MARKETS TODAY March 21st, 2023 (Vica Partners)

A good Tuesday afternoon,

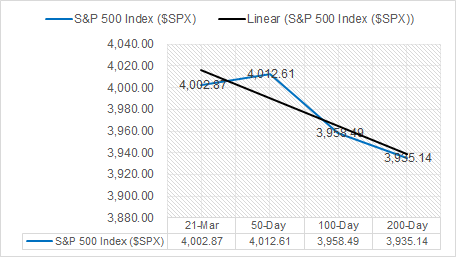

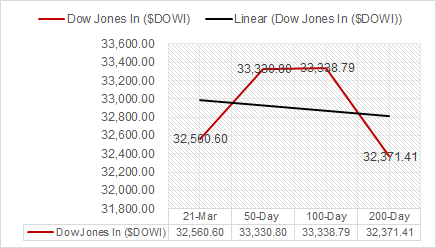

Yesterday, US equities closed higher with S&P500 ending at 3952, above 200d (3936). All 11 of the S&P 500 sectors were higher. Materials and Energy outperformed, while mega cap-tech underperformed. Yields moved higher as the USD Dollar Index lower. Oil rose >1, Gold flat and Bitcoin pulled back. There was no US economic data released.

Overnight, Asian markets finished mixed as the Hang Seng gained 1.39% and the Shanghai Composite rose 0.64%. The Nikkei 225 lost 1.42%. European markets closed sharply higher today with shares in London leading the region. The FTSE 100 is up 1.79% while Germany’s DAX, up 1.75% and France’s CAC 40, up 1.42%. S&P futures were up about 1% overnight as the US dollar dropped to $102.74 on the strength of the rising Euro.

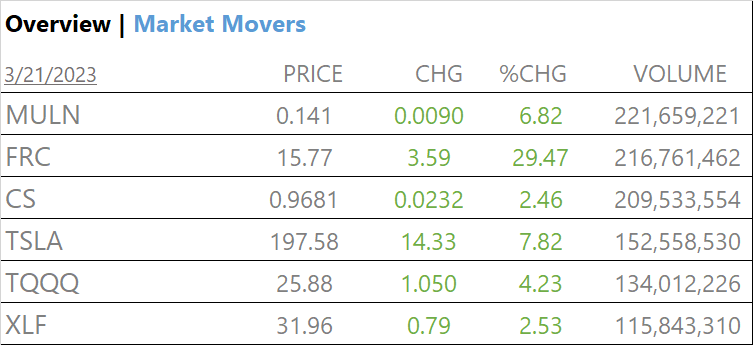

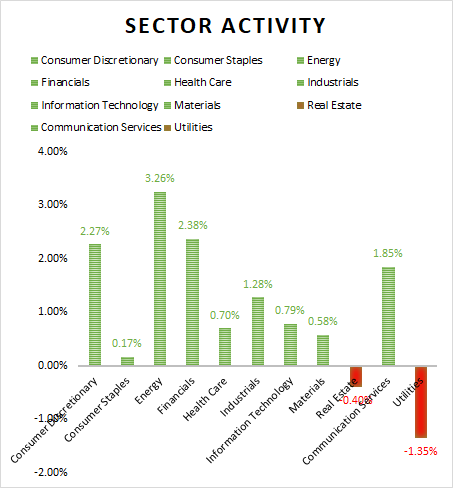

Today, Indices ended higher thanks to the Banks while tech/ mega-cap continues to rise as NYSE FANG+ up 2.30%, testing February highs. 9 of 11 of the S&P 500 sectors were higher led by Energy +3.25% and Financials +2.38%. Yields moved higher with a flattening across the curve. Bitcoin held trading above $28k, Oil futures were up firmly >2%, Industrial metals up, Gold and USD Dollar Index declined.

In economic news, US Existing Home Sales surprised, up 14.5% month/ month in February to 4.58M and beating the 4.2 million expected by economists

Takeaways

- Bank recovery boosts Market today

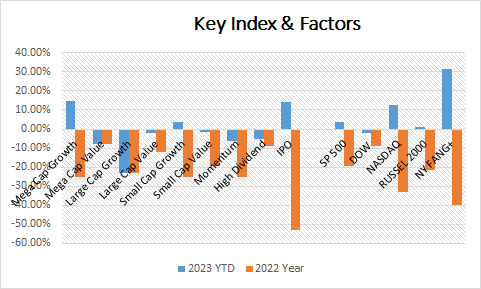

- Mega Cap Growth is up +14.5% YTD (see Factors chart below)

- Key Indices close higher

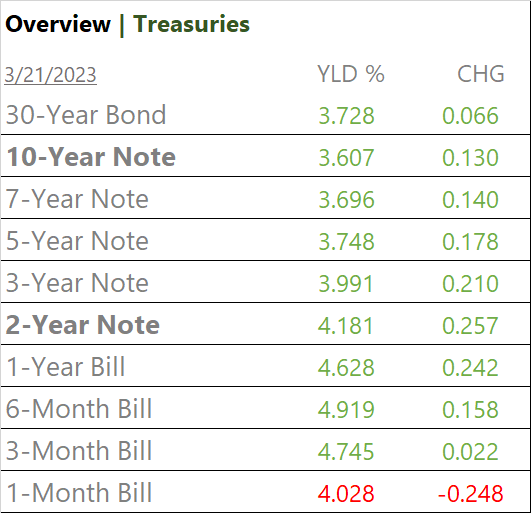

- Yields rise with a moderating 2/10 curve

- 9 of 11 S&P sectors higher: Energy leads with Financials supporting

- Fear & Greed index rating = Fear

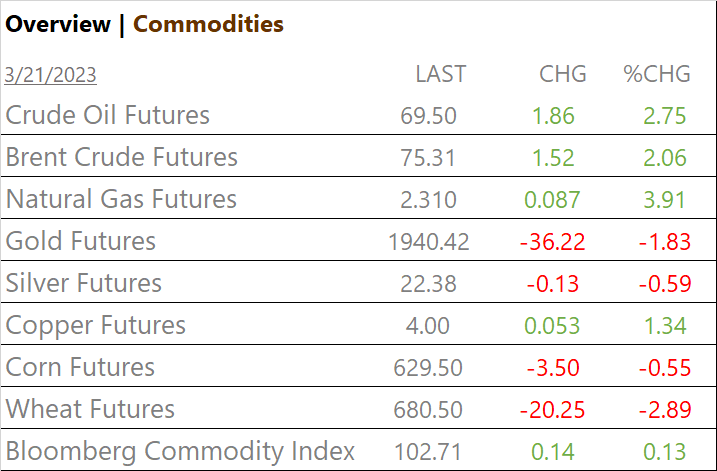

- Bloomberg Commodity Index, up

- Crude Oil Futures rise firmly >2%

- Bitcoin holds above $28k

- Gold falls

- USD Index down with Euro rising

- Markets are pricing in an 85% probability of a 25bps hike tomorrow

Last word, Markets will be welcoming a 25bps hike tomorrow especially after the ECB just went 50bps without negative consequences.

Time to diversify into Large / Small Cap Value with High Dividend now, while the market is recovering and prices remain attractive. FACT: Investor’s rarely change risky portfolio strategies. In ’23 Mega Caps and IPO’s Factors +14% YTD. In ’22. both Factors took the deepest losses. If your in it for the long, its best to balance risk with Value/ Div in the portfolio. – MK

Sectors/ Commodities/ Treasuries

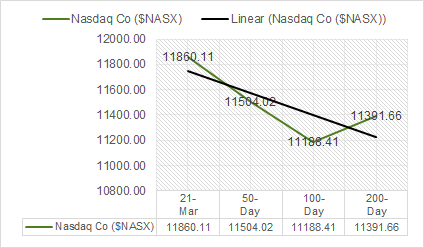

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors were higher, Energy +3.26%, Financials +2.38% outperform/ Utilities -1.35%, Real Estate -0.40%, underperforms

Commodities

US Treasuries

Economic Data

US

- Existing home sales; period Feb., act 4.58m, fc 4.20m, prev. 4.0m.

US Existing Home Sales jumped 14.5% month to month in February to 4.58M beating the 4.2 million expected by economists. Total sales in February were down 22.6% from a year ago and the median selling price declined for the first time in 11 years.

Tomorrow; Fed interest-rate decision, Fed Chair Powell press conference

News

Company News/ Other

- Demand for transatlantic flights soars as Americans can’t get enough of Europe – Reuters

- Biggest Fear for Trillion-Dollar Funds Is Missing Next Rally – Bloomberg

- U.S. seeks to prevent China from benefiting from $52 billion chips funding – Reuters

Central Banks/Inflation/Labor Market

- Yellen Says U.S. Ready to Protect Smaller Banks if Necessary – NY Times

- US Studies Ways to Insure All Bank Deposits If Crisis Grows – Bloomberg

China

- TikTok CEO expected to focus on technical data security points in US testimony – SCMP

- China trade: Xinjiang’s US exports down 90 per cent in February, 8 months after ‘forced labour’ law came into effect – SCMP

Market Outlook and updates posted at vicapartners.com