Technical Update 06-24-2023 DJIA & S&P500

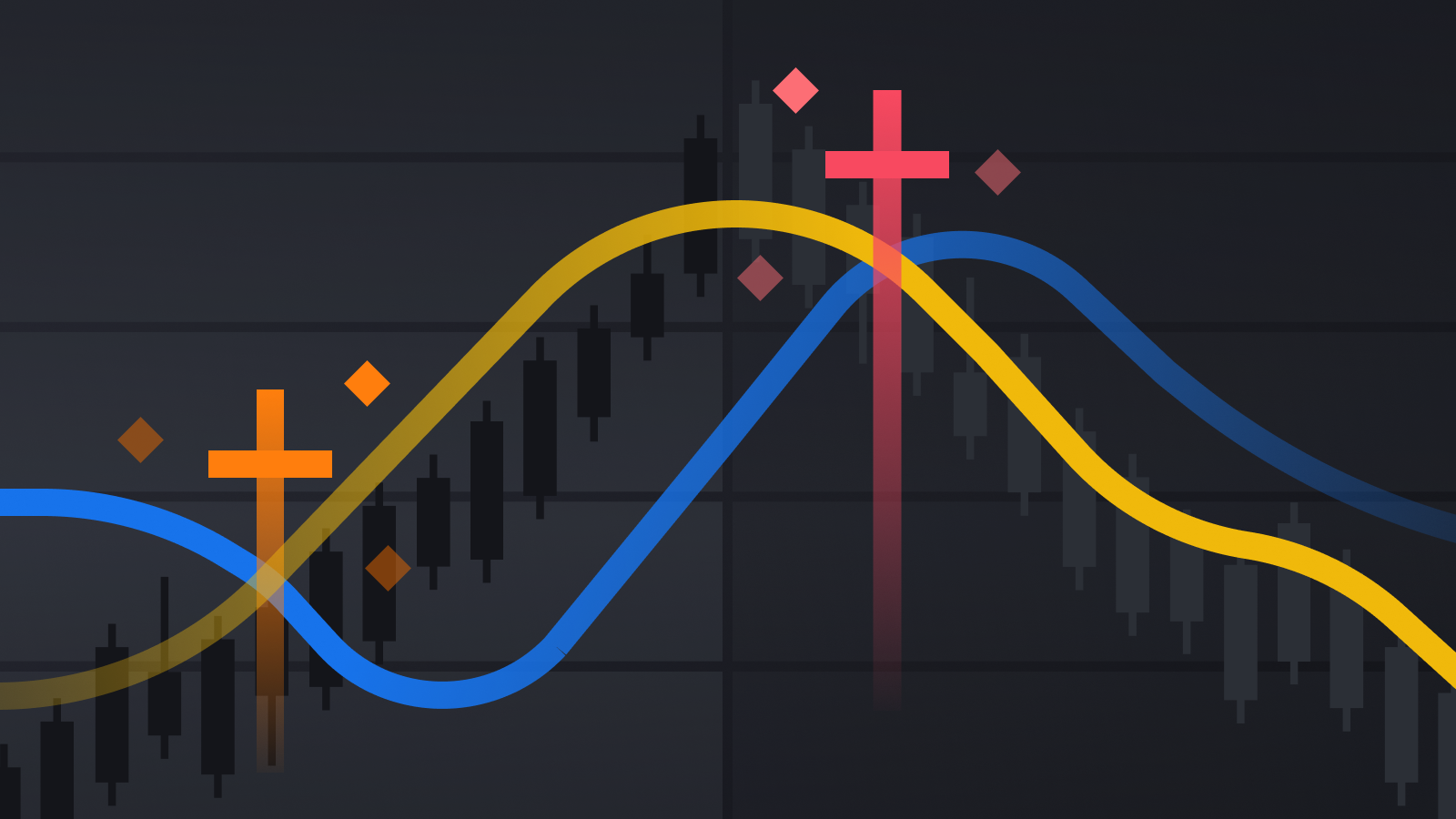

TECHNICAL ANALYSIS Major Indices Week of June 23, 2023 Stocks spent the entire shortened trading week lower and closed near the low end of the weekly ranges. The market is responding to a big shift in sentiment over the past three weeks. Prior to the new 2023 highs for most indices the battle was between … Read more