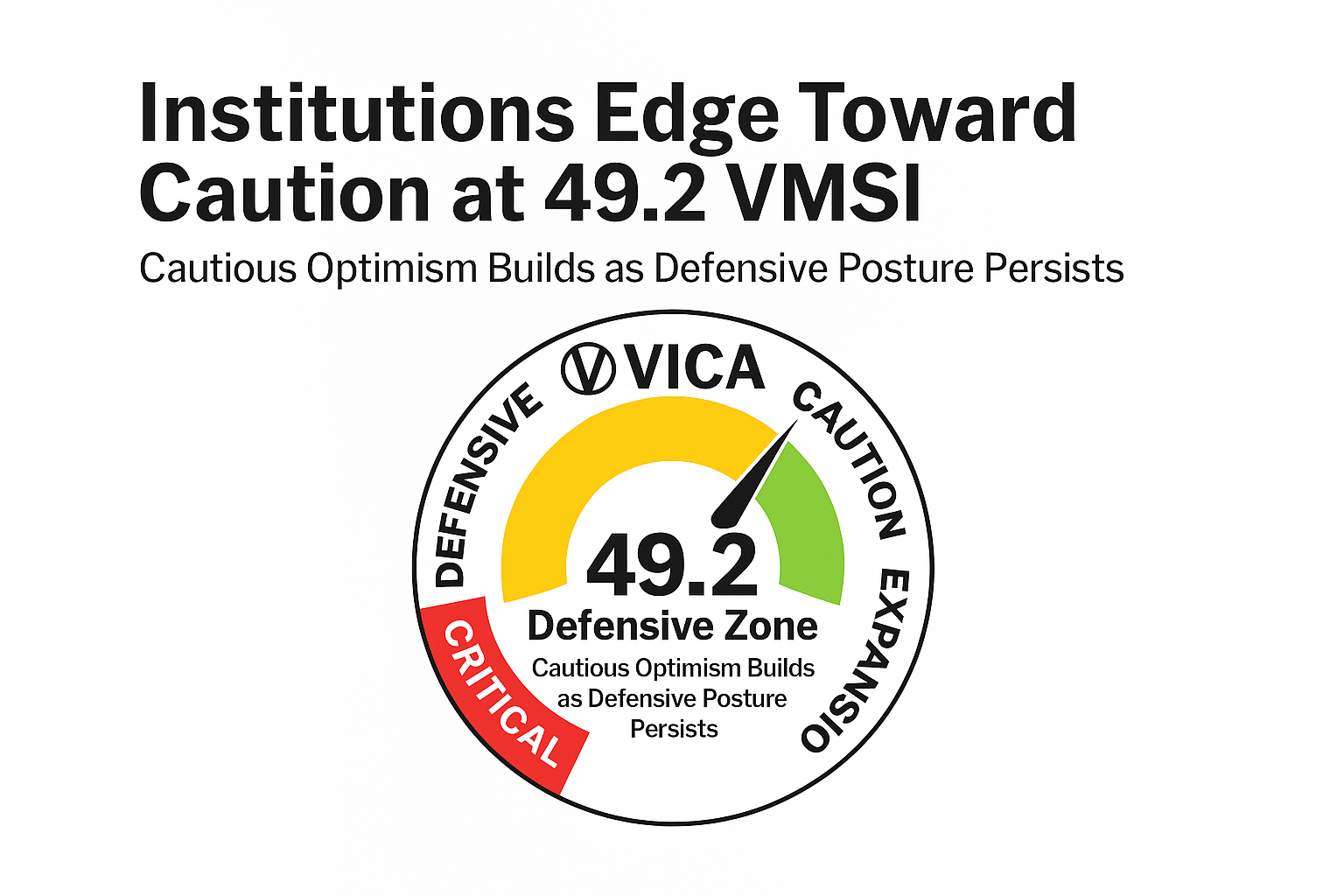

Cautious Confidence Builds as VMSI Brushes Recovery Line

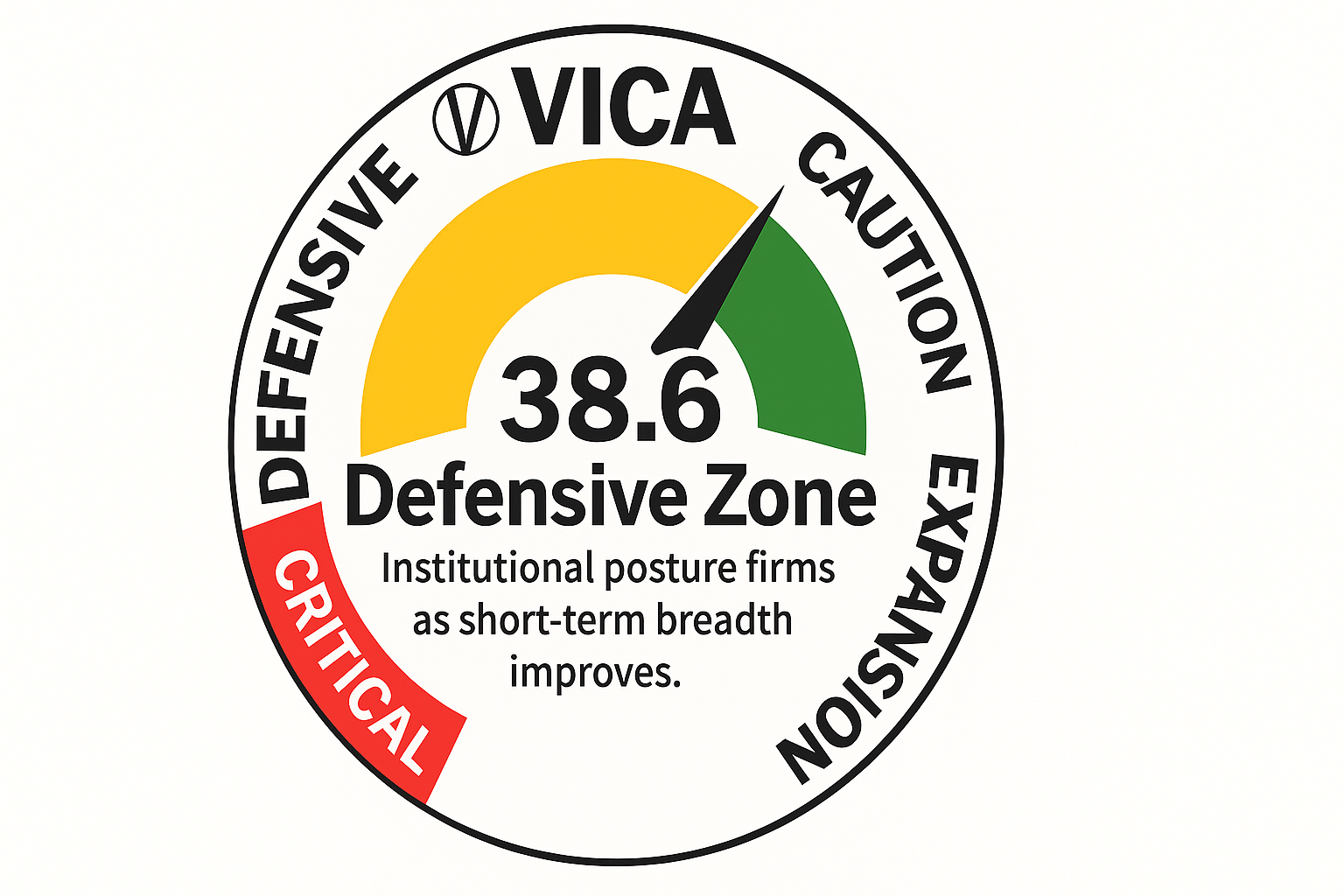

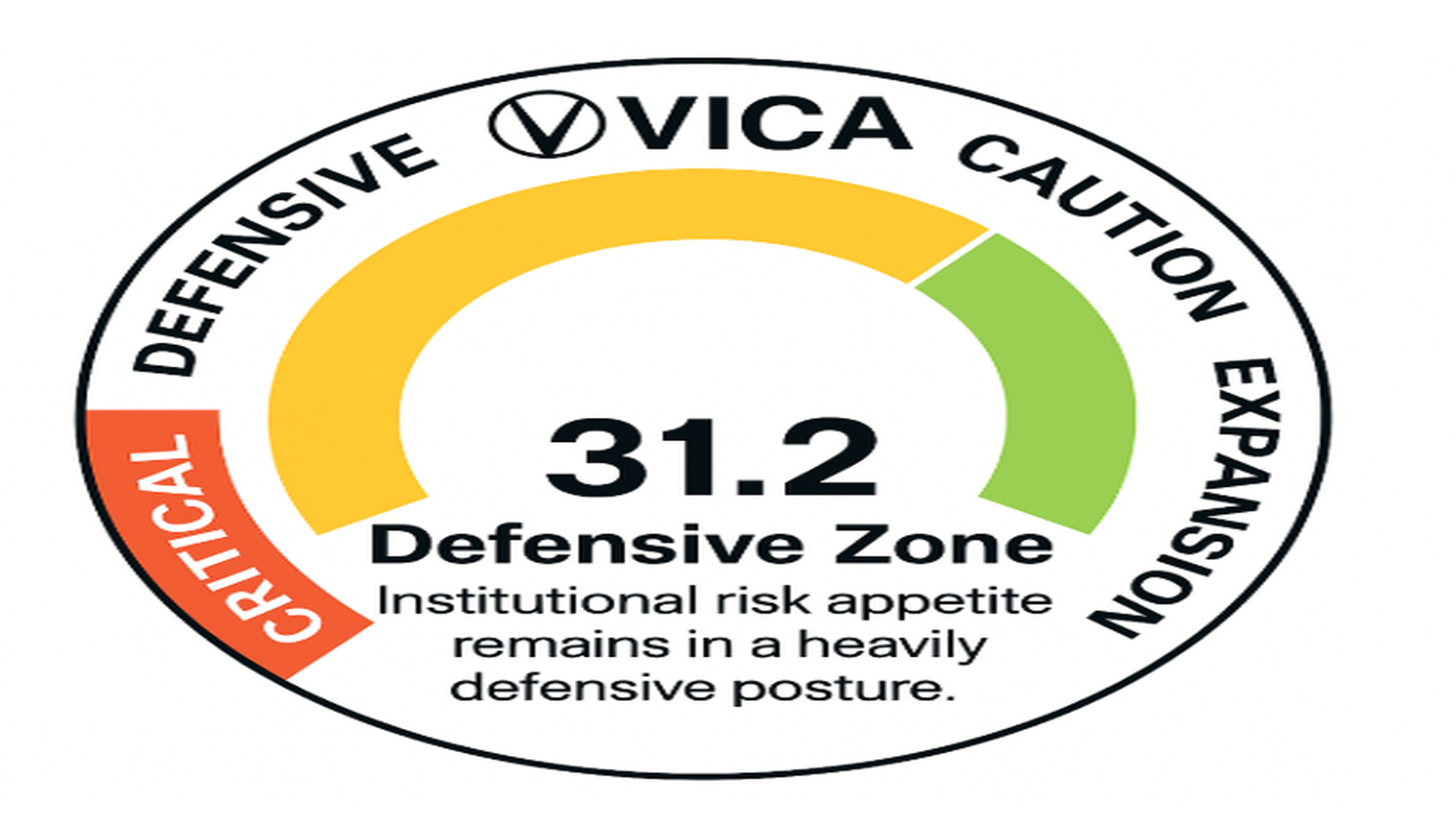

Cautious Optimism Builds as Defensive Posture Persists May 30, 2025 | VICA Research VICA Partners Research’s VMSI © shows where institutional capital is moving — helping investors cut through noise, manage risk, and stay positioned ahead of the curve. Weekly Snapshot VMSI Score: 49.2 (Defensive Zone) S&P 500: –0.01% | Nasdaq: –0.32% | Dow: +0.13% | VIX: 18.57 Momentum: 41.6 | Liquidity: … Read more