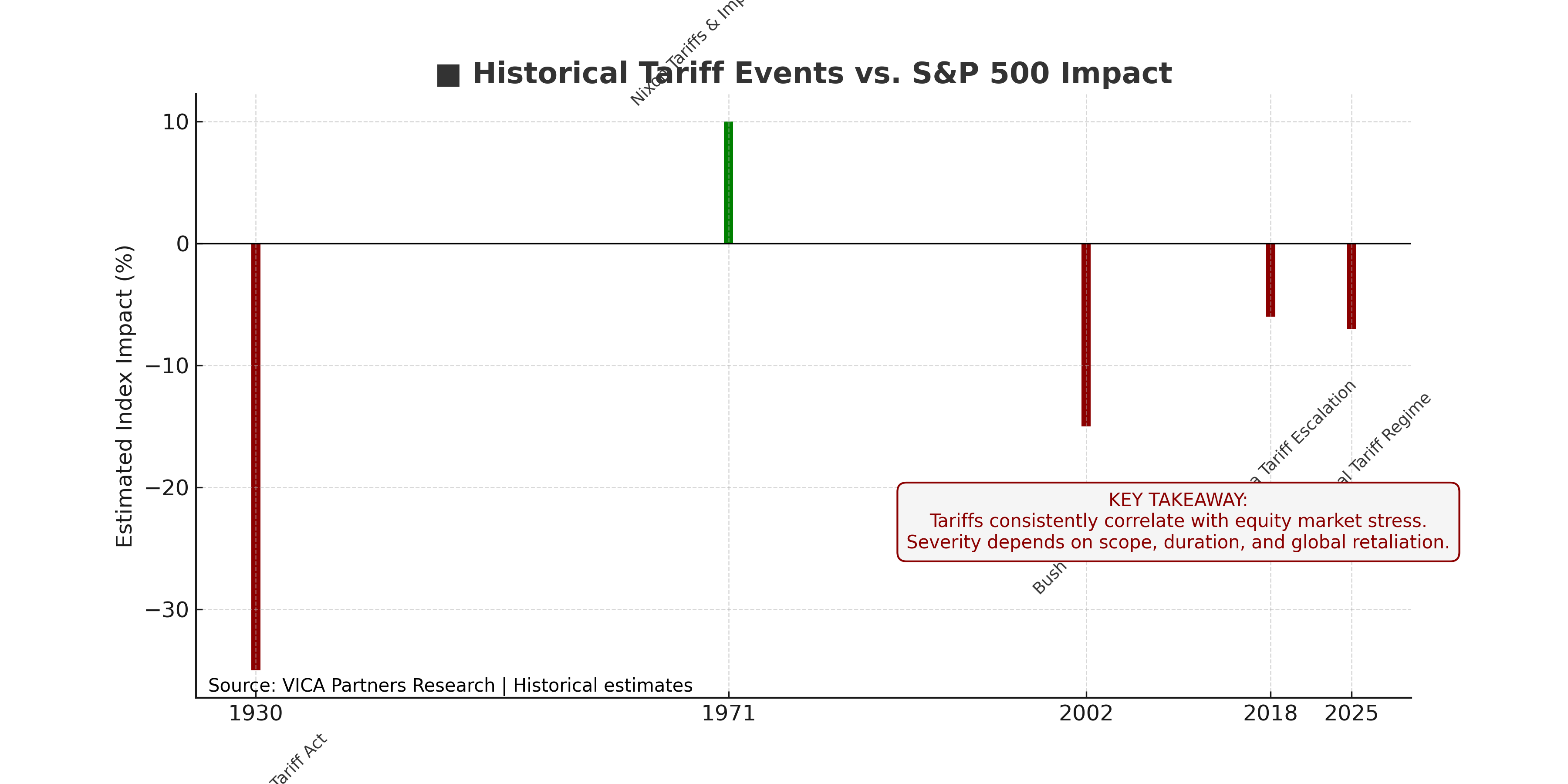

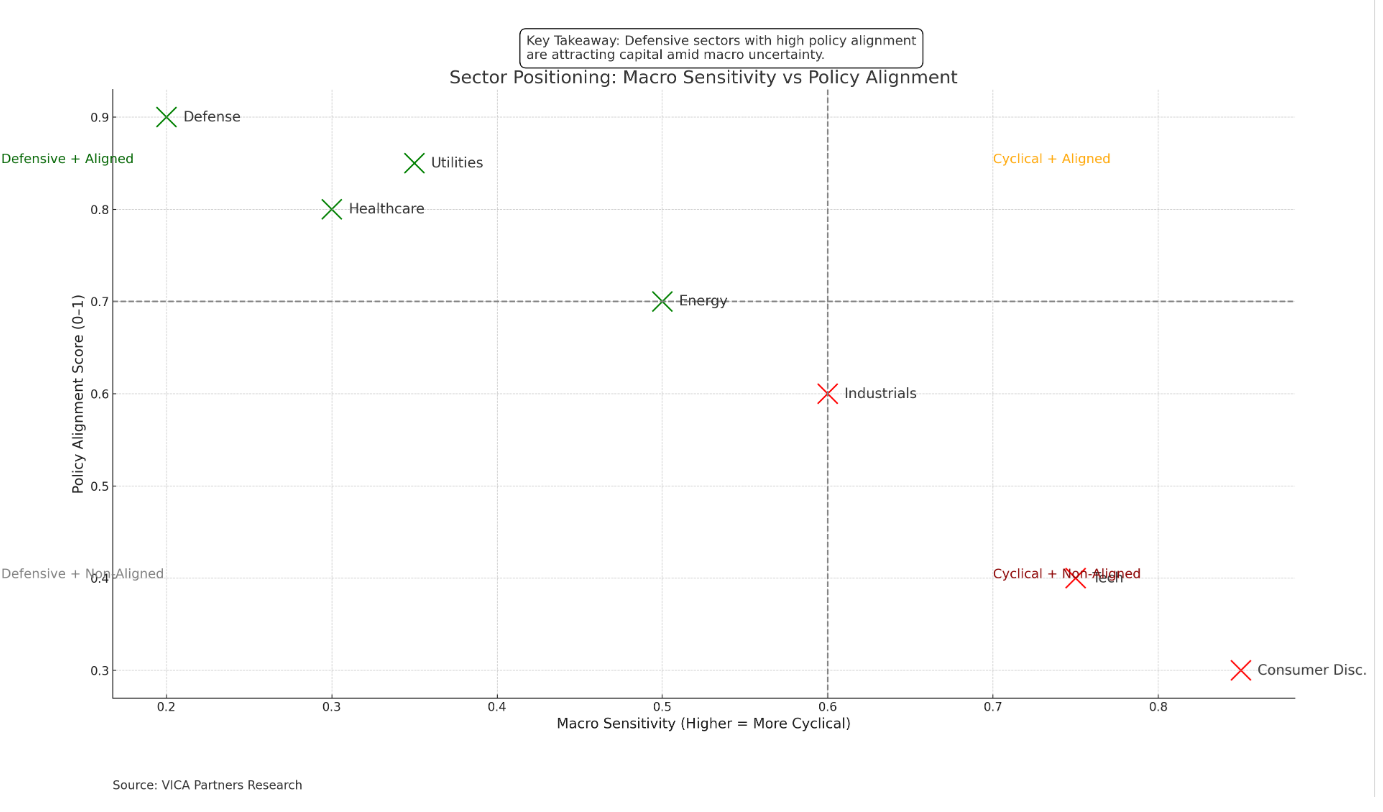

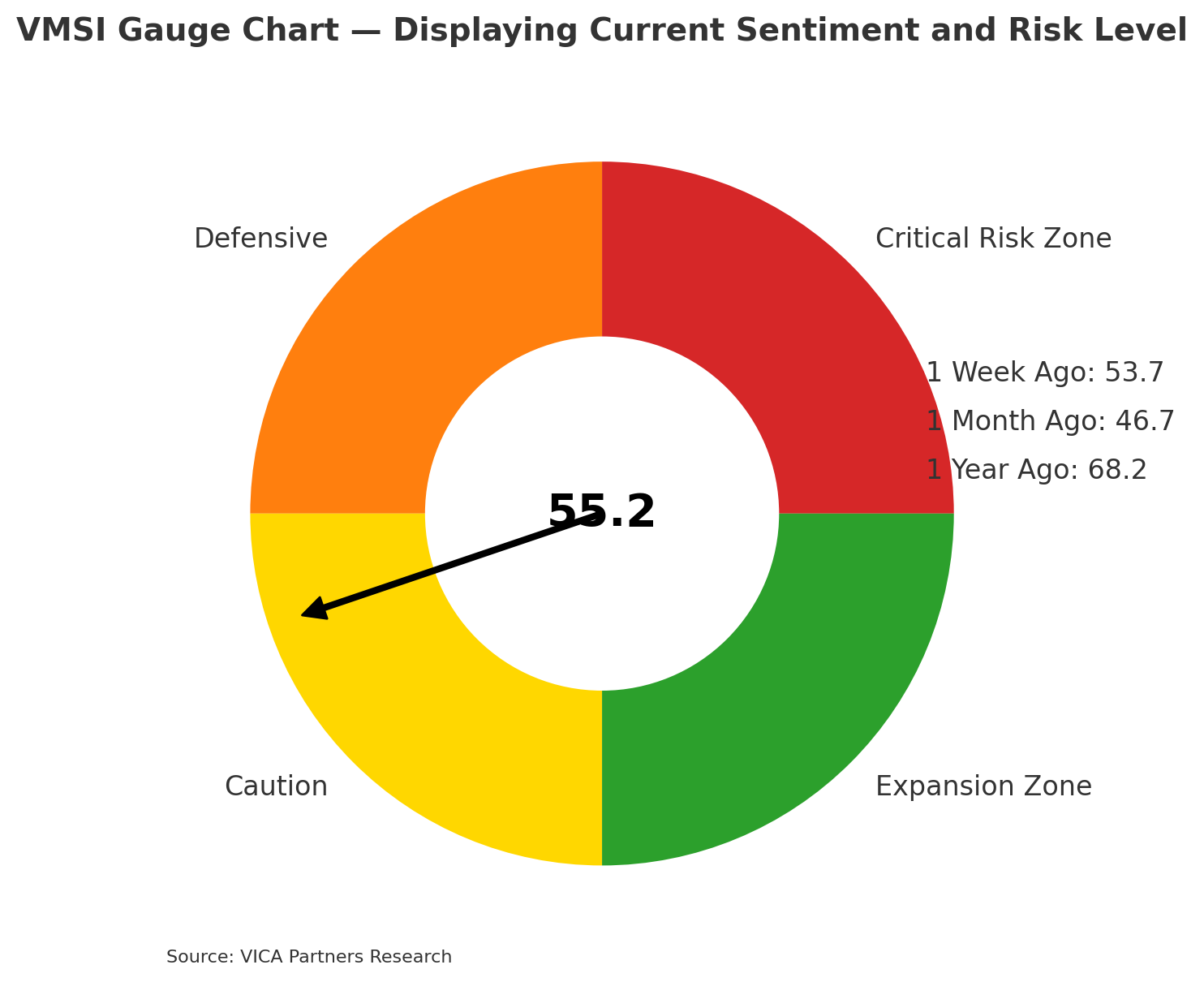

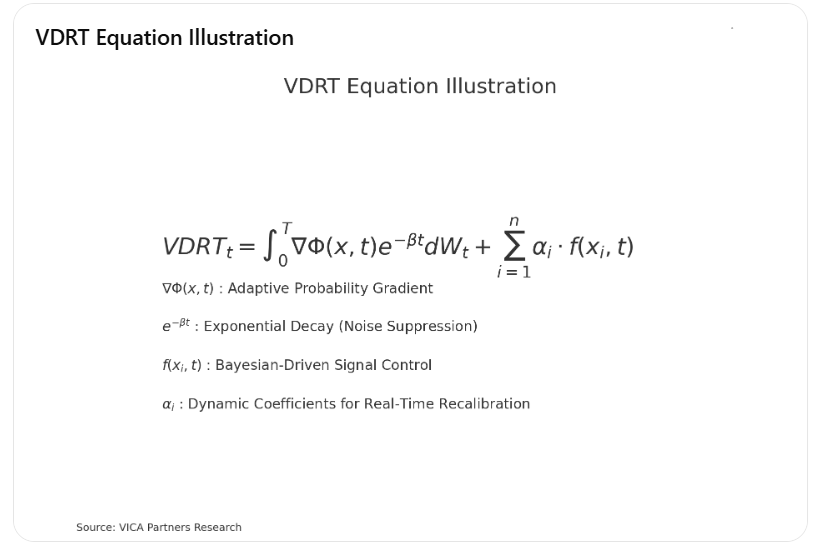

Universal Tariff Shock: The Market’s Structural Repricing Has Begun

VICA Research – April 3, 2025 In this analysis, we break down the real-time market impact of President Trump’s sweeping tariff announcement. With sharp declines across the S&P 500, NASDAQ, and Dow, and technical indicators confirming a structural shift, this piece offers a concise yet comprehensive look at why this isn’t a correction—but a full … Read more