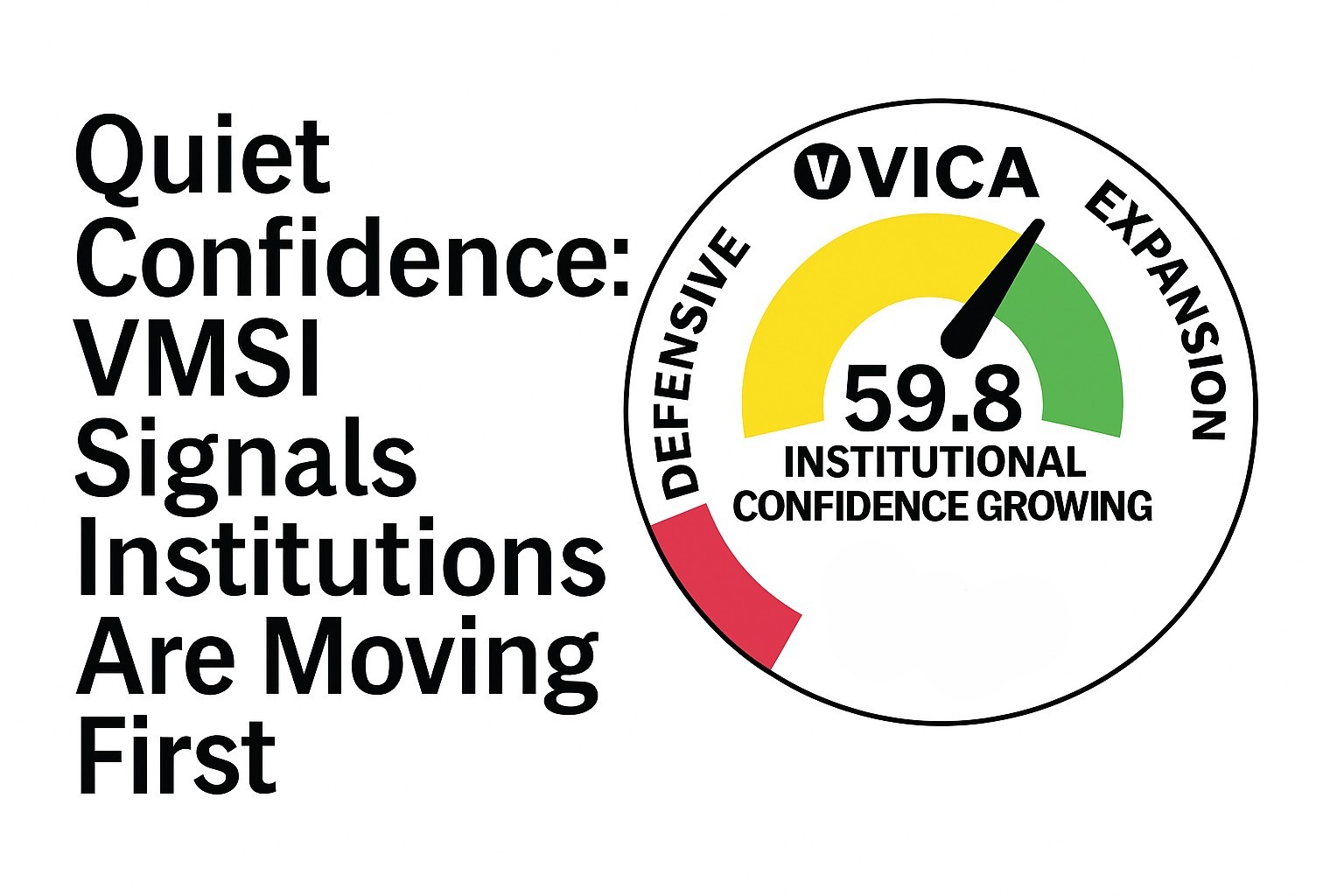

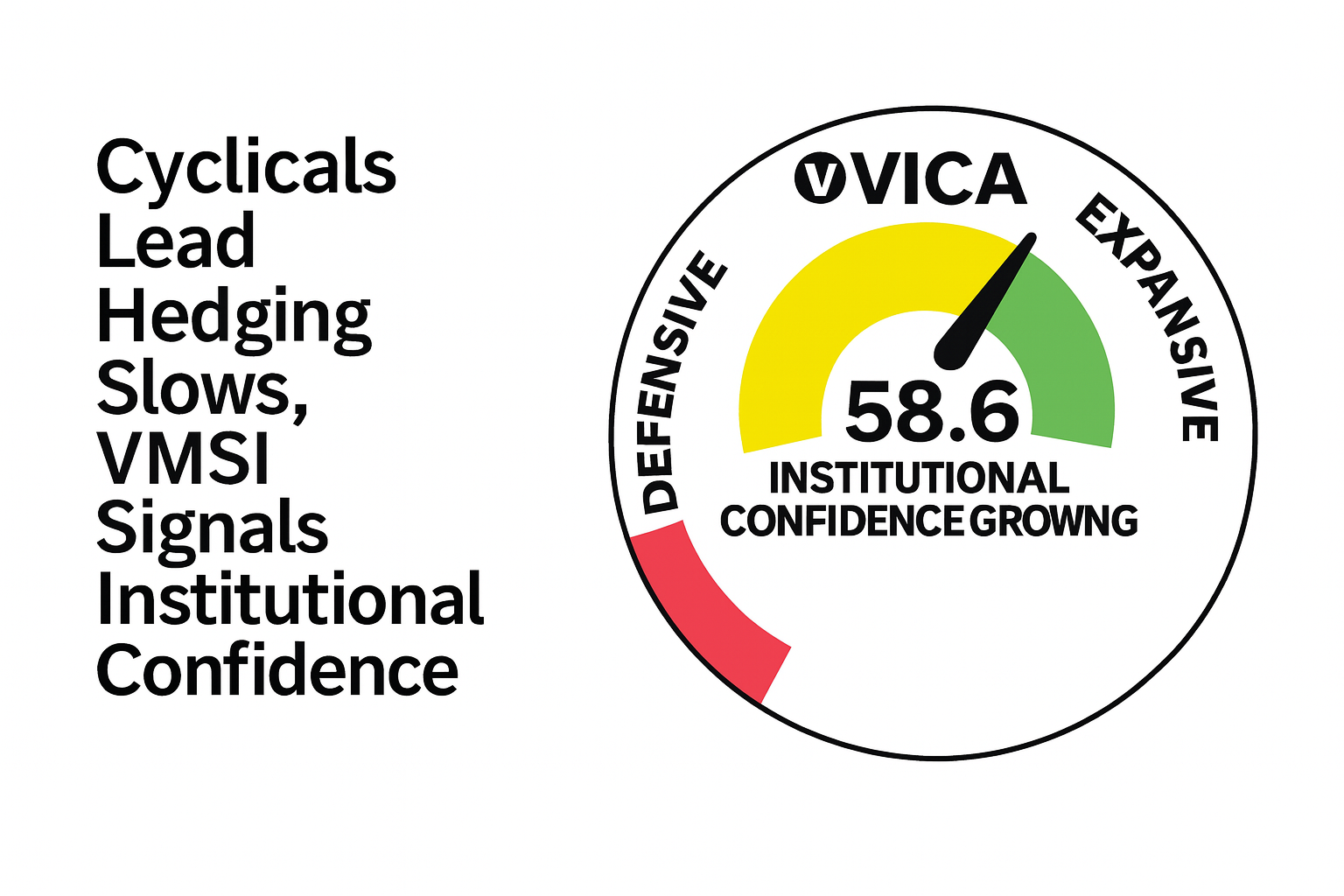

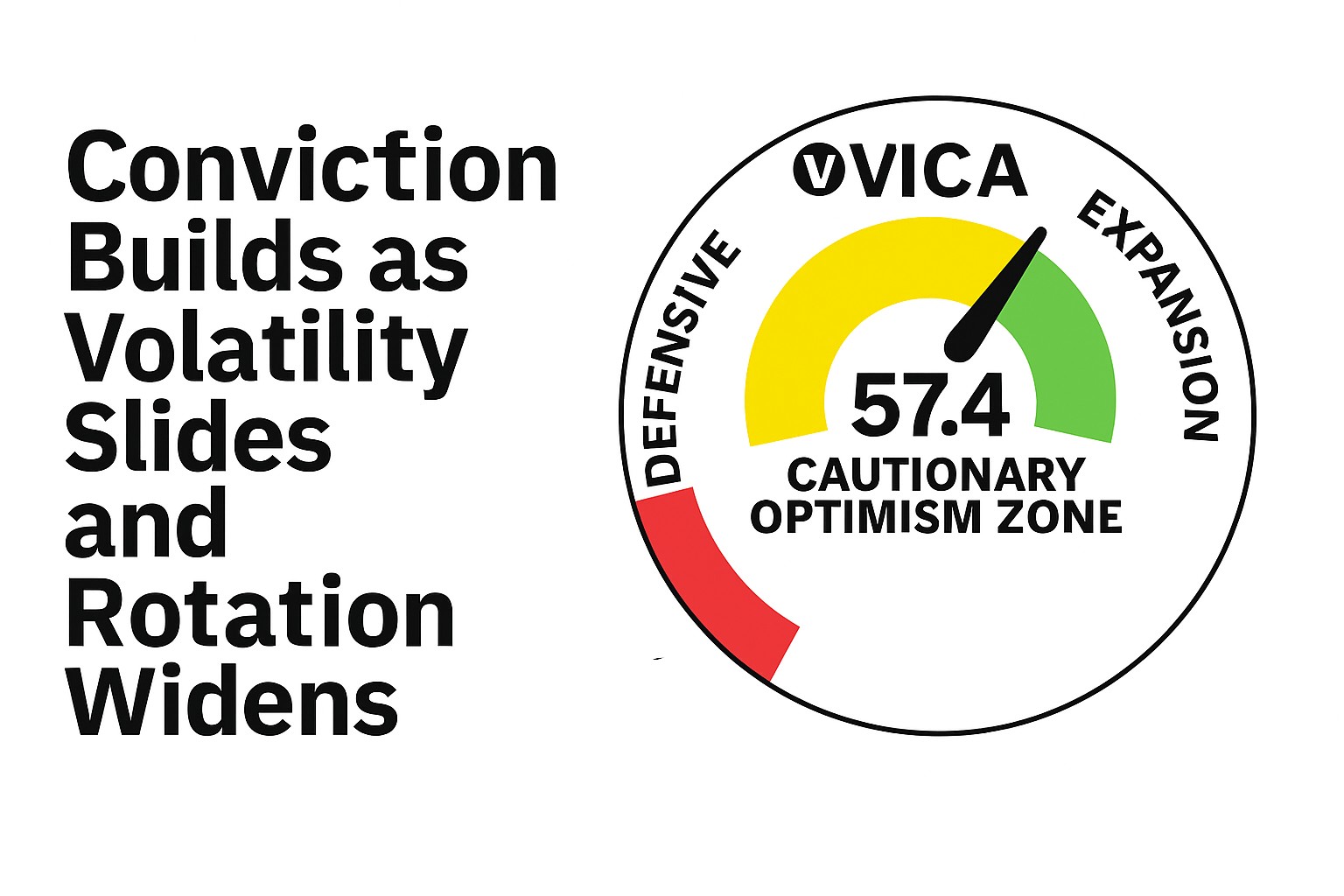

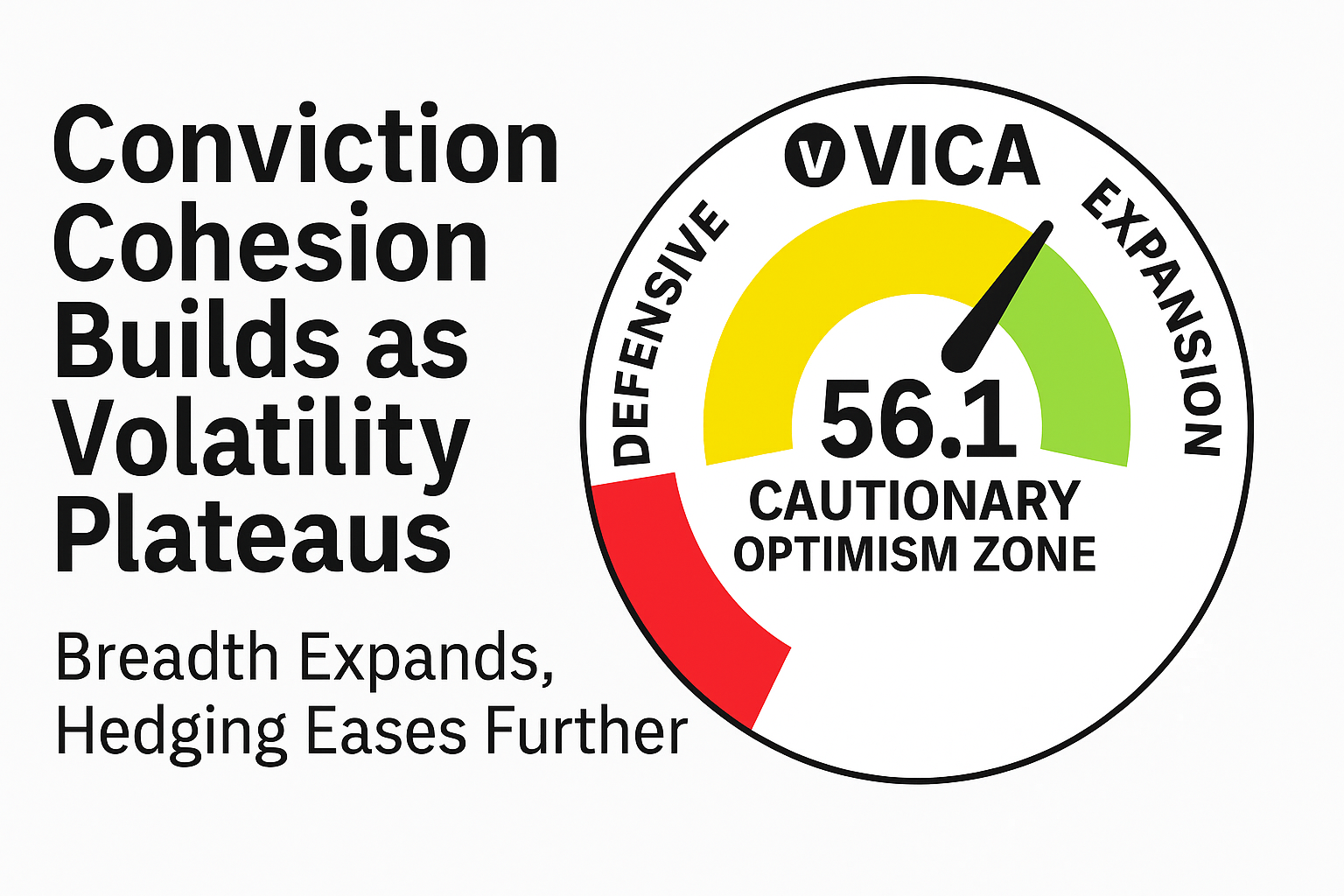

Markets Bet on Fed Cut — But Institutions Are Already Moving

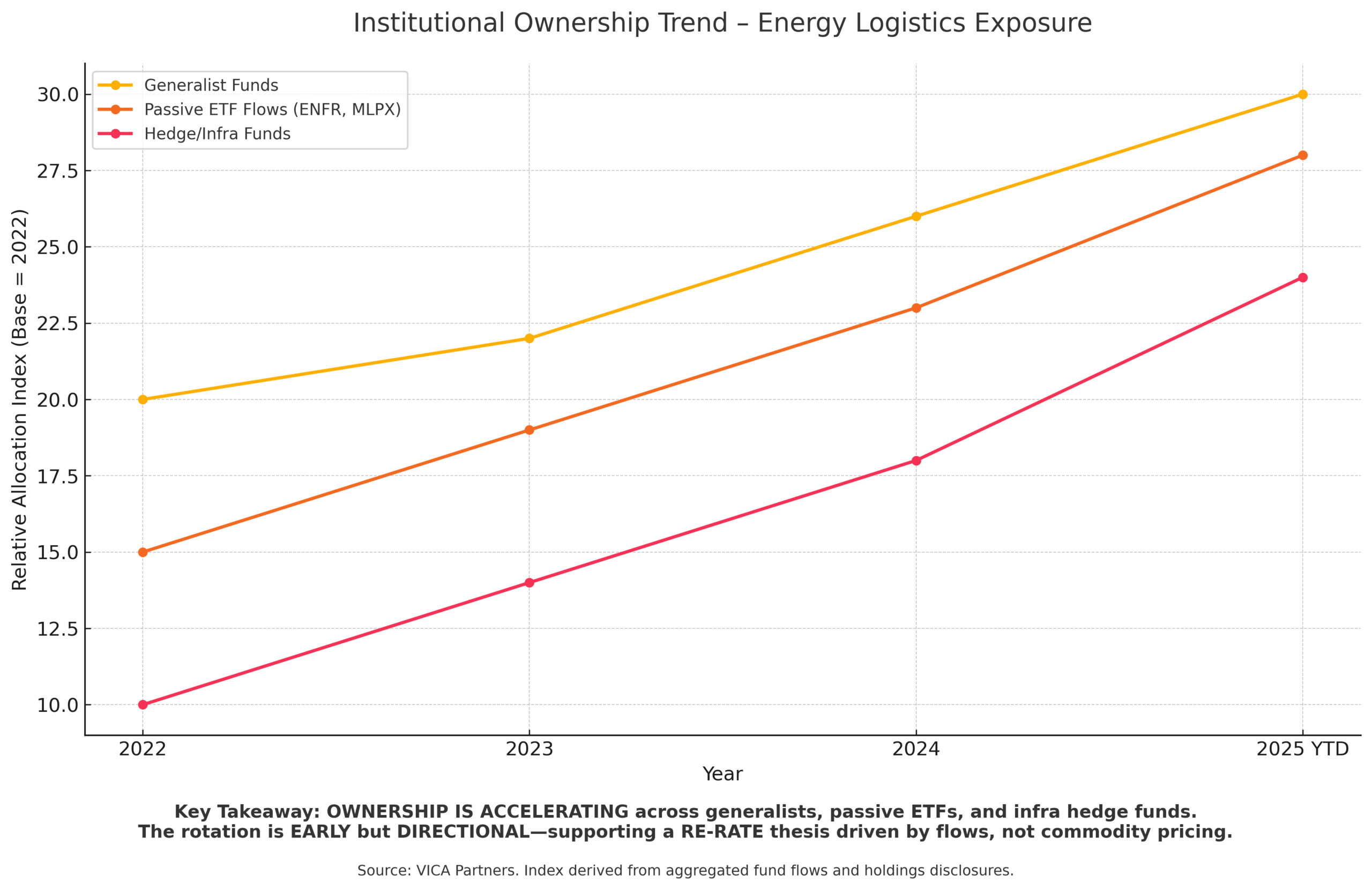

August 4, 2025 | VICA Macro Strategy Note By Matthew Krumholz | Source: VICA Partners Executive Summary A sharp drop in July job creation triggered an aggressive repricing of Federal Reserve expectations. While short-end yields tumbled and Fed cut odds surged, institutional capital quietly rotated into risk. VMSI — VICA’s proprietary Volatility & Market Sentiment … Read more