Stay Informed and Stay Ahead: Report Series, June 6th, 2024

U.S. Economic Reports Series: ADP® National Employment Report

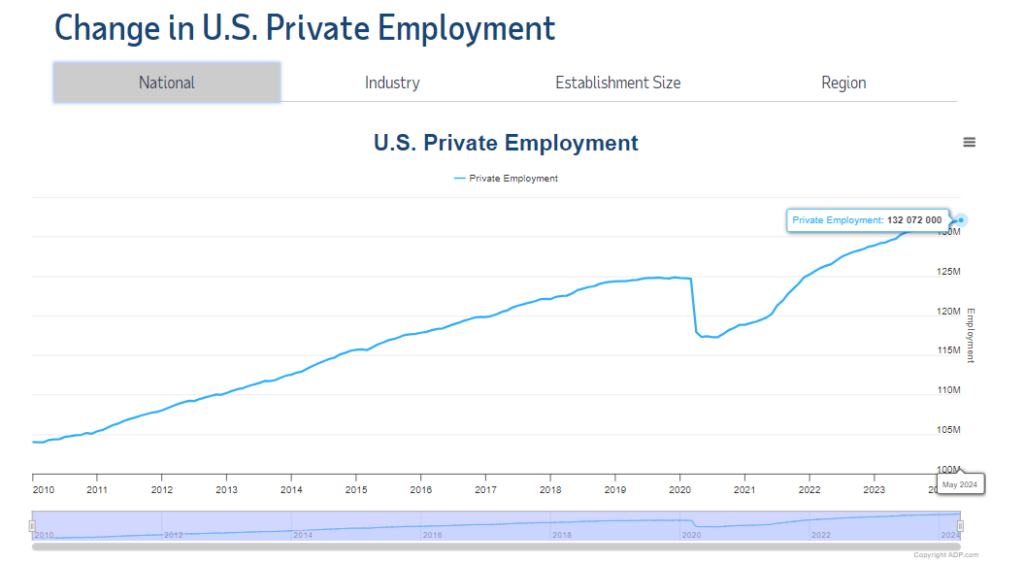

Based on payroll data from approximately 400,000 U.S. business clients, the ADP report is released two days before the government’s Labor Market Report and is often used as a predictor. The ADP National Employment Report, published monthly by Automatic Data Processing, tracks nonfarm private employment in the U.S.

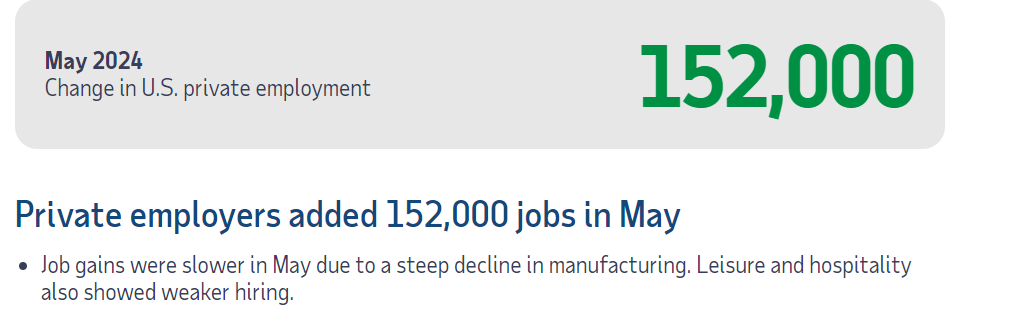

- A higher-than-expected reading is bullish for the USD, while a lower-than-expected reading is bearish. Latest Release, Jun 05, 2024 – Actual152K, Forecast 173K, Previous 188K

The ADP National Employment Report is valuable for several reasons:

- Timeliness: Released two days before the government’s official Labor Market Report, it provides an early look at employment trends.

- Market Indicator: It influences financial markets by providing initial data that can predict the Bureau of Labor Statistics (BLS) report, affecting USD and investment decisions.

- Broad Coverage: Based on payroll data from approximately 400,000 U.S. businesses, it offers a comprehensive view of private sector employment.

- Economic Insight: It helps analysts and policymakers gauge the health of the labor market, informing economic forecasts and decisions.

ADP National Employment Report Data Sets

The ADP National Employment Report provides several key data sets each month, offering a detailed view of the U.S. labor market:

- Total Nonfarm Private Employment: Tracks the overall change in nonfarm private sector employment.

- Employment by Business Size:

- Small Businesses (1-49 employees): Indicates hiring trends in small enterprises.

- Medium Businesses (50-499 employees): Reflects employment changes in mid-sized companies.

- Large Businesses (500+ employees): Shows job growth or decline in large corporations.

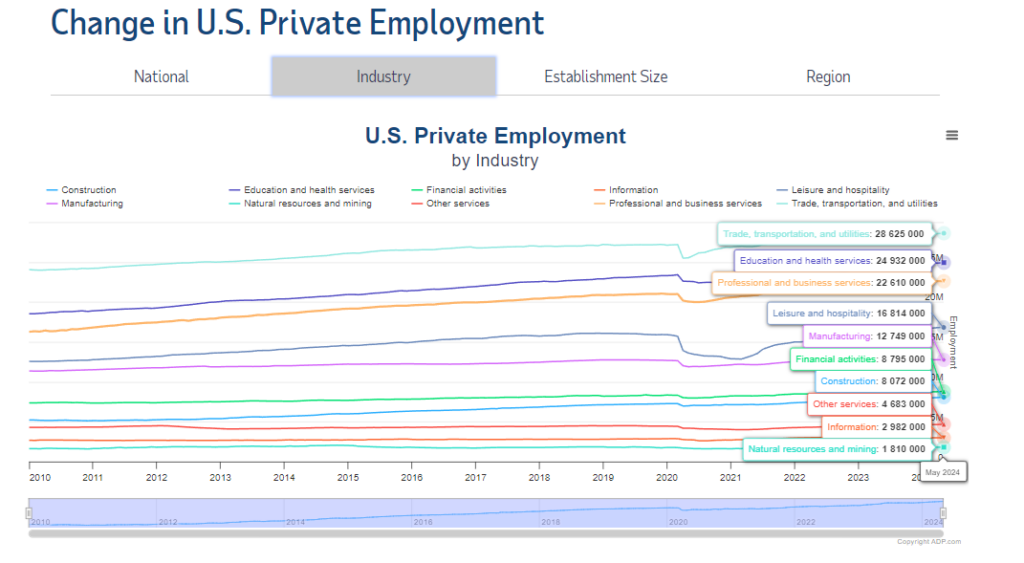

- Employment by Sector:

- Goods-Producing Sector: Includes manufacturing, construction, and mining jobs.

- Service-Providing Sector: Encompasses industries such as trade, transportation, utilities, information, financial activities, professional and business services, education and health services, leisure and hospitality, and other services.

- Industry Breakdown:

- Detailed data for major industries, including manufacturing, construction, trade/transportation/utilities, information, financial activities, professional/business services, education/health services, leisure/hospitality, and other services.

Criticisms of the ADP Report

- Accuracy and Reliability: Often shows discrepancies compared to BLS data.

- Predictive Value: Not always a reliable predictor of the BLS jobs report.

- Revisions and Adjustments: Frequent and sometimes substantial revisions can cause confusion.

- Sectoral Breakdown: Less detailed and consistent compared to BLS data.

- Market Reaction: Inaccuracies can lead to market volatility.

- Methodological Differences: ADP uses payroll data, while BLS uses survey data, potentially missing trends in smaller businesses or less represented industries.

Despite these criticisms, the ADP report is closely watched for its timeliness, providing an early glimpse into labor market conditions. Its broad coverage make it a valuable economic indicator.

BONUS! How the Options Market Leverages the ADP Report

- Volatility Adjustments: The ADP report can increase market volatility as traders react to new employment data. High employment numbers suggest economic strength, potentially leading to higher interest rates and affecting options prices due to changes in implied volatility. Conversely, low numbers can signal economic weakness, impacting investor sentiment.

- Interest Rate Expectations: The ADP report can shape expectations about future Federal Reserve actions. A strong job market may lead to tighter monetary policy, influencing bond yields and stock prices, thus affecting options pricing.

- Market Sentiment: Positive ADP data can boost investor confidence, leading to bullish sentiment and increased call option activity. Negative data can result in bearish sentiment, with more traders buying put options to hedge against potential declines.

- Sector-Specific Impacts: The ADP report can affect different sectors uniquely. For example, strong job growth in construction or manufacturing can increase call option activity in those sectors, while declines in retail employment can boost put option activity on retail stocks.

- Hedging Strategies: Institutional investors use options to hedge against market movements. Significant shifts suggested by the ADP report may lead to adjustments in hedging strategies, impacting options trading volumes and open interest.