Stay Informed and Stay Ahead: Economic Watch, May 7th, 2024.

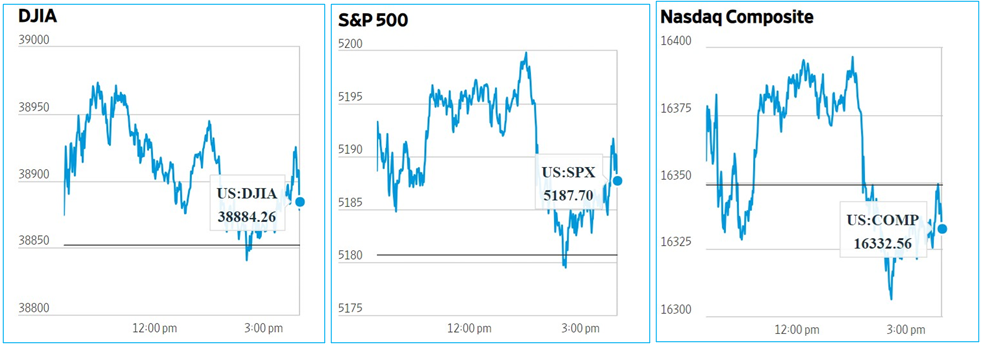

- Market Indices: DJIA (+0.08%), S&P 500 (+0.13%), Nasdaq Composite (-0.10%).

Economic Data & Analysis: Indices, Treasuries, and More…

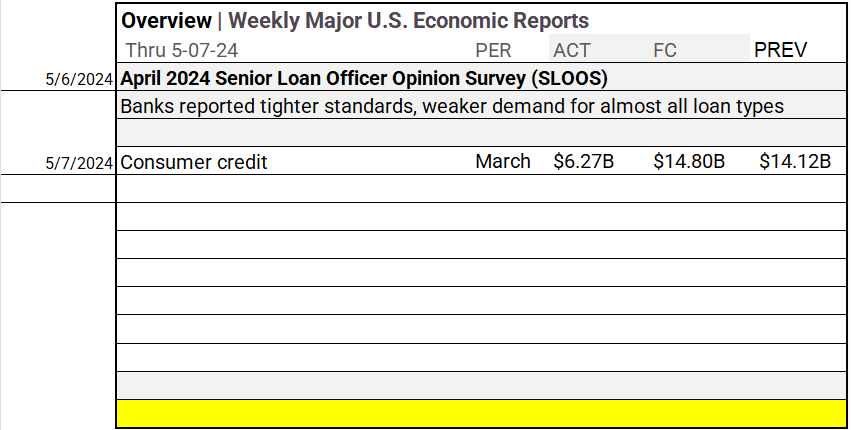

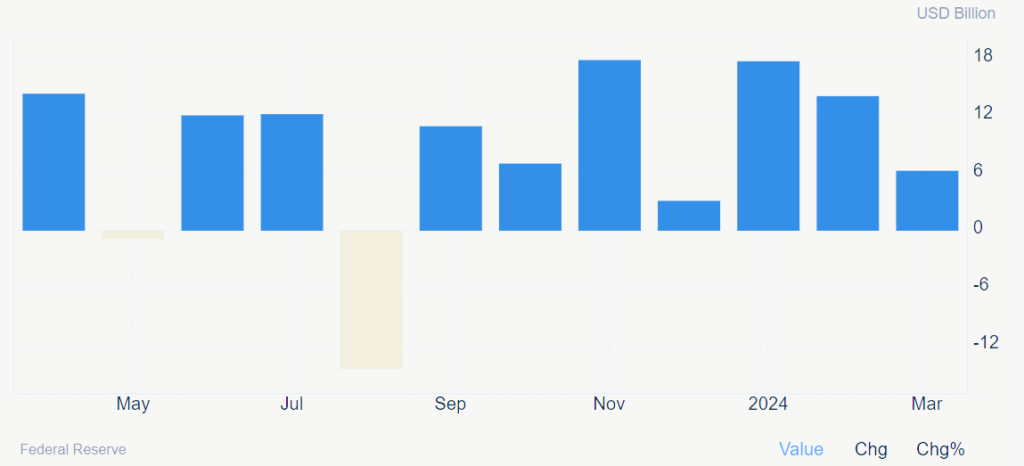

- Economic Data: In March, consumer credit growth slowed to 1.5%, marking a significant drop from the prior month’s 3.6% surge. This resulted in a $6.3 billion increase, below the $14.8 billion forecasted by economists.

- Summary: While the first quarter saw a 3.2% rise in credit, outpacing the preceding quarter, a closer look reveals a mixed picture. Credit-card borrowing crawled up by a mere 0.1%, a stark slowdown compared to the prior month’s 9.7% leap, hinting at cautious spending behaviors. On the flip side, nonrevolving loans, including student and auto loans, maintained a steadier trajectory, rising by 2%.

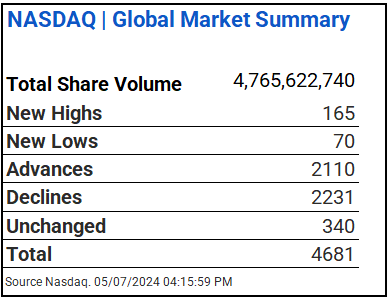

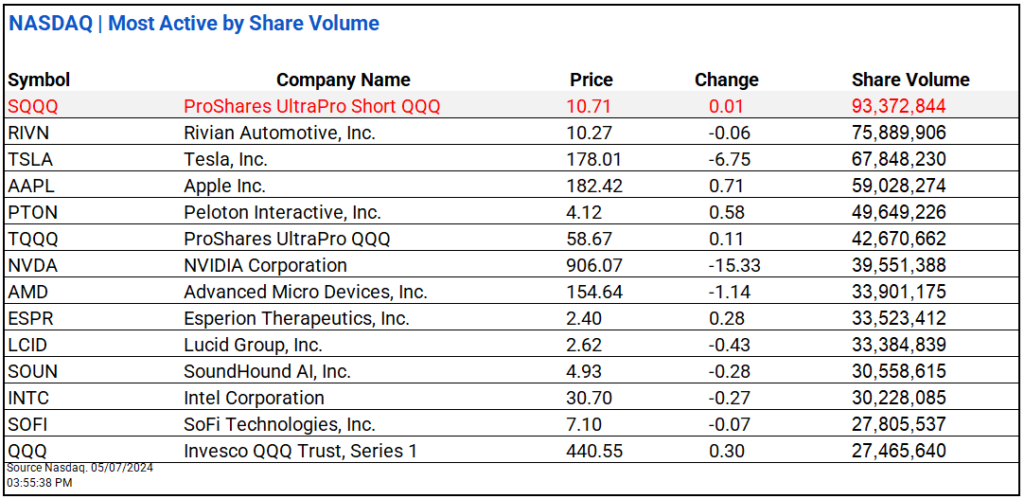

NASDAQ Global Market Summary:

- Caution: High volume alert for SQQQ ProShares UltraPro Short QQQ at 93.4M shares traded

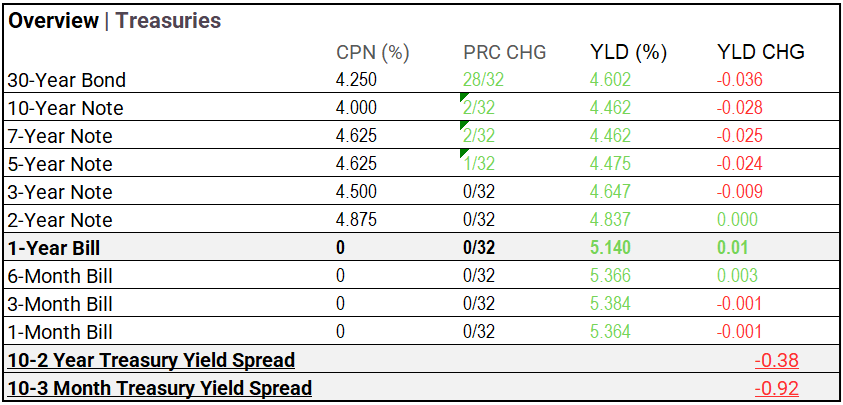

Treasury Markets:

- Bond yields pullback, with the 1-year Bill outperforming.