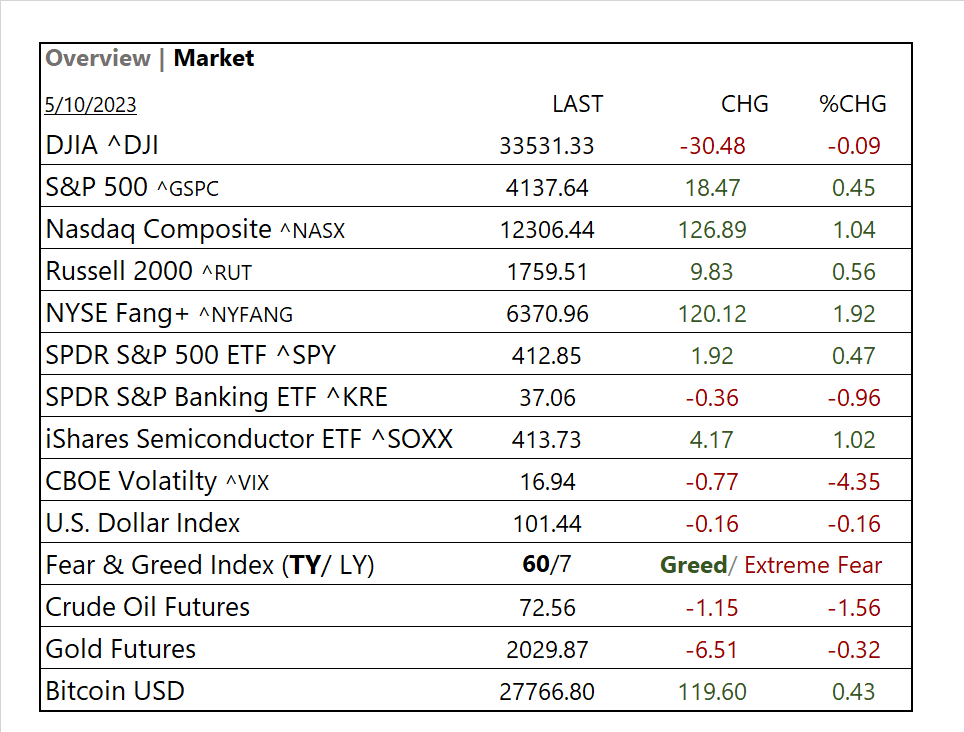

MARKETS TODAY May 10th, 2023 (Vica Partners)

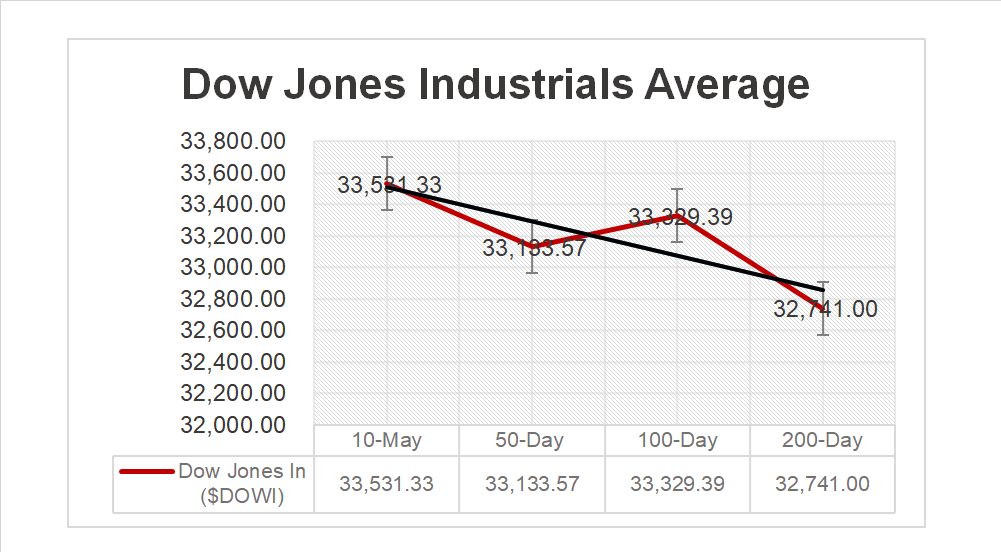

Yesterday, US Markets finished lower the S&P 500 -0.46%, DOW -0.17% and Nasdaq -0.63%. 9 of 11 of the S&P 500 sectors declined: Information Technology underperformed/ Industrials outperformed. Mega cap growth lagged as the Semiconductor ETF (SOXX) was off 1.70%. Yields, Oil and Gold advanced.

Overnight/Premarket, Asian markets finished lower, Shanghai Composite -1.15%, Hong Kong’s Hang Seng -0.53% and Japan’s Nikkei 225 -0.41%. European markets finished lower, Frances CAC 40 -0.49%, Germany’s DAX -0.37% and London’s FTSE 100 -0.33%. US futures were trading at 0.9% above fair-value.

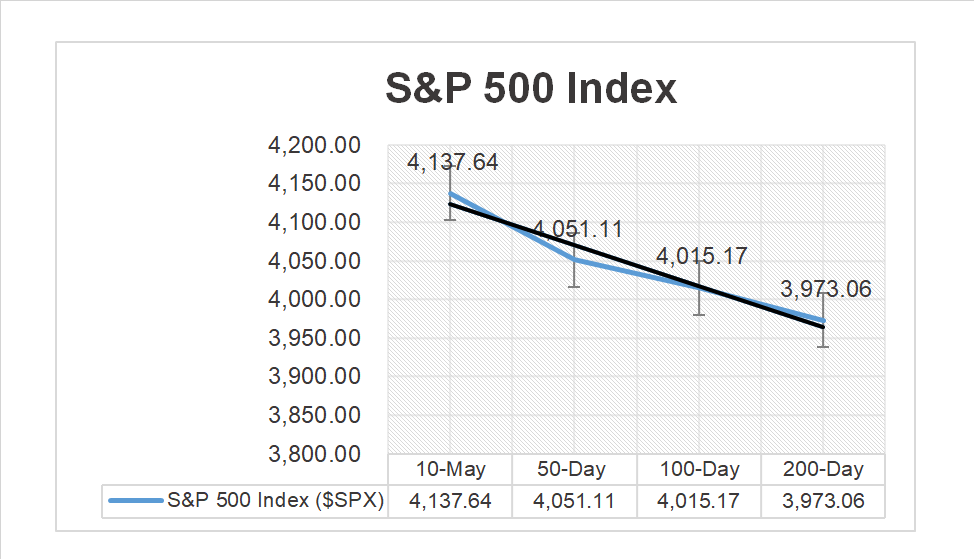

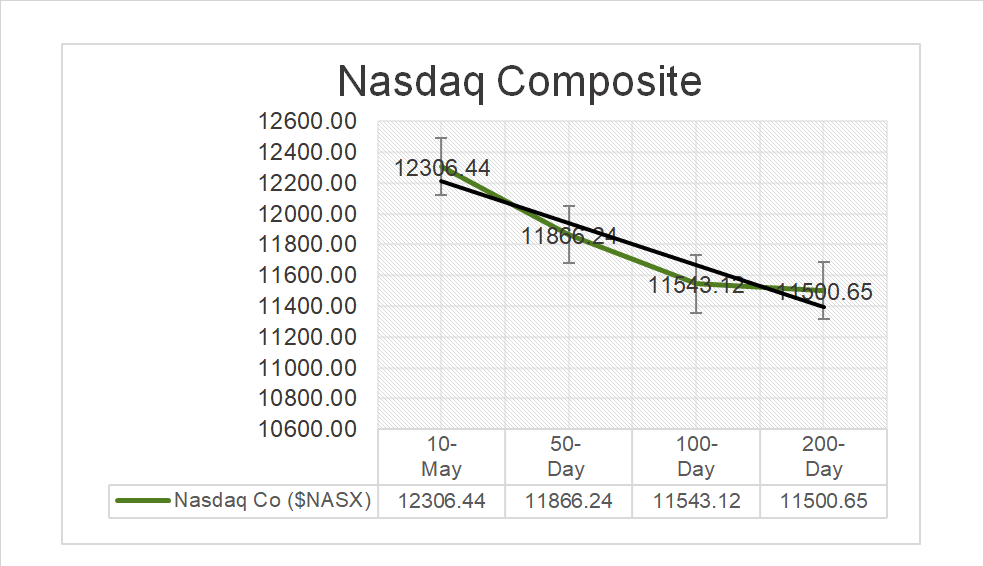

Today, US Markets finished mixed S&P 500 +0.45%, DOW -0.17% and the Nasdaq +1.04%. 6 of 11 of the S&P 500 sectors higher: Information Technology outperforms/ Energy lags. On the upside, mega cap growth rallies with NY FANG+ > 1.9%, the Semiconductor ETF (SOXX) >1%. Treasury Yields, Gold and Oil all declined. In economic news, the Consumer-Price Index rose 4.9% and Core CPI gained 0.4% in April as both were in line with analysts’ expectations. When the April headline CP rate falls below Fed Funds target rate that signals an important Inflation breaking point.

Takeaways

- April headline CP rate falls below Fed Funds target rate

- Mega cap growth sparks Nasdaq rally

- 6 of 11 of the S&P 500 sectors finished higher: Information Technology outperforms/ Energy lags

- Regional Banking SPDR S&P Banking ETF (KR) <0.96%>

- Toyota Motor ADR (TM) beats, Walt Disney (DIS) misses earnings

Pro Tip: Aftermarket trading basics on the quick, a) limited access b) lower trading volumes c) access to after and premarket earning releases d) lower liquidity e) +risk

Sectors/ Commodities/ Treasuries

Key Indexes (50d, 100d, 200d)

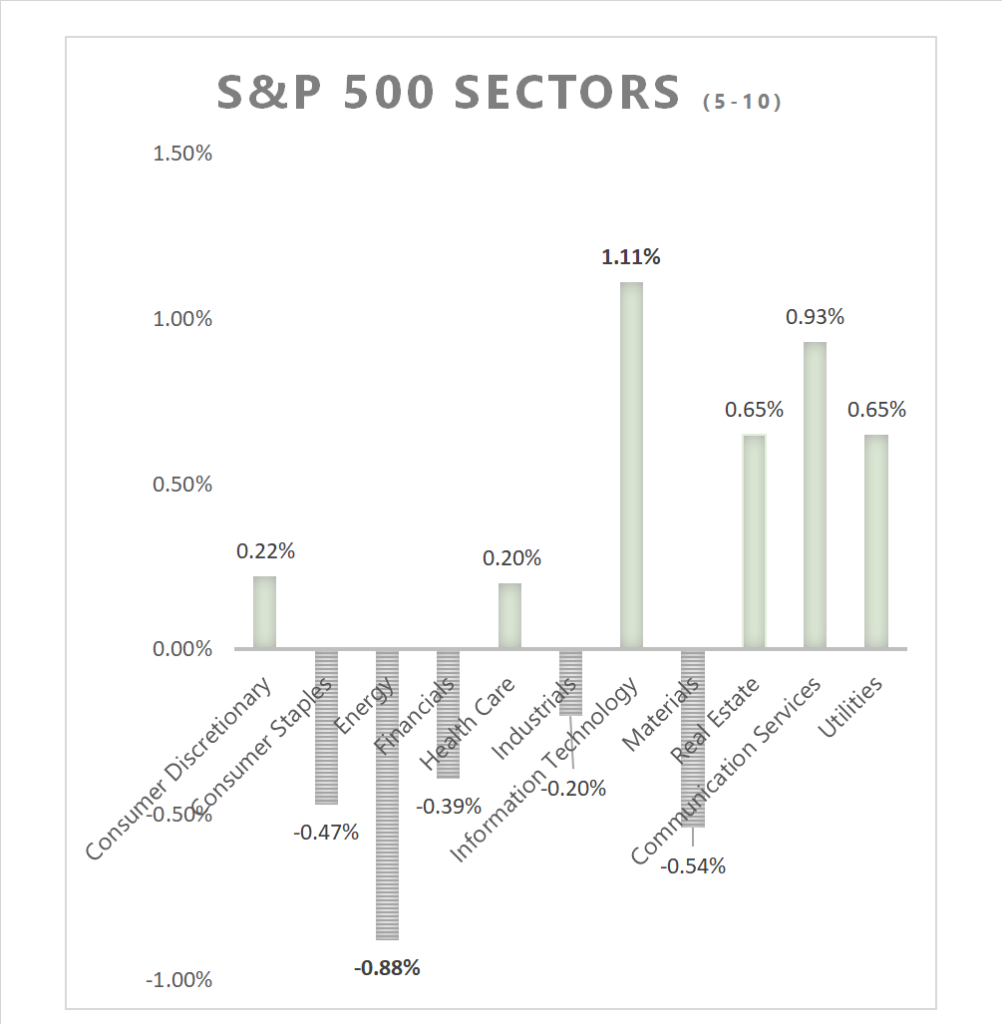

S&P Sectors

- 6 of 11 of the S&P 500 sectors finish higher Information Technology +1.11% and Communication Services +0.93% outperform/ Energy -0.88% and Materials -0.54% lag.

Commodities

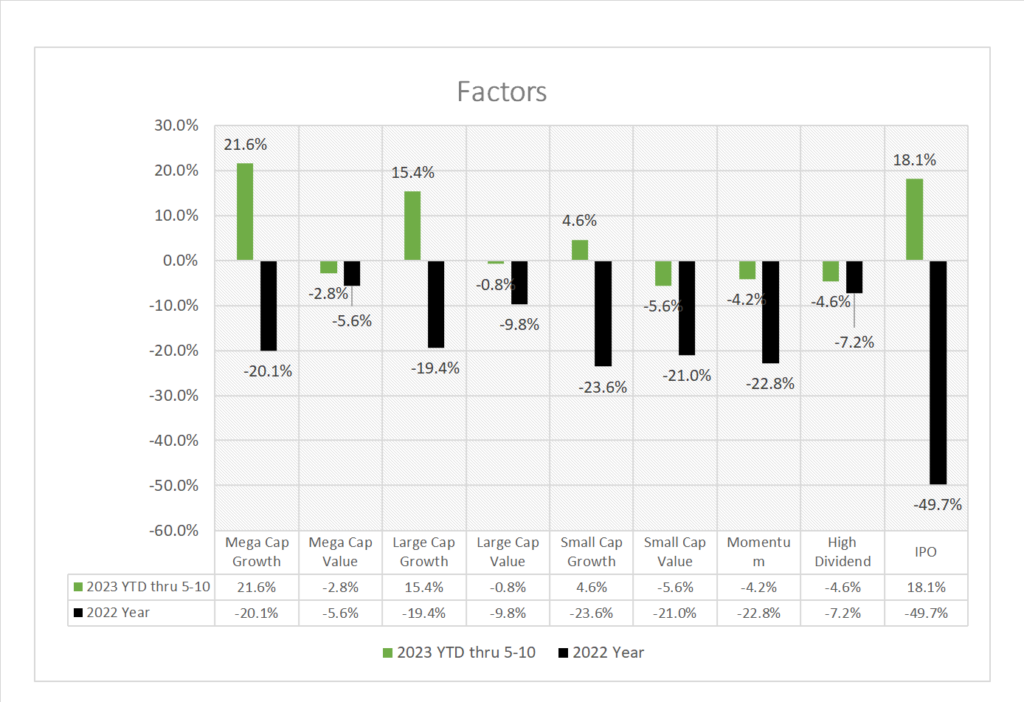

Factors (YTD)

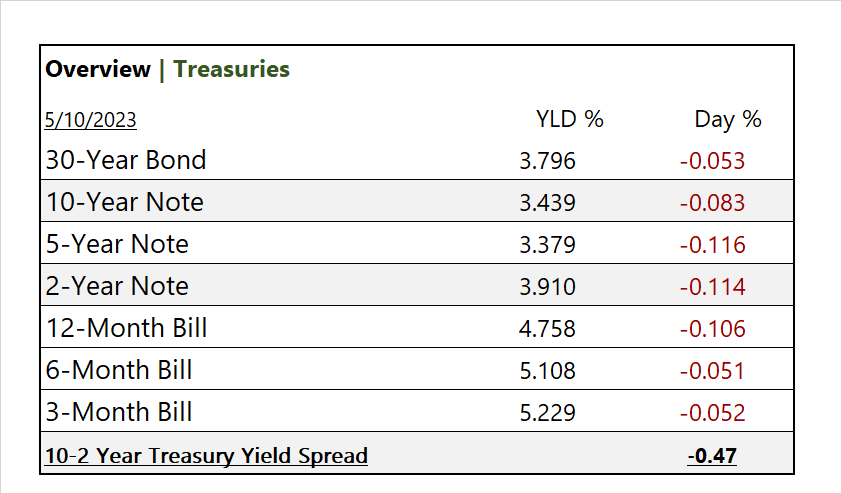

US Treasuries

Notable Earnings Today

- +Beat: Toyota Motor ADR (TM), Vestas Wind (VWSYF), Panasonic Corp PK (PCRFY), Middleby Corp (MIDD), Flex (FLEX), Robinhood Markets (HOOD)

- – Miss: Walt Disney (DIS), Siemens ADR (SMMNY), Nutrien (NTR), Li Auto (LI), Roblox (RBLX), FUJIFILM Holdings Corp (FUJIY), Orix (IX), Nippon Steel ADR (NPSCY), First Citizens BancShares (FCNCA), Icahn Enterprises (IEP)

- * Strong support – NVIDIA (NVDA), Analog Devices (ADI), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Alpha Metallurgical Resources (AMR), DaVita (DVA),

Economic Data

US

- Consumer price index; period April, act 0.4%, fc 0.4%. prev. 0.1%

- Core CPI; period April, act 0.4%, fc 0.4%, prev. 0.4%

- CPI year over year; period April, act 4.9%, fc 5.0%, prev. 5.0%

- Core CPI year over year; period April, act 5%, fc 5.5%, prev. 5.6%

News

Company News/ Other

- SoftBank Nears Sale of Fortress to Abu Dhabi Fund – WSJ

- Lithium producers Allkem, Livent to combine in $10.6 billion deal – Reuters

- The American Home Buyer’s Quandary: Nobody’s Selling – WSJ

Central Banks/Inflation/Labor Market

- Inflation Eased in April but Remains Stubbornly High – WSJ

- Who’s the boss in today’s labor market? – NPR

- Private-credit firms see opportunity as banks tighten lending – Reuters

China