GOVERNMENT REPORT SERIES

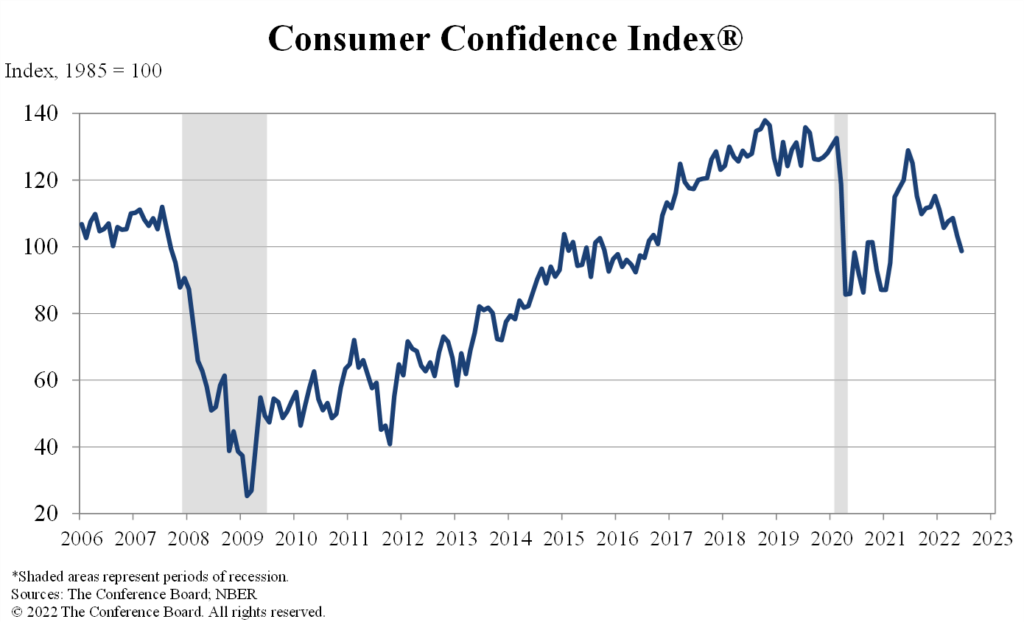

The Conference Board Consumer Confidence Index® decreased in June, following a decline in May. The Index fell to 98.7 (1985=100)—down 4.5 points from 103.2 in May—and now stands at its lowest level since February 2021 (Index, 95.2).

“Purchasing intentions for cars, homes, and major appliances held relatively steady—but intentions have cooled since the start of the year and this trend is likely to continue as the Fed aggressively raises interest rates to tame inflation. Meanwhile, vacation plans softened further as rising prices took their toll. Looking ahead over the next six months, consumer spending and economic growth are likely to continue facing strong headwinds from further inflation and rate hikes.”

The Consumer Confidence Survey® reflects prevailing business conditions and likely developments for the months ahead. This monthly report details consumer attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates

The Consumer Confidence Survey