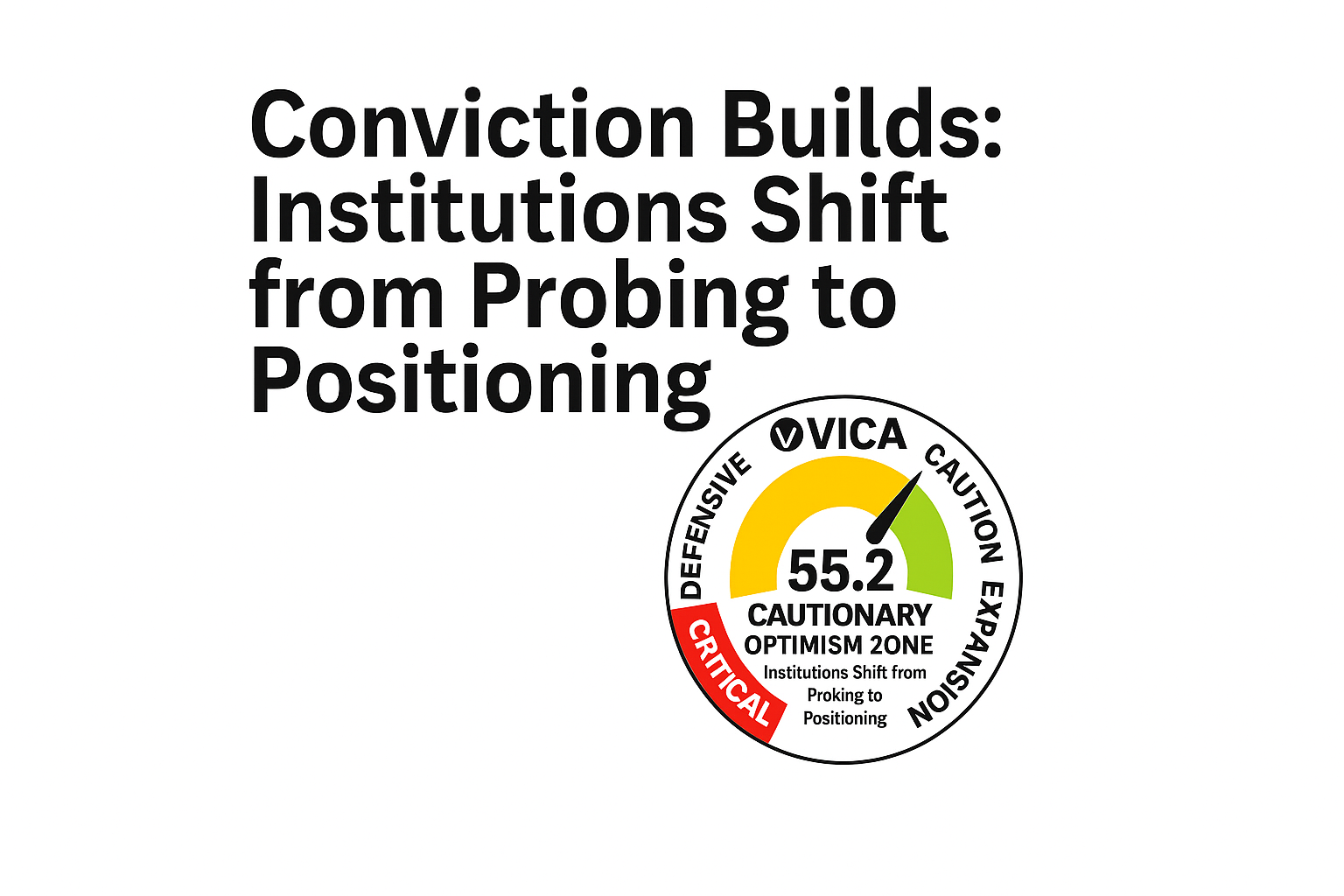

Conviction Builds: Institutions Shift from Probing to Positioning

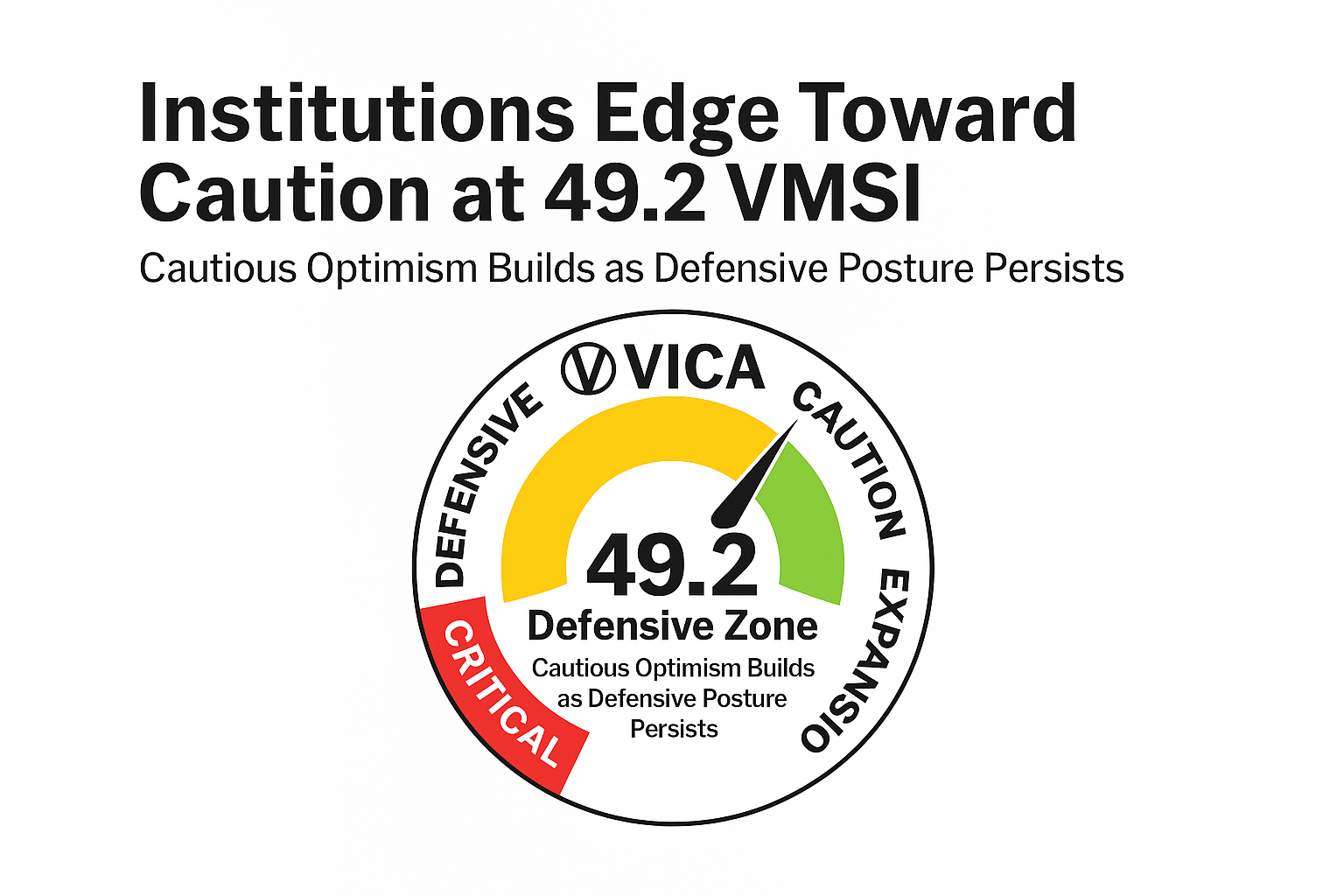

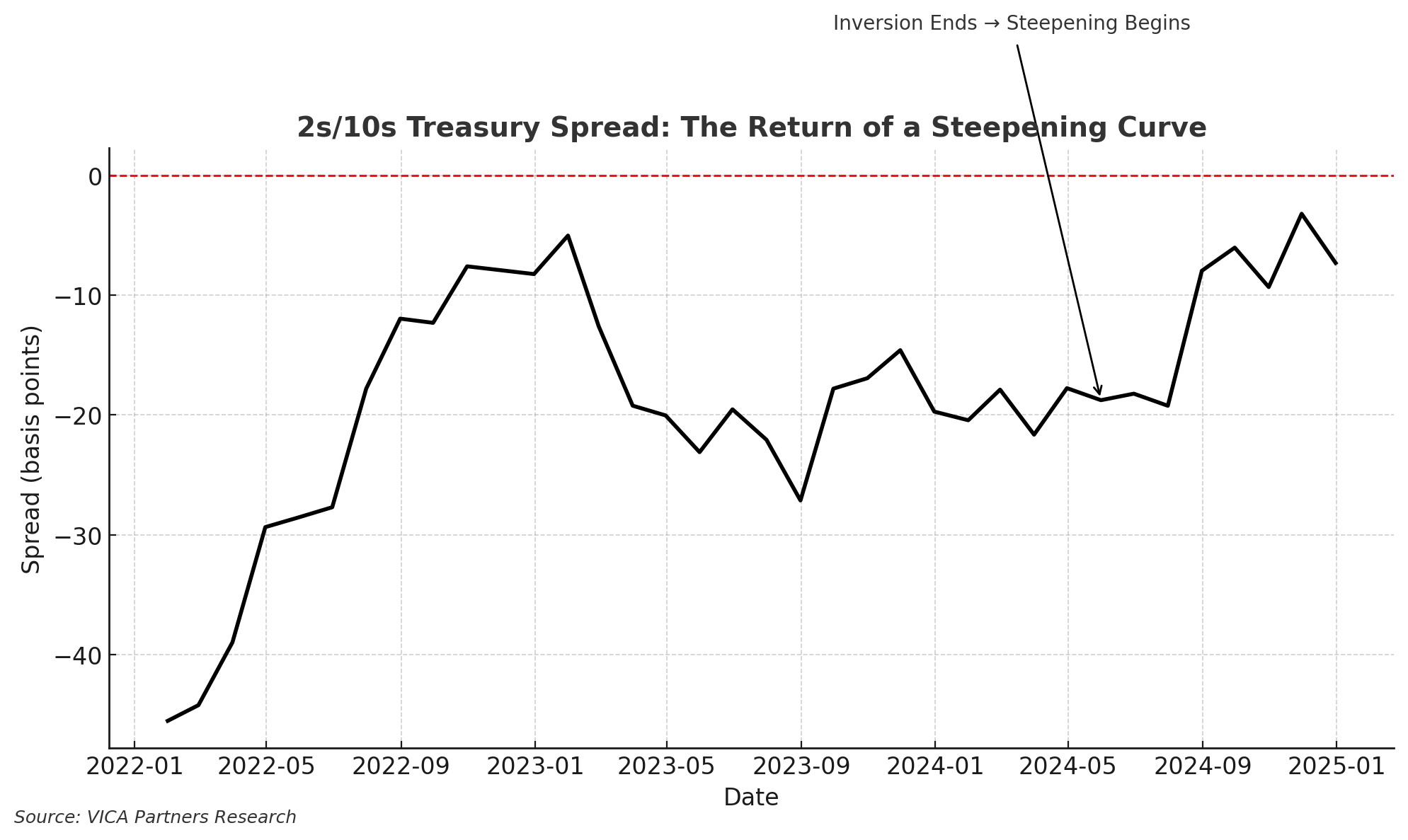

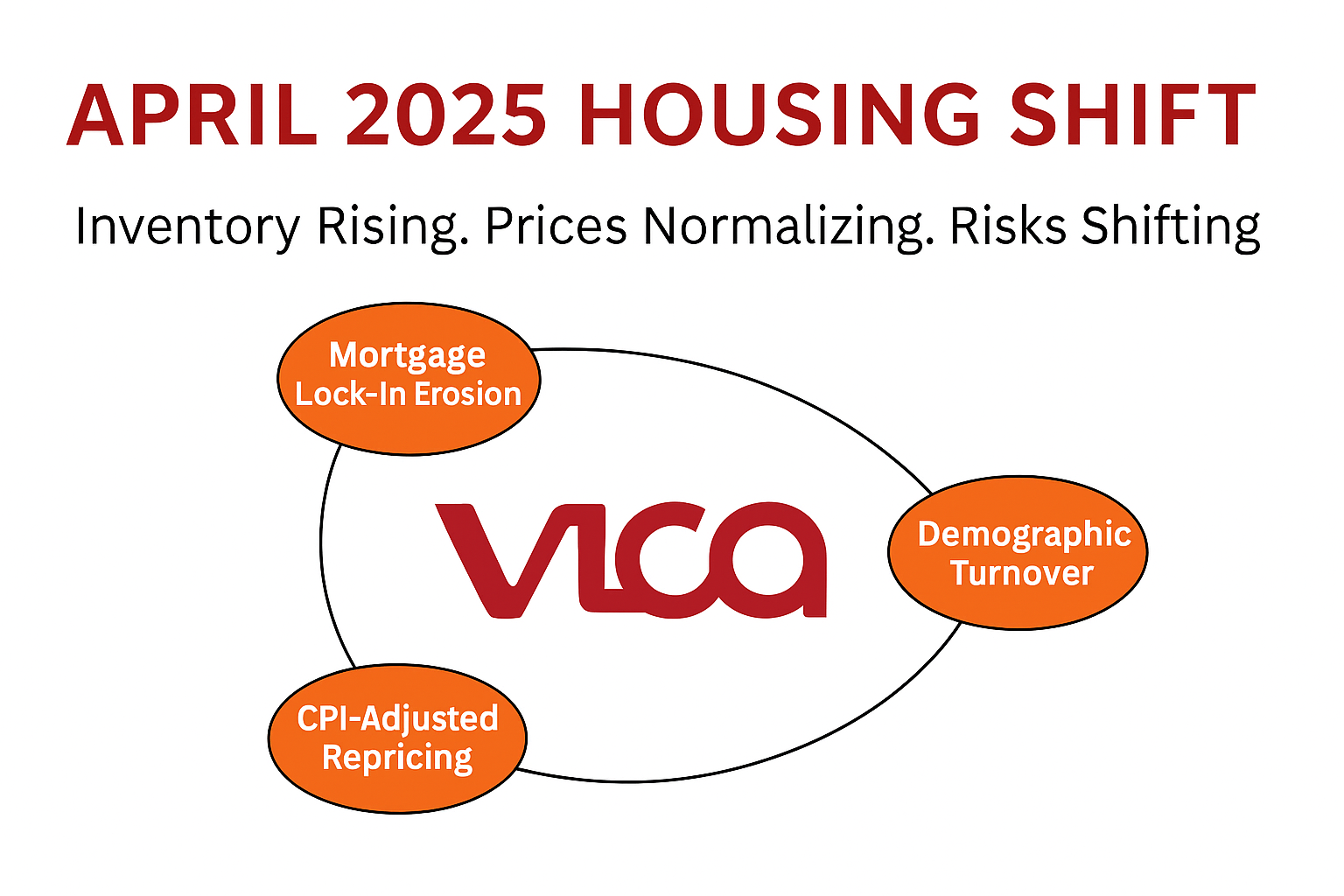

June 12, 2025 | VICA Research — Volatility & Momentum Signal Index VICA Partners Research’s VMSI © tracks how institutional capital is repositioning — delivering signalover sentiment for portfolio decision-makers navigating risk, flow, and macro regime shifts. VMSI Holds at 55.2 as Capital Broadens Re-Risking Footprint Weekly Snapshot Major Index Closes – June 12, … Read more