Why modern markets require a structural model — and what VMSI adds that traditional analysis cannot

VICA Partners | Institutional Market Structure Research

Abstract

The Capital Asset Pricing Model (CAPM) remains foundational to modern finance. It provides a disciplined framework for evaluating whether an asset’s expected return compensates investors for exposure to systematic market risk. What it does not explain — and was never designed to explain — is why prices in modern, index-embedded mega-cap equities often remain remarkably stable despite extreme disagreement among analysts, persistent valuation debates, and repeated macro shocks.

This gap has become consequential.

Over the last decade, capital markets have evolved into systems dominated by passive ownership, benchmark-constrained flows, and capital concentration at a scale not contemplated when CAPM was formalized. In this environment, prices increasingly reflect structural stability rather than marginal opinion. Risk may be debated; regimes may not be.

This paper introduces the VICA Market Sentiment Index (VMSI) as a next-generation structural extension to CAPM — not a replacement — designed to explain why prices hold, when they stop holding, and how regime stability can be measured without forecasting price targets. NVIDIA (NVDA) is used strictly as a conceptual illustration of a broader class of mega-cap, index-embedded assets.

CAPM’s Enduring Role — and Its Modern Limit

CAPM answers a specific and narrow question: what return is required to compensate an investor for exposure to market risk? It does so elegantly, using beta as a proxy for sensitivity to the market portfolio.

This logic remains valid. It remains necessary. It is also incomplete.

CAPM is silent on several features that now dominate price behavior in large-capitalization markets:

-

The concentration of ownership within passive vehicles

-

The persistence of benchmark-anchored flows

-

The role of liquidity as a stabilizing force rather than a return driver

-

The distinction between event risk and regime fragility

As a result, CAPM can correctly identify whether risk is compensated while offering no insight into whether the price regime itself is stable. This distinction matters when prices remain anchored even as forecasts scatter.

Why Forecasts Diverge While Prices Do Not

Analyst dispersion in mega-cap equities has widened materially over time. Forward price targets routinely span outcomes that imply vastly different economic futures. Yet prices often move within comparatively narrow bands for extended periods.

This is not irrationality. It is structure.

In index-embedded assets, price formation is dominated not by marginal valuation disagreement, but by embedded capital inertia — the accumulated weight of ownership, liquidity, and benchmark dependency that resists rapid regime change unless acted upon by sufficient external force.

CAPM cannot express this. VMSI is designed to.

Relevance to Mega-Cap and Index-Embedded Assets

Mega-cap equities function less like isolated securities and more like structural components of the market system itself. Their prices are influenced by:

-

Embedded capital mass

-

Flow persistence

-

Liquidity density

-

Cross-asset hedging behavior

These forces compress outcome space even when opinions diverge.

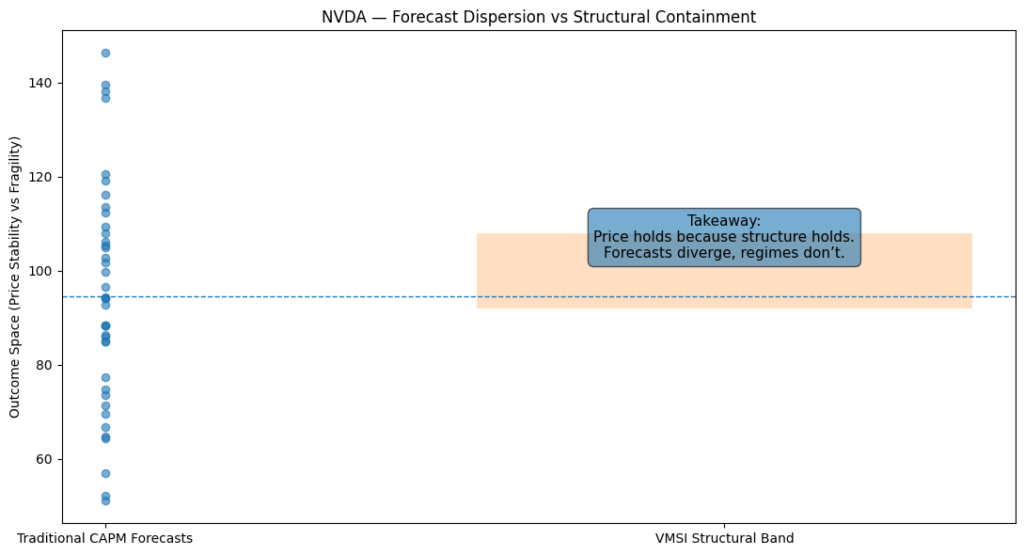

Traditional CAPM-based forecasts exhibit wide dispersion in implied forward outcomes for a mega-cap, index-embedded stock. VMSI models structural containment, producing compressed outcome bands that explain why prices remain anchored despite disagreement.

Takeaway: Price holds because structure holds. Forecasts diverge; regimes don’t.

This visual is not a forecast. It is a diagnosis.

What VMSI Adds Mathematically

VMSI extends CAPM by introducing state variables that describe the stability of the price regime itself.

Where CAPM evaluates expected return relative to market risk, VMSI evaluates whether accumulated force is sufficient to overcome structural inertia.

Conceptually:

-

Beta measures sensitivity to market movement

-

Structural inertia measures resistance to regime change

VMSI does not attempt to predict price targets. It evaluates containment probability versus regime transition risk — a fundamentally different output.

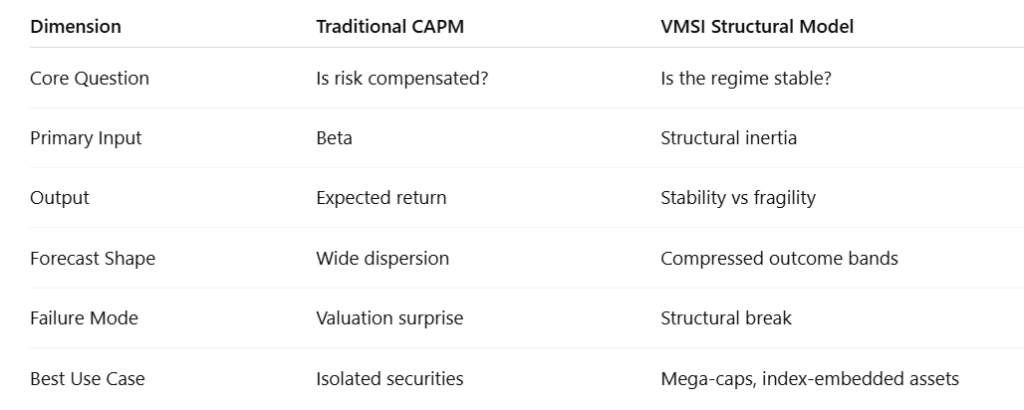

CAPM vs VMSI — Conceptual Comparison

This is why VMSI narrows uncertainty without pretending to predict price.

Why This Matters Now

Modern markets do not break because fundamentals fail. They break when accumulated force overwhelms structural inertia.

This is observable in advance — not through valuation, but through changes in liquidity efficiency, volatility transmission, credit sensitivity, and participation breadth. These are the variables VMSI measures continuously.

In stable regimes, volatility can rise, sentiment can fracture, and narratives can oscillate — while prices remain anchored. In unstable regimes, small shocks propagate disproportionately. CAPM observes neither transition.

Implications for Investors and Policymakers

For allocators, VMSI reframes risk management away from point forecasts and toward regime awareness. For policymakers and regulators, it offers a lens into when markets are absorbing stress versus quietly storing it.

The distinction is not semantic. It is structural.

Conclusion

CAPM remains essential. It explains risk. It does not explain why prices hold.

VMSI does not replace CAPM. It completes it — by modeling the physics of modern capital markets where liquidity, inertia, and regime stability dominate marginal opinion.

This is not a forecasting engine. It is a structural lens.

In markets increasingly governed by concentration rather than dispersion, understanding what keeps prices from breaking is no longer optional. It is the new baseline.

Source: VICA Partners Research © VICA Research — Proprietary Market Intelligence

Disclaimer: This commentary is for informational purposes only and does not constitute investment advice. It reflects market-structure analysis as of publication and should not be relied upon for individual investment decisions.