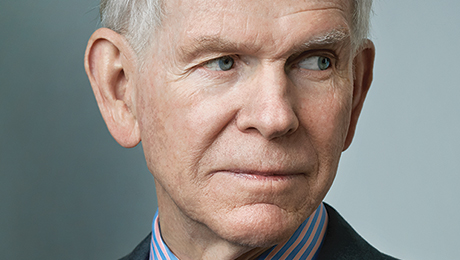

Stocks mixed as megacap earnings continue to weigh on markets

MARKETS TODAY Oct 26 (Vica Partners) – The S&P 500 down 0.21% as of 1.20 p.m. Eastern. The Dow Jones Industrial Average up 125 points, or 0.39%, to 31,962. The tech based Nasdaq down 1.35%. Stock indexes mixed in mid-day trading session, the 10-year Treasury flat with a yield at 4.007%. U.S. Dollar Index (DXY) … Read more