VMSI Climbs to 52.7 as Institutions Shift Toward Cautious Optimism

June 5, 2025 | VICA Research

VICA Partners Research’s VMSI © shows where institutional capital is moving — helping investors cut through noise, manage risk, and stay positioned ahead of the curve.

Weekly Snapshot

VMSI Score (Weekly Composite): 52.7 (Cautionary Optimism Zone)

End-of-Day Market Closes – June 5, 2025:

• S&P 500: –0.53% • Nasdaq: –0.83% • Dow: –0.25% • VIX: 18.48

VMSI Sub-Components (Weekly):

• Momentum: 46.3 • Liquidity: 38.2 • Volatility: 61.4 • Safe Haven Demand: 69.5

Markets softened into the weekly close with all major indices posting daily declines. The VIX rose nearly 5%, reflecting revived caution among traders. Despite this session-end pullback, VMSI climbed to 52.7, signaling a shift in weekly institutional posture — from pure defense toward measured, early-stage reallocation.

Key Takeaway: While Thursday’s session was risk-off, the broader week showed underlying sentiment improvement, pointing to institutions probing for opportunity amid lingering macro concerns.

What is VMSI?

The VICA Market Sentiment Index (VMSI)© tracks institutional capital flows, risk posture, and macro volatility weekly. Built for tactical allocation — not behavioral shifts.

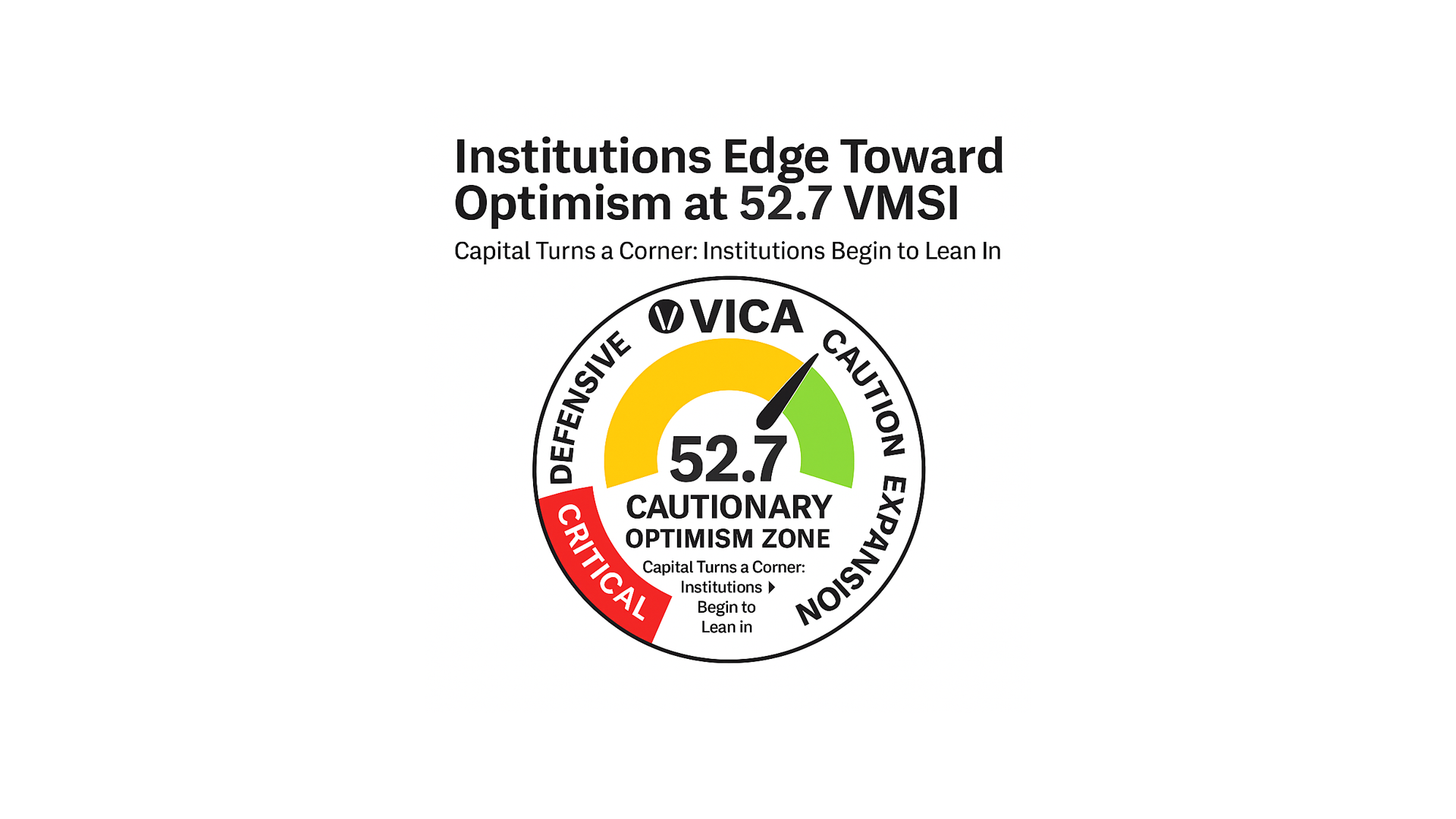

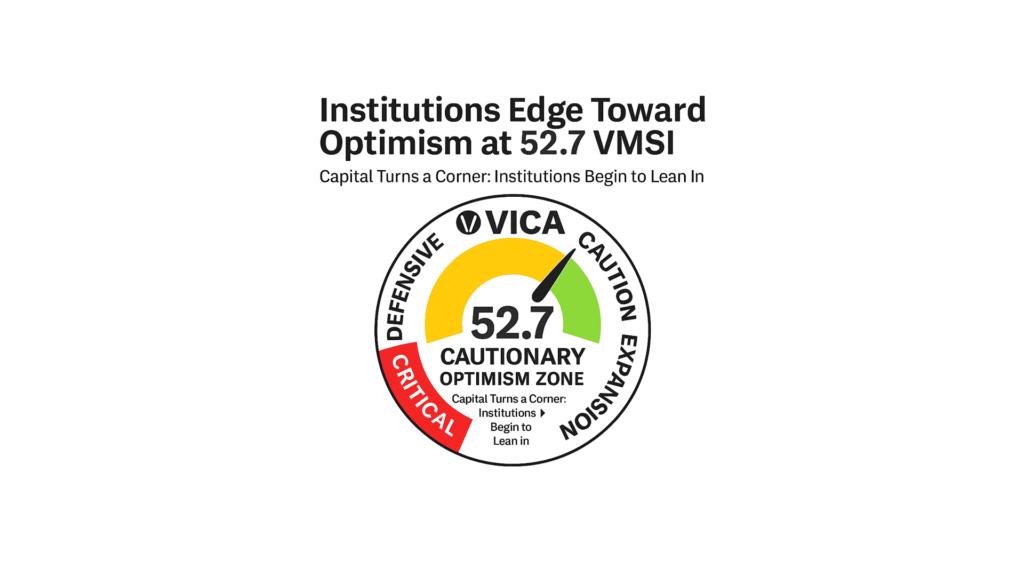

VMSI Gauge — Current Sentiment & Risk Level

VMSI Score – June 5, 2025: 52.7

The gauge shows improving institutional confidence as volatility cools and risk appetite rises.

Key Insight: Capital rotation is broadening — early signs of re-engagement are in play.

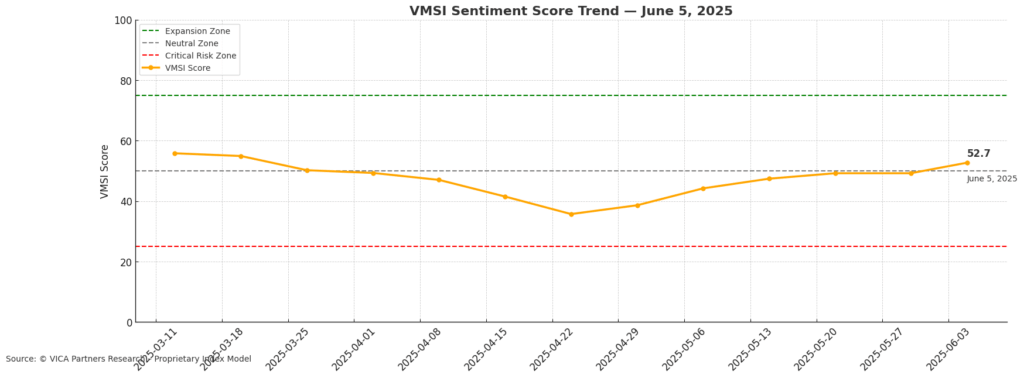

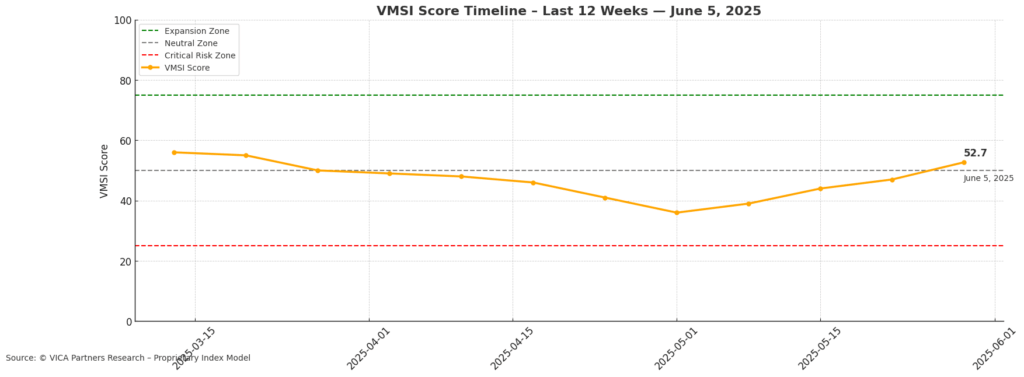

VMSI Timeline — Sentiment Shifts Over Time

The VMSI has gained from 38.6 three weeks ago to 52.7 today — reflecting a gradual yet consistent shift from risk aversion to measured optimism.

Key Insight: Institutions are gaining confidence, but conviction remains dependent on macro clarity.

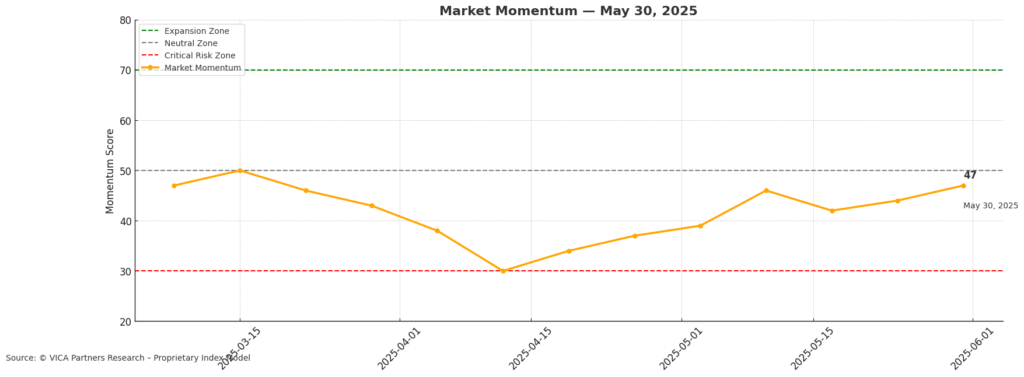

Market Momentum — Institutional Accumulation

Equities posted modest gains this week. Technicals for the S&P and Nasdaq remain strong, supported by momentum in key sectors like semiconductors.

Key Insight: Accumulation continues but lacks a breakout catalyst — watch for breadth expansion.

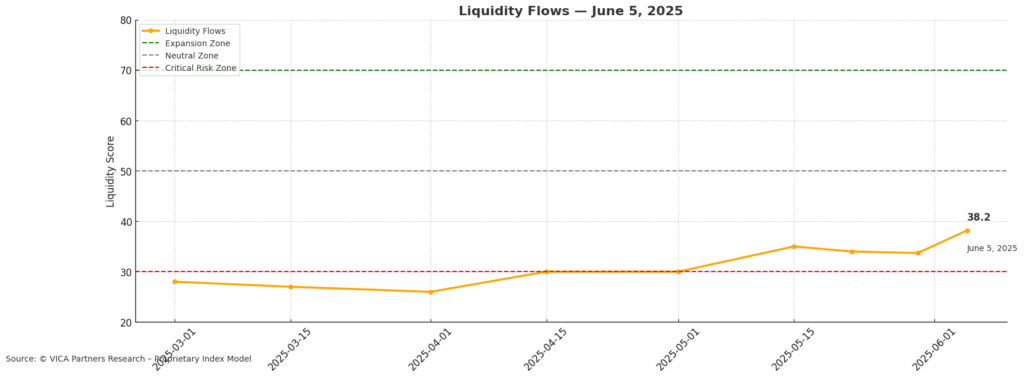

Liquidity Flows — Capital Movement Patterns

Flows remain subdued. VTWO and high-beta assets show only marginal interest. LQD declined slightly after a prior week of strength.

Key Insight: Liquidity is returning, but hesitantly — capital is probing rather than committing.

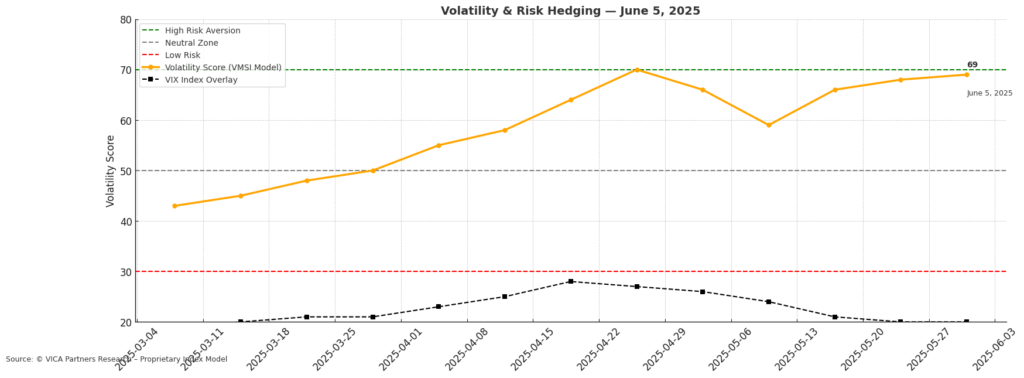

Volatility & Risk Hedging — Uncertainty Barometer

The VIX closed the week at 18.48, rising nearly 5% from prior levels. Hedging activity is still visible but receding from peak levels.

Key Insight: Institutions are unwinding some hedges, though downside protection remains intact.

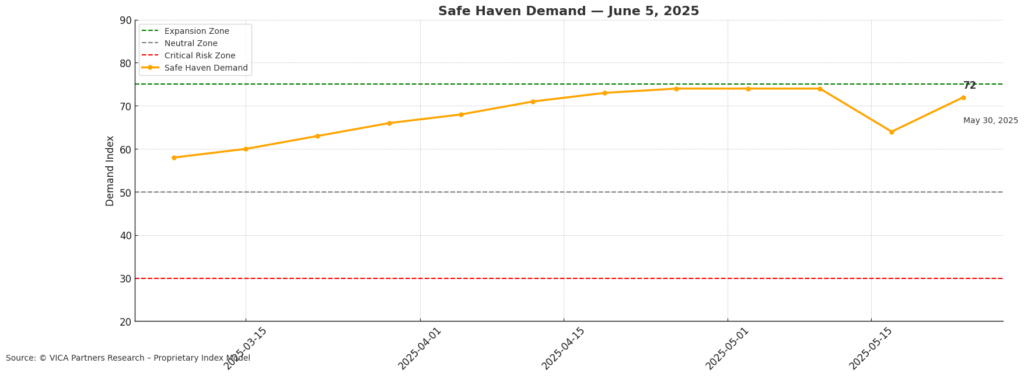

Safe Haven Demand — Flight to Quality

Treasury yields ticked up to 4.38%, while LQD softened. Safe haven appetite remains elevated, albeit with early signs of diversification.

Key Insight: Stability remains attractive, but appetite for yield is slowly pulling flows outward.

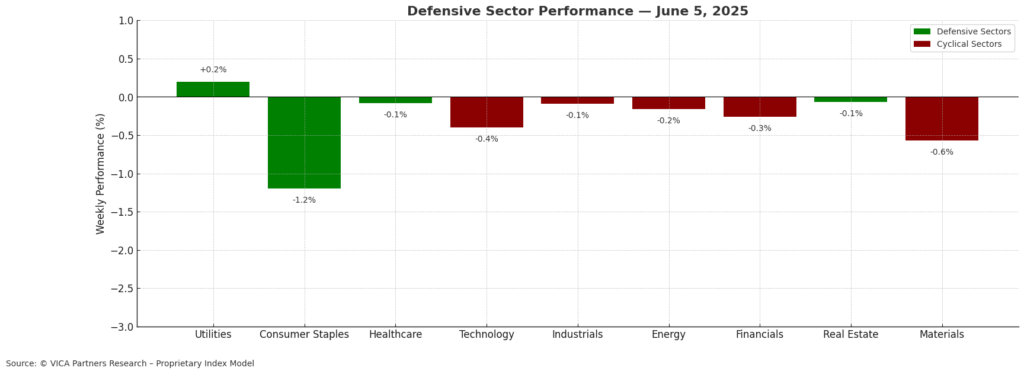

Defensive Sector Rotation — Equity Preference

Defensive sectors continue to hold relative strength, but leadership rotation is beginning. Utilities and Staples remain modestly favored.

Key Insight: Rotation is real — but not fully committed. Sector positioning remains cautious.

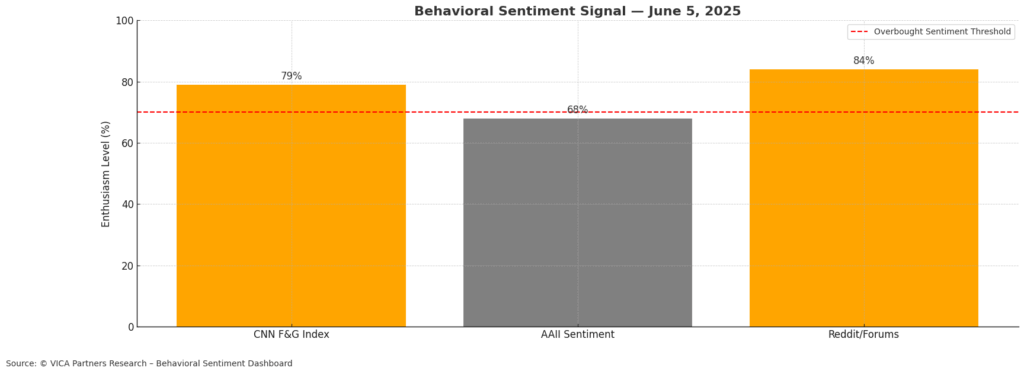

Investor Sentiment Caution Note

Retail sentiment has moved further toward greed territory. Social chatter and positioning suggest an emotional disconnect from institutional caution.

Key Insight: Emotional sentiment is elevated — a contrarian flag for disciplined capital.

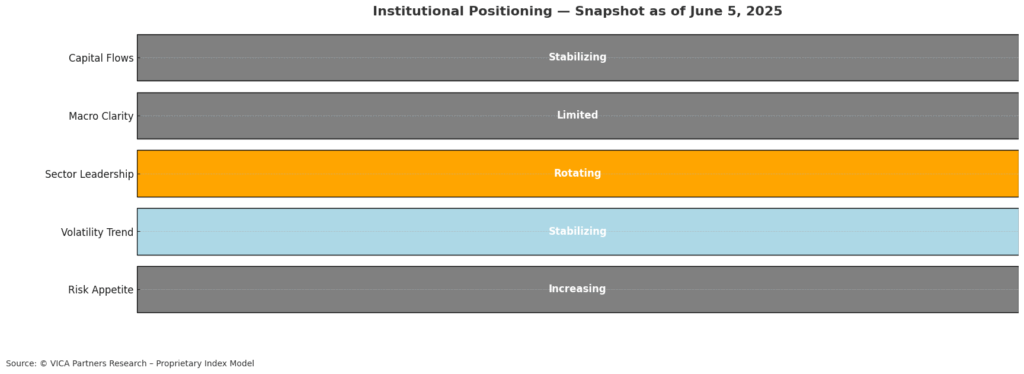

Institutional Positioning Snapshot

Positioning Overview – June 5, 2025

Risk Appetite: Increasing

Volatility Trend: Stabilizing

Sector Leadership: Shifting

Macro Clarity: Improving

Capital Flows: Selective

Key Insight: Risk-on postures are emerging selectively — conviction hinges on follow-through.

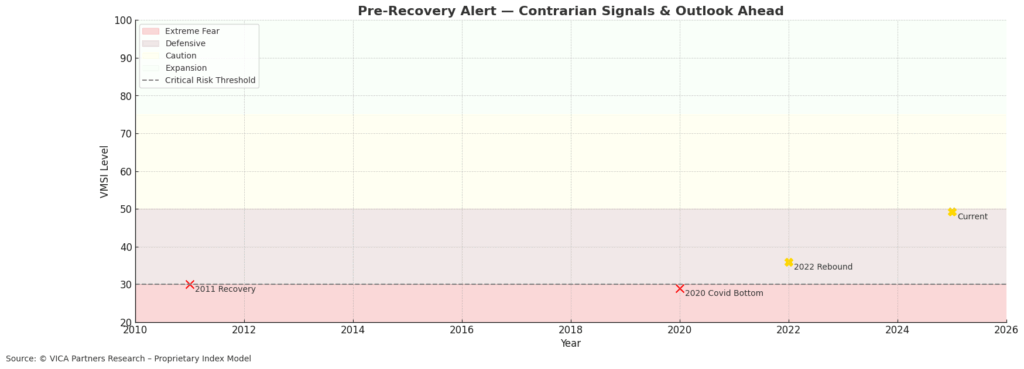

Pre-Recovery Alert — Historical Recovery Zones

VMSI at 52.7 has breached prior pre-recovery thresholds. Past cycles (2011, 2020) suggest this zone precedes allocation waves.

Key Insight: Historical patterns support a potential pivot — sustained confirmation is still needed.

About the VICA Market Sentiment Index (VMSI)©

The VMSI is VICA Research’s proprietary sentiment gauge designed to track shifts in institutional risk behavior, capital flow posture, and macro-driven volatility signals.

Each weekly score reflects a multi-factor model that blends market structure, flow dynamics, defensive rotation, and volatility hedging — calibrated against technical and behavioral thresholds.

Index Scale:

🟥 0–25: Critical Risk Zone

🟧 26–49: Defensive

🟨 50–74: Cautionary Optimism

🟩 75–100: Expansion / High Confidence

VMSI is published weekly following Thursday’s market close unless otherwise noted.

Disclaimer

This report and the proprietary VICA Market Sentiment Index (VMSI)© are confidential works of authorship protected by intellectual property laws. Unauthorized reproduction, copying, redistribution, or use without express permission from VICA Research is strictly prohibited and monitored.

A portion of future VMSI-related proceeds will support global literacy, vocational education, and the advancement of scholars in critical fields like engineering — with a commitment to measurable impact and long-term social return.