The Dollar Is Not in Decline — But Complacency Is the Real Risk

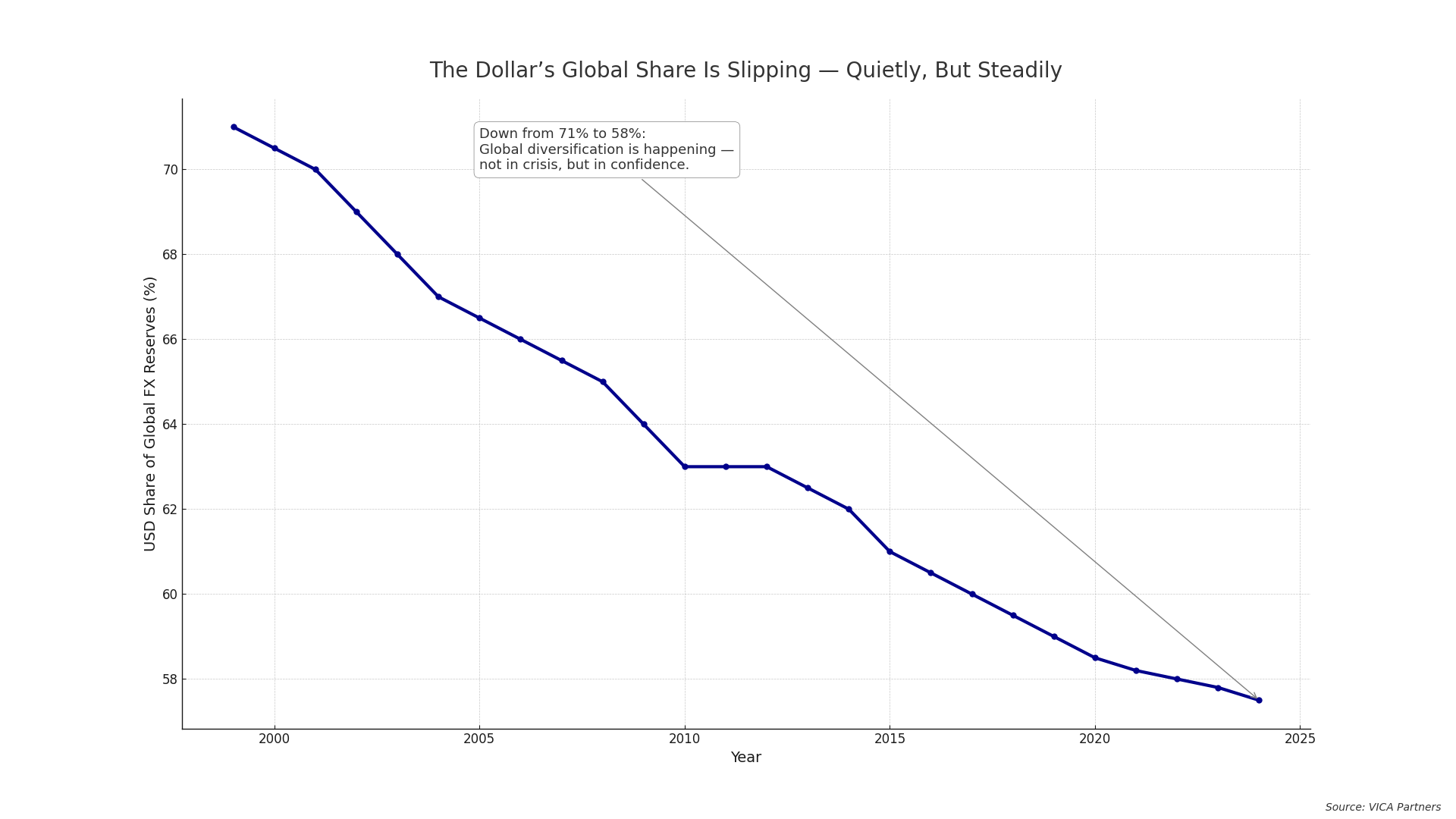

VICA Partners, June 9, 2025 The dollar’s reserve share has slipped from 71% to 58%. This isn’t collapse — it’s erosion. The world diversifies against confidence, not currency. The Familiar Warning — and the Flawed Assumption A familiar argument is making the rounds again: that America’s persistent trade deficits will eventually bring the dollar to … Read more