Inside the Mechanics of the Market (Week Ahead: February 9, 2026)

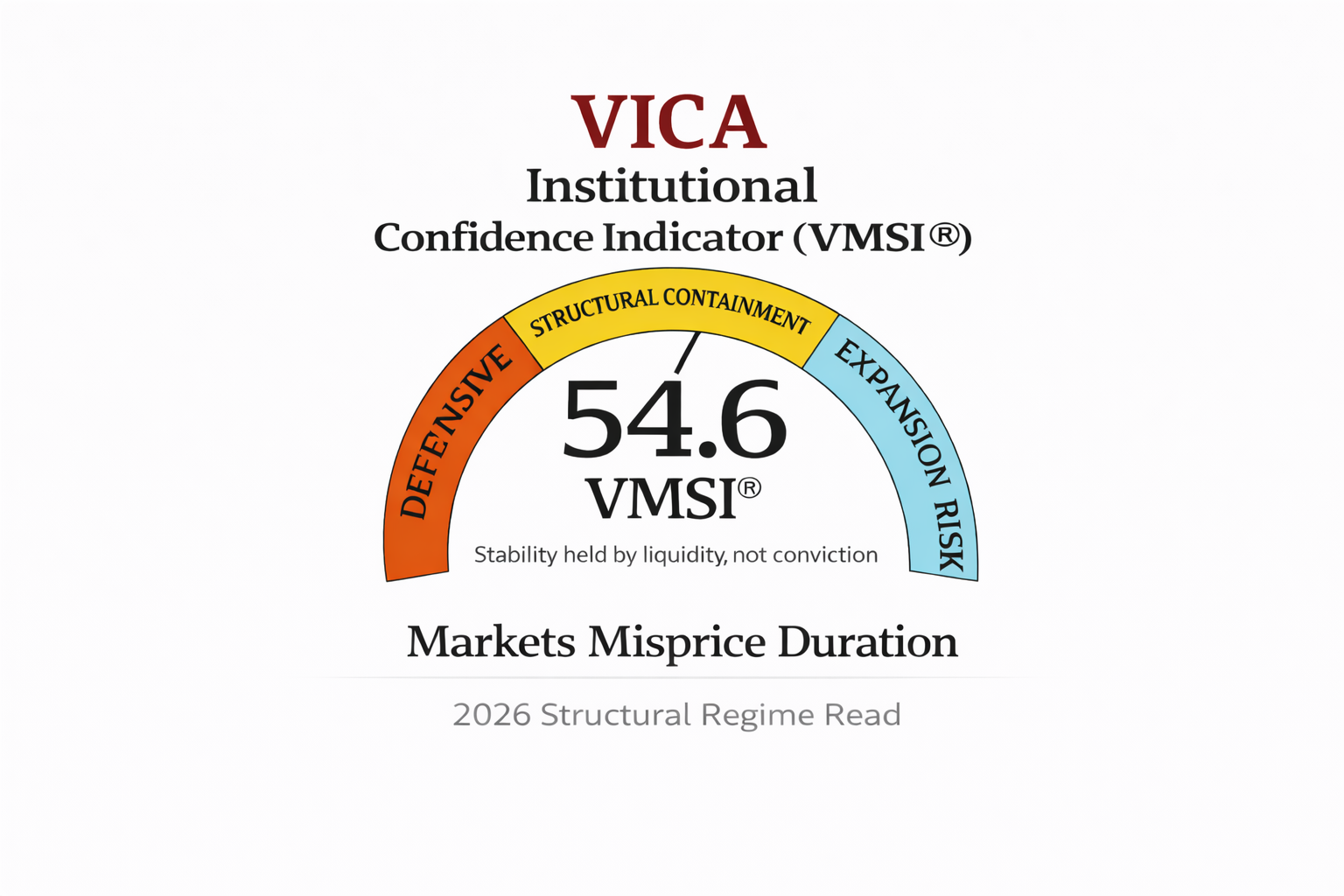

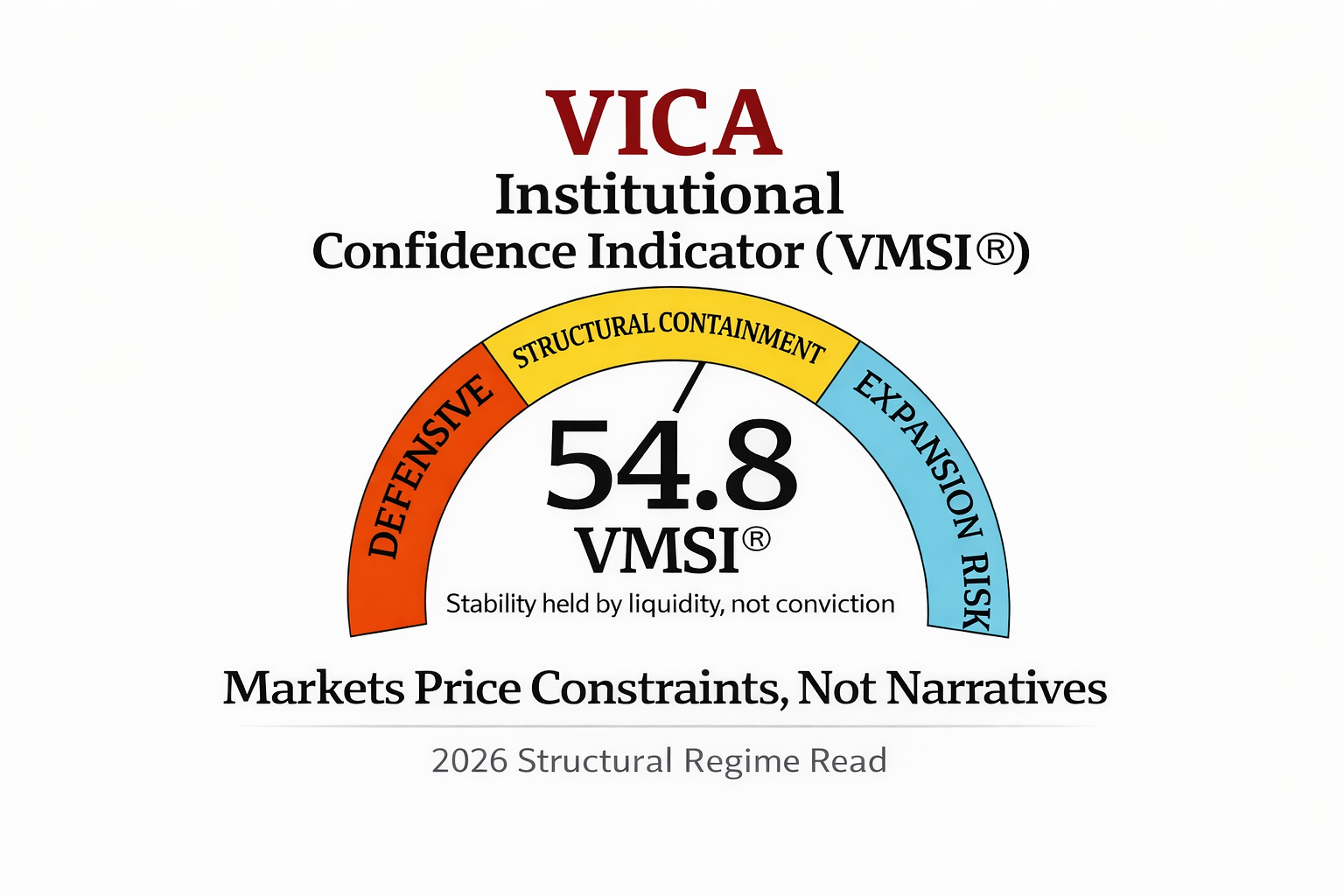

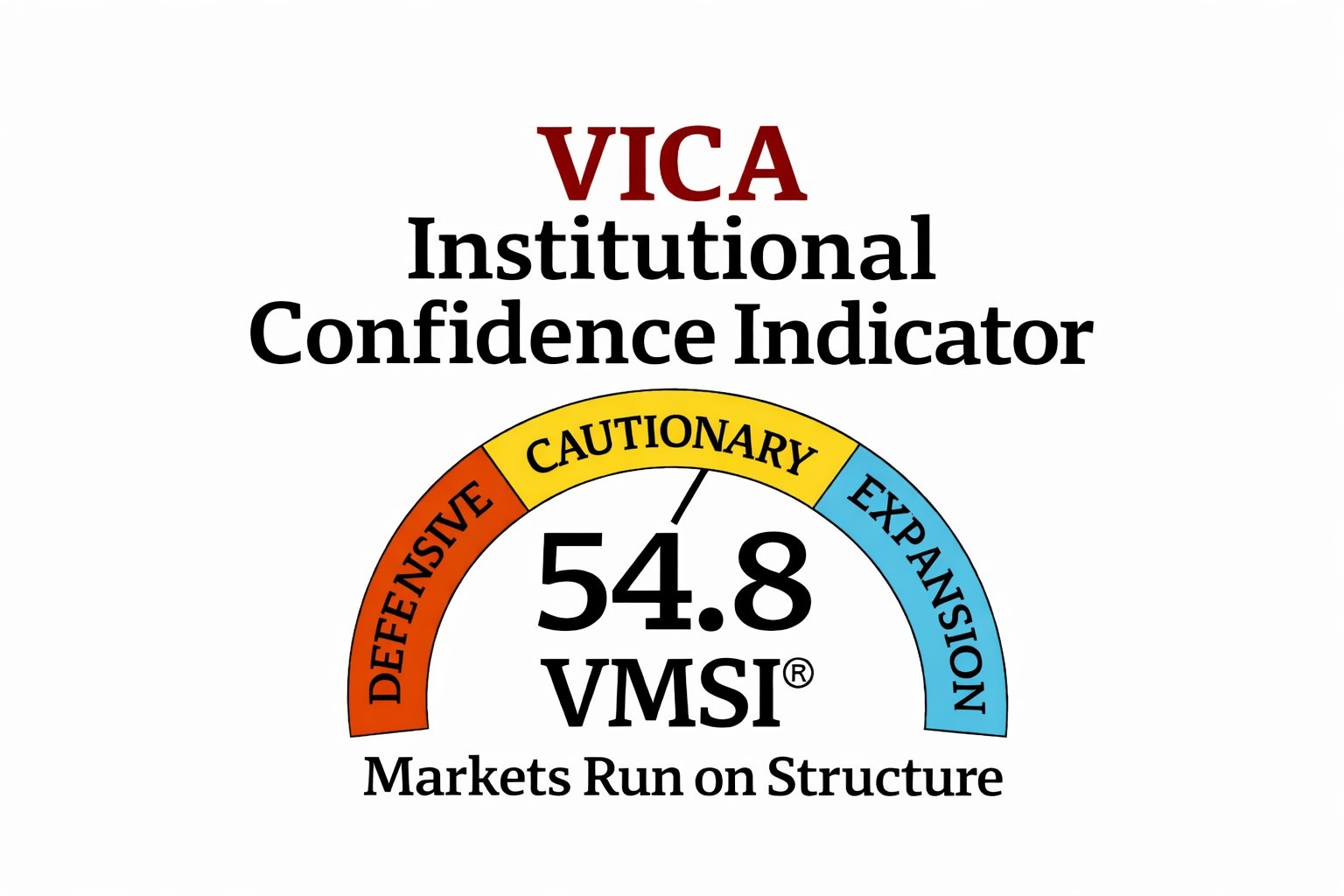

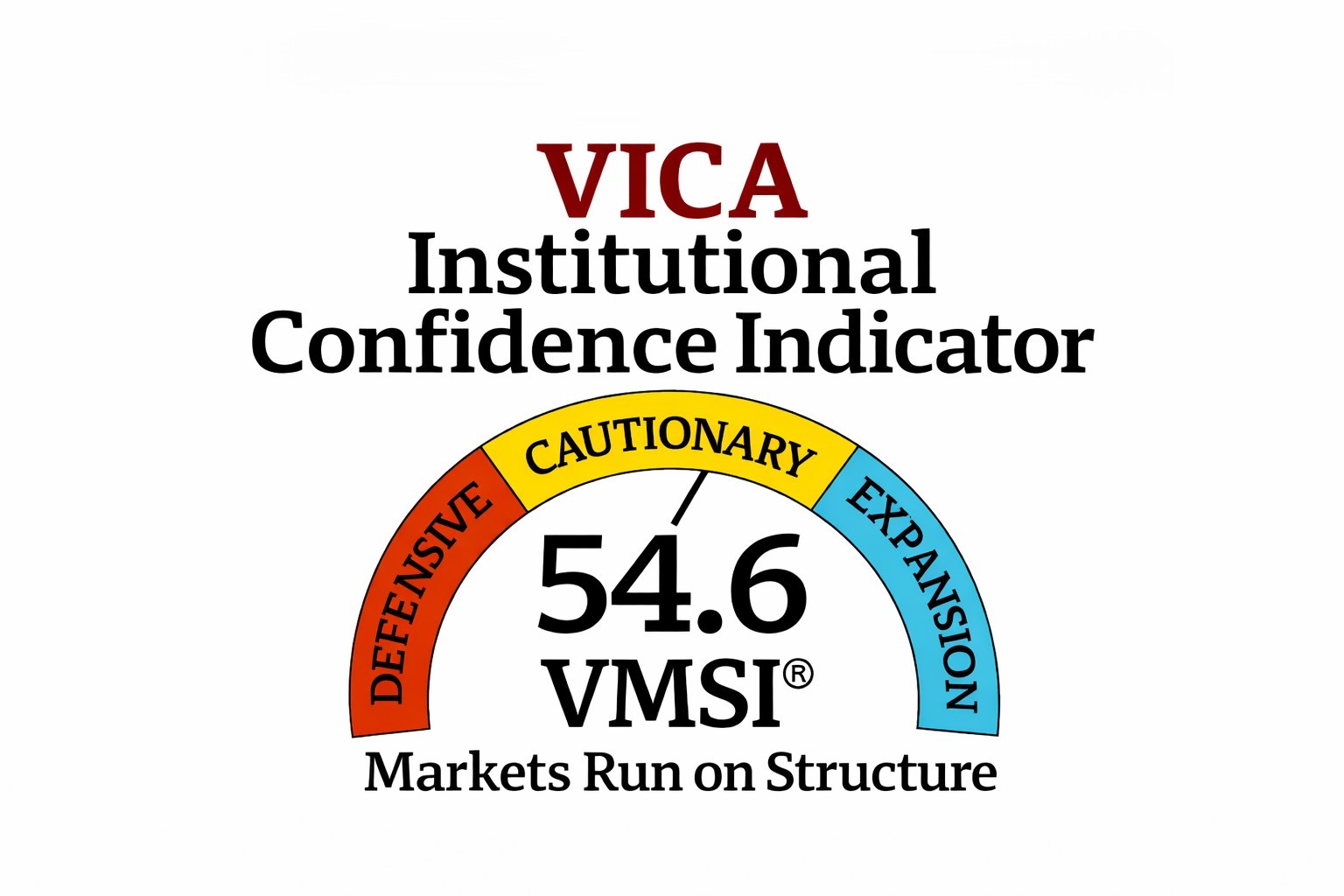

Equities Remain Firm as Volatility Resets Summary: Global risk assets remain resilient despite mixed index performance. U.S. equities are holding near highs, credit remains stable, and volatility continues to compress — a combination that signals controlled risk-on positioning rather than euphoric risk chasing. The key message heading into the week: institutions are staying invested, but … Read more