MARKETS TODAY June 21st, 2023 (Vica Partners)

On Tuesday, US Markets finished lower, S&P 500 -0.47%, DOW -0.72%, NASDAQ -0.16%. 10 of 11 of the S&P 500 sectors declining: Consumer Discretionary +0.75% outperforms/ Energy -2.29% lags. On the upside, NY FANG+, Mega Cap Tech, Bitcoin, Treasury Yields mixed. In economic news, Housing Marker Index and starts beat consensus.

Overnight/US Premarket, Asian markets finished mixed, Japan’s Nikkei 225 +0.56%, Hong Kong’s Hang Seng -1.98%, China’s Shanghai Composite -1.31%. European markets finished lower, Germany’s DAX -0.55%, France’s CAC 40 -0.46%, London’s FTSE 100 -0.13%. S&P futures were trading at 0.5% below fair-value.

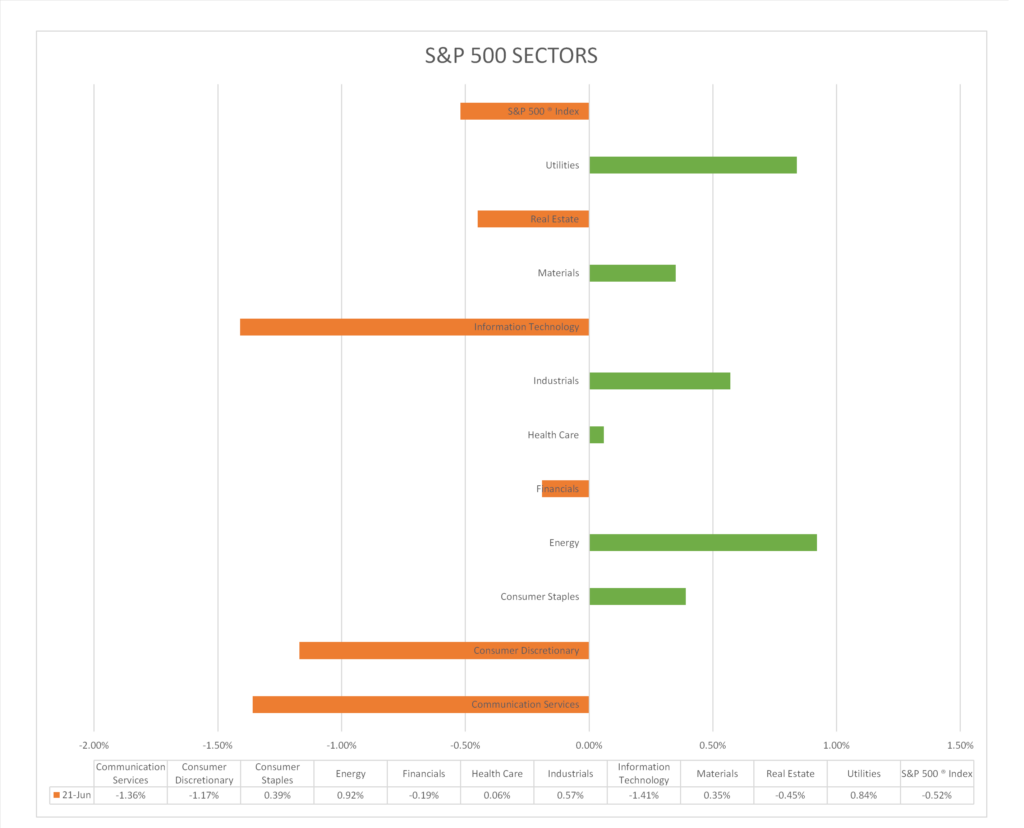

Today US Markets finished lower, S&P 500 -0.52%, DOW -0.30%, NASDAQ -1.21%. 6 of 11 of the S&P 500 sectors advancing: Energy +0.92% outperforms/ Information Technology -1.41% lags. On the upside, Mega Cap Value, Treasury Yields, Bitcoin, Oil and the Bloomberg Commodity Index. In economic news, Fed Chair Powell testified to House panel on bank regulation rather than monetary policy.

Takeaways

- Powell’s testimony “nothing new”

- FANG+ gets hammered <2.4%>

- Cyclical sectors outperform

- 6 of 11 of the S&P 500 sectors advancing: Energy +0.92% outperforms/ Information Technology -1.41% lags

- Semiconductor ETF (SOXX) falls <2.5%>

- Bitcoin up >5.6% and testing $30k

- Oil and Bloomberg Commodity Index gain

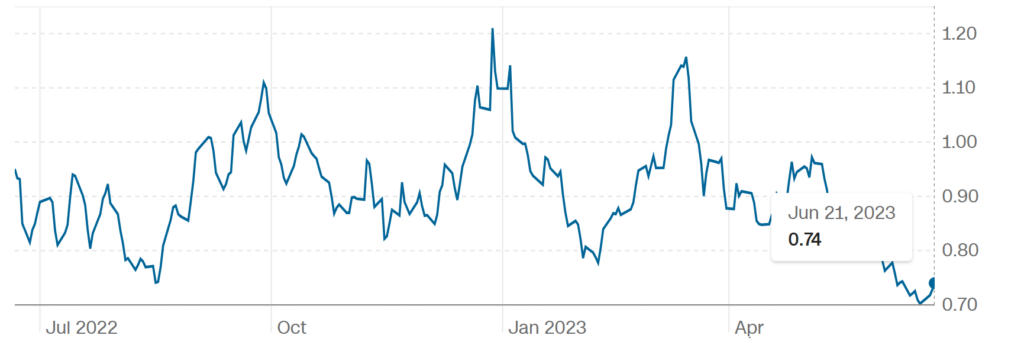

Pro Tip: Puts/ Call Options give investors the right to buy or sell stocks, indexes or other financial securities at an agreed upon price and date. Puts are the option to sell while calls are the option to buy. When the ratio of puts to calls is above 1 is considered bearish.

5-day average put/call ratio

Sectors/ Commodities/ Treasuries

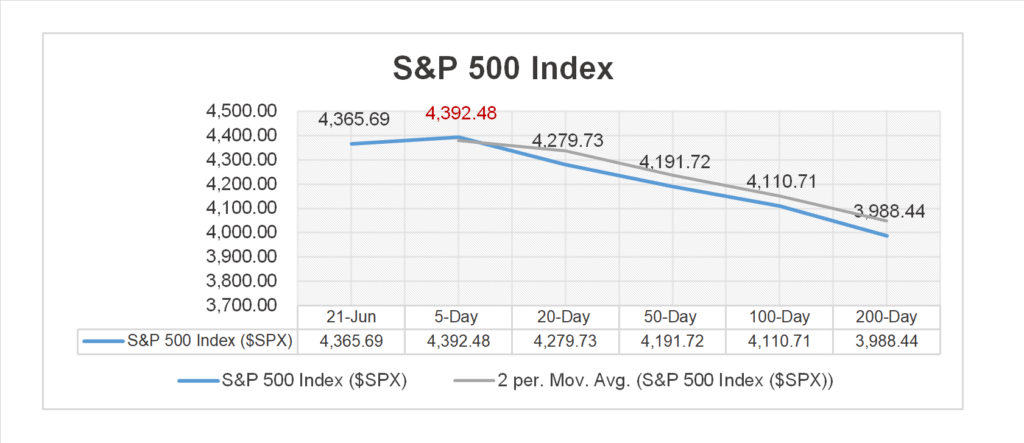

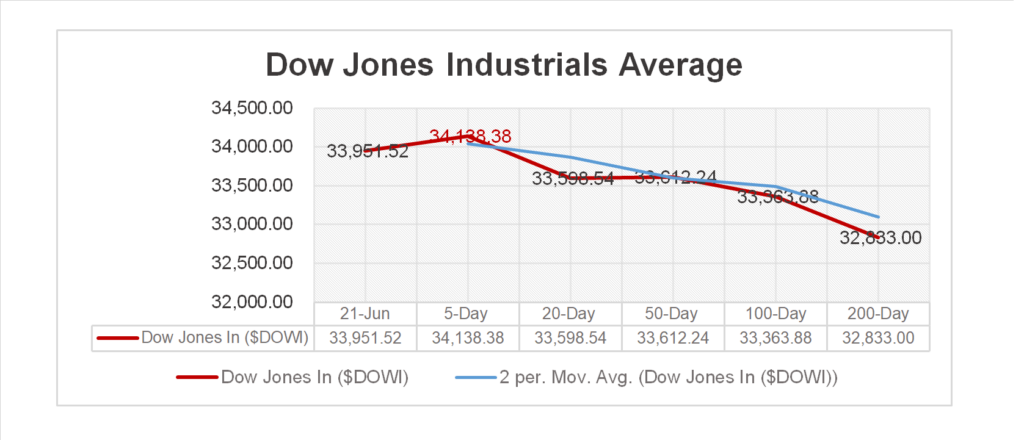

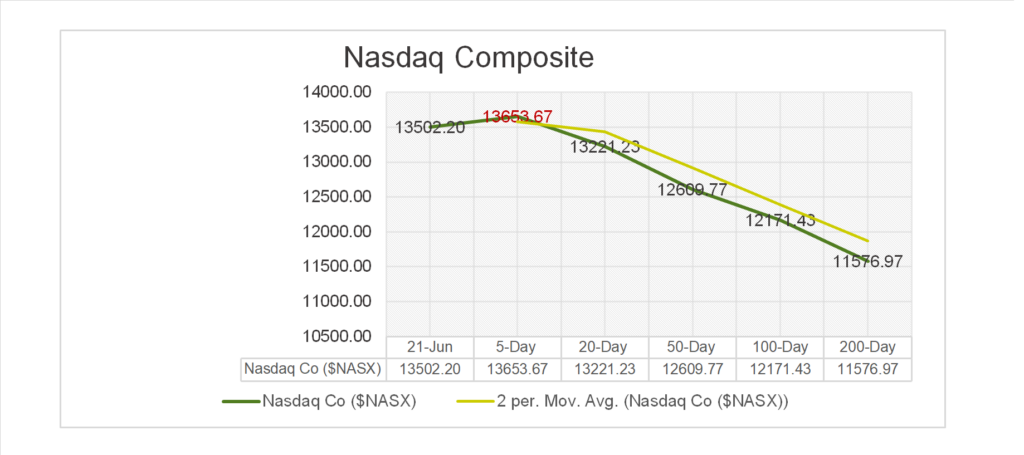

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 6 of 11 of the S&P 500 sectors advancing: Energy +0.92%, Utilities +0.84% outperform/ Information Technology -1.41%, Communication Services -1.36% lag.

Commodities

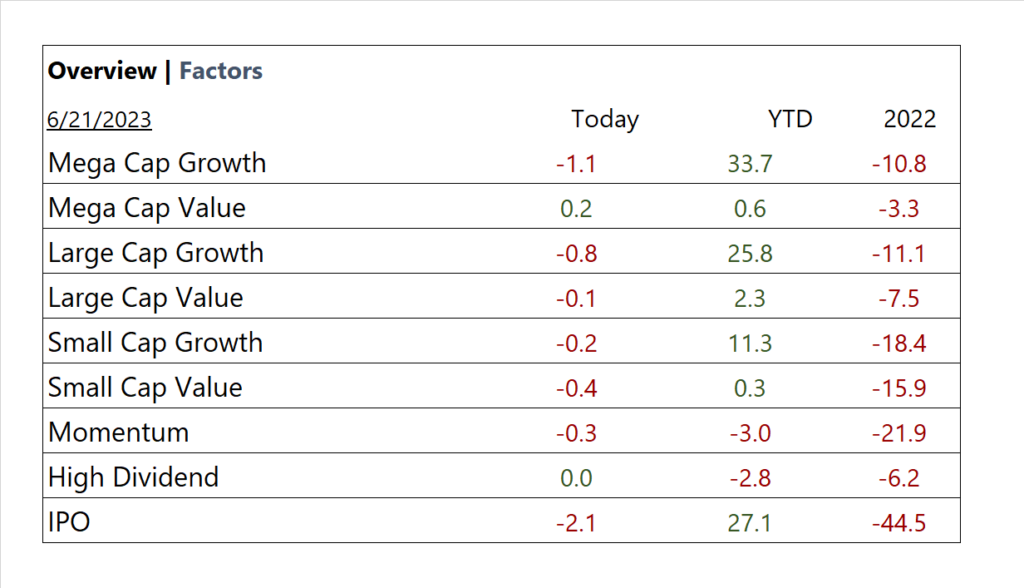

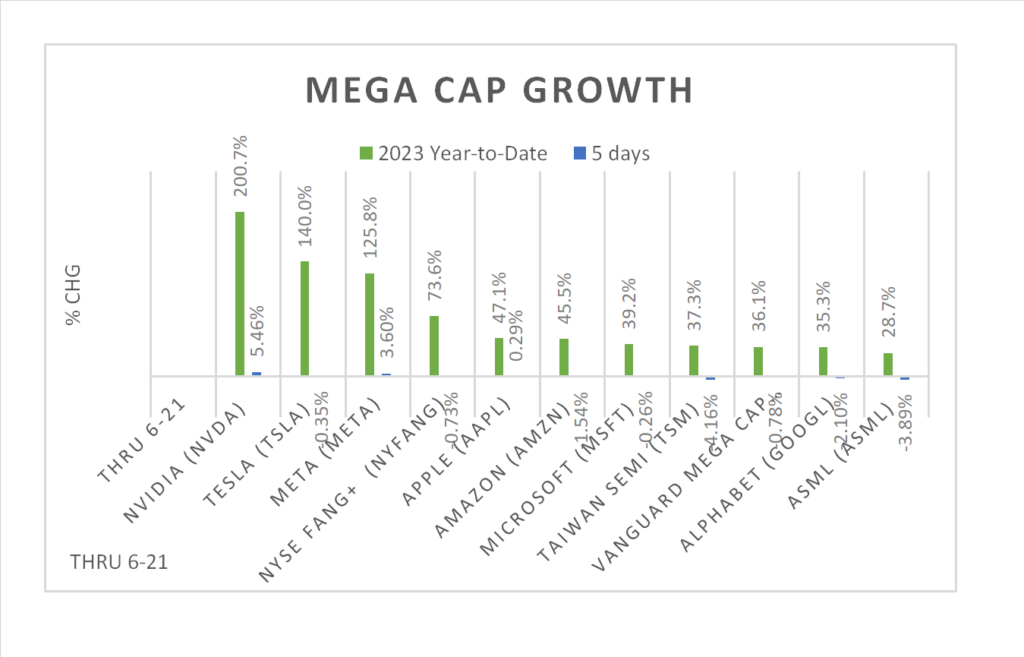

Factors/ Mega Cap Growth Chart

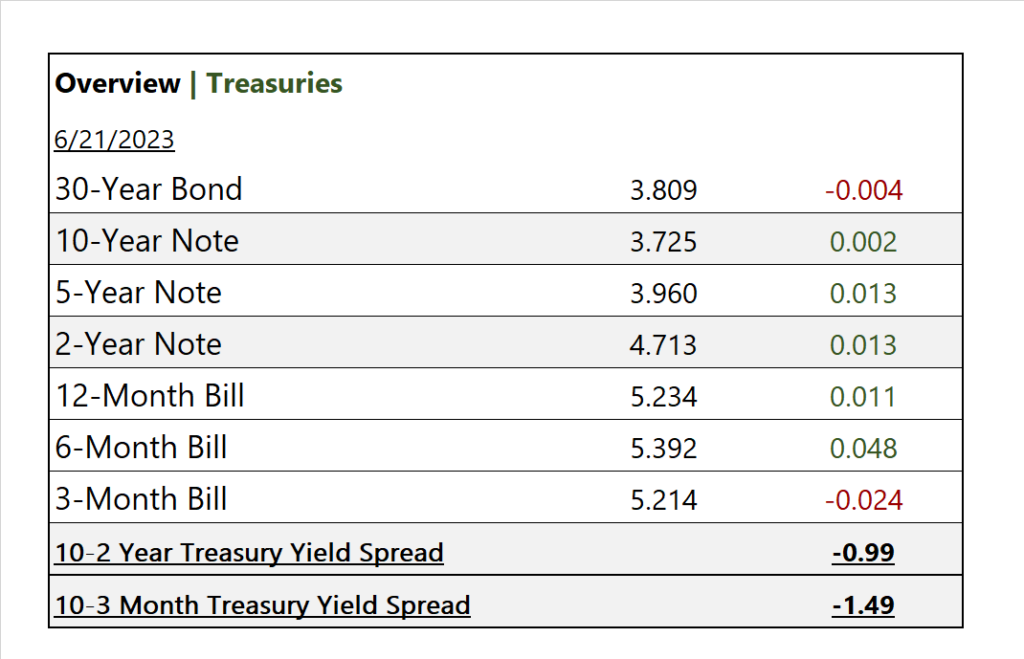

US Treasuries

Notable Earnings Today

- +Beat: KB Home (KBH), Patterson (PDCO)

- – Miss: Winnebago Industries (WGO)

- * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom Inc (AVGO), Intel (INTC)

Economic Data

US

- Fed Chair Powell testified to House panel on bank regulation rather than monetary policy. He did say that 16 of the 18 members of the policy committee expect another interest-rate hike.

News

Company News/ Other

- Apple Plans Major Retail Push With New Stores Across China, US – Bloomberg

- American Companies Held Hostage by the Whims of TikTok – WSJ

- Bitcoin Bonanza on Tap if BlackRock ETF Is Approved – WSJ

Energy/ Materials

- Scope 3 Emissions: What Businesses Need to Know – WSJ

- Arizona Is Running Out of Cheap Water. Investors Saw It Coming – Bloomberg

Central Banks/Inflation/Labor Market

- Inflation Would Be Same Today Even if Fed Had Hiked Interest Rates Earlier, New Model Shows – Bloomberg

- Fed’s Powell Says Interest-Rate Pause Is Expected to Be Temporary – WSJ

China/ Asia

- China Cuts Borrowing Rates Again in Bid to Juice Recovery – WSJ

- Biden’s ‘Dictator’ Xi Riff Undercuts Painstaking China Diplomacy – Bloomberg