“Empowering Financial Success” Vica Partners Financial Group’s Newsletter

MARKETS TODAY – August 31st, 2023 (Vica Partners)

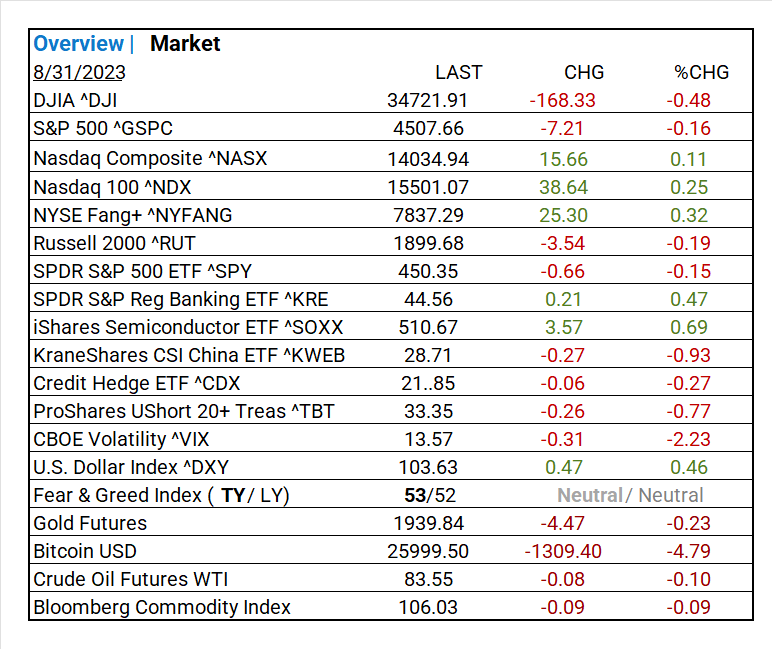

Global Markets Snapshot

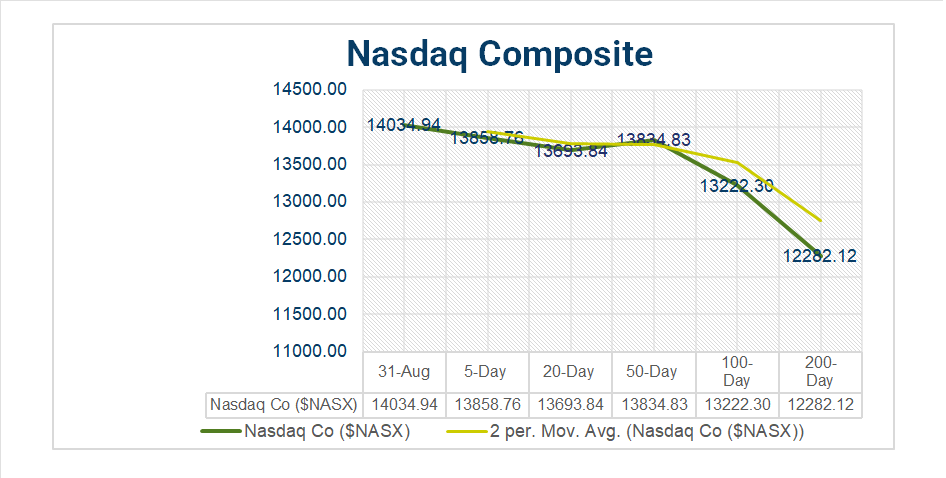

- Asian Markets: Overnight, Asian markets showed mixed performance. Japan’s Nikkei 225 rose by 0.88%, while China’s Shanghai Composite and Hong Kong’s Hang Seng declined by 0.55%. S&P futures opened slightly above fair value, up by 0.05%.

- European Markets: European markets also displayed mixed results, with Germany’s DAX up by 0.35%, France’s CAC 40 down by 0.65%, and London’s FTSE 100 falling by 0.46%.

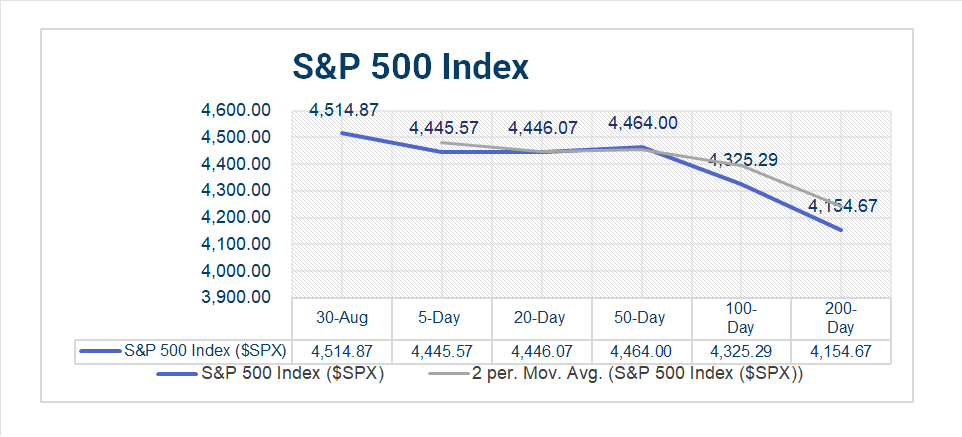

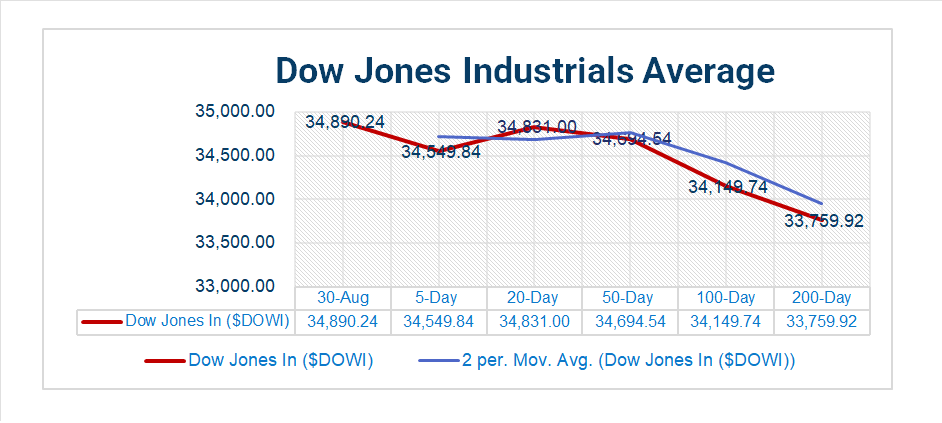

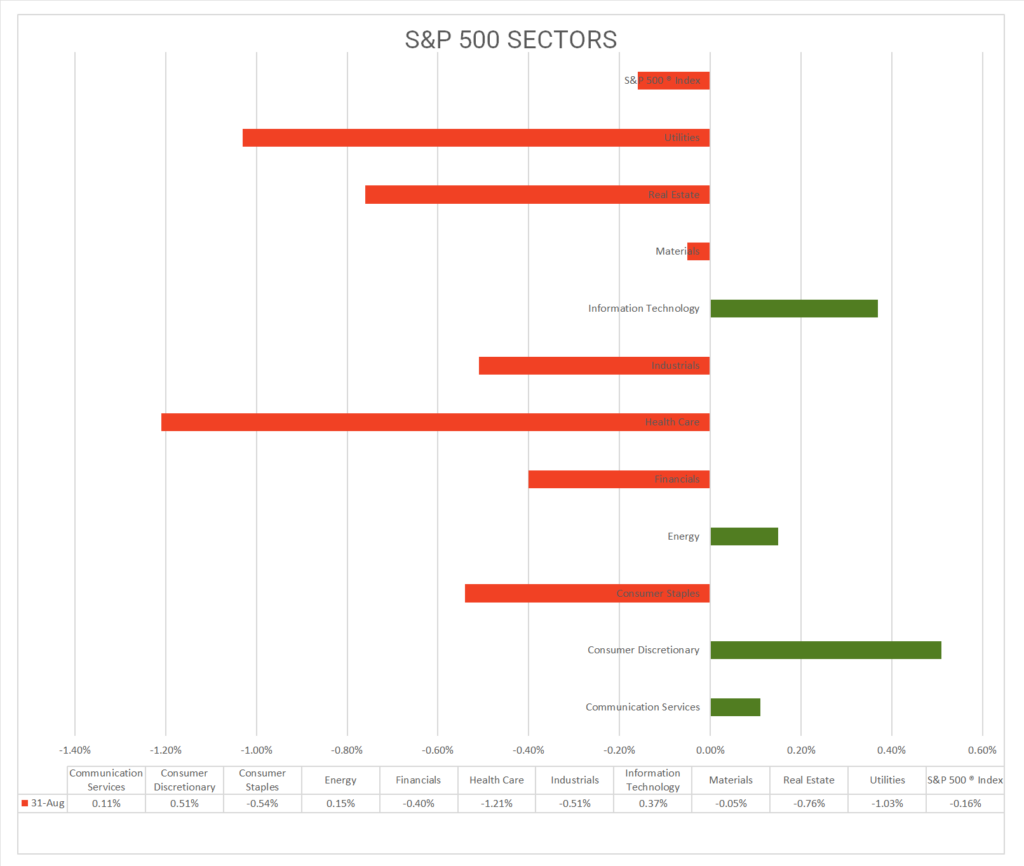

- US Markets Today: In the US, the markets closed with mixed results. The NASDAQ was up by 0.11%, the S&P 500 down by 0.16%, and the DOW declined by 0.48%. Notably, 7 out of 11 S&P 500 sectors experienced declines. Consumer Discretionary outperformed by 0.51%, while Health Care lagged with a 1.21% decrease. The standout industries of the day were Broadline Retail, up by 2.11%, and Communications Equipment, up by 1.32%. The Semiconductor ETF and S&P Reg Banking ETF also saw gains of 0.69% and 0.47%, respectively.

US Economic Highlights

- In US economic news, Initial Jobless Claims were softer. The July Core PCE Price Index MoM/YoY was in line with consensus. Personal Spending in July increased for the third consecutive month, despite a decline in income. The Chicago PMI reported a surprise beat.

Key Takeaways

- July Core/ PCE Price Index MoM/YoY in line with consensus.

- NYSE Fang+ (^NYFANG) gained 0.32%.

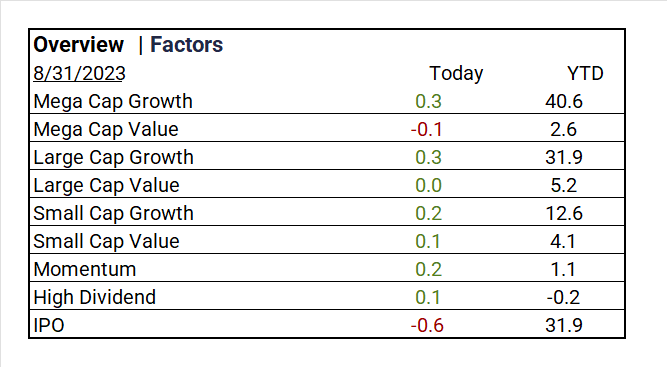

- Growth Stocks performed well.

- Trending “on the Day”: Broadline Retail (+2.11%), Communications Equipment (+1.32%).

- Semiconductor ETF (^SOXX) rose by 0.69%.

- S&P Reg Banking ETF (^KRE) also gained by 0.47%.

- Noteworthy 90-day growth in the Energy Equipment & Services Industry at +30%.

- U.S. Dollar Index (^DXY) showed strength.

- Dell Tech (DELL) and MongoDB (MDB) reported solid earnings beats.

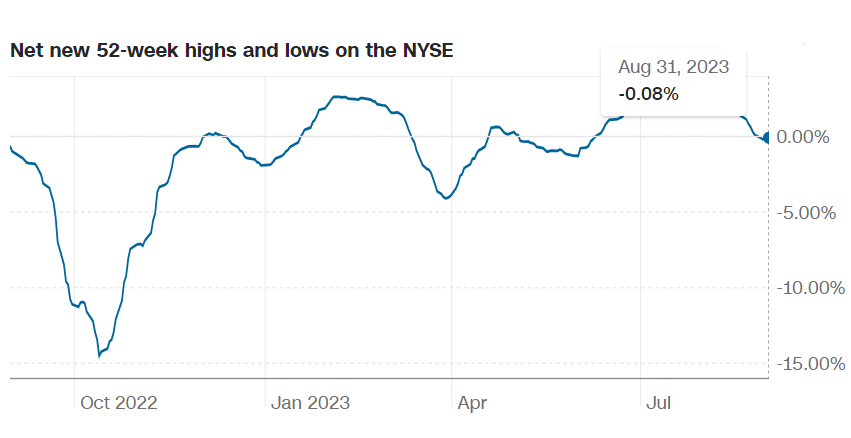

Pro Tip: Stock Price Strength shows the number of stocks on the NYSE at 52-week highs compared to those at 52-week lows.

Sectors, Commodities, and Treasuries

S&P Sectors

- Out of the 11 S&P 500 sectors, 7 declined. Consumer Discretionary led with a +0.51% gain, while Health Care lagged at -1.21%.

- Notable industries “on the Day” included Broadline Retail (+2.11%), Communications Equipment (+1.32%), Semiconductor & Semiconductor Equipment (+0.80%), Leisure Products (+0.79%), and Diversified Telecommunication Services (+0.74%).

- Performance Leaders (1 Month): Energy (+3.14%) and Health Care (-0.39%).

- Year-to-Date (YTD) Leaders: Communication Services (+43.98%), Information Technology (+43.16%), and Consumer Discretionary (+33.07%).

- S&P 500 posted a 17.59% gain as of Aug-30-2023.

Factors

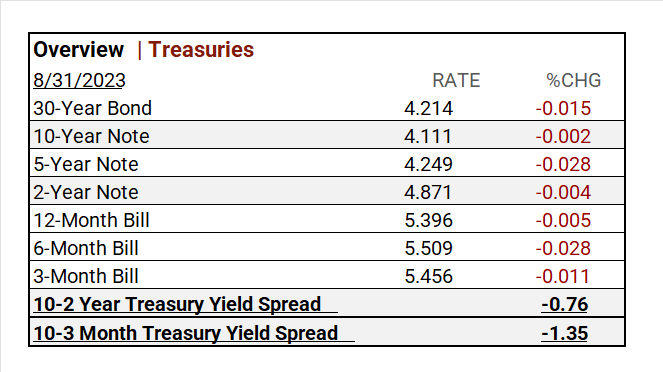

US Treasuries

Earnings

- In Q1 ’23, 79% of companies beat analyst estimates by an average of 6.5%.

- The Q2 Forecast predicted a decline of <7.2%> in S&P 500 EPS, with Fiscal year 2023 EPS remaining flat YoY.

- Q2 Seasonal Actuals are yet to be reported.

Notable Earnings Today

- +Beat: Broadcom (AVGO), UBS Group (UBS), Lululemon Athletica (LULU), Dell Tech (DELL), Canadian Imperial Bank (CM), MongoDB (MDB), Ke Hldg (BEKE), Samsara (IOT), Campbell Soup (CPB), Nutanix (NTNX), Ciena Corp (CIEN), Elastic (ESTC), Hashicorp (HCP), SentinelOne (S).

- Miss: VMware (VMW), Pernod Ricard (PRNDY), Dollar General (DG), Hormel Foods (HRL), Polestar Automotive Holding A (PSNY).

Economic Data

US

- Initial jobless claims on Aug. 26: Actual 228,000, Forecast 235,000, Prior 232,000.

- Personal income in July: Actual 0.2%, Forecast 0.3%, Prior 0.3%.

- Personal spending (YoY) in July: Actual 0.8%, Forecast 0.7%, Prior 0.5%.

- PCE index in July: Actual 0.2%, Forecast 0.2%, Prior 0.2%.

- Core PCE index in July: Actual 0.2%, Forecast 0.2%, Prior 0.2%.

- PCE (year-over-year) in July: Actual 3.3%, Forecast 3.3%, Prior 3.0%.

- Core PCE (year-over-year) in July: Actual 4.2%, Forecast 4.2%, Prior 4.1%.

- Chicago Business Barometer in August: Actual 48.7, Forecast 44.3, Prior 42.8.

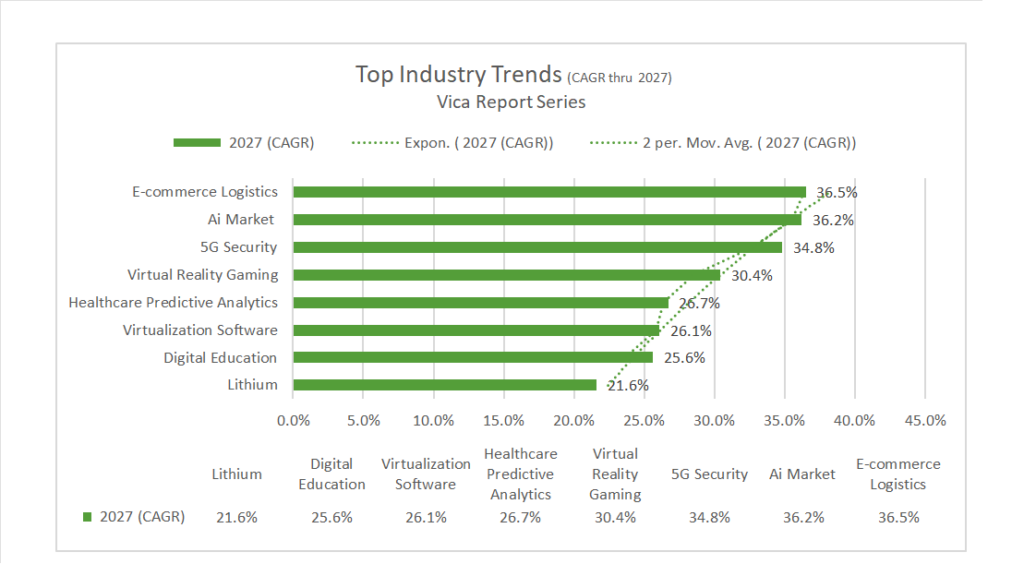

“Navigating September 2023: Vica Partners Insights”

- Our aim with this report is to provide you with a comprehensive overview of the prevailing trends that are shaping financial markets.

Key Trends

- Growth stocks tend to perform well during economic optimism.

- ^NYFANG new defensive’s Index as “bigger allows for more capital to scale”

- AI and Semiconductor Equipment will continue to outperform.

- Market had a Factor regression from Growth to Value stocks in the past 45 days.

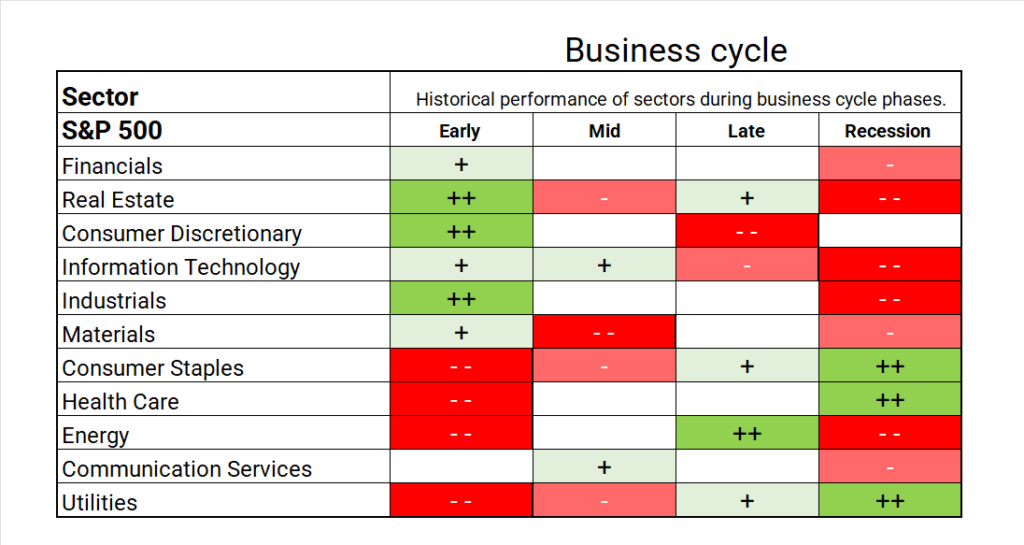

- Energy is August Sector leader and look for further ’23 opportunity here.

- Health Care and Materials undervalued.

- Current economic signals are mixed with deflation concerns.

- August/September historically have lower ROI.

“Vica Partners: Navigating the Economic Landscape – 2023 Economic Forecast

- As of September 2023, the Federal Reserve no longer predicts a recession. However, Vica Partners disagrees and forecasts a potential recession starting as early as Q4 ’23 and extending into ’24. This projection is based on factors including Fed tightening, rising oil prices, overvalued stock markets, and a strong dollar. Vica Partners believes that market bottoms typically occur amid negative news and deflationary signals. Rising interest rates and their impact on the real estate market, coupled with historical highs in consumer debt, are significant concerns. Vica Partners also notes the shift from Growth to Value stocks and the moderation of the Information Technology sector correction occurred.

Key Points

- The Federal Reserve’s power to control inflation is limited, and traditional economic principles may not be effective in today’s highly automated global economy.

- A 2% inflation target may not be realistic today, and a base rate exceeding 3% could fund wage increases, energy transition, operational efficiency improvements, and protection against deflation.

News

Company News/ Other

- UBS Flags Cost Cuts After $29 Billion Credit Suisse Windfall – Bloomberg.

- Hyundai to Invest $400 Million for Stake in an EV Metal Company – Bloomberg.

- Dollar Stores Flash Warning Signs on Consumer Spending – WSJ.

Energy/ Materials

- Europe’s Biggest Oil Company Quietly Shelves a Radical Plan to Shrink Its Carbon Footprint – Bloomberg.

Real Estate

- How to Navigate the Property Meltdown in Five Charts – WSJ.

Central Banks/Inflation/Labor Market

- Fed’s Preferred Inflation Gauges Rise Modestly, While Spending Jumps – Bloomberg.

- China’s Economy Shows Fresh Weakness in Factories, Housing, and Consumer Spending – WSJ.

- Stagflation Dangers Loom in Europe as Markets Eye an End to Rate Hikes – Bloomberg.

- Rising Stock Prices Pose Challenges for Powell’s Inflation Gauge – Bloomberg.

Asia/ China

- China’s Slowing Economy Spells Trouble for Dry-Bulk Shipping – WSJ.