Continuation Until Credit Breaks

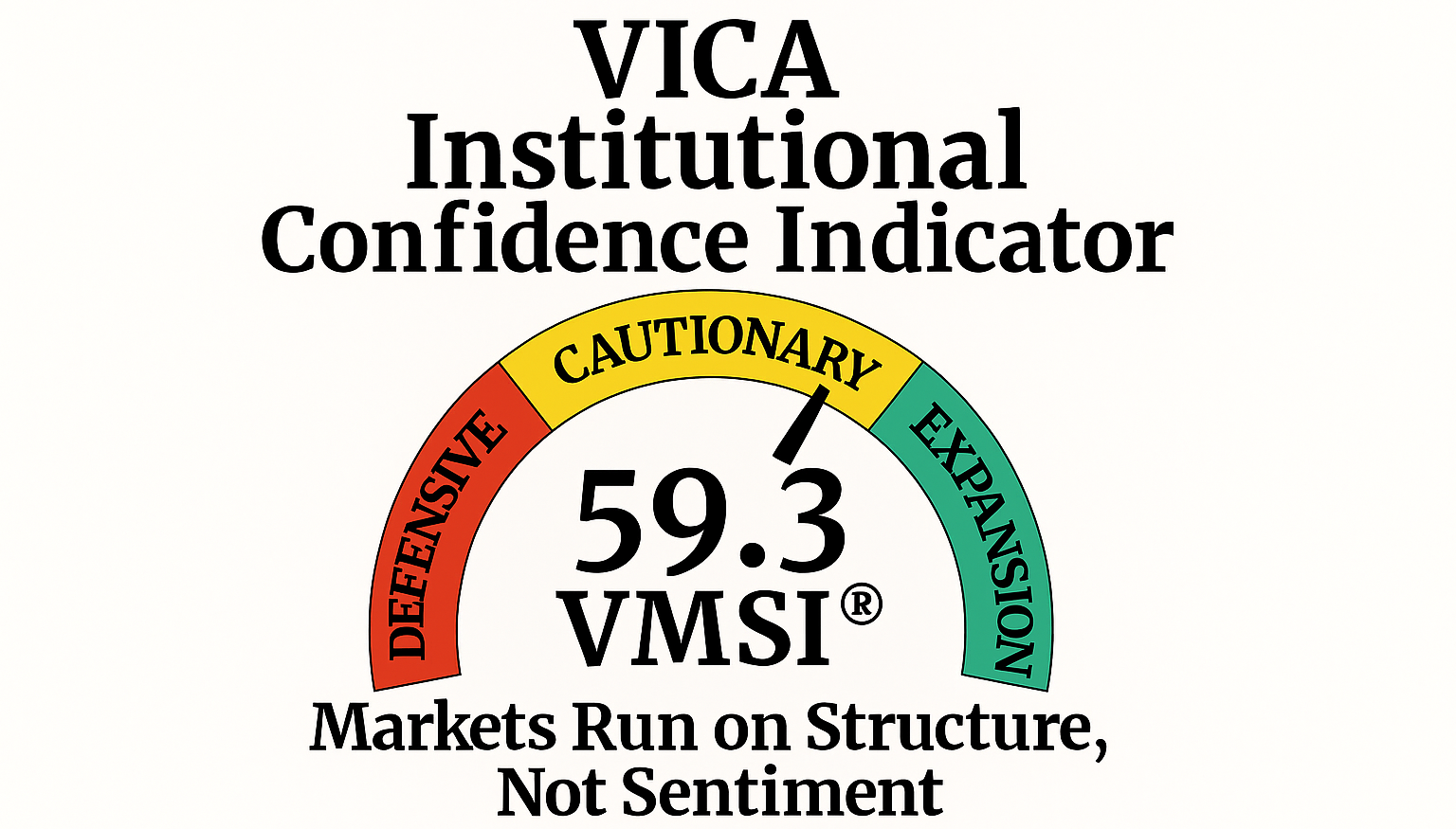

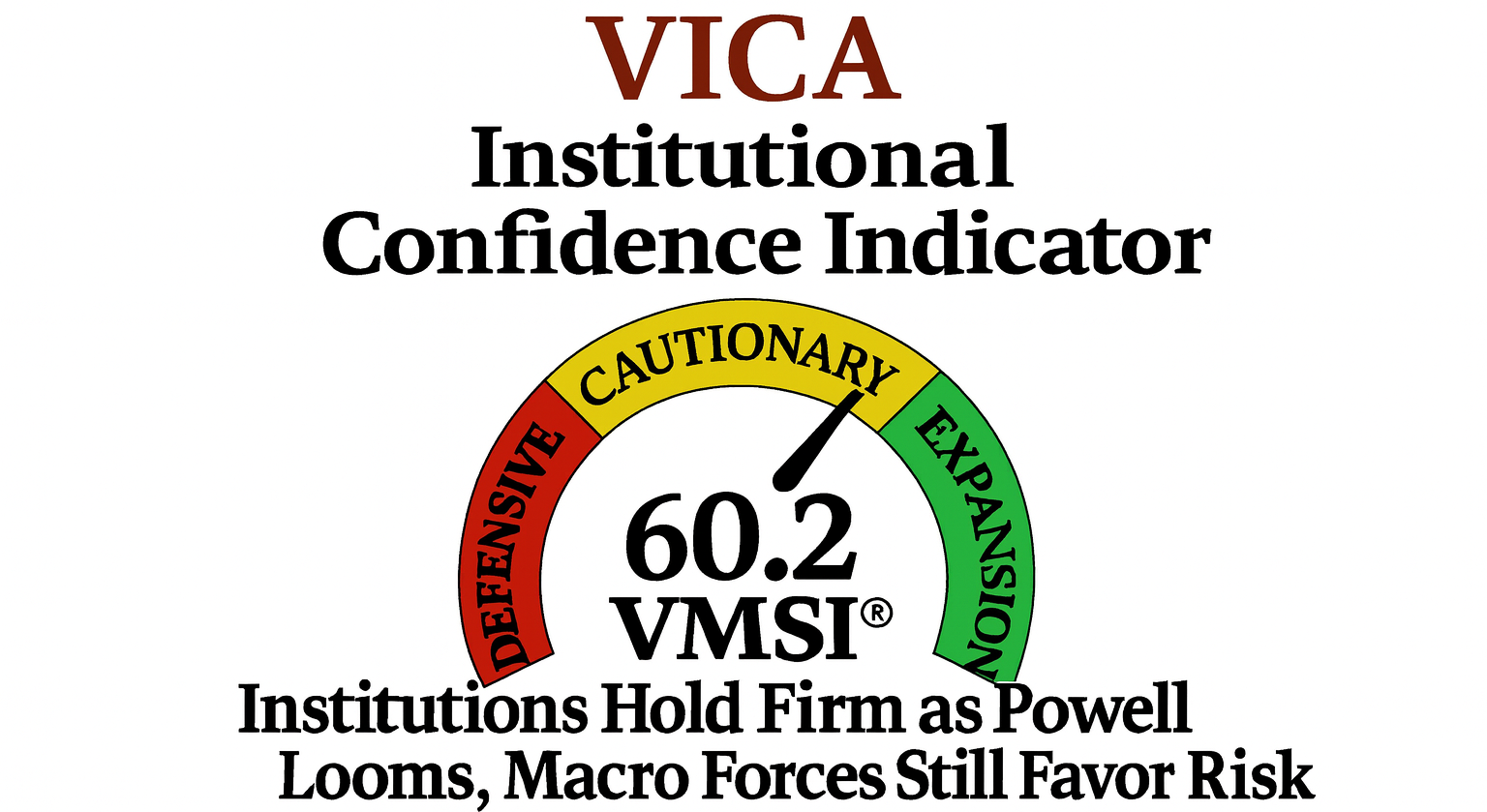

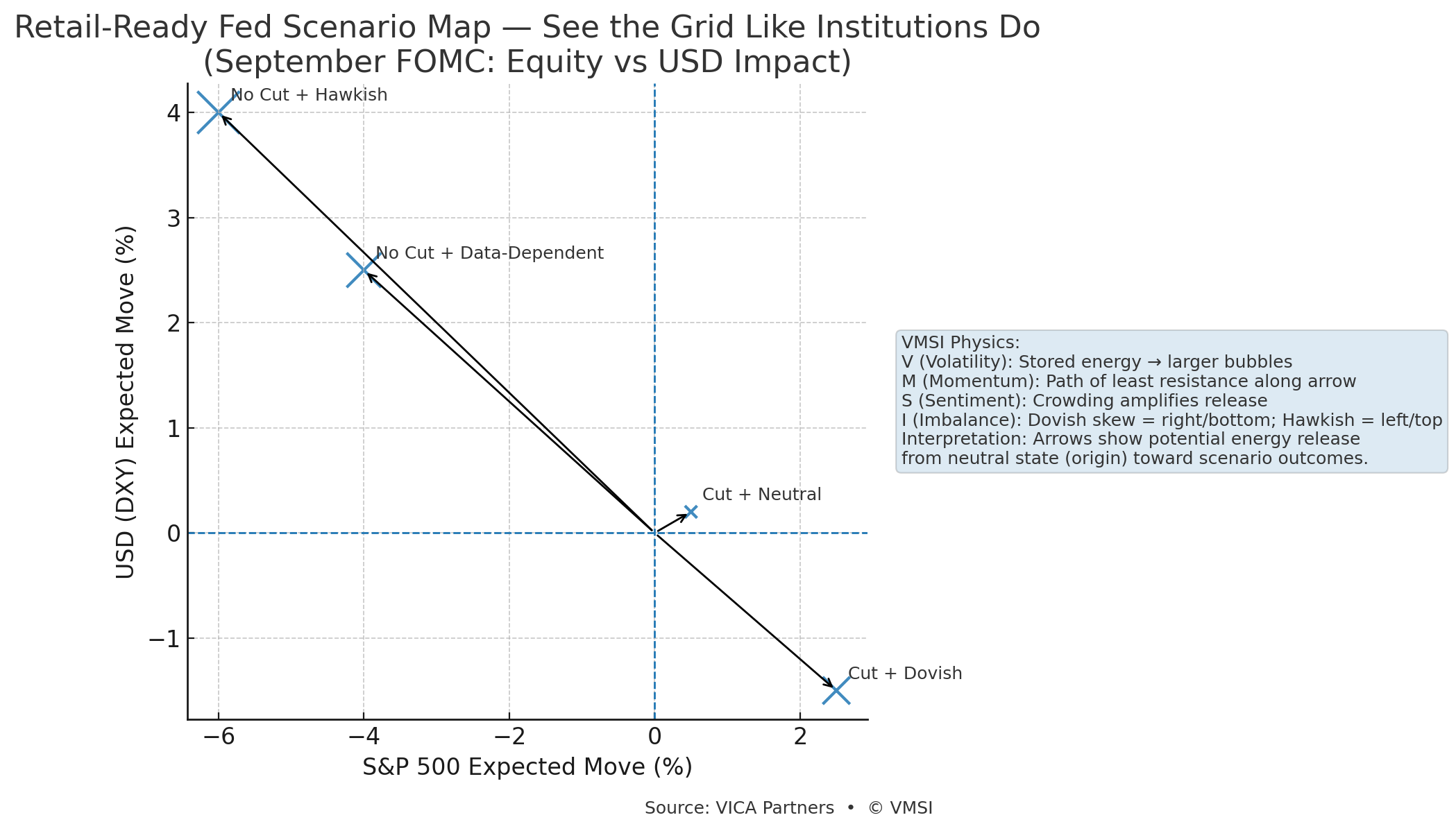

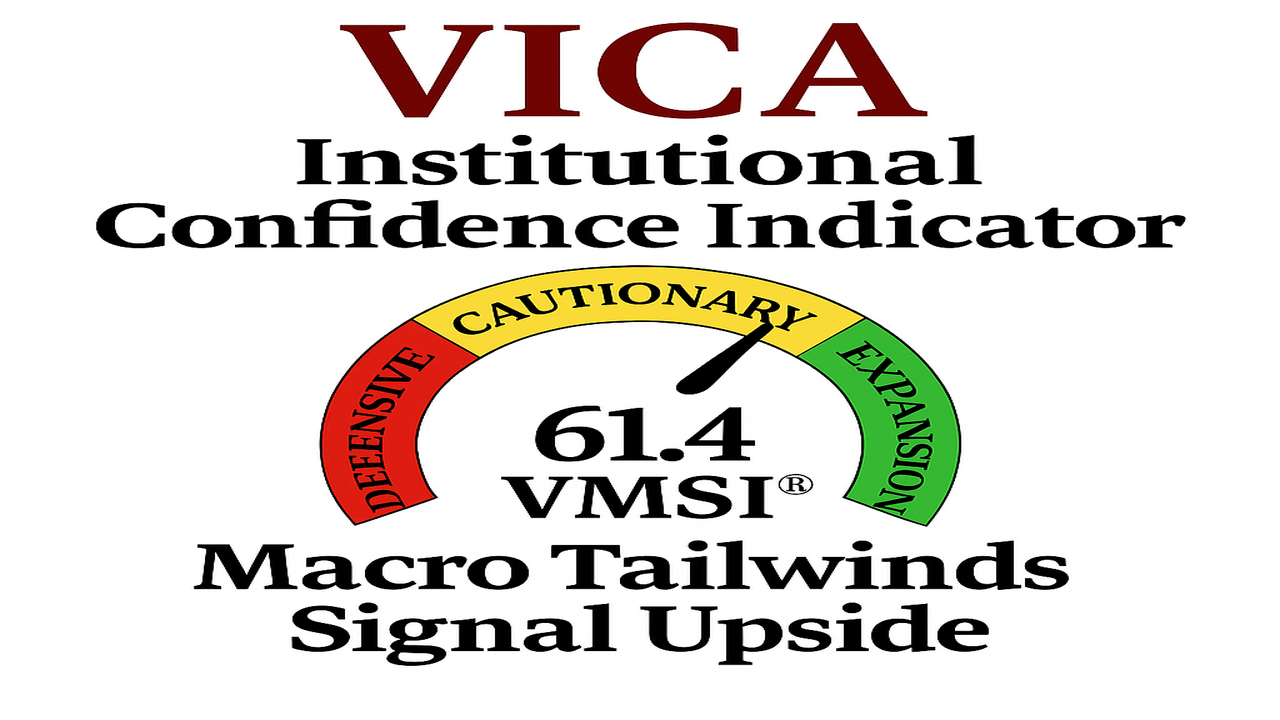

VMSI: Continuation Until Credit Breaks — Credit/CRE now the hinge (59.3) VMSI Institutional Market Intelligence Report – Week Ending October 2, 2025 Weekly Summary – Week Ending October 2, 2025 The VMSI composite index edged up to 59.3 from 59.1, holding firm above the continuation threshold of 58. Liquidity depth and execution capacity remain the … Read more