Cautious Optimism Builds as Defensive Posture Persists

May 30, 2025 | VICA Research

VICA Partners Research’s VMSI © shows where institutional capital is moving — helping investors cut through noise, manage risk, and stay positioned ahead of the curve.

Weekly Snapshot

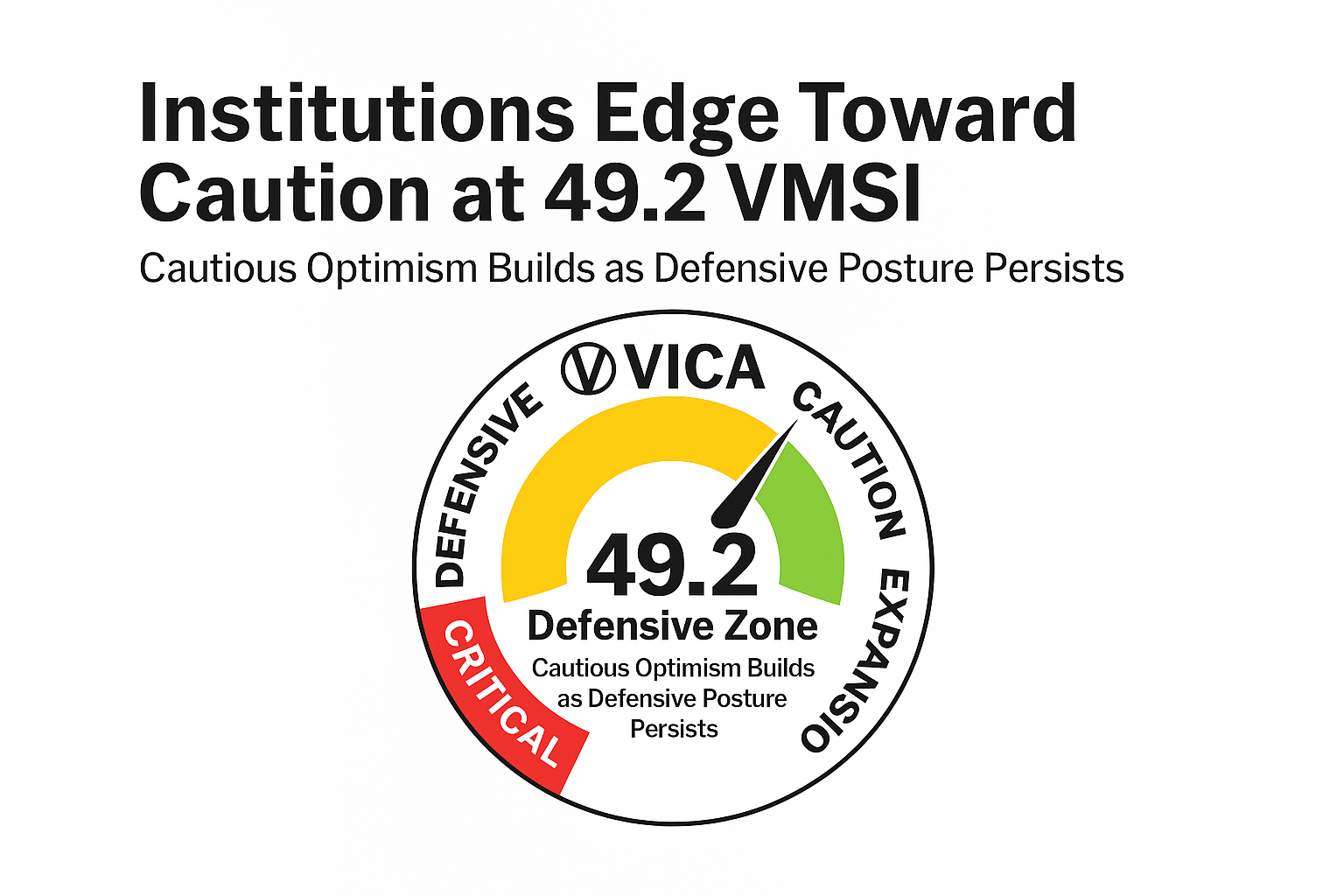

VMSI Score: 49.2 (Defensive Zone)

S&P 500: –0.01% | Nasdaq: –0.32% | Dow: +0.13% | VIX: 18.57

Momentum: 41.6 | Liquidity: 33.7 | Volatility: 66.2 | Safe Haven Demand: 74.0

Markets showed a muted directional close for the week, with the S&P and Nasdaq nearly flat and the Dow slightly positive. Despite supportive macro data, volatility retreated moderately, and institutional posture remains hedged. The VMSI holds at 49.2 — just below the optimism threshold — reflecting cautious re-engagement amid elevated risk premiums.

What is VMSI?

The VICA Market Sentiment Index (VMSI)© tracks institutional capital flows, risk posture, and macro volatility weekly. Built for tactical allocation — not behavioral shifts.

VMSI Score – May 30, 2025: 49.2

The gauge reflects continued upward momentum without broad confirmation. Institutional positioning remains defensive but is slowly leaning risk-on.

Key Insight: Institutions are beginning to lean in, but caution still prevails.

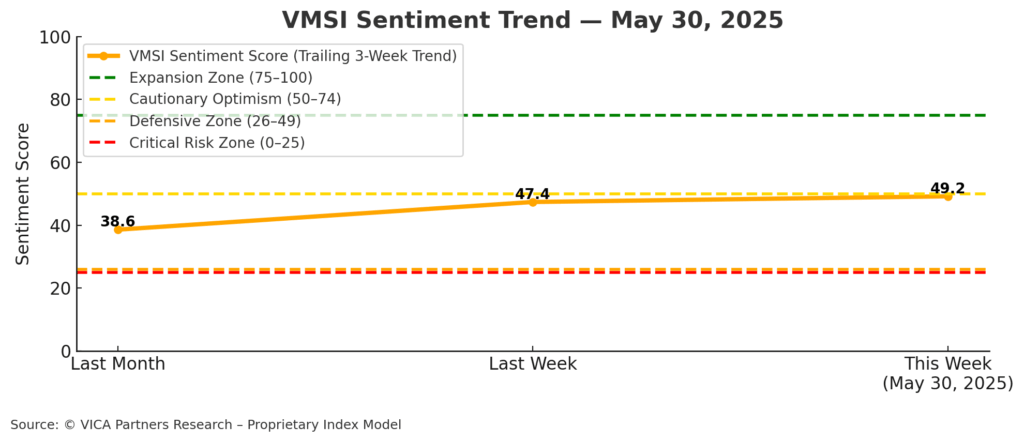

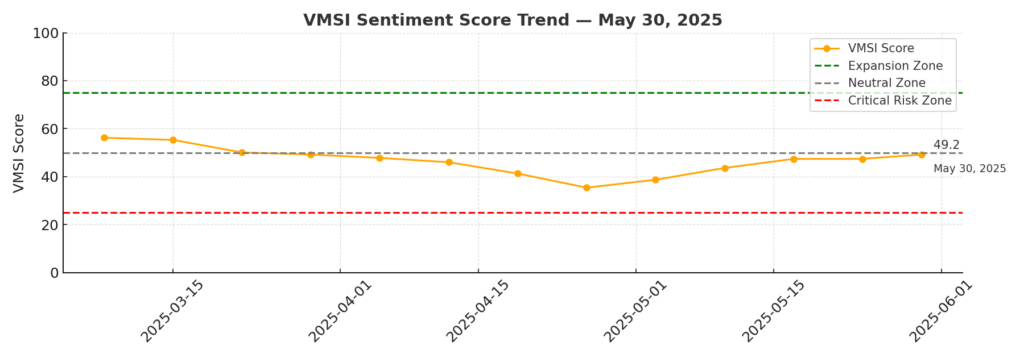

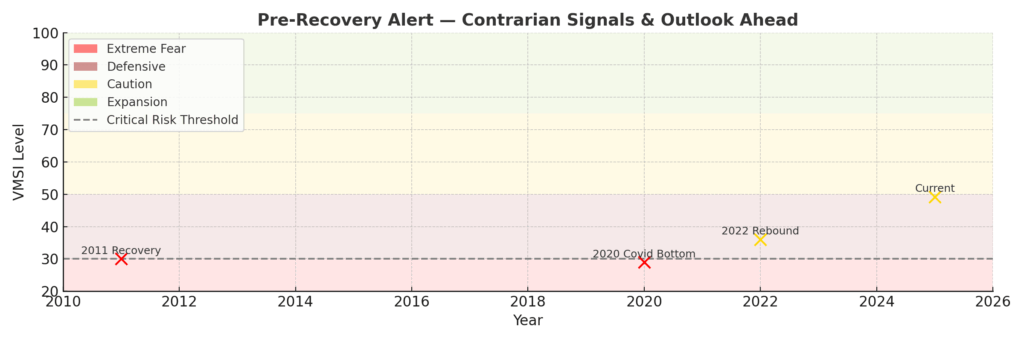

VMSI Timeline — Sentiment Shifts Over Time

The VMSI trajectory has moved upward over the past month. While the path suggests recovery, volatility trends and shallow liquidity prevent confident risk-taking.

Key Insight: Momentum builds, but confidence remains tethered by volatility and credit caution.

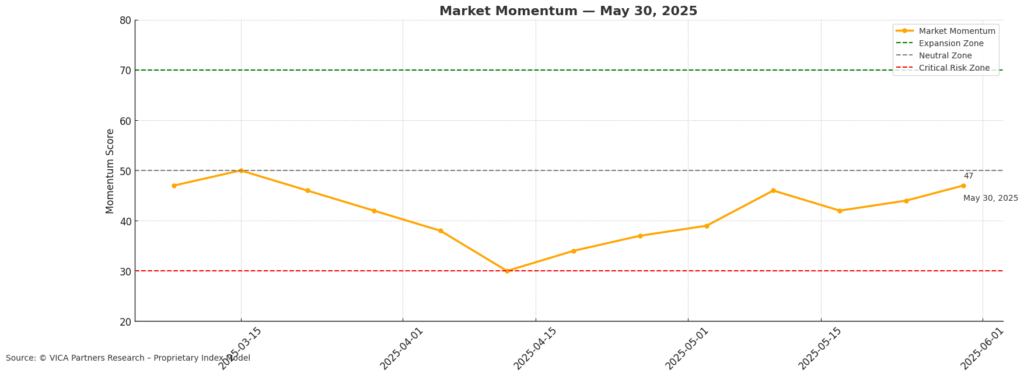

Market Momentum — Institutional Accumulation

The S&P 500 edged up 0.01%, the Nasdaq dipped 0.32%, and the Dow closed +0.13%. Semiconductors retreated but held technical support. Momentum remains selectively positive.

Key Insight: Leadership is narrowing again; tech outperformance needs broadening to sustain trend.

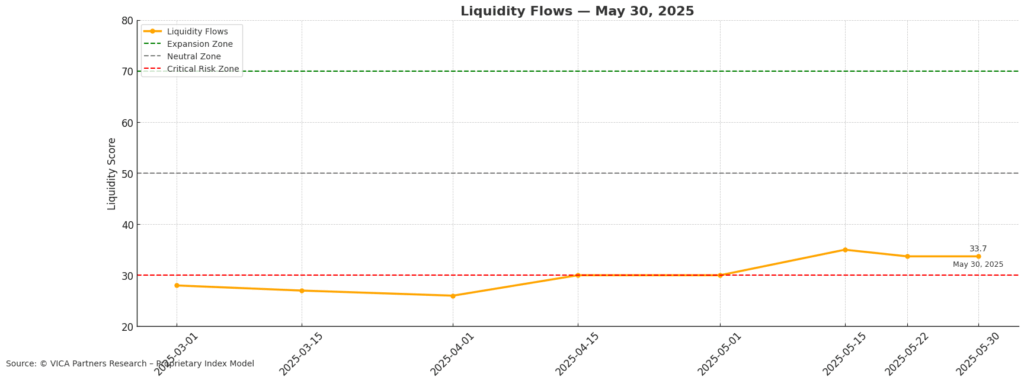

Liquidity Flows — Capital Movement Patterns

Despite outflows in small caps (VTWO –0.38%) and high-beta sectors, LQD investment grade bonds rose +0.29%. Liquidity flows stabilized but lack conviction.

Key Insight: Institutions are cautious and slow to rotate into higher-risk segments.

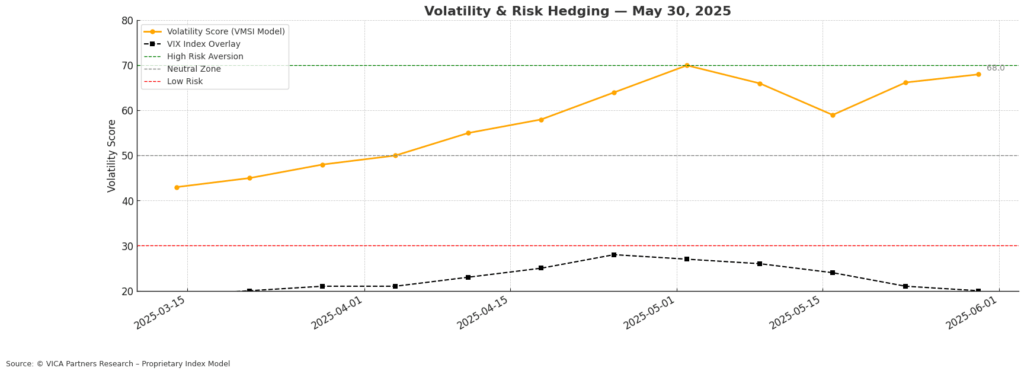

Volatility & Risk Hedging — Uncertainty Barometer

VIX fell to 18.57 (–3.18%), signaling receding fear. However, volatility readings remain above long-term averages, and risk hedging is still in place.

Key Insight: Risk appetite is returning, but fear is not fully unwound.

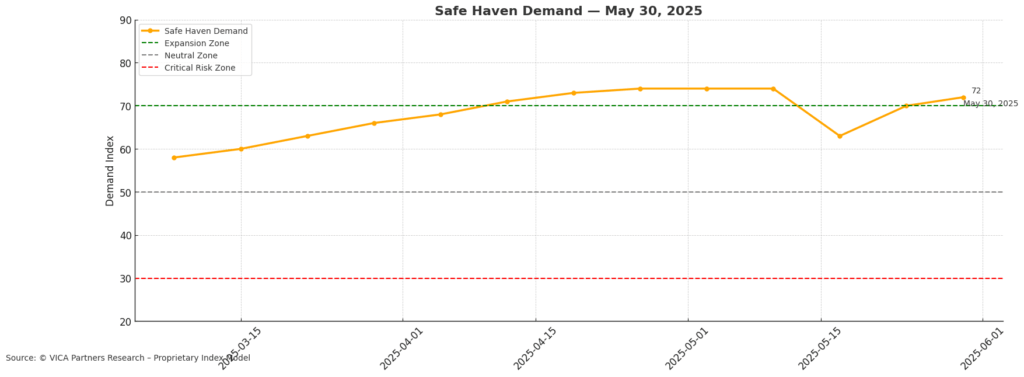

Safe Haven Demand — Flight to Quality

Safe haven demand remains elevated. Treasury yields dipped to 4.41%, and LQD rose slightly, showing steady institutional preference for stability.

Key Insight: Institutions are still favoring safety as a hedge.

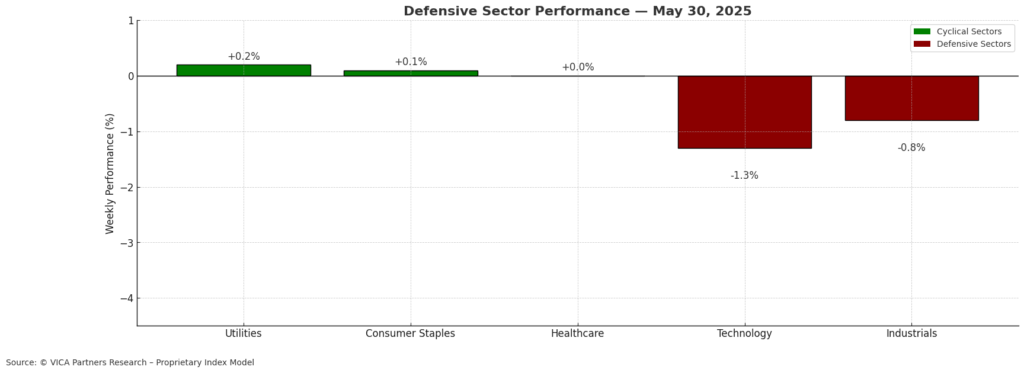

Defensive Sector Rotation — Equity Preference

Defensive sectors held steady. Staples and Utilities maintained modest inflows. Risk preference remains selective and skewed toward stability.

Key Insight: Positioning favors defense, not speculative beta.

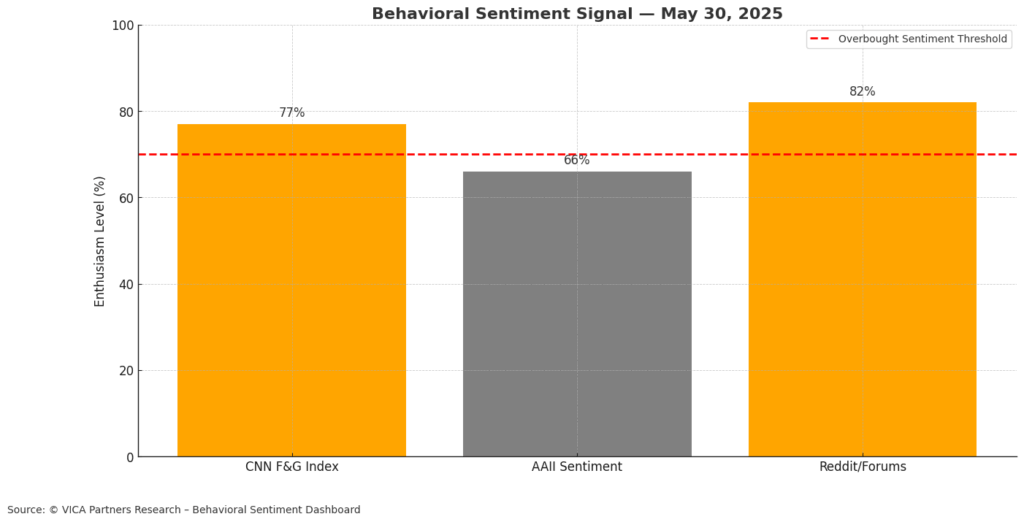

Investor Sentiment Caution Note

Retail sentiment has risen, with Fear & Greed indices ticking toward greed despite lingering macro risks. Forums and surveys show growing emotional optimism.

Key Insight: Emotional optimism is disconnected from capital structure. Use caution chasing rallies.

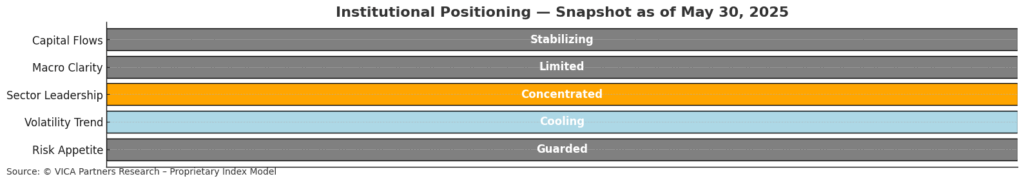

Institutional Positioning Snapshot

Positioning Overview – May 30, 2025

Risk Appetite: Guarded

Volatility Trend: Cooling

Sector Leadership: Concentrated

Macro Clarity: Limited

Capital Flows: Stabilizing

Key Insight: Tactical posture remains risk-aware and narrow.

Pre-Recovery Alert — Historical Recovery Zones

VMSI at 49.2 is now brushing up against levels seen just before inflection points in 2011 and 2020. These pivots require stronger liquidity and conviction.

Key Insight: Recovery possible — but not confirmed.

About the VICA Market Sentiment Index (VMSI)©

The VMSI is VICA Research’s proprietary sentiment gauge designed to track shifts in institutional risk behavior, capital flow posture, and macro-driven volatility signals.

Each weekly score reflects a multi-factor model that blends market structure, flow dynamics, defensive rotation, and volatility hedging — calibrated against technical and behavioral thresholds.

Index Scale:

🟥 0–25: Critical Risk Zone

🟧 26–49: Defensive

🟨 50–74: Cautionary Optimism

🟩 75–100: Expansion / High Confidence

VMSI is published weekly following Thursday’s market close unless otherwise noted.

Disclaimer

This report and the proprietary VICA Market Sentiment Index (VMSI)© are confidential works of authorship protected by intellectual property laws. Unauthorized reproduction, copying, redistribution, or use without express permission from VICA Research is strictly prohibited and monitored.

A portion of future VMSI-related proceeds will support global literacy, vocational education, and the advancement of scholars in critical fields like engineering — with a commitment to measurable impact and long-term social return.