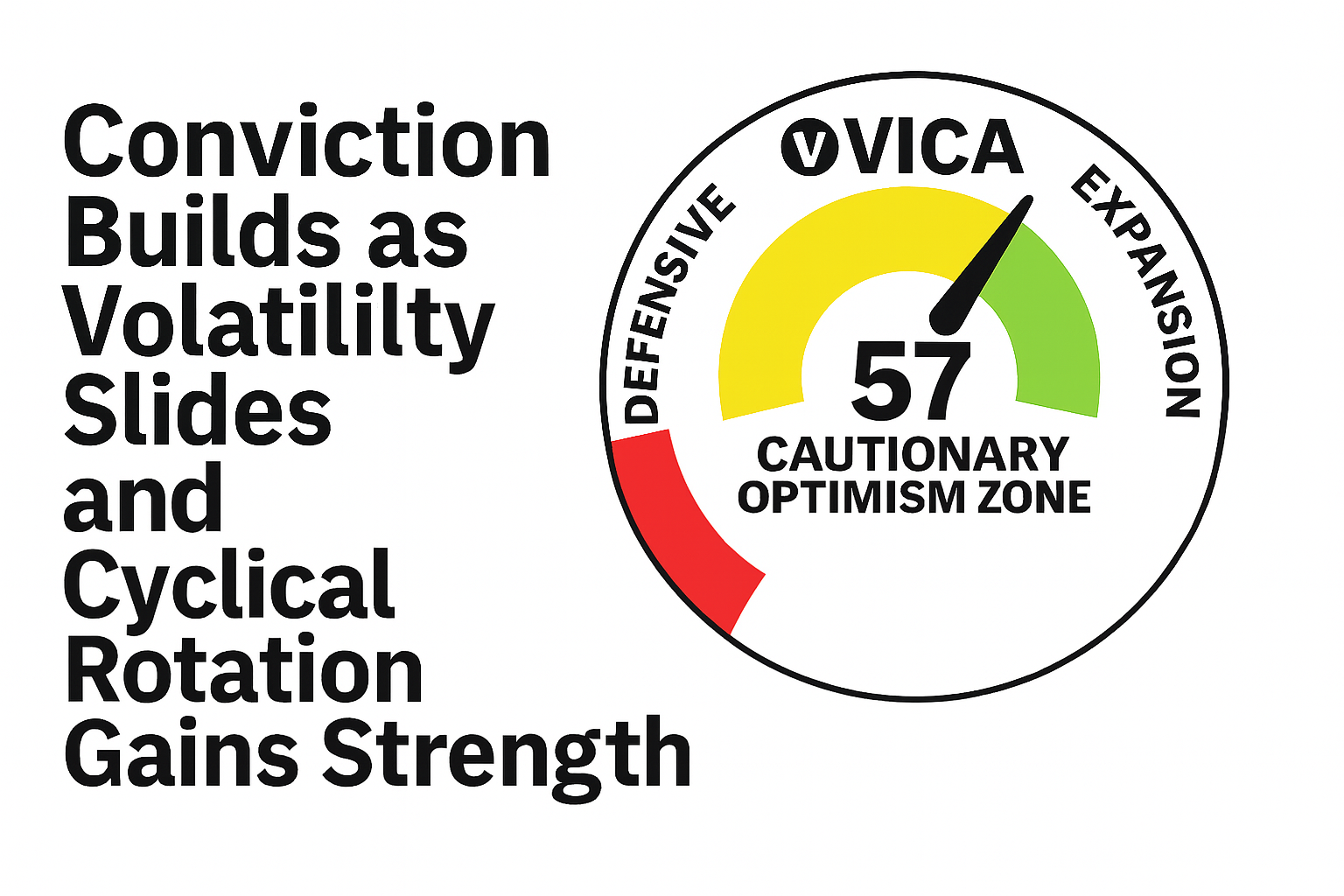

Conviction Builds as Volatility Slides and Cyclical Rotation Gains Strength

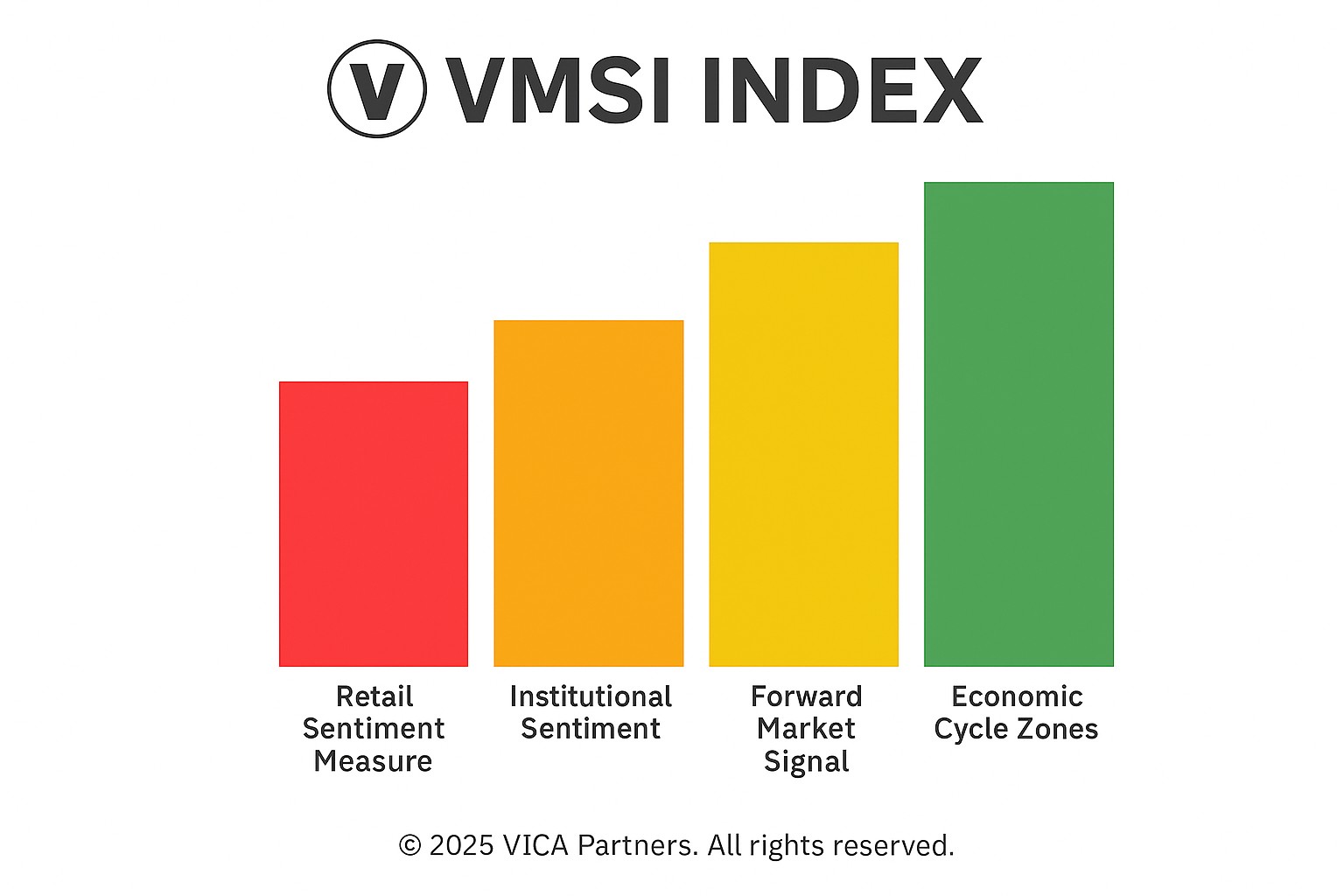

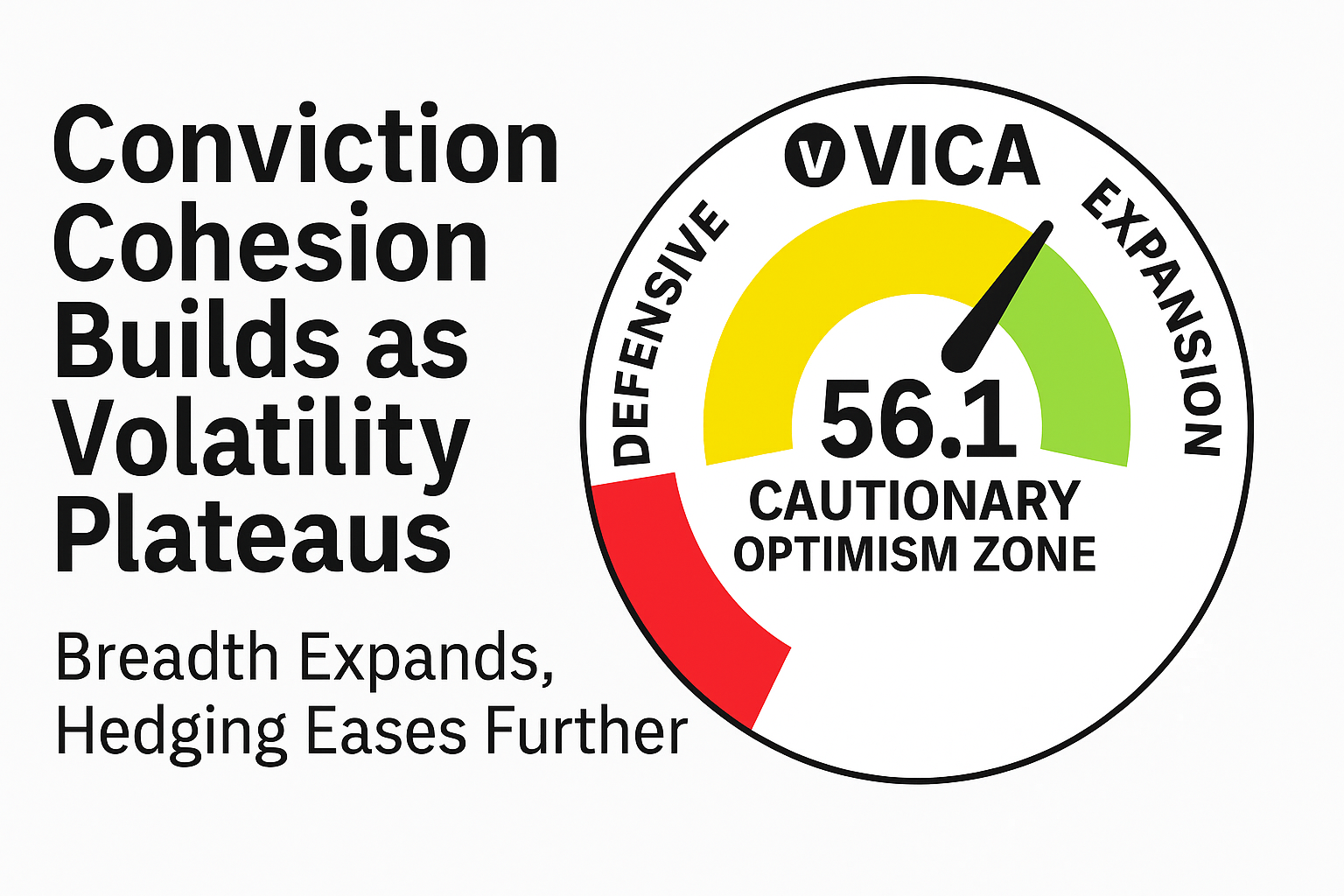

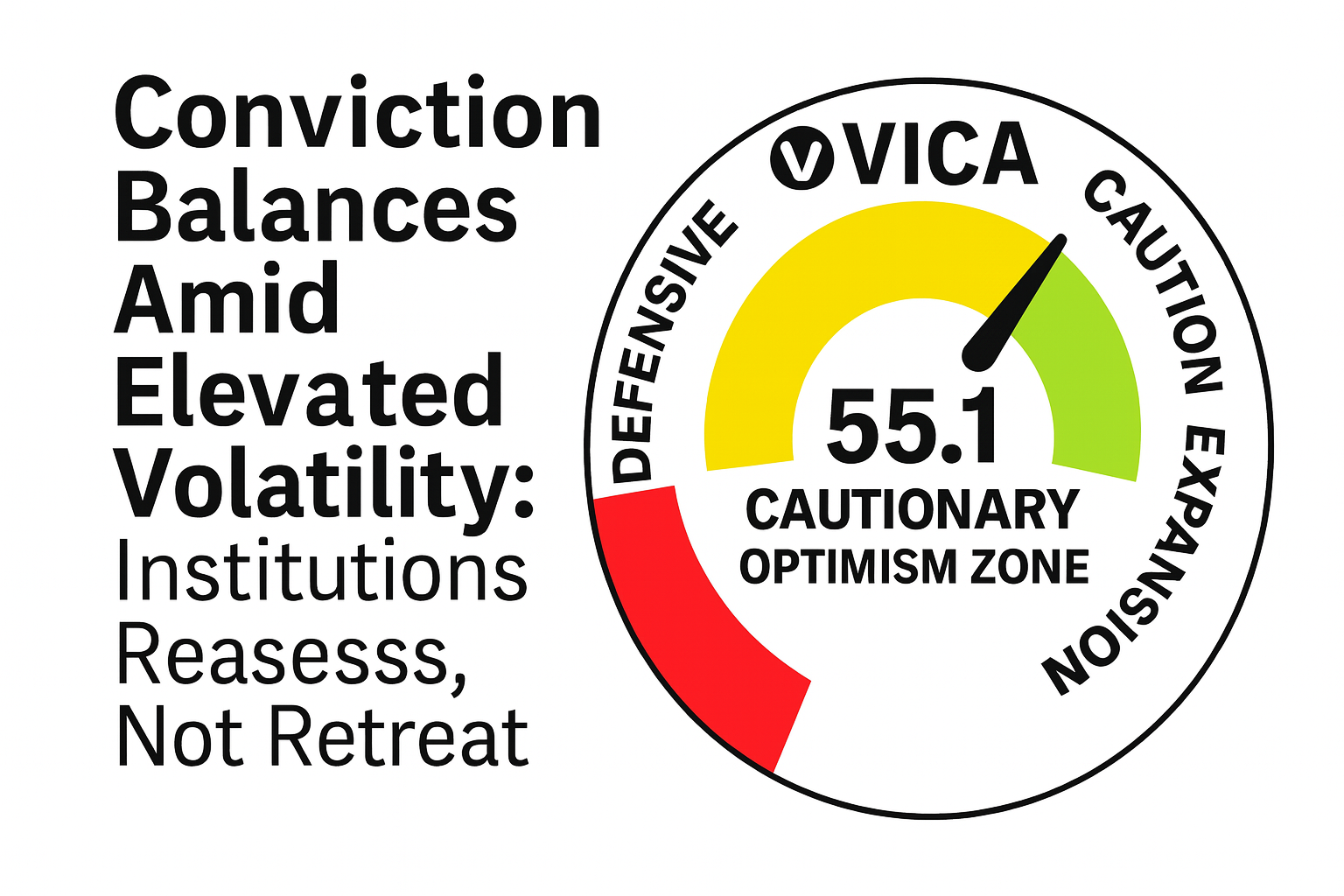

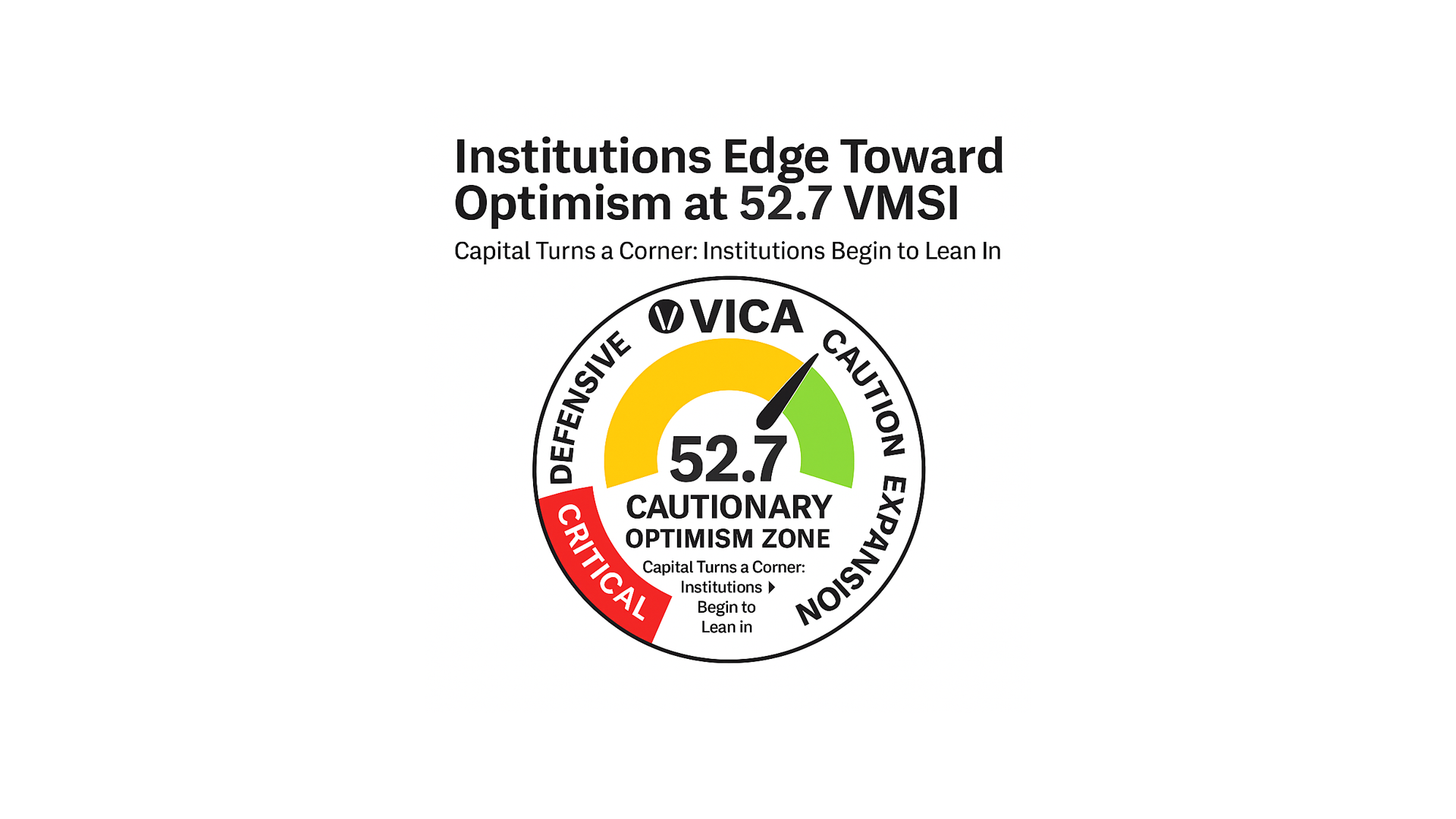

VMSI Edges to 57.0 as Breadth Expands, Hedging Costs Slide Further July 10, 2025 | VICA Research — Volatility & Market Sentiment Index VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning — helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus. … Read more