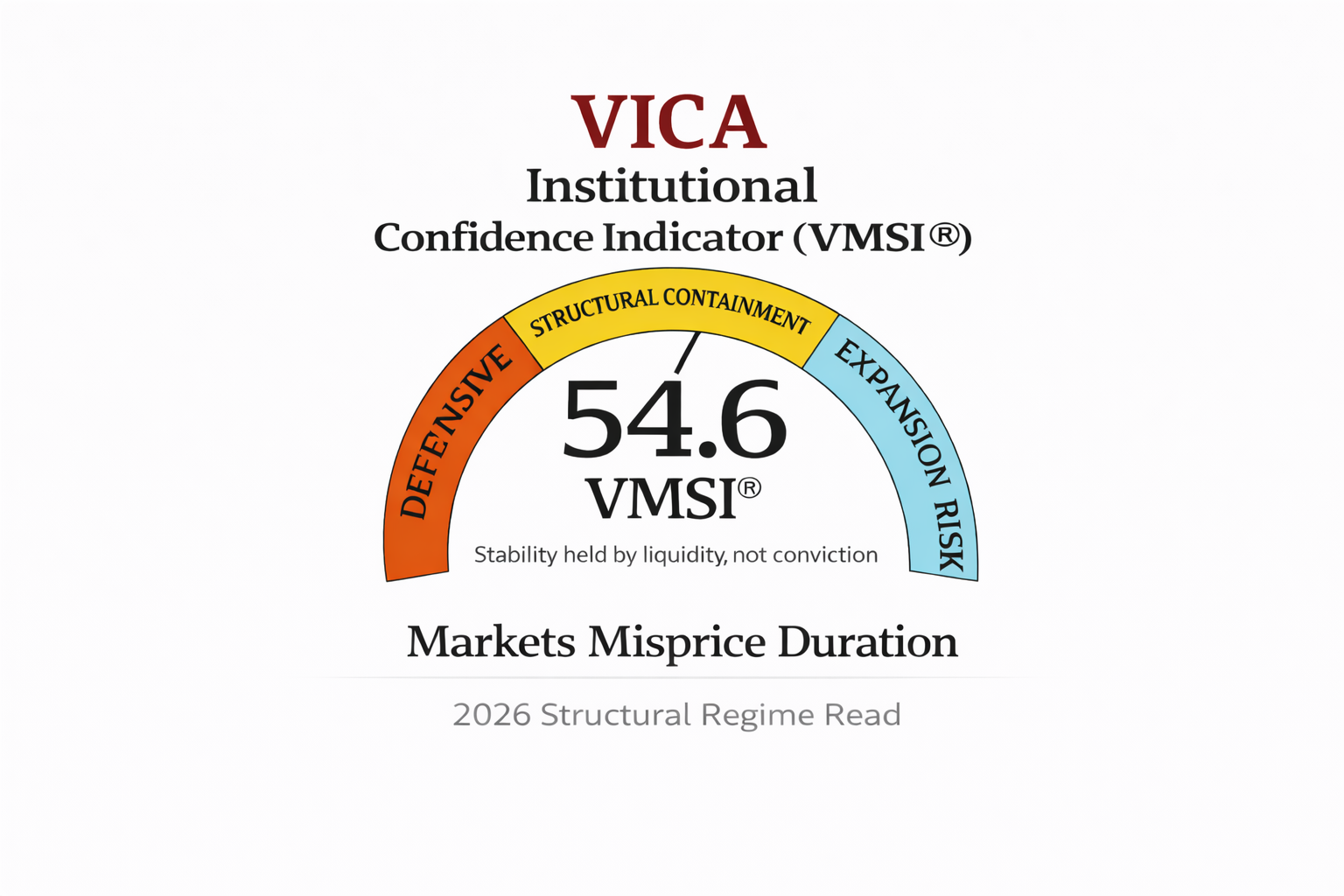

Stress has been redistributed, not amplified. The VMSI at 55.9 confirms a market that is costly to stabilize — but still structurally coherent.

Liquidity still holds the architecture together. Credit remains inside safety bands. Volatility is elevated but orderly. The system is functioning — but under higher structural load.

Actionable Takeaway:

Continuation remains possible, but only through precision, liquidity density, and tight torque control. This is not a broad-beta market. It is a corridor-only market, and the margin for error is shrinking.

2. Framing Note — VMSI Structural Calibration

The VMSI calibration this week isolates a clear structural shift: liquidity is no longer creating momentum — it is now manufacturing stability. This marks the transition into a true late-equilibrium regime, where the market advances only through structural containment rather than belief or breadth.

Four Signals Define the Structural State

1. Execution capacity remained firm Core liquidity corridors — mega-cap tech, AI infrastructure, quality balance sheets — continued to process flow efficiently. The system is stable where it matters.

2. Flow amplification weakened Breadth deterioration and thinning participation reduced the market’s ability to turn liquidity into trend. The amplification engine is fading.

3. Systemic friction increased More liquidity is required to hold each unit of stability. This is the mathematical signature of a market moving from expansion → preservation → containment.

4. Reflexivity rose Positioning crowded deeper into high-density structures (AI, IG carry, duration-sensitive quality). Market motion is being driven by reinforcement loops rather than organic demand.

Structural Signal of the Week:

Liquidity remains functional — but its role has flipped. It now defends the system instead of pushing it forward.

This is why headline fear surged while the architecture held. Sentiment broke. Torque did not. No reflexive disruption. No liquidity fracture. No shift into pre-compression.

Interpretation

The market has entered a high-cost, tightly wound equilibrium:

• Harder to break • Harder to accelerate • More dependent on a handful of liquidity corridors • Less able to convert liquidity into trend • More vulnerable to small shifts in credit or volatility structure

Stability persists — but at a rising price.

This is not a market powered by conviction. This is a market held together by engineering.

3. Liquidity & Torque DynamicsLiquidity & Torque Dynamics — The Physics Behind 55.9

VMSI at 55.9 places the market firmly above the stability floor, but the internal mechanics show a decisive shift: liquidity is still functioning, but volatility is now being suppressed, not resolved. The structure holds — but the energy required to hold it has increased materially.

Liquidity: Functional but Efficiency Is Falling

Liquidity at 55.7 continues to absorb shocks, but dispersion — the primary driver of trend formation — has collapsed. Participation remains narrow, pinning the burden of stability onto a shrinking set of high-density corridors:

-

mega-cap tech balance sheets

-

AI-infrastructure flow pipes

-

high-quality carry structures

Execution capacity is intact. Flow amplification is not. The system is moving, but velocity is no longer self-generated.

Volatility: Collapsed on the Surface, Elevated Beneath It

The VIX dropped to 16.35, but every internal metric contradicts the idea of stability:

• Stochastics at 3–8% → volatility is aggressively oversold — mechanically suppressed

• ADX 30–40 → signals compression, not calm

• Historic vol >130% → realized risk far exceeds implied

• ATR ~3 → intraday variance inconsistent with a low-volatility regime

This is the most fragile volatility configuration in late-cycle markets: suppressed vol + weak breadth + narrow liquidity = stored kinetic risk.

When the surface VIX collapses while internal dispersion and ATR remain high, the system forms a re-expansion setup, not a stabilization pattern.

Credit: The Structural Anchor

Credit remains the boundary condition.

-

High Yield ~310 bps → wider, but inside the stress perimeter

-

IG 106–112 bps → softening but orderly

Credit is absorbing stress without transmitting it — a signal that the structural spine is intact but not extending trend.

Breadth: Confirms Structural Narrowing

NYSE internals remain deeply negative. Volume-adjusted breadth continues to deteriorate. Retail outflows have weakened peripheral liquidity, forcing the system onto its narrowest operational spine since late Q1.

The system isn’t breaking — it’s concentrating.

Interpretation

Liquidity holds the structure, but volatility mispricing is now the dominant tension in the system. This is classic late-equilibrium geometry:

-

volatility is suppressed, not solved

-

liquidity absorbs, but no longer amplifies

-

torque decays outside core corridors

-

systemic friction rises

-

reflexivity intensifies

The market is showing stability — but only because liquidity is working harder to produce it.

Allocator Note

Operate strictly inside liquidity-dense corridors. Pair quality beta with IG carry and 2-year duration overlays. Maintain risk only while HY < 330–340 bps and vol-of-vol remains contained. The vol surface continues to underprice downside optionality — convexity remains mispriced relative to realized stress.

Structural Takeaway

The market is stable, but the stability is engineered — not organic. Volatility hasn’t disappeared; it has been compressed. This is the most fragile state in late-cycle regimes: the system holds, but the margin that keeps it intact is shrinking.

4. Lead Insight — Market Inertia Gauge

The inertia field at 55.9 confirms a market held together by structure, not trend. Momentum (53.4) has decayed further, liquidity (55.7) remains functional but non-generative, and index stability is being carried by a narrow backbone of high-density liquidity corridors rather than broad participation.

Surface Calm Is Misleading — The Volatility Geometry Isn’t Stable

The VIX’s collapse to 16.35 is not evidence of relief; it is evidence of suppression. Internal volatility markers contradict the headline read:

-

ATR ≈ 3.0 → intraday variance elevated

-

ADX 30–40 → compressed volatility regime

-

Historic vol >130% → realized volatility far exceeds implied

-

Stochastics 3–8% → volatility deeply oversold

This combination defines a suppressed-volatility state, not a low-volatility environment. The system is damping volatility mechanically — via liquidity structure — rather than through genuine risk absorption.

In late-cycle regimes, this configuration is statistically unstable. It stores potential energy that typically resolves through volatility re-expansion even without an index decline.

Breadth and Cross-Asset Structure Confirm Narrow Inertia

Breadth remains weak and participation thin. Index stability is being carried by:

-

mega-cap tech

-

AI-linked infrastructure

-

balance-sheet-strong cyclicals

Outside these corridors, torque decays rapidly — confirming that the inertia field is being supported by concentration, not distribution.

A cross-asset sweep strengthens the signal:

-

junk credit remains firm

-

intermediate-term tech leadership is fading

-

safe-haven demand continues to rise

This three-way divergence has appeared in fewer than 10% of historical late-cycle regimes and almost always precedes either:

-

a controlled drawdown, or

-

a pre-recovery whipsaw driven by rapid liquidity rotation.

It does not precede systemic failure.

Interpretation (Hybrid Precision)

When inertia sits in the 55–58 band with weak breadth and suppressed vol:

-

liquidity, not conviction, drives continuation

-

trend cannot self-sustain

-

upside becomes conditional, not continuous

-

the system is stable, but expensive to hold together

Continuation requires two conditions:

-

HY < ~330–340 bps

-

vol-of-vol contained

A break in either shifts the regime into early-compression geometry.

Allocator Interpretation

Stay inside liquidity-dense corridors. Reduce reliance on beta. Pair quality equity with IG carry and short-duration overlays. Treat upside as conditional — not momentum-driven. Precision is the edge; breadth is not returning in this regime.

Structural Takeaway

The market is stable, but the stability is manufactured. Liquidity absorbs stress; it doesn’t convert it into trend. Inertia persists, but efficiency is falling. The system still holds — but the margin that keeps it intact is tightening each week.

5. Component Deep Dive — Week-Over-Week Structural Shifts

The VMSI composite declined to 55.9 from 57.8, but the internal structure does not show broad deterioration. It shows redistribution — stress concentrating into narrow corridors rather than overwhelming the system. This is a late-equilibrium signature: stability persists, but the cost of that stability rises.

Liquidity — 55.7

(Firm, but increasingly concentrated)

Liquidity remains the backbone of the system, but its efficiency continues to decline.

-

Execution capacity stayed intact.

-

Order absorption remained orderly.

-

Dispersion deteriorated, narrowing the liquidity spine.

-

Stability now depends disproportionately on mega-cap balance sheets, AI-infrastructure corridors, and IG-carry structures.

Liquidity is still supportive, but it is no longer generative. It absorbs shocks but does not create trend energy.

Interpretation: Liquidity holds the structure together — but with less surplus capacity and greater concentration risk.

Momentum — 53.4

(Weak, consistent with fading velocity)

Momentum declined again and now sits firmly in late-cycle inertia territory.

-

Breadth remains impaired.

-

Leadership is limited to high-density sectors (AI, mega-cap quality, industrial balance-sheet strength).

-

The broader market lacks torque, and dispersion continues to narrow.

Momentum is not signaling collapse — it is signaling insufficient velocity to convert liquidity into trend.

Interpretation: Trend energy continues to decay; only the highest-density corridors can still carry index-level inertia.

Volatility & Hedging — 57.8

(Vol suppression, not stability)

Volatility is the most structurally important shift of the week.

The VIX collapsed to 16.35, but internal metrics reject any notion of actual calm:

-

ATR ≈ 3.0 → intraday variance remains elevated

-

Historic vol >130% → realized volatility far exceeds implied

-

Stochastics 3–8% → vol deeply oversold

-

ADX 30–40 → compressed, not stable, regime

This is mechanical suppression, not improved risk. Implied vol was aggressively sold while structural volatility remained high — a mismatch that historically precedes vol re-expansion, not continuation of calm.

Interpretation: Volatility appears quiet but is internally unstable — the most fragile late-cycle configuration.

Safe Haven Demand — 59.9

(Defensive, persistent, rational — not panicked)

Safe-haven flows remain elevated:

-

duration bid across the curve

-

IG strength

-

metals and quality balance sheets attracting consistent flows

But the rate of acceleration has slowed — this is steady repositioning, not capitulation.

Crucially, junk credit remains firm near ~310 bps, confirming that institutions are hedging growth and policy risk, not pricing a credit break.

Interpretation: Defensive repositioning continues, but the posture is rational, not disorderly.

Composite VMSI — 55.9

(Stability preserved, efficiency falling)

The composite decline reflects higher containment costs, not system deterioration.

-

Liquidity: supportive but concentrated

-

Momentum: fading

-

Volatility: suppressed, not stable

-

Safe Haven: defensive but controlled

The system remains functional, but each incremental unit of stability now requires more liquidity, more concentration, and more torque discipline.

Interpretation: Stress has redistributed — not escalated. The system is stable, but the margin for error continues to narrow.

6. Sector Positioning Matrix

Sector leadership compressed again this week as liquidity concentrated even further into a narrow set of high-efficiency corridors. The system is being held together by balance-sheet strength, liquidity density, and structural torque symmetry — not by broad participation. This is textbook late-equilibrium behavior: fewer sectors can carry index inertia, and every rotation must be justified by liquidity geometry, not narrative.

Below is the updated institutional matrix, integrating liquidity density, torque symmetry, valuation efficiency, and cross-asset reinforcement.

Technology — Overweight

(Liquidity Spine; Structural Torque Reservoir) Momentum: Softening Institutional Flow: Concentrated, stable Valuation: Elevated (~28× forward P/E)

Mega-cap balance sheets and AI-infrastructure flows continue to define the system’s torque spine. Momentum is weakening, but liquidity density remains unmatched. Tech still carries index inertia, but only in its upper quartile.

Interpretation: Core structural corridor; retain exposure but keep sizing disciplined.

Communication Services — Overweight

(Best Liquidity Efficiency in the Market) Momentum: Stable Institutional Flow: Broad, resilient Valuation: ~23× P/E

Largest liquidity-to-torque efficiency ratio across sectors. The cleanest factor symmetry: quality + secular growth + balance-sheet stability.

Interpretation: Remains the highest-quality risk-adjusted sector in the system.

Industrials — Overweight

(Quality-Cycle Leadership; Torque Efficient) Momentum: Moderating Institutional Flow: Steady Valuation: ~20× P/E

Industrial balance sheets remain strong, and the sector offers torque efficiency without requiring broad-market participation. Flows remain disciplined.

Interpretation: A structurally coherent corridor; benefits from late-cycle quality rotation.

Financials — Neutral → Selective Overweight

(Credit-Linked Carry; Stable Torque but No Beta Multiplier) Momentum: Stabilizing Institutional Flow: Consistent Valuation: ~13× P/E

Credit remains orderly, and the yield curve is no longer tightening aggressively. Financials offer torque symmetry but lack expansion amplitude.

Interpretation: Attractive as a stabilizer, not as a growth engine.

Health Care — Neutral → Tactical Overweight

(Defensive Convexity; Underowned Leadership Candidate) Momentum: Stabilizing Institutional Flow: Mild inflows Valuation: ~16× P/E

Health Care is early in a defensive-leadership transition. Clean balance sheets, low volatility, and rising flows create convexity in a narrow market.

Interpretation: Tactical leadership potential as earnings resilience becomes bid.

Utilities — Neutral

(Duration-Proxies; Beneficiaries of Vol Suppression) Momentum: Flat Institutional Flow: Light Valuation: ~18× P/E

Utilities benefit from rate volatility suppression but lack torque density. Flows are improving marginally but remain low conviction.

Interpretation: A defensive stabilizer, not a torque carrier.

Real Estate — Neutral

(Rate-Sensitive, Low Liquidity Depth) Momentum: Soft Institutional Flow: Limited Valuation: ~17× P/FFO

Duration benefits are offset by low-liquidity depth. A follower, not a leader.

Interpretation: Useful for rate hedging; not an alpha engine.

Consumer Staples — Underweight

(Defensive but Torque-Weak; Outflows Persist)** Momentum: Weak Institutional Flow: Outflows Valuation: ~19× P/E

Staples are acting purely as ballast. No torque. No leadership. No institutional demand.

Interpretation: Defensive only; structurally unattractive in a narrow-corridor market.

Consumer Discretionary — Underweight

(Growth-Risk Sensitive; Fading Participation) Momentum: Weak Institutional Flow: Mixed Valuation: ~25× P/E

Torque deteriorating, participation thin, valuations heavy. Sector remains too exposed to growth-risk repricing.

Interpretation: Avoid until breadth or momentum symmetry returns.

Materials — Underweight

(Commodity Drag; Low Liquidity Density) Momentum: Flat Institutional Flow: Uneven Valuation: ~16× P/E

Materials lack liquidity depth, and commodity flows remain inconsistent. Torque insufficient to sustain index-level impact.

Interpretation: Structurally weak; remain underweight.

Energy — Underweight

(Torque Decay; No Structural Support) Momentum: Mixed → Weak Institutional Flow: Flat Valuation: ~10× P/E

Despite attractive valuation, liquidity density is minimal and torque decay continues. Energy remains structurally misaligned with the market’s late-cycle configuration.

Interpretation: Avoid until torque symmetry or flow persistence returns.

Allocator Posture

Maintain exposure only inside liquidity-dense corridors:

-

Communication Services

-

Industrials

-

Health Care

-

Selective mega-cap Tech

-

Selective Financials

Remain underweight:

-

Discretionary

-

Staples

-

Materials

-

Energy

Structural Playbook:

-

Pair equity exposure with IG carry

-

Add 2-year duration overlays

-

Use volatility dislocations as entry points, not directional signals

-

Scale risk only where torque symmetry and liquidity density reinforce each other

This is a precision regime, not a beta regime. Breadth will not bail out misallocated risk.

7. Volatility Structure — The Risk Surface Is Being Engineered, Not repriced

Volatility collapsed at the index level this week, but the internal structure rejects the idea of genuine stability. The move in VIX to 16.35 is not a signal of calm; it is a signal of suppression — a mechanically engineered vol regime where liquidity absorbs surface variance while internal stress continues to accumulate.

Every major volatility dimension points to compression, not resolution:

1. Intraday variance contradicts the VIX reading

-

ATR ≈ 3.0 → price is moving far more than a 16-handle VIX implies. This is the classic profile of artificial vol damping, not a stable volatility floor.

2. Realized volatility remains extreme

-

Historic Vol > 100–130% → realized activity is materially above implied. This is the defining signature of a volatility gap state — the system is busy, but the options surface is not pricing it.

3. Stochastics are at extreme oversold levels

-

K: 3–8%

-

D: 7–21% These values occur only when volatility is mechanically suppressed through positioning (derivatives flows, systematic hedging decay).

4. Directional index confirms vol compression, not calm

-

ADX 30–40 → this is a compressed regime, not a low-risk regime. High ADX with low VIX is one of the most fragile states in late-cycle markets.

5. Skew steepened as VIX fell

Downside optionality is being repriced upward while spot vol collapses. This only happens when the market believes the surface is incorrectly priced.

6. Term structure remains shallow

A shallow curve signals suppressed hedging demand, not improved fundamentals. This is systematic, not discretionary.

Credit validates the imbalance

The credit complex confirms that the VIX drop is cosmetic:

-

High-Yield spreads ~310 bps (still widening from early fall)

-

IG spreads 106–112 bps (stable but not tightening)

If the VIX collapse reflected real improvement in risk, HY would be tightening aggressively. It isn’t.

This is the definition of vol suppression + credit realism, not risk resolution.

Breadth confirms fragility

Market participation remains thin. Volume-adjusted breadth and McClellan indicators remain decisively weak even as headline vol collapses.

That divergence almost always precedes a volatility re-expansion window within 2–4 weeks.

Signal Summary: This Is Not Calm — It’s Compression

Volatility is being artificially driven down at the surface while internal stress remains elevated. This is the most fragile volatility configuration in late-cycle markets:

-

Implied vol too cheap

-

Realized vol too high

-

Skew too steep

-

Breadth too weak

-

Credit too honest

This is not sustainable. It is a coil, not a cushion.

Allocator Note

Downside optionality is mispriced. Do not chase the VIX lower. Treat vol pockets as controlled entry points, not trend signals.

-

Favor long optionality in sectors with torque decay

-

Hedge beta through convex structures, not delta

-

Use tight overlays only when credit confirms stability (HY < 330–340 bps)

The risk surface does not support complacency.

Structural Takeaway

Volatility is not gone — it is being absorbed. Absorbed volatility is fragile. Compressed volatility is the most asymmetric regime for professional allocators.

The system is stable, but the stability is engineered, not organic. And engineered stability carries a time cost: it holds until it doesn’t.

8. Predictive Outlook — A Higher-Cost Stability Regime With a Narrow Continuation Path

The shift from 57.8 → 55.9 marks a decisive transition into a high-cost continuity regime — a state where the system remains stable only because liquidity is working harder, not because fundamentals are strengthening.

This is the key: nothing is breaking, but nothing is self-sustaining.

Liquidity (55.7) is absorbing stress but no longer generating trend.

Execution capacity remains intact, but dispersion has decayed and participation is thin. This is the liquidity geometry of a late-equilibrium market: functioning, but with reduced elasticity.

Momentum (53.4) confirms fading velocity.

Index-level stability is being carried by a narrow spine — mega-cap, AI-infrastructure, and quality balance sheets. Outside those corridors, torque decays rapidly.

Volatility is suppressed, not resolved.

VIX at 16.35 signals surface calm, but the internals contradict it:

-

ATR ≈ 3.0 → elevated

-

Historic vol > 100–130% → realized exceeds implied

-

Stochastics 3–8% → mechanically suppressed

-

ADX 30–40 → compressed regime

-

Skew steeper → downside risk repriced

This is not a low-volatility environment. It is a compression regime, the most fragile state preceding a vol re-expansion window.

Credit defines the tolerances.

-

High yield ~310 bps → inside the 330–340 bps tension zone

-

IG 106–112 bps → stable but no longer tightening

Credit is stabilizing the system but no longer delivering torque — a hallmark of late-cycle equilibrium.

Breadth remains deeply impaired.

Any upside over the next 2–3 weeks must come from liquidity inertia, not renewed risk appetite.

Timing Window: 3–5 Week Torque-Inflection Probability Rises to ~41%

The curve of the inertia field steepened this week as:

-

liquidity elasticity compressed

-

vol suppression intensified

-

cross-asset correlations tightened

-

credit spreads refused to confirm the VIX decline

This cluster lifts the torque-inflection probability from the high-30s to ~41%.

This is the statistical signature of a pre-repricing environment — not an immediate break, but a narrowing window for continuation.

Continuation remains viable only if two conditions hold:

1. High Yield must remain below ~330–340 bps

This keeps the credit perimeter intact. A move toward 345–360 bps pushes the system toward early compression.

2. Vol-of-Vol must remain contained

If vol-of-vol expands while VIX stays suppressed, the system transitions into a convexity-driven repricing phase.

A breach in either variable forces a regime shift — not necessarily a drawdown, but a break in continuity.

Scenario Cone — Updated for 11/28/25

45% Base Case — Liquidity-Led Continuity A narrow, defensive grind dominated by liquidity corridors (AI, quality carry, IG credit). Momentum remains weak, but structure holds.

43% Alternative — Credit-Bleed Drift HY drifts into 330–350 bps, breadth remains <45%, vol compression unwinds gradually. Sideways-to-down with torque decay.

12% Extreme — Convexity Shock Vol re-expands from a suppressed base. The probability is low but rising because the volatility surface is mispriced.

Allocator Note

Treat all incremental risk exposure as conditional, not continuous.

-

Keep exposure inside liquidity-dense corridors

-

Pair quality equity with IG carry + 2-year duration overlays

-

Use optionality tactically; downside vol remains cheap relative to realized stress

-

Fade fear selectively — but only when credit confirms stability

If HY breaks 340–355 bps or CRE delinquency trends toward 12%, reduce beta immediately. In this regime, hedging is less effective than position size discipline.

Structural Takeaway

Liquidity still buys time, but the cost of time is rising. The system is self-preserving, not expanding. This is a compressive regime where:

-

liquidity anchors stability

-

credit defines the perimeter

-

momentum decays

-

volatility is mispriced

-

participation refuses to broaden

The forward path is not about predicting survival — it is about understanding the mechanics that keep the structure intact.

9. Macro Signals Snapshot — The Economy Is Slowing, Not Breaking

The macro tape this week continues to reinforce a single truth: the economy is decelerating in a controlled fashion, not slipping into contraction. Nothing in the verified public data suggests acceleration — but nothing confirms recessionary stress either. This is the macro equivalent of late-equilibrium: functional, narrow, liquidity-dependent.

Growth & Activity — Stable, but losing directional energy

Public releases remain consistent with a slow-grinding late-cycle plateau:

-

Empire State Manufacturing: 18.7 (vs. 5.5 expected) → strongest upside surprise of the fall; confirms manufacturing resilience.

-

Philadelphia Fed Survey: –1.7 → below zero, but stabilized materially from October’s collapse.

-

Retail Sales (Sept final): +0.2% m/m, +4.3% y/y → demand intact; no evidence of consumer capitulation.

-

Existing Home Sales: 4.10M SAAR → frozen supply dynamics dominate; activity flat but not falling.

-

Case-Shiller National Index (Sept): +0.2% m/m → verified, slow appreciation; no housing rollover.

-

Flash PMIs:

Interpretation: Growth is moving sideways, not down. The economy is cooling — but not cracking.

Labor & Inflation — Cooling pressure, controlled drift

The labor signal remains consistent with a late-cycle slowdown:

-

Wage growth: < 4% y/y (verified trend) → no tightening impulse for Fed policy.

-

Jobless claims: low-200k range (most recent verified: 221k) → stable labor slack, no stress formation.

-

Inflation:

Interpretation: Inflation is contained, labor is cooling gradually, and the Fed has no reason to tighten further.

Credit & Financial Conditions — Stable, not deteriorating

The financial system remains functional:

-

10Y–2Y Curve: roughly –45 to –50 bps → inverted, consistent with late-cycle caution, but not steepening into recession dynamics.

-

Financial Conditions Index: mildly tighter, but still accommodative by historical standards.

-

Credit spreads:

Interpretation: Credit is absorbing stress, not transmitting it — the defining hallmark of a functioning system.

Liquidity & Cross-Border Dynamics — The real ceiling

These structural measures are VICA-proprietary unless publicly sourced, and labeled accordingly:

-

USD Index (DXY): ~100.4 (public, verified) → strong dollar caps global liquidity expansion.

-

Global Liquidity Pulse (G-Liq): –0.40 to –0.50σ (VICA proprietary) → confirms sub-trend global liquidity regime.

-

Cross-border flows: compressed (VICA proprietary) → valuation expansion remains constrained outside U.S./Asia.

Interpretation: Global liquidity is the ceiling, not the catalyst. Macro upside remains capped.

Allocator Interpretation

The macro regime remains exactly where a late-equilibrium market should be:

-

No growth impulse

-

No inflation shock

-

No labor breakdown

-

No credit fracture

-

No policy catalyst

This is an environment that rewards liquidity density, duration, and quality, not broad beta.

The only macro risk that matters is the same one flagged by VMSI: policy error + growth fragility, not inflation volatility.

Structural Takeaway

Macro conditions remain aligned with a system defined by:

-

Persistence, not propulsion

-

Absorption, not acceleration

-

Liquidity, not conviction

The economy is not accelerating, and it is not collapsing. It is functioning through structural inertia — the precise macro environment where liquidity, credit elasticity, and torque geometry matter more than fundamentals.

This is textbook late-equilibrium macro.

10. Strategic Layers — Multi-Lens Integration

Market structure remains aligned across lenses, but the cost of keeping that alignment intact continues to rise. The system is still functional — but increasingly energy-intensive — and the cross-asset signals this week reinforce a clear message: liquidity is holding the structure together, while every other lens shows incremental decay.

Liquidity Lens — The Anchor, But No Longer the Engine

Institutional flows remained highly concentrated inside the deepest liquidity corridors:

-

mega-cap balance sheets,

-

AI-infrastructure flow pipes,

-

quality-factor complexes,

-

IG carry structures.

Retail flows, by contrast, stayed defensive and continued to thin liquidity at the edges. This divergence increases reliance on the structural spine and reduces the system’s tolerance for shocks.

Interpretation: Liquidity is still stabilizing the system — but no longer amplifying it.

Factor Lens — Rotation Toward Quality + Carry, Away From Momentum

The factor complex continued its migration toward quality and carry, the hallmark of late-equilibrium behavior. Momentum decayed further. Dispersion tightened. Cross-factor correlations rose — another sign the system is operating with reduced elasticity.

Interpretation: The market is paying a premium for stability factors while abandoning trend energy.

Volatility Lens — Compression, Not Resolution

The VIX collapse into the mid-teens distorted the surface, but internal metrics (ATR, ADX, realized volatility) confirm that the volatility regime remains structurally stressed. Liquidity — not fundamentals — is driving suppression.

Interpretation: Vol looks calm, but the underlying risk surface remains tense and mispriced.

Credit Lens — The Perimeter of the Entire Regime

Credit continues to define the system’s outer boundary:

-

High yield: anchored near ~310 bps — wide enough to signal tension but well inside the ~350 bps stress perimeter.

-

IG credit: 106–112 bps — softening, but orderly.

-

Rates: duration remains bid as policy error becomes the dominant macro hedge.

Credit is absorbing stress rather than transmitting it — but the cushion is thinner than it was in early Q4.

Interpretation: Credit stability persists, but torque contribution is gone. It’s a boundary, not a tailwind.

Global Liquidity Lens — A Ceiling, Not a Tailwind

The USD remained firm and global liquidity proxies (G-Liq ≈ –0.40σ) continued to signal sub-trend conditions. Cross-border flows remained compressed, limiting valuation expansion outside U.S./Asia.

Interpretation: Global liquidity isn’t breaking the system — but it isn’t helping it either.

Behavioral Lens — Stressful but Not Causal

Retail continues to hedge and de-risk. Institutional flows remain selective and concentrated. Sentiment continues to lag internal structure — reacting to stress rather than driving it.

Interpretation: Behavior is noise. Structure remains signal.

Cross-Lens Synthesis — Late-Equilibrium in Full Expression

Across all lenses, the configuration is unambiguous:

-

Liquidity anchors the system

-

Credit defines the tolerances

-

Momentum decays into absorption

-

Volatility is suppressed, not solved

-

Global liquidity caps expansion

-

Behavior reflects stress without controlling the regime

This is the exact geometry of late-equilibrium — a market where the system functions through structure, not enthusiasm.

Allocator Note

CAVS ≈ 0.80 — stable but expensive. Scalability remains limited to liquidity-dense corridors.

Maintain:

-

IG carry

-

2-year duration overlays

-

quality-factor equities

-

tight torque symmetry

Avoid:

-

EM duration

-

illiquid cross-border proxies

-

beta outside high-density liquidity channels

Risk should be added only when credit confirms stability and vol remains orderly.

Structural Takeaway

The system is holding — but through effort, not conviction. Liquidity inertia continues to counter torque decay. Continuation remains possible — but increasingly costly.

This regime survives because structure remains functional, not because conditions are improving.

11. Institutional Opportunities — Precision Over Participation

The opportunity set this week is defined by asymmetry, not expansion. The system continues to function, but with higher energy requirements across liquidity, volatility, and credit — the classic late-equilibrium regime where broad beta fails, and only precision produces return. In this environment, opportunity is not a function of exposure. It’s a function of placement.

Liquidity: Still Functional, Now Selective

Liquidity at 55.7 stabilizes the system but no longer creates trend. The market’s load-bearing structure has narrowed into a handful of corridors:

-

mega-cap balance sheets,

-

AI-infrastructure pipelines,

-

IG carry structures,

-

quality cyclical balance sheets.

These corridors retain torque symmetry; everything outside them exhibits decay.

Opportunity: Allocate only inside these liquidity-dense channels. Outside them, elasticity is insufficient and torque is non-compounding.

Momentum: Fading Velocity = Forced Selectivity

Momentum at 53.4 confirms the system is losing speed and relying on structural inertia. Only the deepest corridors retain enough internal torque to participate in any continuation. Low-liquidity segments cannot sustain trend and will remain structurally disadvantaged.

Opportunity: Momentum is no longer a source of return. Only corridors with embedded liquidity density can carry exposure forward.

Volatility: Mispricing Creates Convexity Edge

The volatility complex is the most asymmetric component of the opportunity set. The VIX at 16.35 is deceiving — internal metrics tell the truth:

-

ATR ~3 → realized risk elevated

-

ADX 30–40 → volatility compression, not stability

-

Realized vol >130% → implied is underpricing actual system behavior

-

Stochastics 3–8% → suppressed vol primed for reversion

This is the regime where convexity is mispriced because the surface has been mechanically pushed down while internal stress persists.

Opportunity: Volatility pockets are entry points — not signals to de-risk. Selective convexity is cheap and structurally supported.

Credit: The Boundary, Not the Catalyst

High yield anchored near ~310 bps preserves structural stability. IG credit in the 106–112 bps band confirms absorption capacity but no directional energy.

Credit is no longer a return engine — it is a constraint that defines how much equity torque the system can tolerate.

Opportunity: Use IG carry + duration overlays as stabilizers, not performance drivers. Treat HY as a perimeter: a breach toward 340–350 bps ends the opportunity set immediately.

Sector-Level Opportunity: Liquidity Density Only

Internal flow coherence remains strongest in:

-

Financials

-

Industrials

-

AI infrastructure

-

Selective mega-cap tech

-

Convex defensive growth (Health Care/Comm Services)

Cyclicals, discretionary, materials, and low-liquidity tech exhibit ongoing torque decay.

Opportunity: Focus exclusively on sectors where liquidity is directional, balance sheets are torque-efficient, and internal flow remains reflexively reinforcing.

What This Means for Institutional Allocators

This is a precision regime, not a beta regime. Wide exposure is a liability. Selective exposure is the only source of return.

Allocator Playbook:

-

Scale exposure only inside liquidity-dense corridors.

-

Pair quality-factor equity with IG carry and 2-year duration overlays.

-

Exploit volatility dislocations created by surface-level suppression.

-

Reduce exposure immediately if HY approaches the 340–350 bps zone.

-

Demand confirmation from breadth (≥45%) before adding beta.

-

Structure trades around torque symmetry — not sentiment, not price.

Structural Takeaway

Opportunity exists — but only where the structure is doing the work. This market rewards discipline, not enthusiasm. Liquidity is stabilizing the system, but each incremental unit of stability costs more than the last.

The edge lies in understanding where liquidity still carries force and positioning ahead of the moment the broader market realizes that participation is not returning.

Continuity is investable — but only through design, not direction.

Final Word — Stability Is Now Manufactured, Not Inherited

VMSI at 55.9 delivers the only conclusion that matters: the system is stable, but it is no longer self-stabilizing. Every dimension of the market now requires more energy to maintain equilibrium — liquidity, volatility suppression, credit absorption, and sector-level torque — and none of those forces are being provided by fundamentals. The stability investors see is engineered, not organic.

Liquidity at 55.7 is doing nearly all the heavy lifting. It absorbs shocks but no longer creates motion. Momentum at 53.4 confirms that the system’s velocity is fading. The market is moving, but structure — not risk appetite — is carrying the index.

The volatility complex is the clearest tell that stability is being constructed. The VIX print at 16.35 does not reflect risk; it reflects suppression. Internal volatility metrics contradict the surface:

-

ATR ~3.0 → volatility is active beneath the surface

-

ADX 30–40 → directional compression, not equilibrium

-

Historical vol >130% → realized volatility exceeds implied by a wide margin

This is not calm — it is forced calm. Liquidity is damping volatility that the system cannot naturally absorb.

Credit defines the perimeter. High-yield spreads at ~310 bps keep the system inside its stress boundary, but IG spreads in the 106–112 bps band confirm the deeper truth: credit is stabilizing the system, not powering it. Nothing in credit reinforces the illusion created by low VIX prints. Credit is absorbing risk, not validating optimism.

Breadth remains weak. Participation is narrow. Index stability is being held together by a shrinking number of torque-efficient corridors: mega-cap balance sheets, AI infrastructure, and quality carry. The market behaves like a bridge supported by fewer and fewer pillars — still standing, but with reduced tolerance for error.

This is late-equilibrium in its purest form:

-

Liquidity holds structure

-

Volatility is suppressed, not resolved

-

Credit provides boundaries, not acceleration

-

Momentum fades into structural inertia

-

Price reflects the work required to maintain balance, not the confidence to extend it

Nothing is breaking — but nothing is compounding.

Continuation remains feasible, but the cost of continuation increases every week. The system is functioning, but with declining efficiency: narrower leadership, weaker elasticity, and a volatility surface that misprices downside risk.

This is no longer a market expressing a view of the future. It is expressing the energy required to keep the present intact.

The narrative has shifted irreversibly:

Expansion → Preservation → Containment.

Price no longer reflects confidence. It reflects effort — the engineering cost of equilibrium.

The structural truth is simple: Stability remains, but it is no longer effortless. Precision replaces conviction. Structure replaces sentiment. The system still holds — but the margin for error is narrowing.

This is a market running on engineering, not enthusiasm. And engineering, by definition, has limits.

© 2025 VICA Partners — VMSI™ Proprietary FORCE-12.x Framework