VICA Partners | Institutional Market Structure Commentary

Abstract

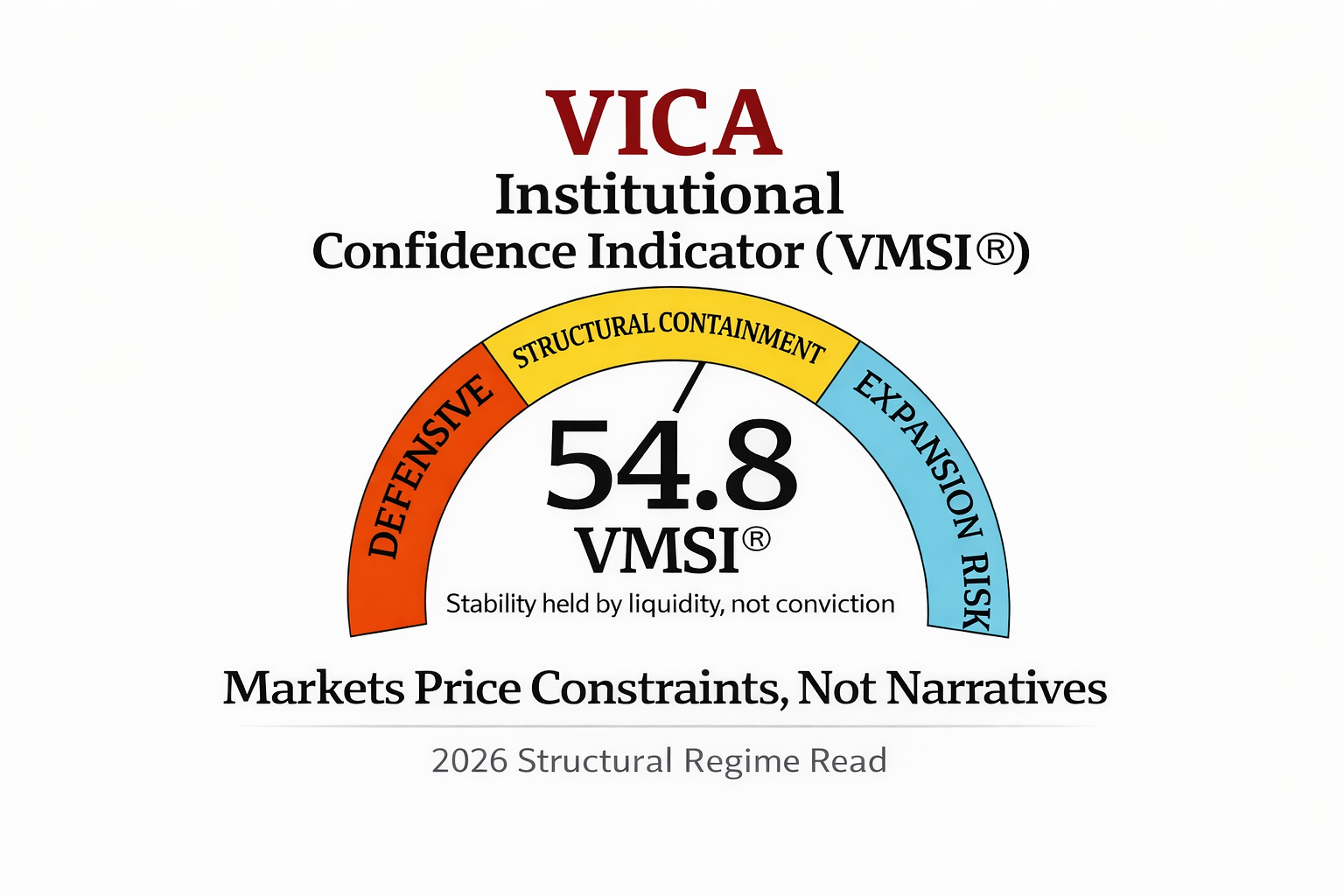

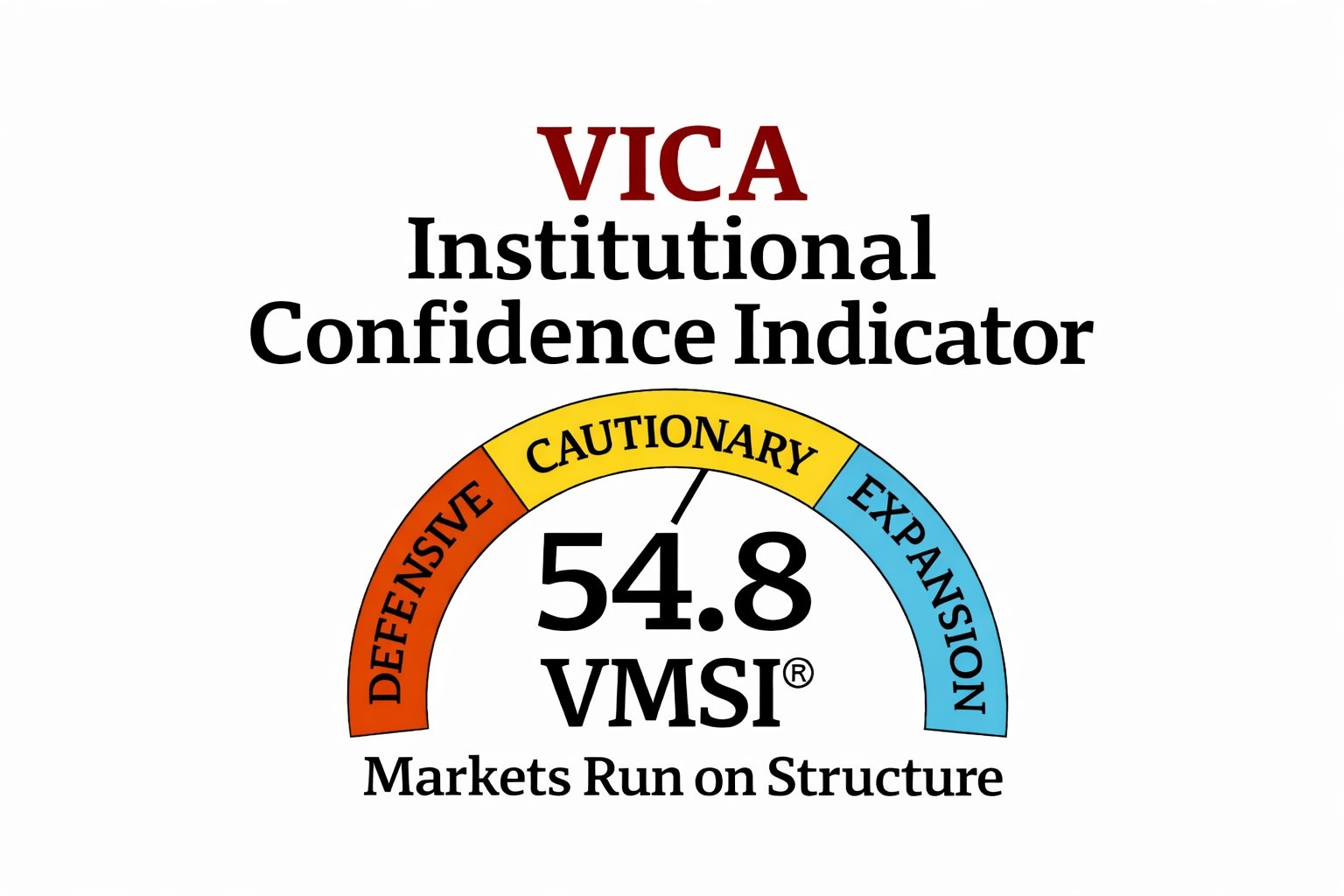

Markets are no longer governed by inflation narratives. The dominant risk entering 2026 is policy error interacting with growth fragility inside a late-equilibrium structure. Retail sentiment gauges routinely register fear, yet institutional architecture continues to hold — through liquidity concentration, duration accumulation, and volatility suppression.

At the same time, public discourse continues to overstate China’s economic autonomy and understate its reliance on U.S. end-demand and dollar-based clearing. That mischaracterization extends duration uncertainty rather than resolving it. Capital responds accordingly — not by reallocating toward alternatives, but by consolidating around the systems that continue to function under constraint.

The system is not breaking. It is tightening. That distinction defines the institutional opportunity set into 2026.

Structural Reality: China’s External Anchor Has Not Changed

Despite persistent headlines emphasizing decoupling, China’s growth model remains externally anchored. U.S. consumers continue to represent the most critical endpoint for Chinese industrial output, directly and indirectly. Domestic absorption has not scaled to replace export dependency. Overcapacity across manufacturing-intensive sectors cannot be cleared internally without margin compression, employment pressure, and balance-sheet stress.

A sustained failure of U.S. end-demand transmission would not produce a marginal slowdown. It would force internal adjustment under conditions China historically manages poorly: declining profitability, rising labor strain, and deteriorating capital confidence.

Markets understand this asymmetry even when public narratives do not. Capital prices constraints, not rhetoric.

Media Amplification and the Extension of Duration Risk

The gap between narrative and feasibility matters. Media coverage increasingly frames China’s geopolitical signaling and trade diversification as evidence of economic independence. In practice, these actions reflect defensive positioning within a constrained system, not the emergence of a viable replacement growth engine.

This distortion has a predictable market effect. As rhetoric accelerates without corresponding structural change, uncertainty persists. Persistent uncertainty favors systems with proven liquidity, settlement reliability, and exit optionality. It does not favor aspirational alternatives.

Rather than destabilizing the existing order, narrative amplification reinforces it.

Liquidity, Volatility, and the Mechanics of Containment

In late-equilibrium regimes, markets do not fail loudly. They tighten quietly.

Liquidity remains functional but increasingly concentrated. Participation narrows. Execution capacity holds, but efficiency declines. Volatility compresses at the surface even as internal fragility remains elevated. Duration demand persists as a hedge against policy miscalibration rather than a bet on recession.

This is a containment regime. Stability is preserved through structure, not conviction.

Within this framework, dollar-centric systems continue to benefit — not because of optimism, but because they remain the primary mechanisms through which global risk is cleared, collateralized, and repriced.

Market Inertia and Structural Asymmetry

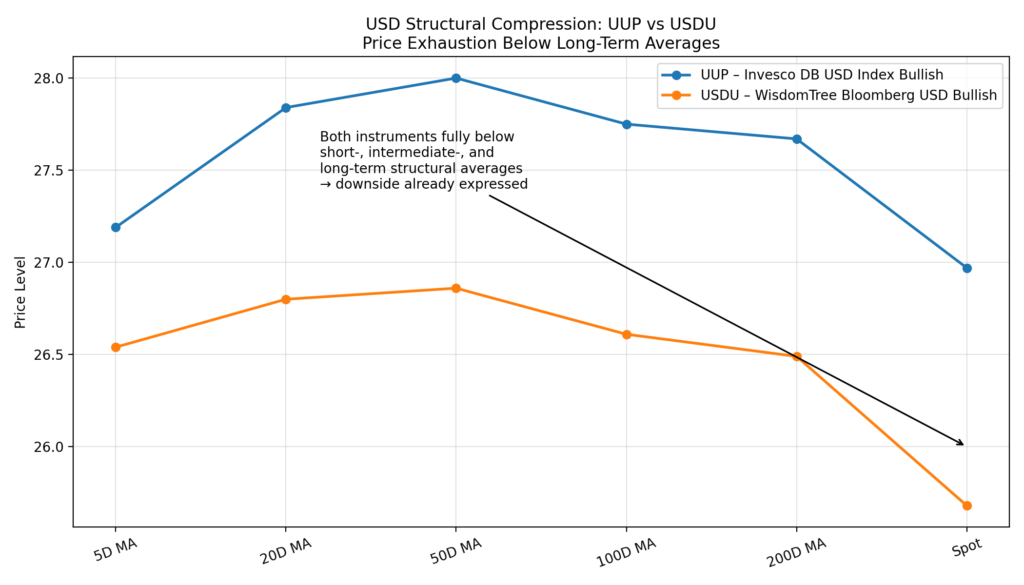

As regimes move from expansion toward preservation and containment, the market’s center of gravity shifts. Capital becomes less sensitive to growth narratives and more sensitive to operational reliability. Assets that have already absorbed downside pressure while retaining structural integrity gain asymmetric appeal.

This is where the opportunity emerges.

Single Technical Takeaway

Dollar exposure is no longer a consensus trade — it is a structurally supported asset that has already absorbed downside pressure. Price has fully repriced while trend integrity remains intact, shifting asymmetry toward stabilization or recovery within the dominant liquidity system rather than further liquidation.

Institutional Opportunity Into 2026

This is not a directional bet on growth, policy, or geopolitics. It is an alignment with structure.

Dollar-centric exposure functions as portfolio ballast in environments where uncertainty persists without resolution. It benefits from liquidity concentration, duration sensitivity, and the absence of credible substitutes capable of absorbing global capital flows at scale.

For institutional portfolios, the highest risk-adjusted expression into 2026 is not broad beta. It is precision — pairing liquidity-dense equity corridors and quality balance sheets with structural ballast that benefits from constraint rather than momentum.

Traditional crisis hedges decay when risk lingers without breaking. Structural exposure benefits from time.

What Would Invalidate the Thesis

This framework requires reassessment only under clear structural change:

-

Durable resolution of geopolitical and trade uncertainty

-

Emergence of a credible reserve substitute with deep liquidity and capital mobility

-

Material impairment of U.S. market functionality

-

Broad, synchronized global expansion outside the U.S. that compresses safe-haven demand

Absent these, capital behavior remains consistent with the current regime.

Conclusion

China’s growth model remains externally anchored. Media narratives continue to overstate autonomy and understate dependence. Markets, however, are positioning for the constraint.

In late-equilibrium regimes, stability persists not because conditions improve, but because liquidity, duration, and structure work harder to preserve balance. That environment rewards assets aligned with operational reality rather than narrative conviction.

The dollar benefits not from optimism, but from structure.

Stability persists. Efficiency declines. Precision matters.

Source: VICA Partners Research © VICA Research — Proprietary Market Intelligence