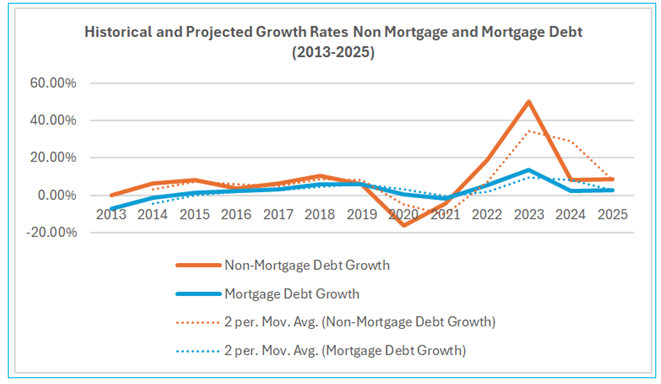

Fed Rate Cuts & Small-Cap ETFs: Key Opportunities for Fall 2024

Stay Informed and Stay Ahead: Guidance, August 21st, 2024 Forecasting Performance Gains for Small-Cap ETFs Amid Fed Rate Cuts Impact of Federal Reserve Rate Cuts on Small-Cap ETFs As the Federal Reserve signals a potential rate cut, small-cap stocks and their associated exchange-traded funds (ETFs) are at a crucial inflection point. Small-cap equities, known for … Read more