Liquidity Is the Last Word: Why Markets Refuse to Break

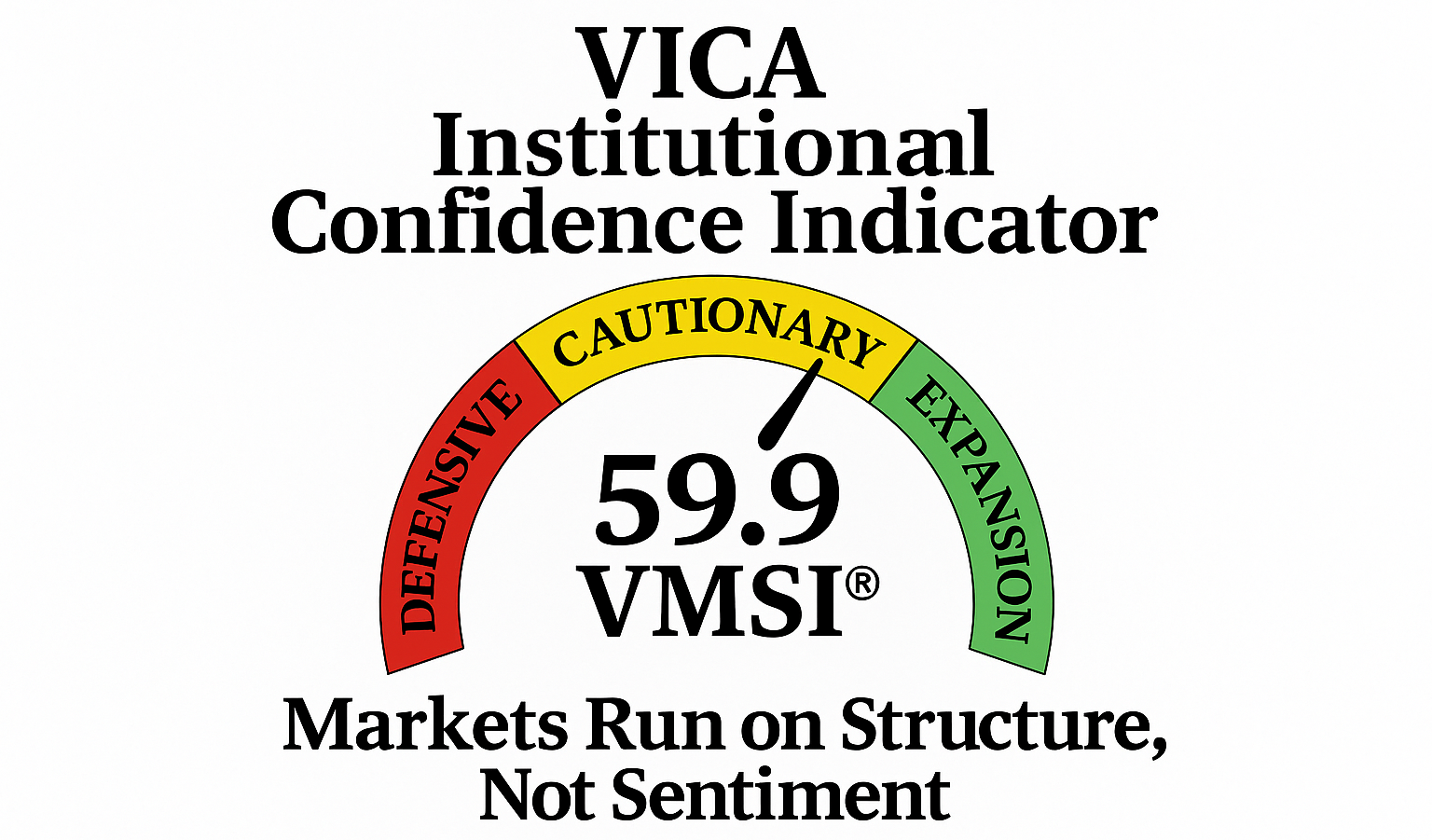

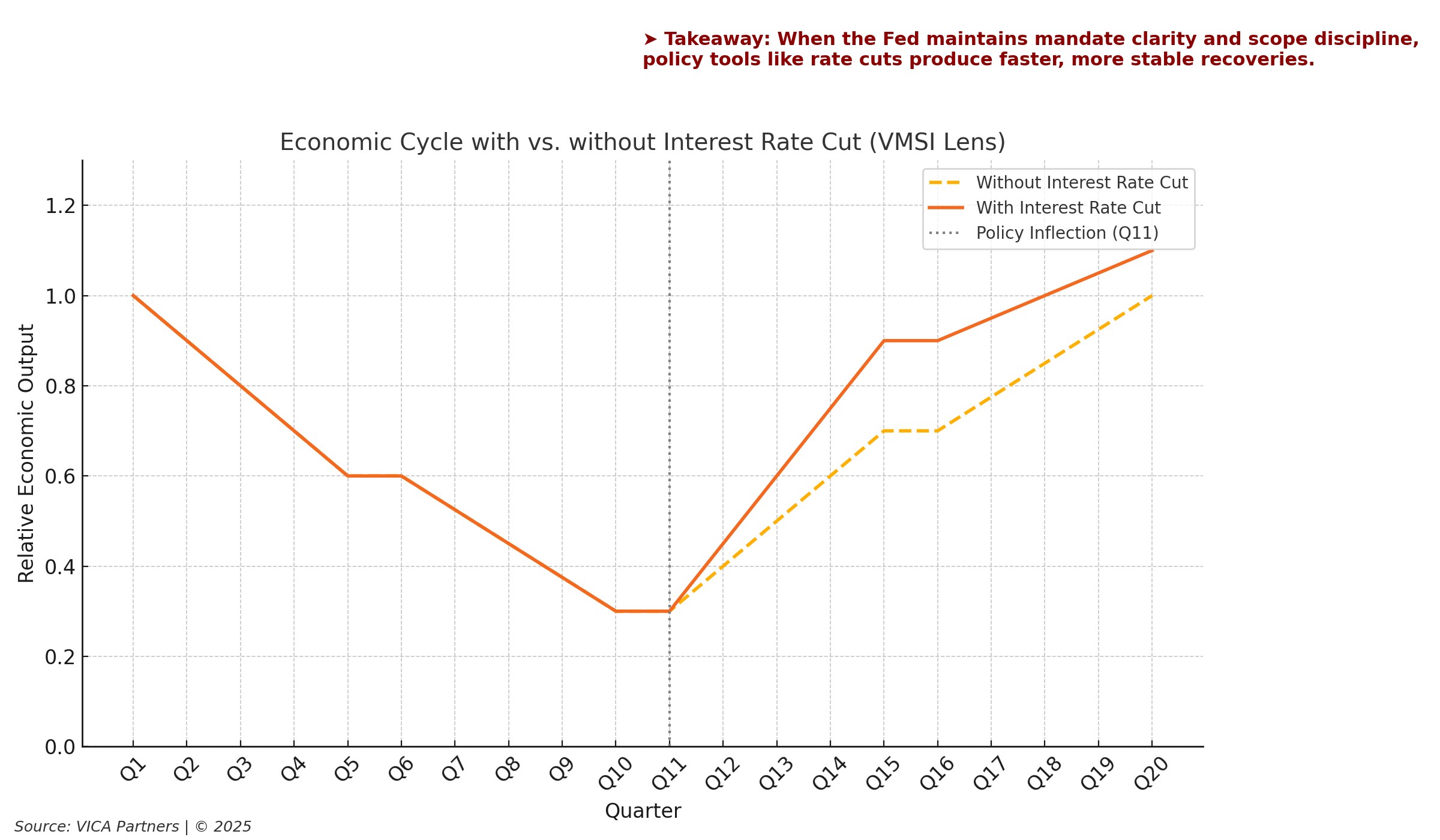

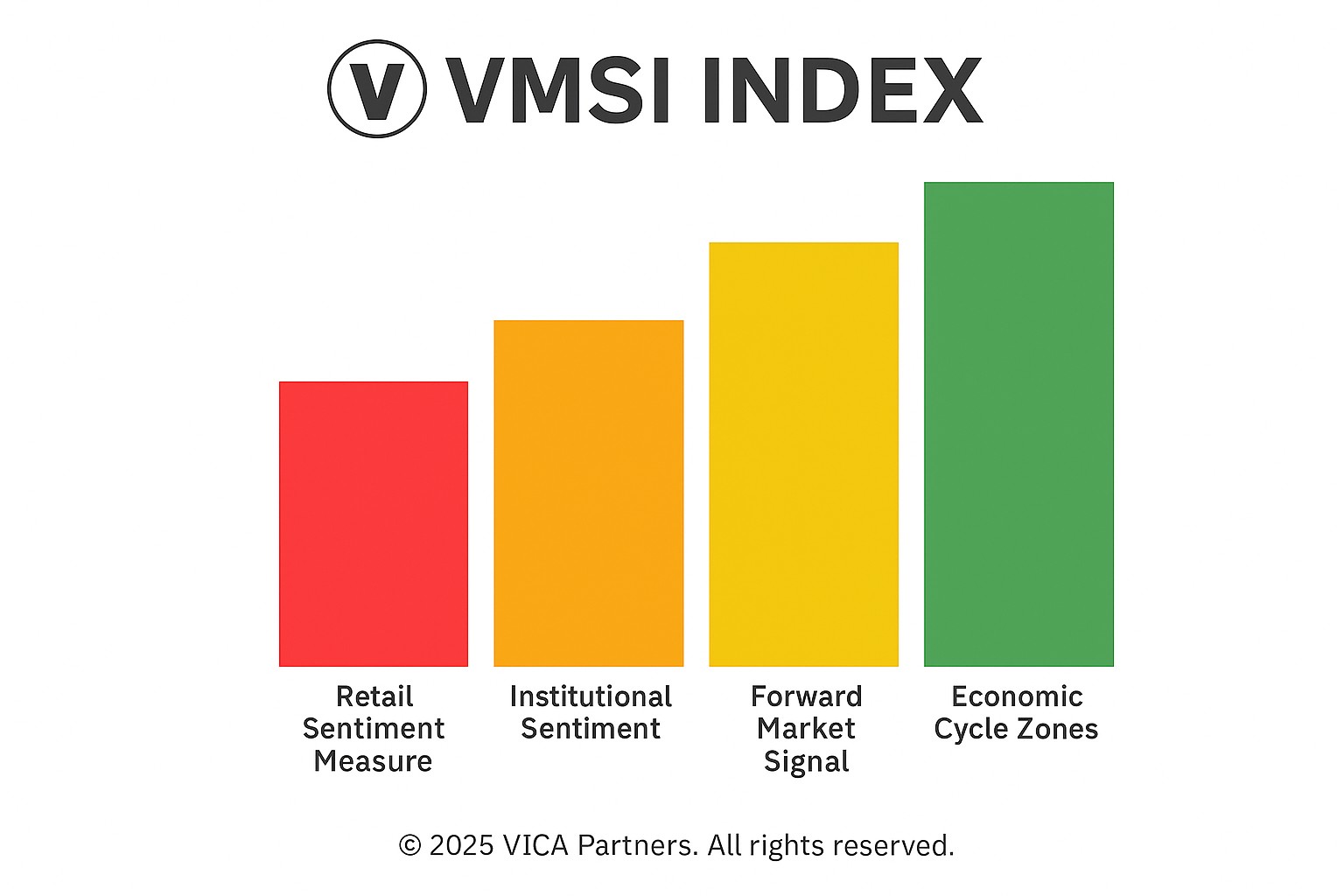

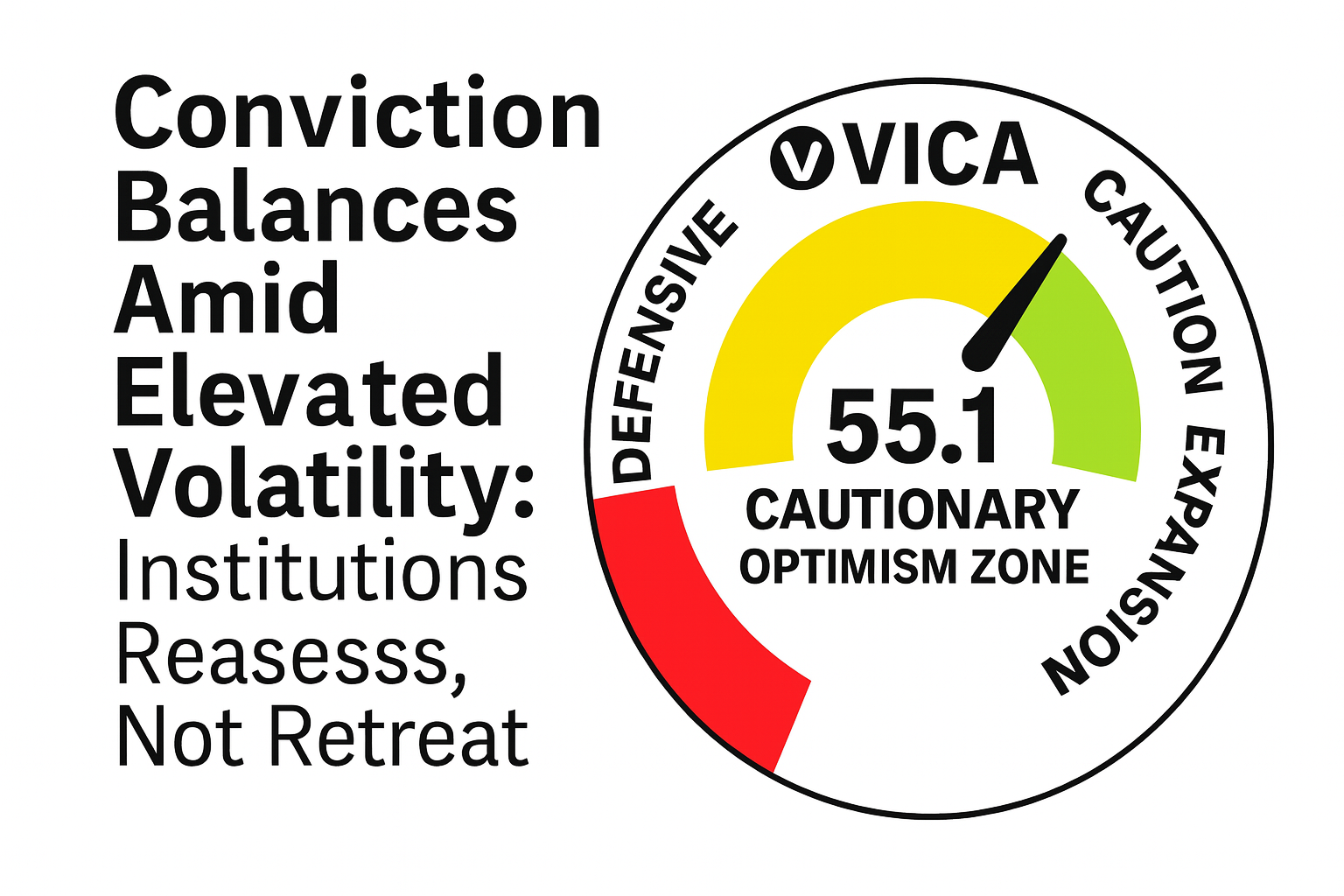

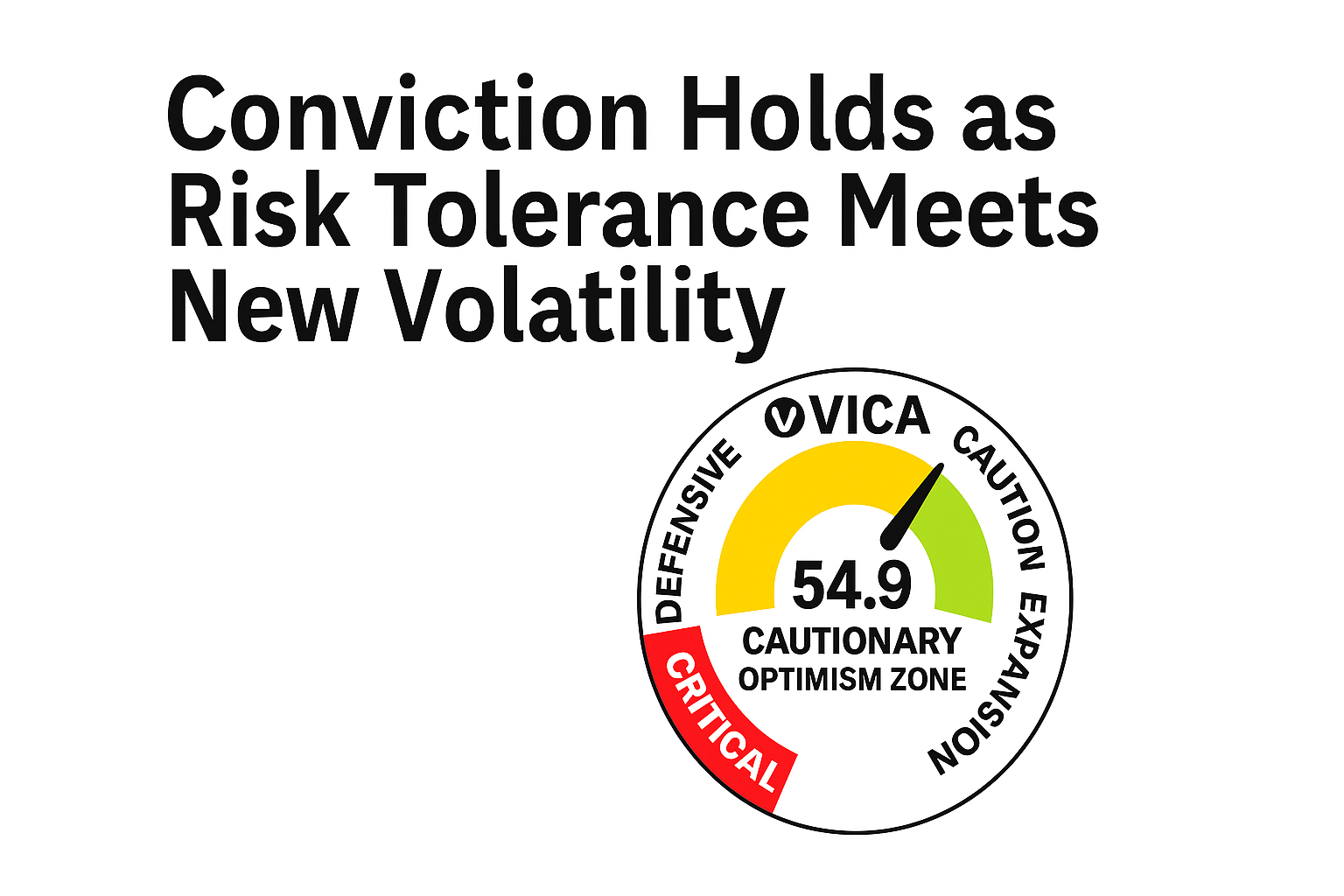

VMSI Institutional Market Intelligence Report – Week Ending September 18, 2025 (Published September 19, 2025) Weekly Summary – Week Ending September 18, 2025 The VMSI composite index ticked higher to 59.9 from 58.9, reinforcing the resilience of structural liquidity in holding the market together. While sector breadth remains mixed and macro signals softened, liquidity depth … Read more