MARKETS

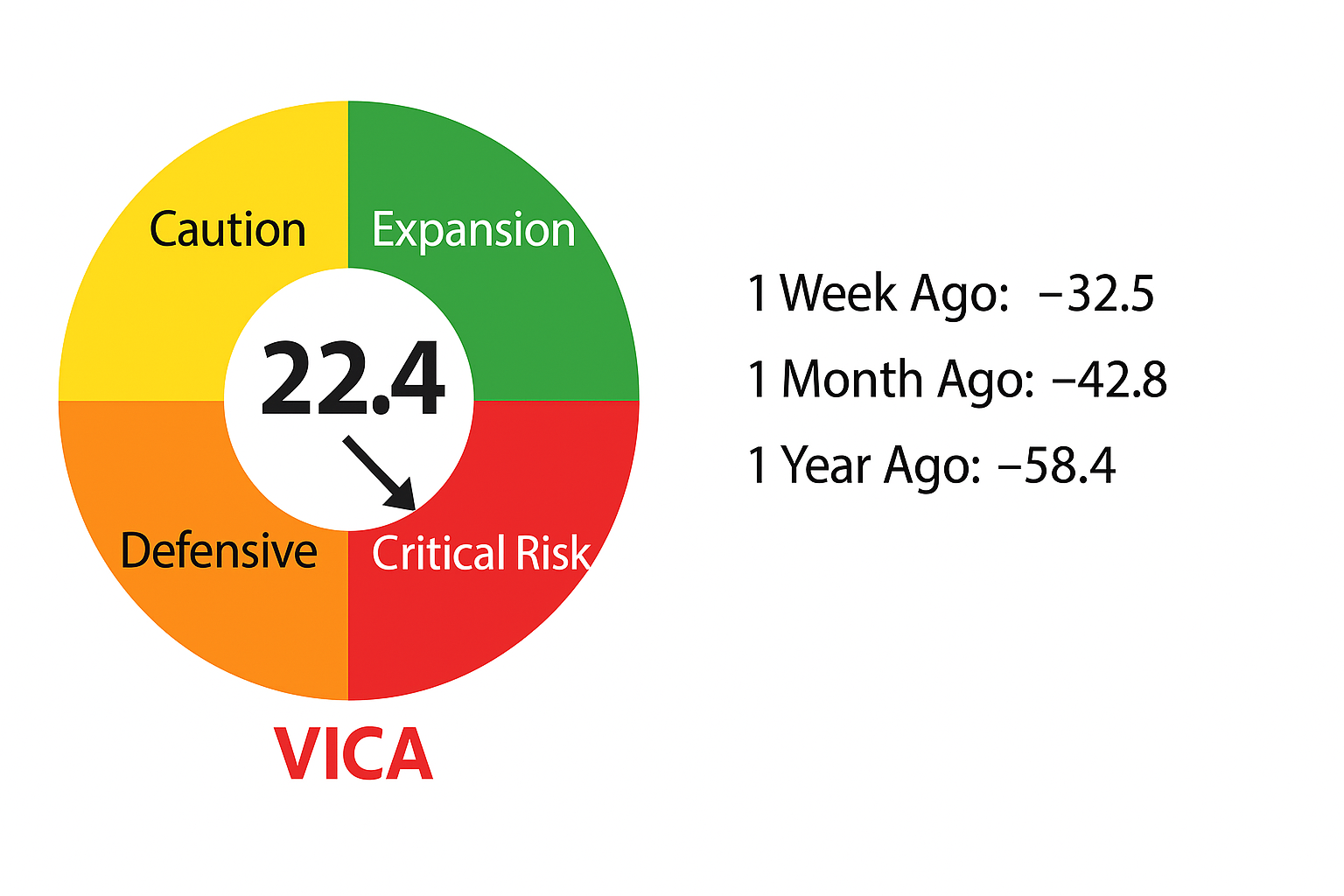

Markets are trading lower early today as Investors await the latest CPI inflation data to be released on Wednesday August 10th which guide upcoming US Federal Reserve’s rate hikes.

In addition the NASDAQ got blindsided by Micron Technology weak forward forecast.

Expect no real surprises this Weeks as consumer price index reports priced-in

- Core CPI July new forecast 0.5%, July previous forecast 0.7%

- CPI (year-over-year)July new forecast 8.7%, July previous forecast 9.1%

- Core CPI (year-over-year) July new forecast 6.1%, July previous forecast 5.9%

- Wholesale inventories (revision) June 1.9%, July 1.7%

The 24 hour prior rule should be in effect

On a day like today a regression to yesterday trading day averages should offset most index losses by tomorrows market close assuming no Government report surprises. Our data team expects Wednesday market trading to be in-line with current market pricing with possible upside.