MARKETS TODAY April 26th, 2023 (Vica Partners)

Yesterday US Markets finished lower. All 11 of the S&P 500 sectors fell, Materials and Information Technology led decliners. SPDR S&P Banking ETF (KRE) was down >4%. Treasury Yields across the curve fall. Oil and the Bloomberg Commodity Index sharply decline. On the upside Bitcoin and Gold gain and BIG tech beats earnings in afterhours. In economic news, new home sales were up 9.6% (MOM) however US consumer confidence reached a 9-month low in April.

Overnight Asian markets finished mixed, Hang Seng +0.71%, Nikkei 225 -0.71%, Shanghai Composite -0.02%. Pre-market, European markets finished lower, CAC 40 -0.86%, London’s FTSE 100 -0.49%, Germany’s DAX -0.48%. S&P 500 US futures were trading 0.3% above fair-value.

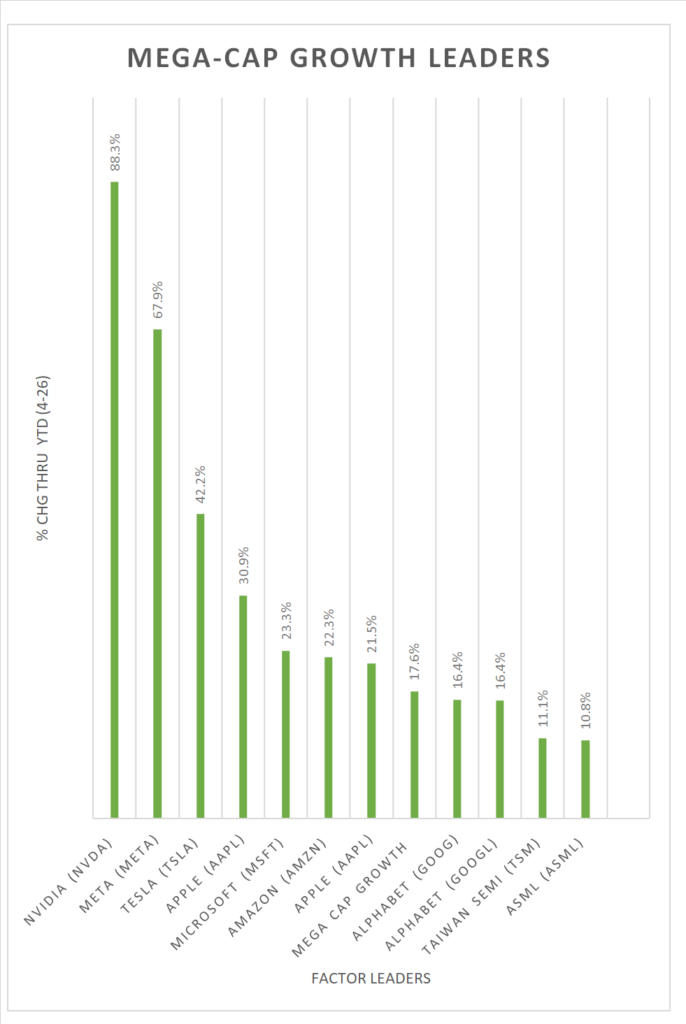

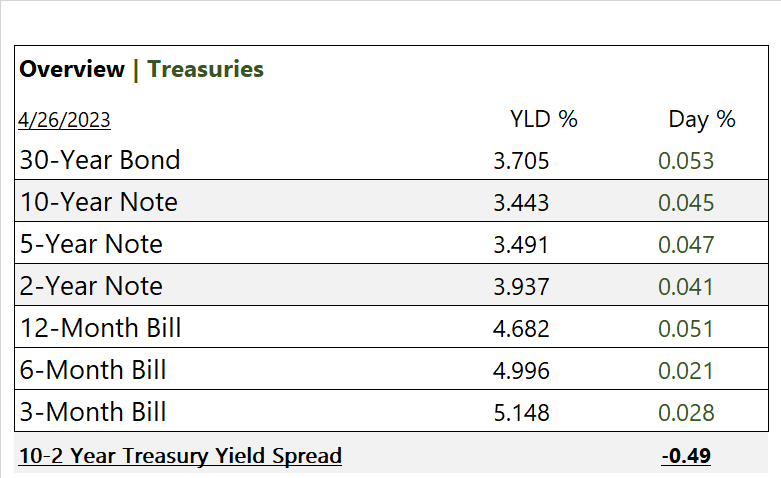

US Markets today finished mixed with Big Tech coming to the rescue, as they continue to beat on earnings. The NY FANG+ up 2%/ Mega Cap Growth +>1.2% leading gainers. 9 of 11 of the S&P 500 sectors finished lower, Information Technology outperforms/ Utilities lagged. The SPDR S&P Banking ETF (KRE) was up 0.61% today while the Cboe Volatility Index steadied. Oil and the Bloomberg Commodity Index sharply declined. On the upside, Treasury Yields rose across the curve, Meta beats earnings in afterhours. In economic news, weekly Mortgage Applications up 4% and Durable Goods Orders rose 3% in March surpassing expectations.

Takeaways

- Big Tech earnings steadies market

- Volatility Index flat

- The NY FANG+ up 2%/ Mega Cap Growth +>1.2% leading gainers

- Information Technology outperforms

- Oil and the Bloomberg Commodity Index sharply declined

- After market earnings, Meta with BIG beat

Pro Tip: The PEG ratio, which stands for Price/Earnings to Growth ratio, is an important financial metric that investors use to assess the value of a stock. It takes into account a company’s earnings growth rate and its price-to-earnings (P/E) ratio to determine whether a stock is overvalued or undervalued. A PEG ratio of less than 1 suggests that a stock may be undervalued. Formula for PEG ratio = P/E ratio / Annual earnings per share (EPS) growth rate click here to learn more

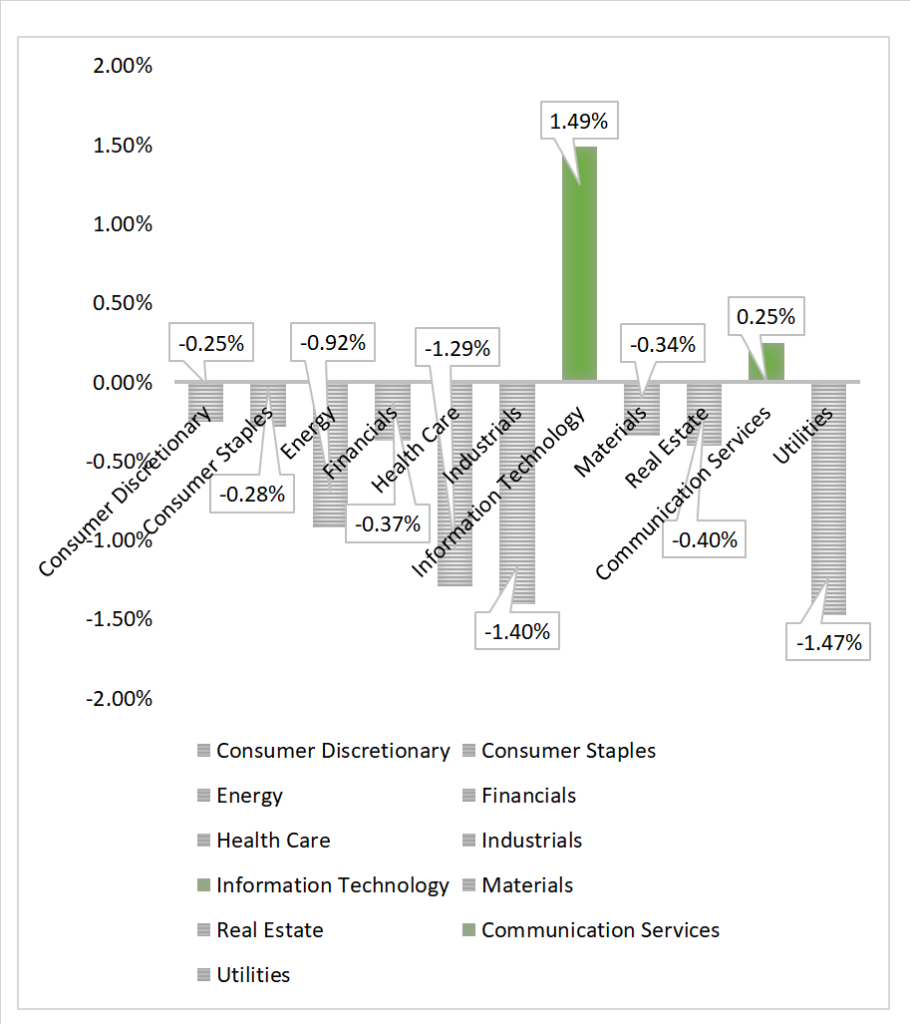

Sectors/ Commodities/ Treasuries

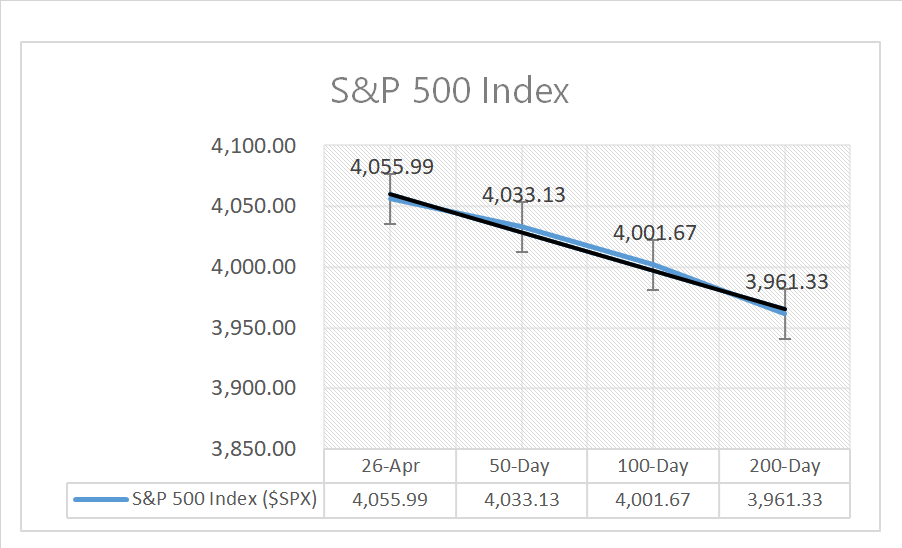

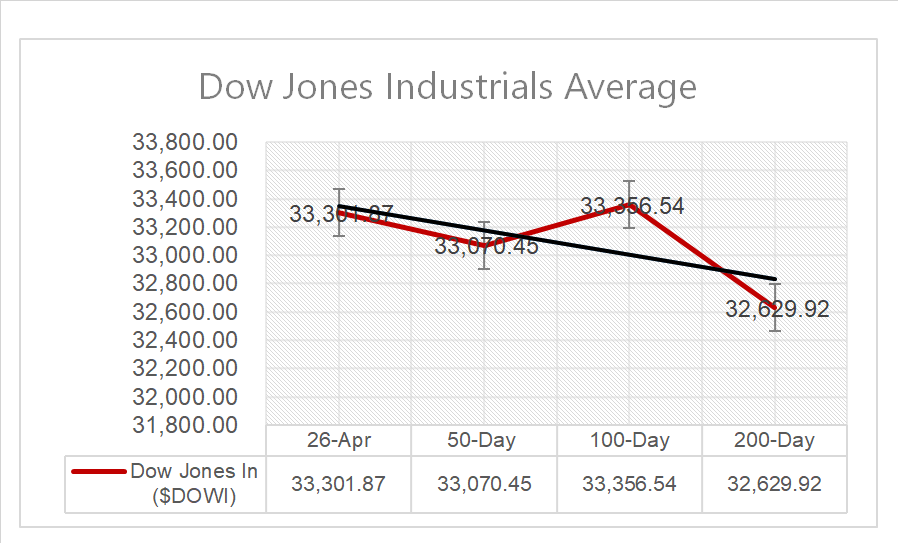

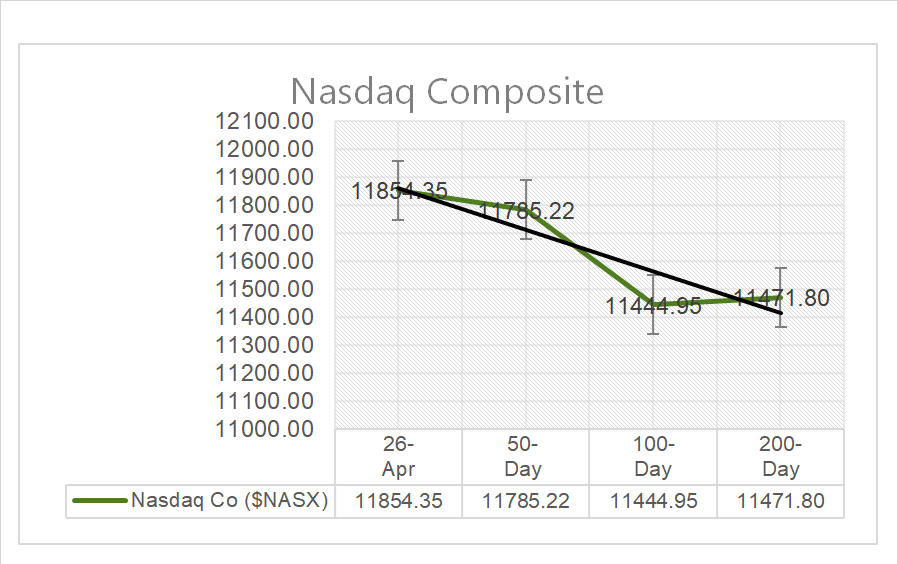

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 9 of 11 of the S&P 500 sectors finish lower, Utilities -1.47% and Industrials -1.40 led decliners/ Information Technology +1.49% outperforms

Commodities

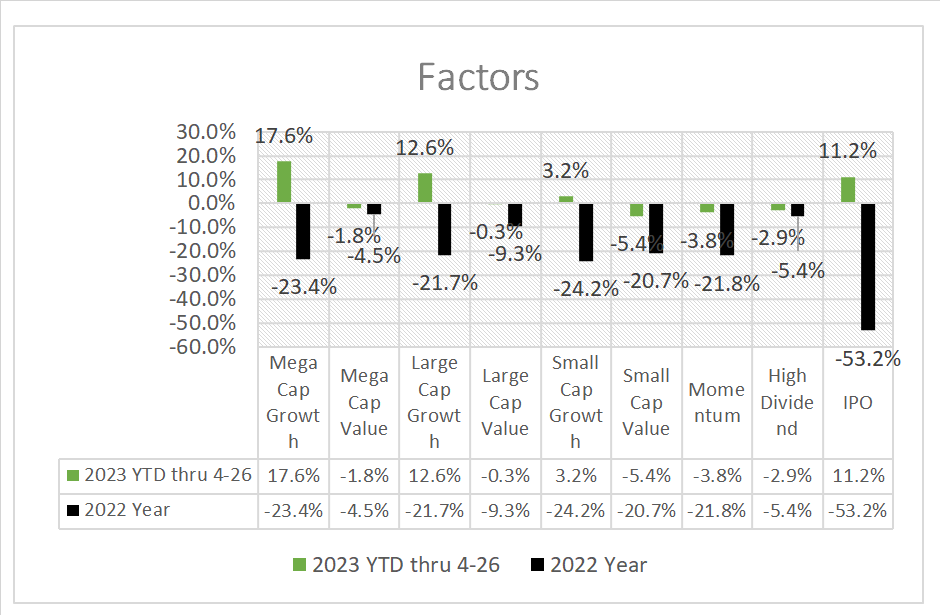

Factors (YTD)

US Treasuries

US Treasuries

Notable Earnings Today

Notable Earnings Today

- +Beat: Meta Platforms (META), Thermo Fisher Scientific (TMO), ADP (ADP), Boston Scientific (BSX), CME Group (CME), Humana (HUM), General Dynamics (GD)

- – Miss: Boeing (BA), American Tower (AMT), Southern (SO), GSK plc DRC (GSK), Hess (HES)

- * Strong support – Meta Platforms (META) Microsoft (MSFT), Alphabet (GOOG,GOOGL), Visa (V), NVIDIA (NVDA), QUALCOMM (QCOM), Amazon (AMZN), Owens Corning (OC),Berkshire Hathaway (BRK-B), Citigroup (C), BlackRock (BLK), Morgan Stanley (MS), Union Pacific (UNP), Coca-Cola (KO), PACCAR (PCAR), Centene (CNC), Humana (HUM)

Economic Data

US

- Mortgage apps; 3.7%, prior -8.8%; 30yr rate: 6.55% prior 6.43%

- Durable-goods orders; period March, act 3.2%, fc 0.5%, prev. -1.2%

- Durable-goods ex transportation. Period March, act 3%, prev. -0.3%

- Advanced U.S. trade balance in goods; period March, act -$84.6B, prev. -$92B

- Advanced retail inventories; period March. act 0.7%, prev.0.3%

- Advanced wholesale inventories; period March, act 0.1%. prev. 0.1%

- Oil Inventories; period April weekly, act -5.054m, fc -1.48m, prev. -4.581m (note – Gasoline -2408K vs -933K)

News

Company News/ Other

- Microsoft and Activision Blizzard hit out as UK regulator blocks takeover – BBC

- Disney sues DeSantis, calling park takeover ‘retaliation’ – AP

- Oil slides as recession fears outweigh large US inventory draw – Reuters

Central Banks/Inflation/Labor Market

- First Republic Bank shares plumb new lows on report government reluctant to intervene – Reuters

- Bank of Canada rate-cut bets recede as core inflation proves sticky – Reuters

- Which Inflation Measures Matter? – NY Times

China

- Yuan overtakes dollar to become most-used currency in China’s cross-border transactions – Reuters