MARKETS TODAY July 20th, 2023 (Vica Partners)

Overnight/US Premarket, Asian markets finished lower, Japan’s Nikkei 225 down 1.23%, China’s Shanghai Composite off 0.92%, while Hong Kong’s Hang Seng ended lower 0.13%.

European markets finished higher, France’s CAC 40 gained 0.79%, London’s FTSE 100 up 0.76% and Germany’s DAX is up 0.59%. S&P futures opened trading at 0.25% below fair value.

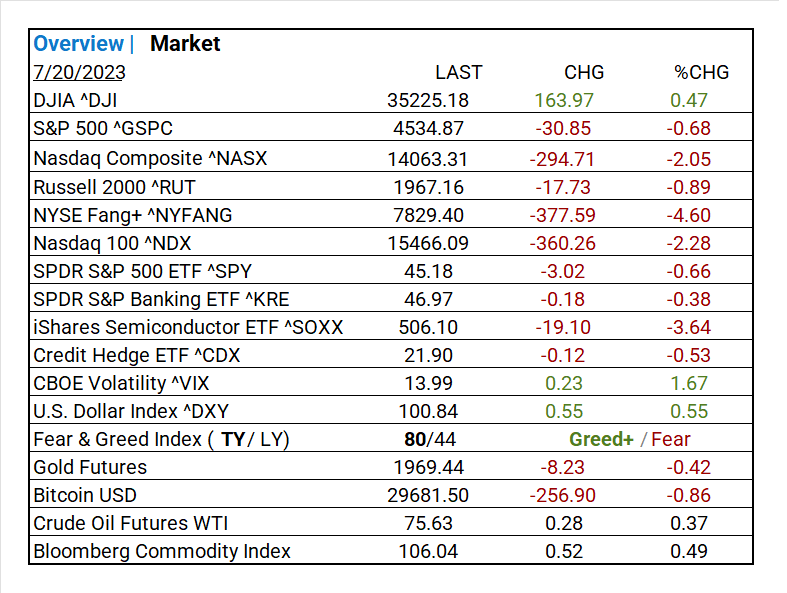

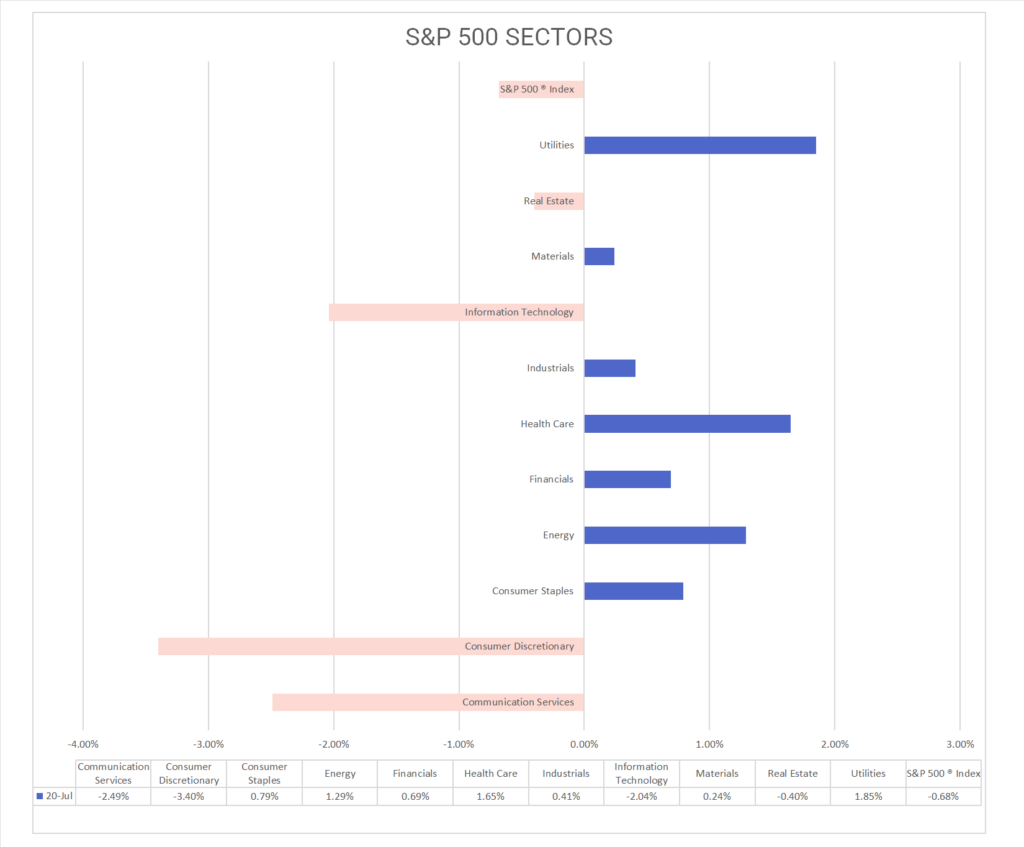

Today US Markets finished mixed, DOW gained 0.47%, S&P 500 and NASDAQ dropped 0.68% and 2.05% respectively. 7 of 11 S&P 500 sectors advancing: Utilities 1.85% outperforms/ Consumer Discretionary -3.40% lags. On the upside, Mega Cap Value, High Dividend, Pharmaceuticals, Insurance, Water Utilities, Treasury Yields, USD Index, Oil and the Bloomberg Commodity Index.

In economic news, initial claims came in better than expected while continuing claims rose. The Philly Fed index remained in negative territory but with better expectations for future activity. The leading economic index missed median expectations and existing home sales soft.

Takeaways

- Economic reports signal recession/ Jobless Claims at two-month low

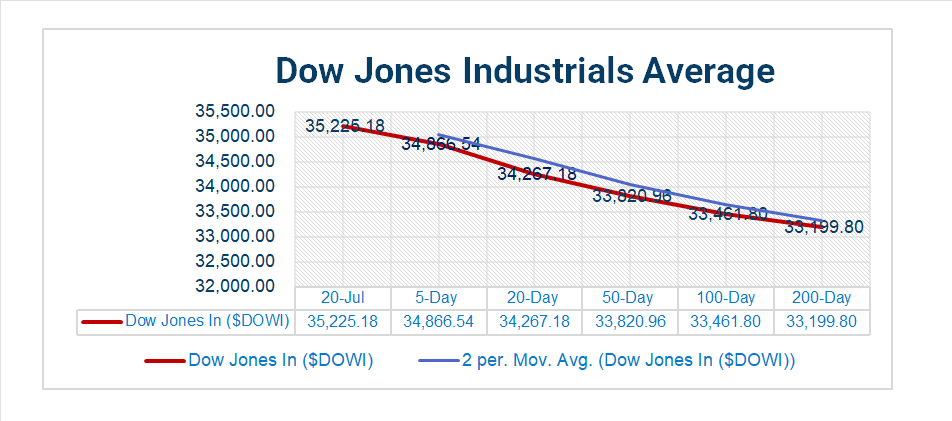

- DOW leads majors +0.47% (9 straight day rally)

- NYSE FANG+ sharp decline <4.60%>

- 7 of 11 S&P 500 sectors advancing: Utilities 1.85% outperforms/ Consumer Discretionary -3.40% lags

- Pharmaceuticals +3.08%, Insurance +2.31%, Water Utilities +2.06%, Multi-Utilities +2.00%, Electric Utilities +1.87%, Oil, Gas & Consumable Fuels +1.52%

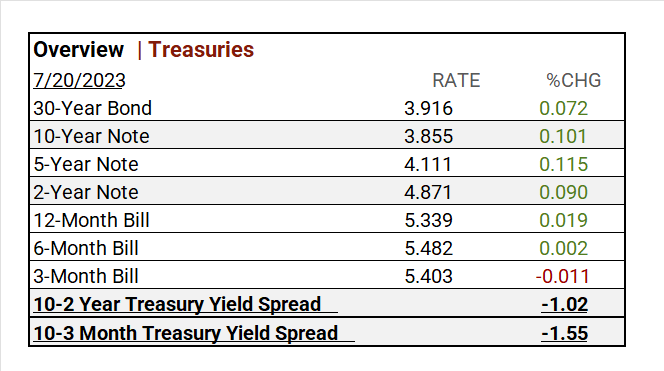

- Treasury Yields and USD Index rise

- Oil and the Bloomberg Commodity Index gain

- Taiwan Semiconductor (TSM) and J&J (JNJ) earnings beat

- SAP ADR (SAP) and Capital One Financial (COF) earnings misses

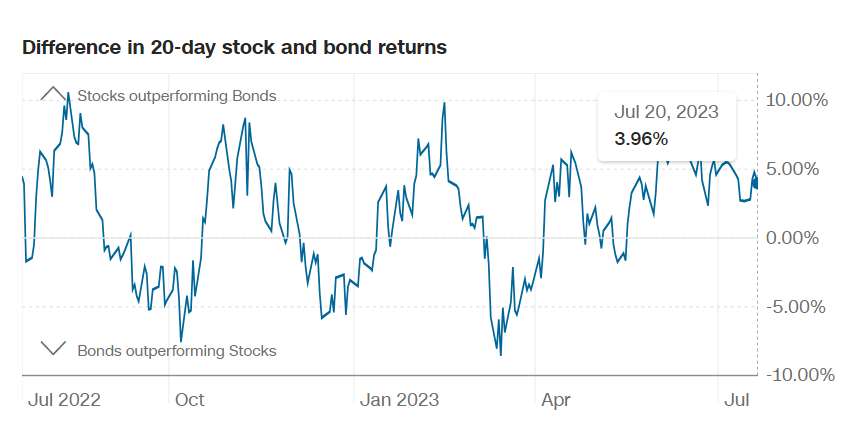

Pro Tip: Safe Haven Demand shows the difference between Treasury bond and stock returns over the past 20 trading days. Stocks do better when investors are less risk averse.

Sectors/ Commodities/ Treasuries

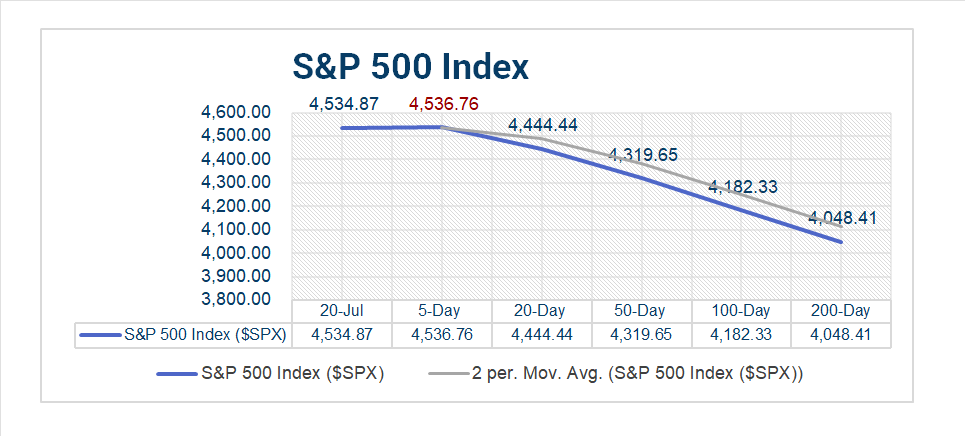

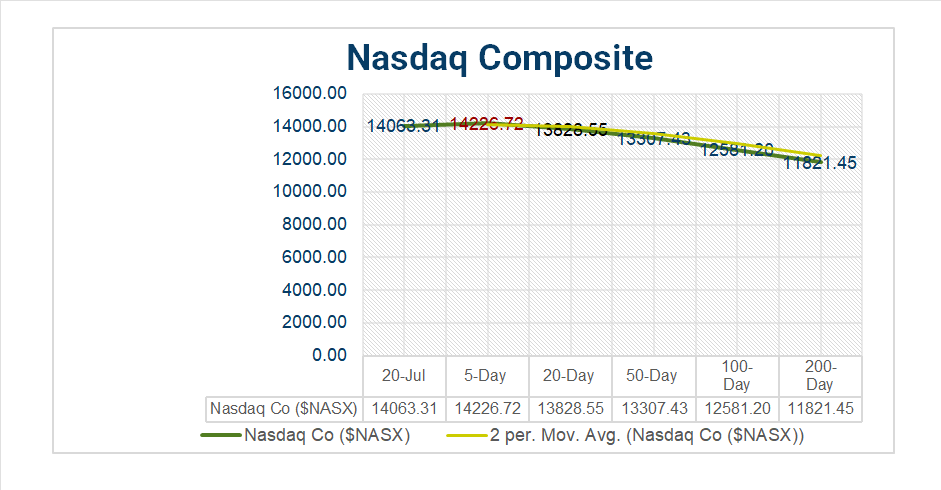

Key Indexes (5d, 20d, 50d, 100d, 200d)

S&P Sectors

- 7 of 11 S&P 500 sectors advancing: Utilities 1.85% outperforms/ Consumer Discretionary -3.40% lags.

- Pharmaceuticals +3.08%, Insurance +2.31%, Water Utilities +2.06%, Multi-Utilities +2.00%, Electric Utilities +1.87%, Oil, Gas & Consumable Fuels +1.52%

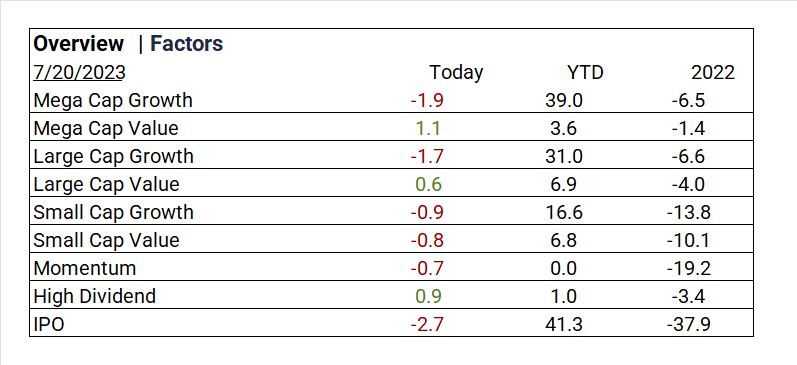

Factors

US Treasuries

Q2 ’23 Top Line Earnings Preview

- In Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%

- Q2 S&P 500 EPS expected to decline <7.2%>/ Fiscal year 2023 EPS flat YoY

- Expect lower Q1 revenues

- Call topics: economic uncertainty, aggregate demand, inventories, costs, roi

Notable Earnings Today

- +Beat: Taiwan Semiconductor (TSM), J&J (JNJ), Abbott Labs (ABT), Philip Morris (PM), Intuitive Surgical (ISRG), Marsh McLennan (MMC), Atlas Copco AB (ATLKY), Kenvue (KVUE), DR Horton (DHI), PPG Industries (PPG), Nidec (NJDCY), WR Berkley (WRB), American Airlines (AAL)

- – Miss: SAP ADR (SAP), ABB ADR (ABBNY), Infosys ADR (INFY), Freeport-McMoran (FCX), Capital One Financial (COF), Truist Financial Corp (TFC), Travelers (TRV), Newmont Goldcorp (NEM), Genuine Parts (GPC), Nokia ADR (NOK), Fifth Third (FITB), Pool (POOL), KeyCorp (KEY), MarketAxesss (MKTX)

Economic Data

US

- Initial jobless claims: period July 15, act 228,000, fc 240,000, prior 237,000

- Continuing claims: period July 15, act 1.754m, fc 1.73m, prior 1.729m

- Philadelphia Fed mfg. survey: period June, act -13.5, fc -10.0, prior -13.7

- Existing home sales: period June, act 4.16m, fc 4.2m, prior 4.3m

- US. leading economic indicators: period June, act -0.7%, fc -0.6%. prior -0.7%

Vica Partner Guidance July ’23, (updated 7-20)

- Q3/4 highlighting Energy Equipment & Services, Banks, Health Care Providers & Services, Passenger Airlines, Building Products. Real Estate Management & Development, Office REITs and Gas Utilities. Undervaluation for Chinese Mega Cap Tech.

- Cautionary, Mega and Large Cap Growth moderating, Banks shortly could be overvalued. Current indicators are recessionary. Credit default swap (CDS) to pick-up through Q4/Q1.

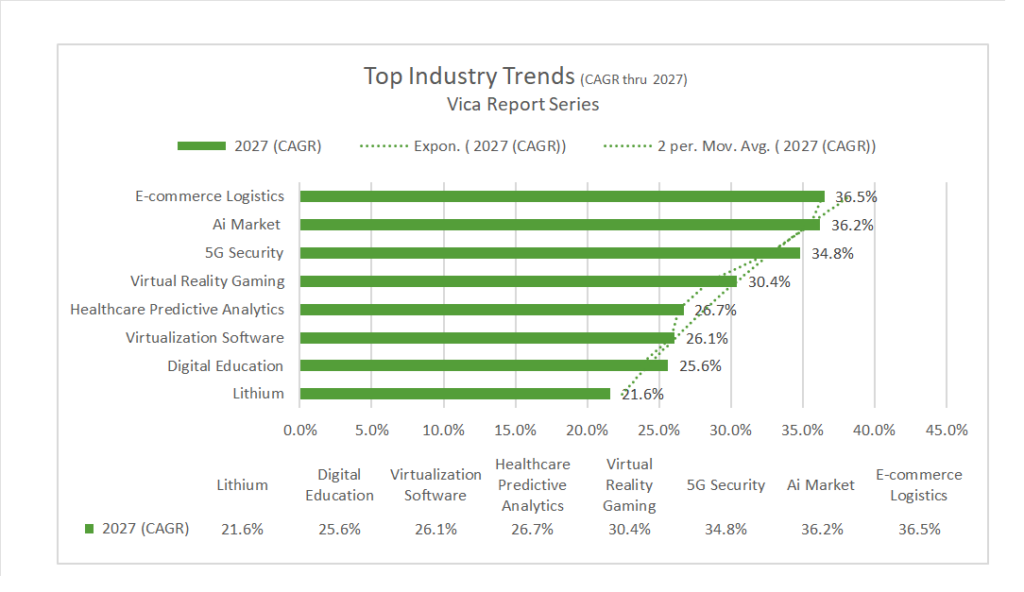

- Longer Term, Nasdaq 100^NDX companies will continue to outperform in the longer term along with Semiconductor Equipment. Forward looking CAGR growth below.

- We continue to emphasize business *quality and strength of balance sheet for all investments. * Strong support – NVIDIA (NVDA), Meta Platforms (META), Microsoft (MSFT), Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Tesla (TSLA), Taiwan Semi (TSM), ASML Holding NV (ASML), Broadcom (AVGO).

News

Company News/ Other

- Surge in Heart Procedures Helps Drive Johnson & Johnson Revenue – WSJ

- Blackstone Wins Private Equity’s Race to $1 Trillion – WSJ

Energy/ Materials

- This Arkansas Town Could Become the Epicenter of a U.S. Lithium Boom – WSJ

- Making Solar Panels Is ‘Horrible’ Business. The US Still Wants It. – Bloomberg

Central Banks/Inflation/Labor Market

- Bernanke Says Next Fed Interest Rate Hike May Be Its Last – Bloomberg

- Home Sales Fall as Would-Be Buyers Face High Rates, Low Supply – WSJ

Asia/ China