Liquidity Rules, Credit Waits — The Calm Before Convexity

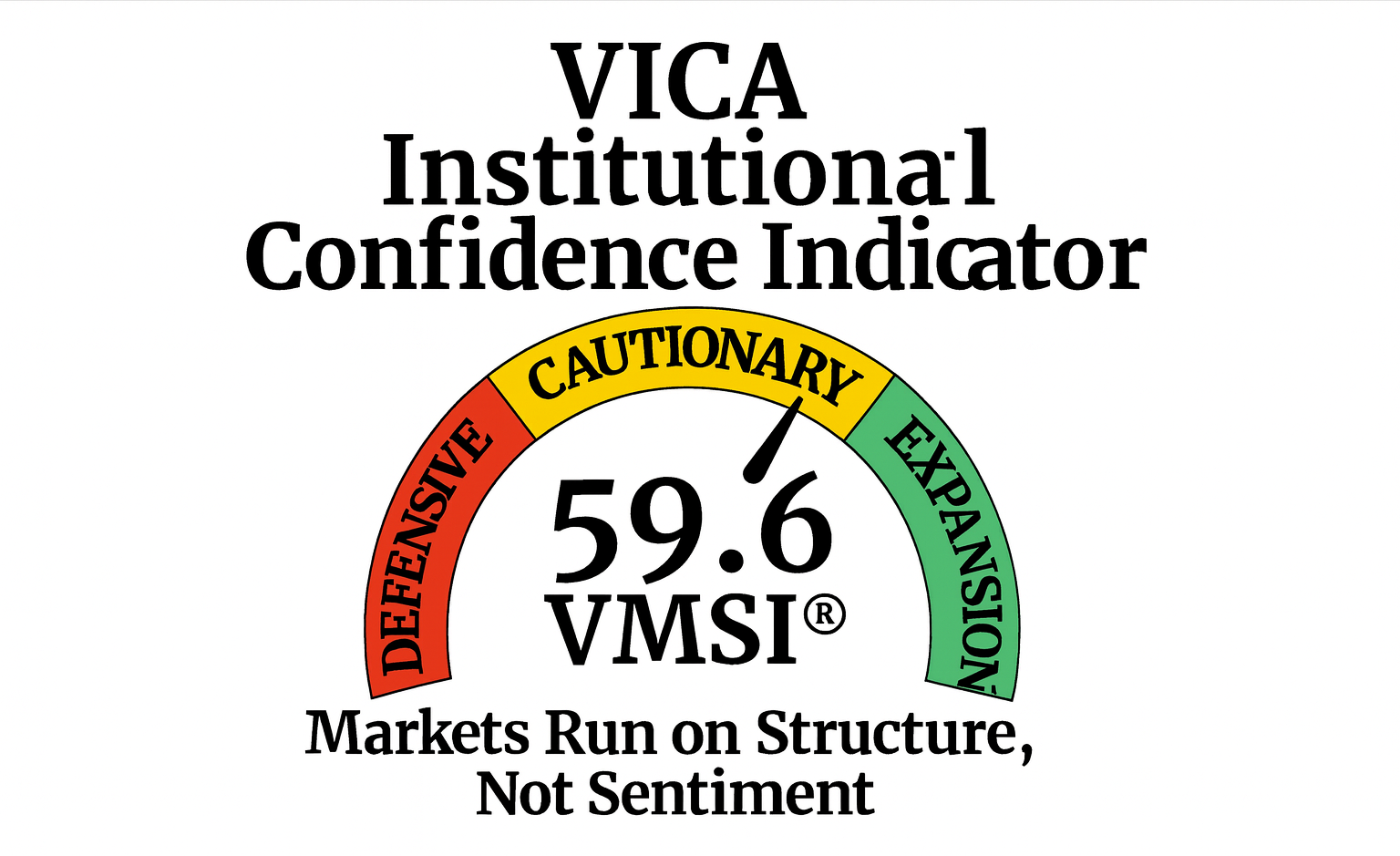

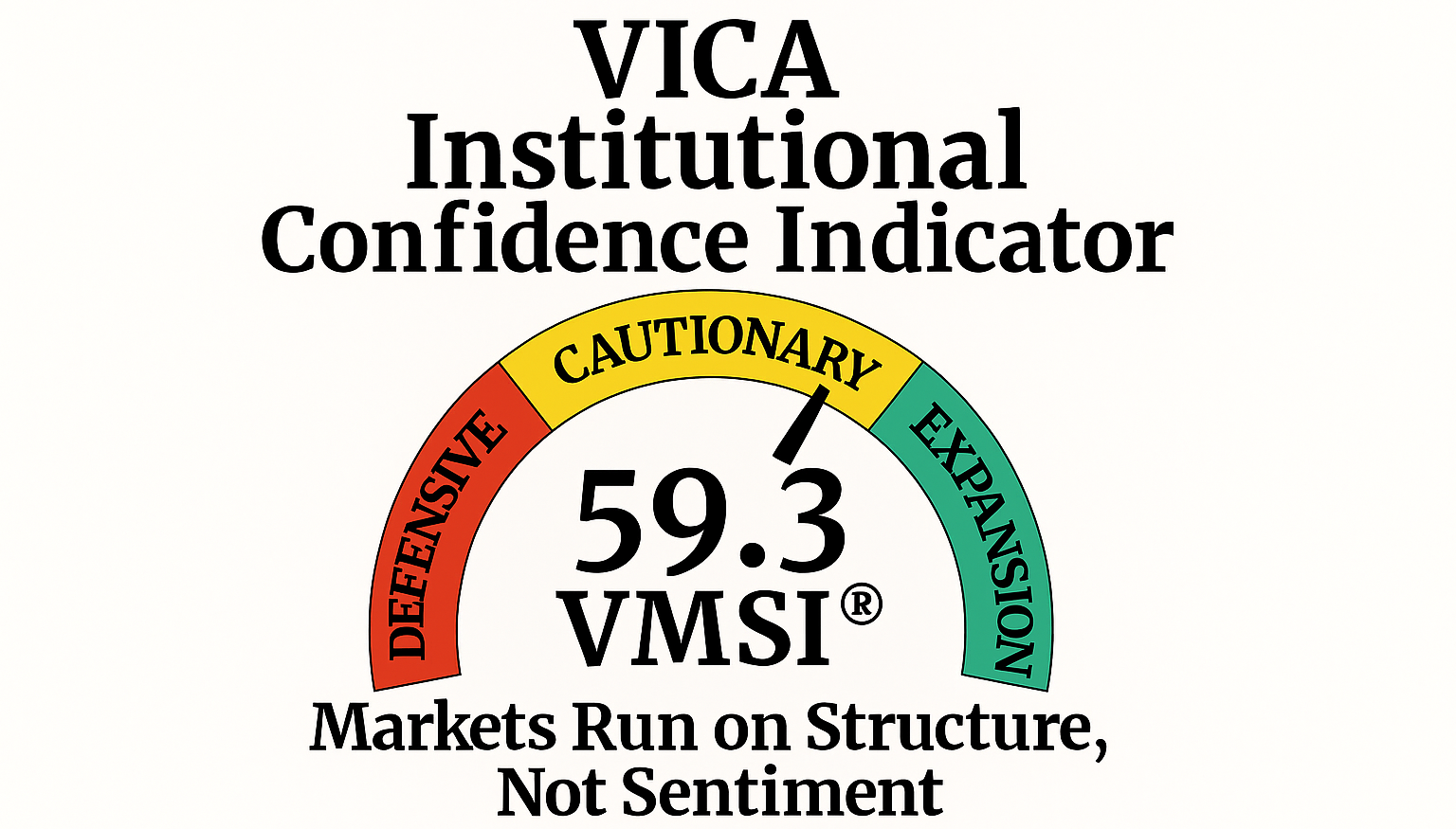

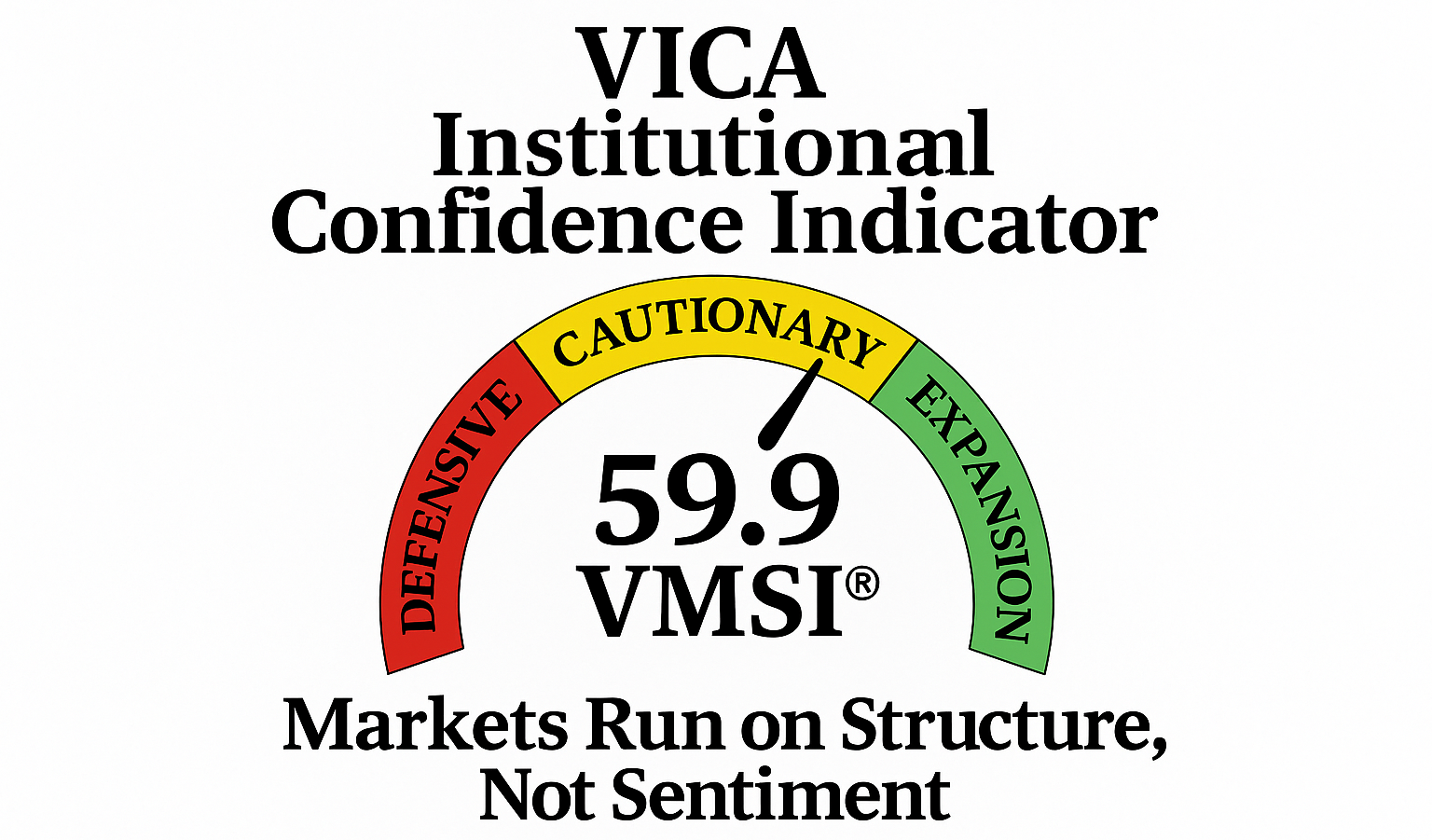

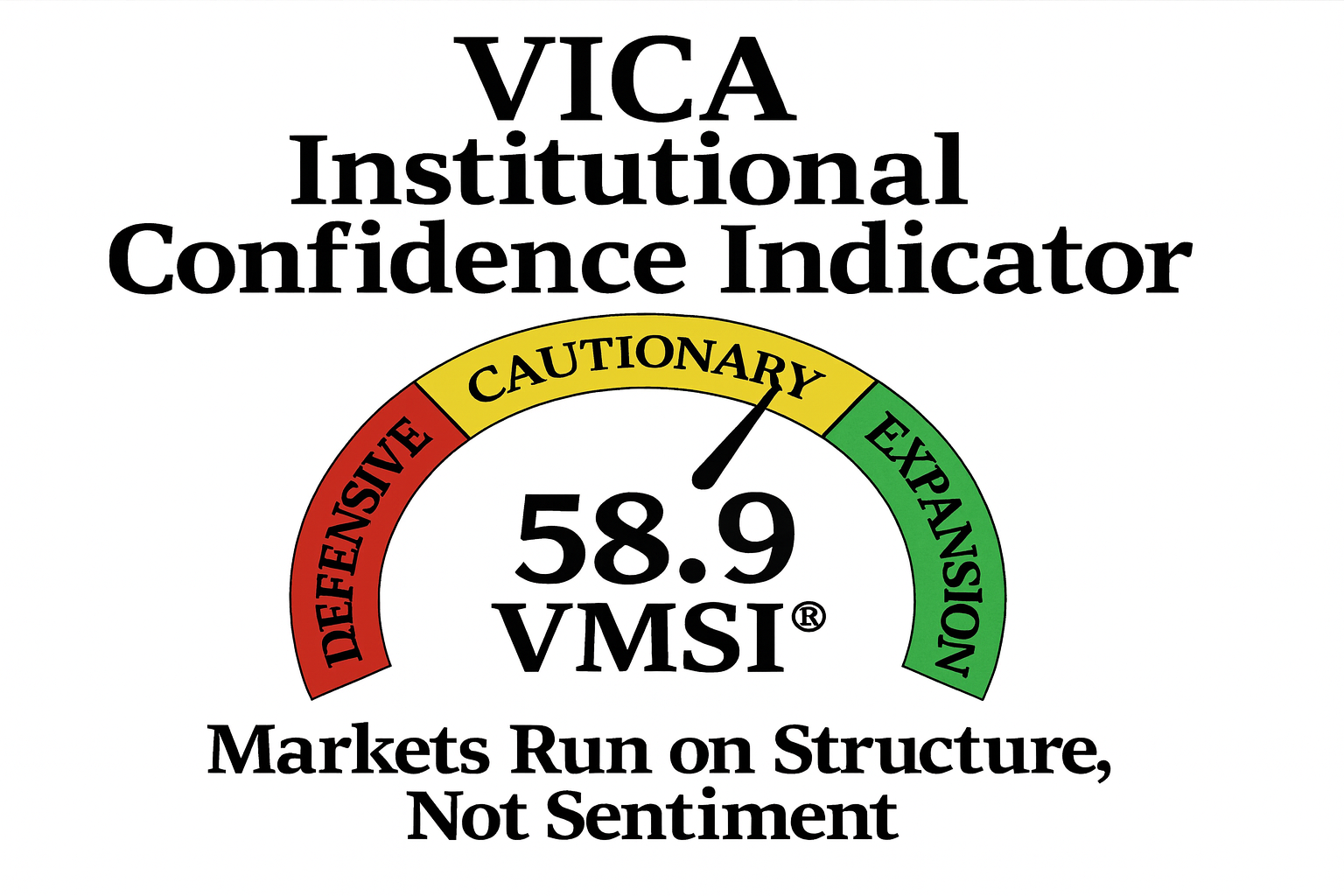

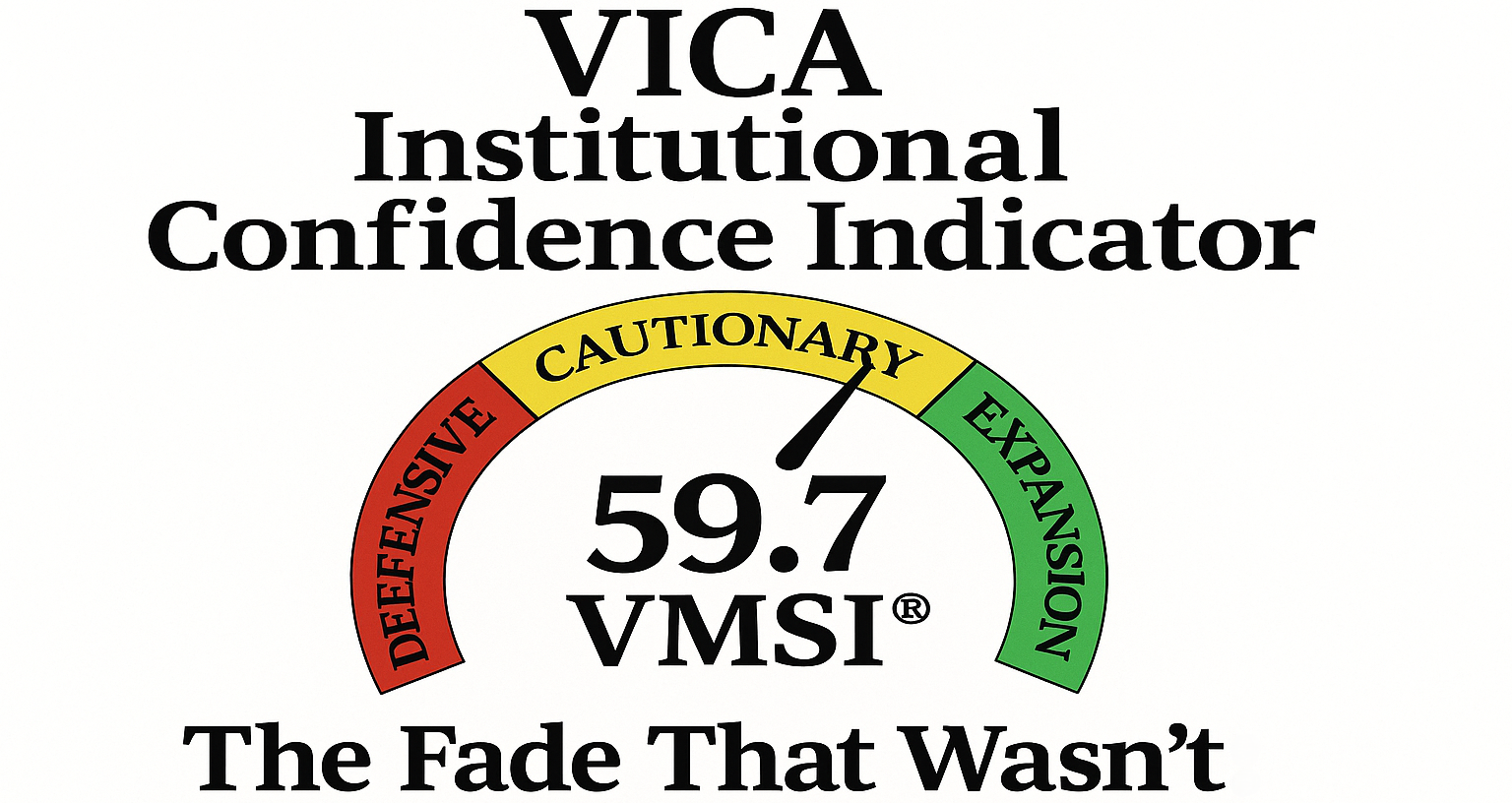

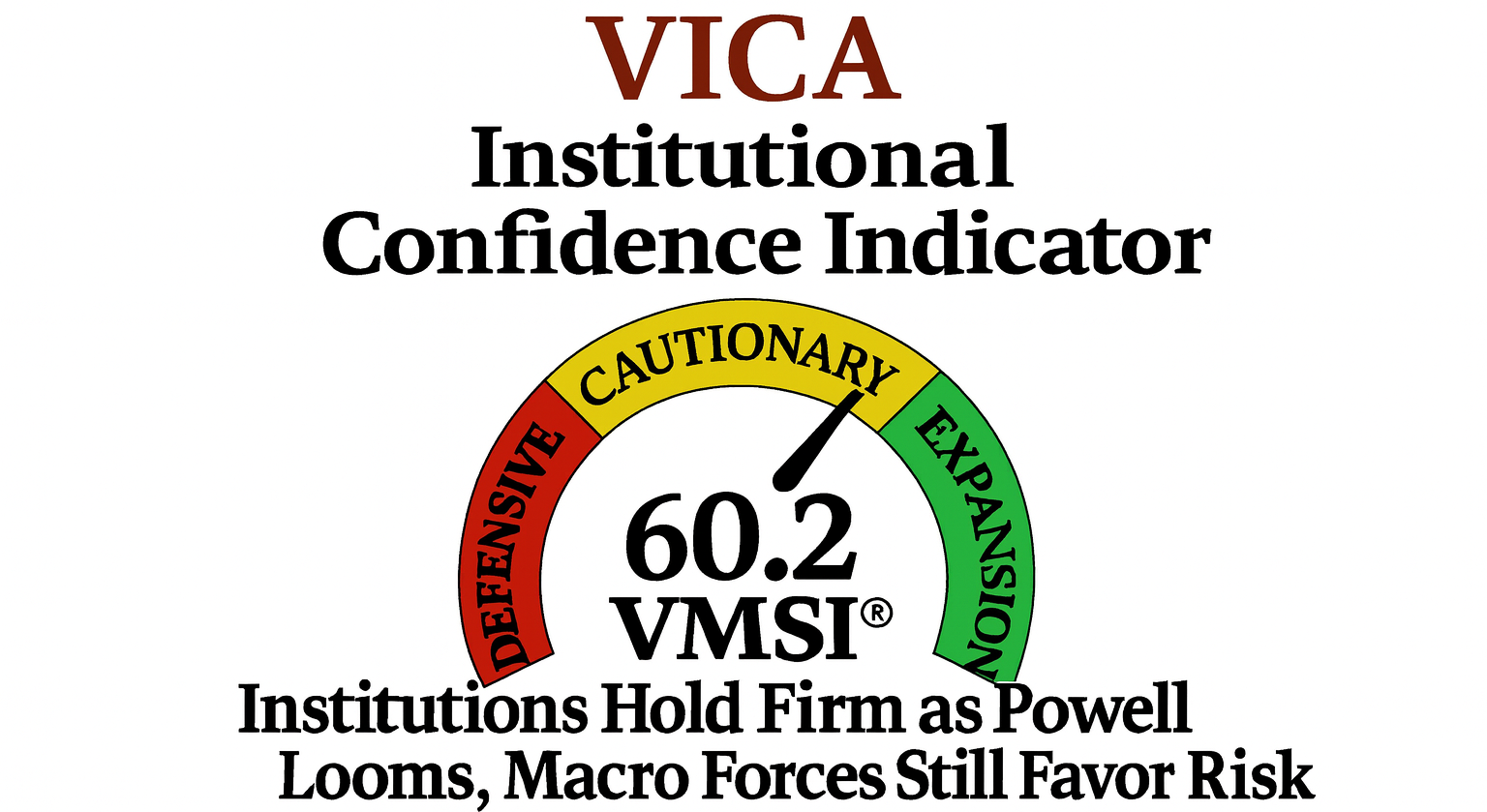

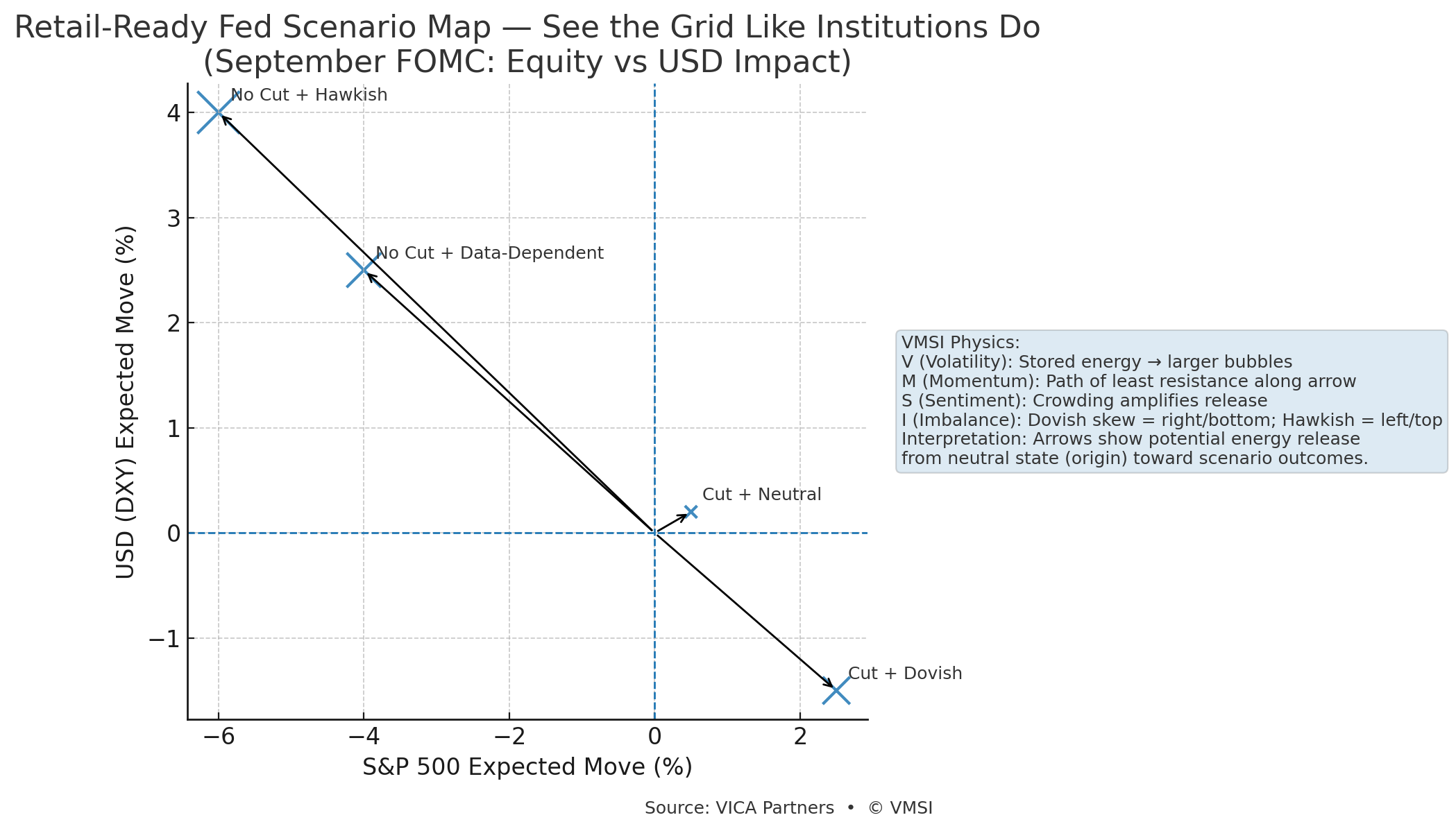

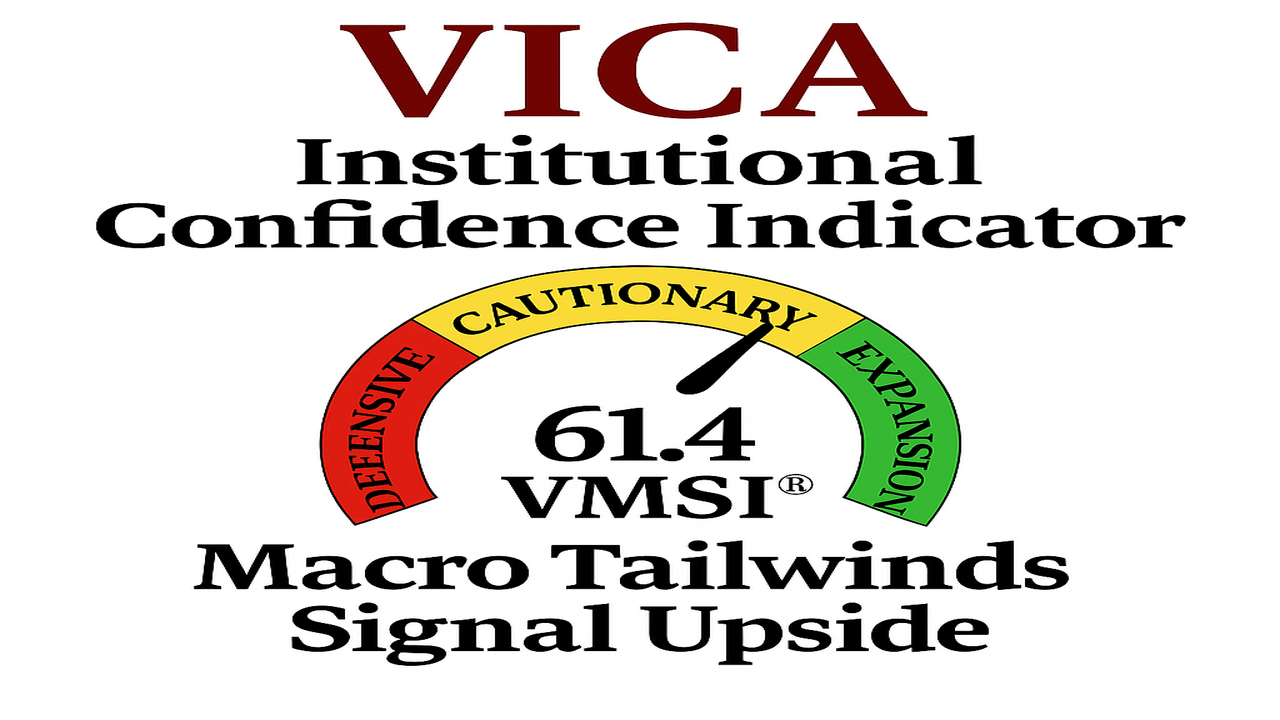

VMSI™ Institutional Market Intelligence Report — FORCE-12 Institutional Edition Week Ending October 9 2025 Theme: Liquidity Rules, Credit Waits — The Calm Before Convexity Composite Ignore the late Week noise — this regime is about structure, not NEWS headlines. Liquidity remains the dominant signal; credit is the hinge. Until torque breaches through credit channels, noise … Read more