VMSI Edges to 55.1 as Rotation Stabilizes, Capital Maintains Risk-Aware Engagement

June 26, 2025 | VICA Research — Volatility & Market Sentiment Index

VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning—helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus. Institutional-grade signals — opened by design to those who think ahead.

Weekly Snapshot

**Major Index Closes – June 26, 2025

🟢 S&P 500: 6,141.02 (+0.80%) | 🟢 Nasdaq: 20,167.91 (+0.97%) | 🟢 Dow: 43,386.84 (+0.94%) | 🔴 VIX: 16.59 (−1.01%)

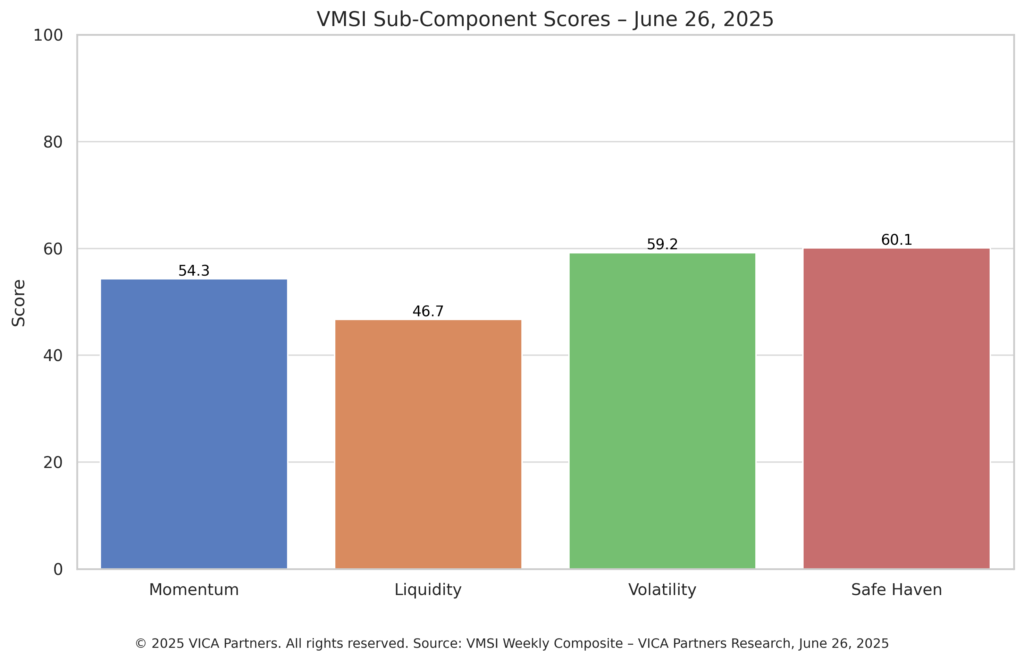

VMSI Sub-Components

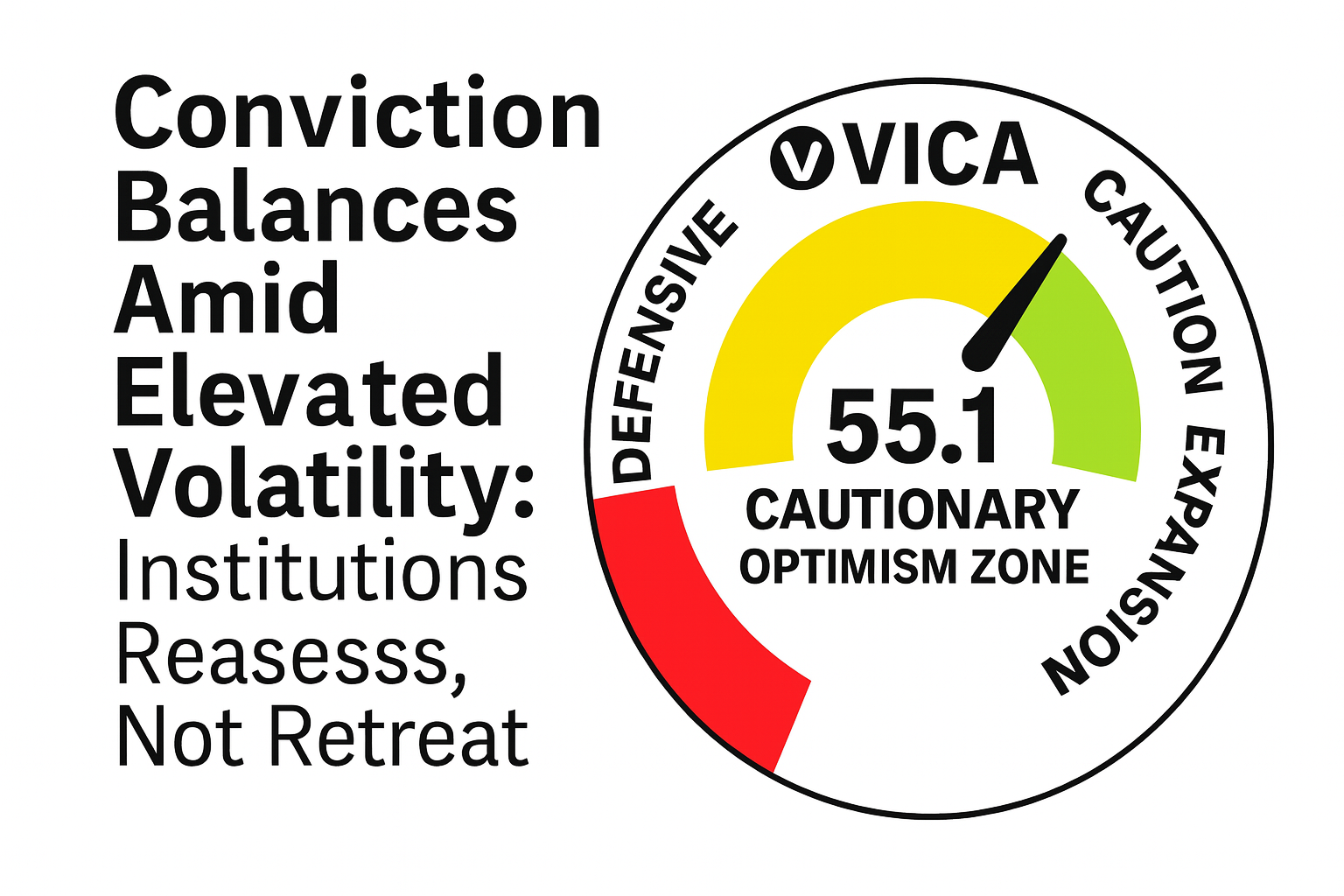

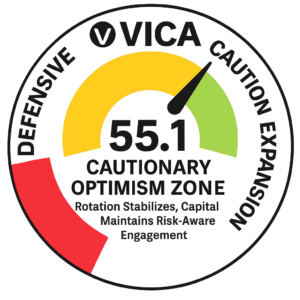

VMSI Gauge – June 26, 2025

VMSI Gauge – Composite Score Distribution

VMSI: 55.1 → firmly in the Cautionary Optimism zone. Capital rotation is stabilizing, yet volatility keeps institutional positioning tactical.

Strategic Insight:

Institutions are navigating the market’s shifting temperature — risk isn’t being pulled, but it is being monitored.

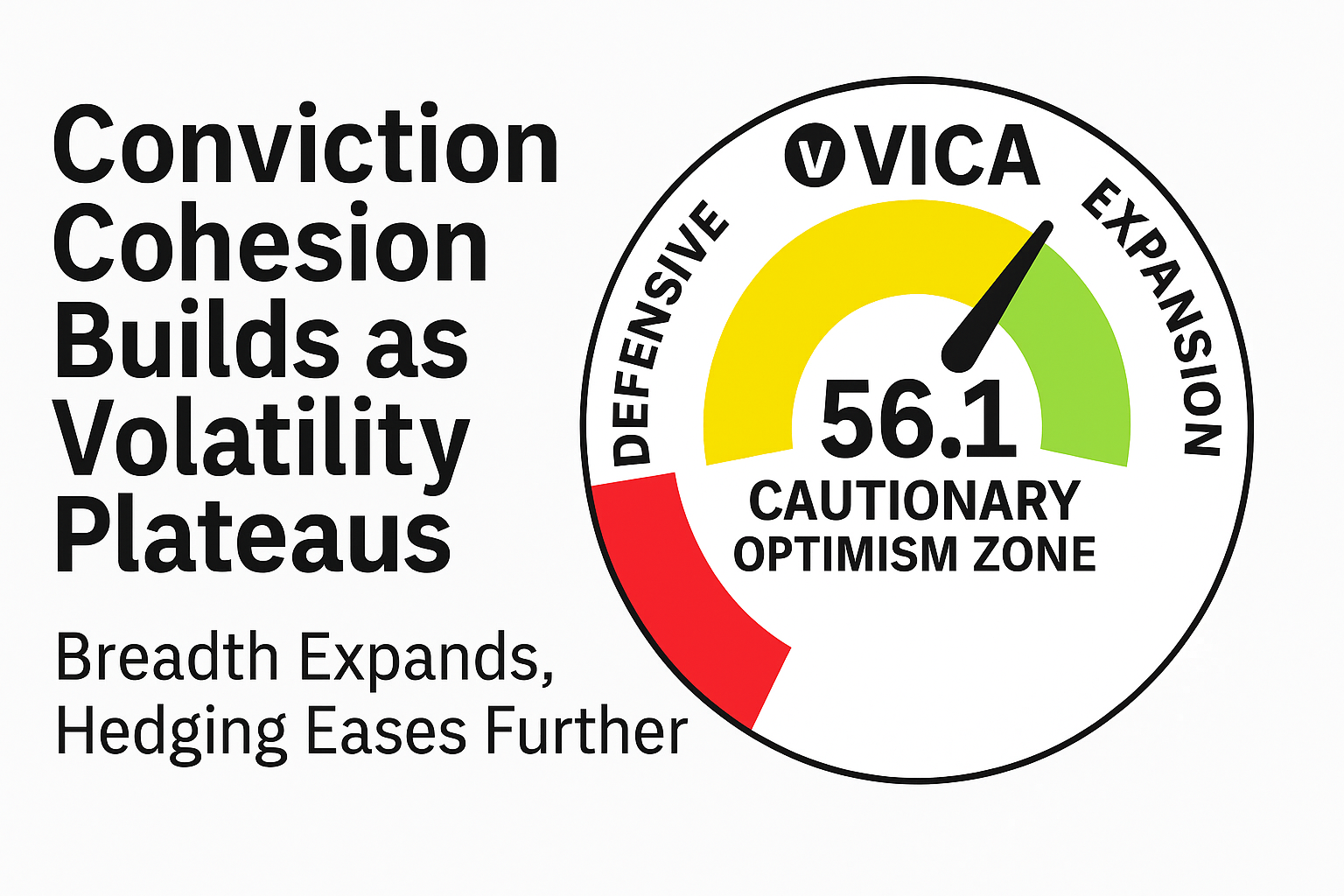

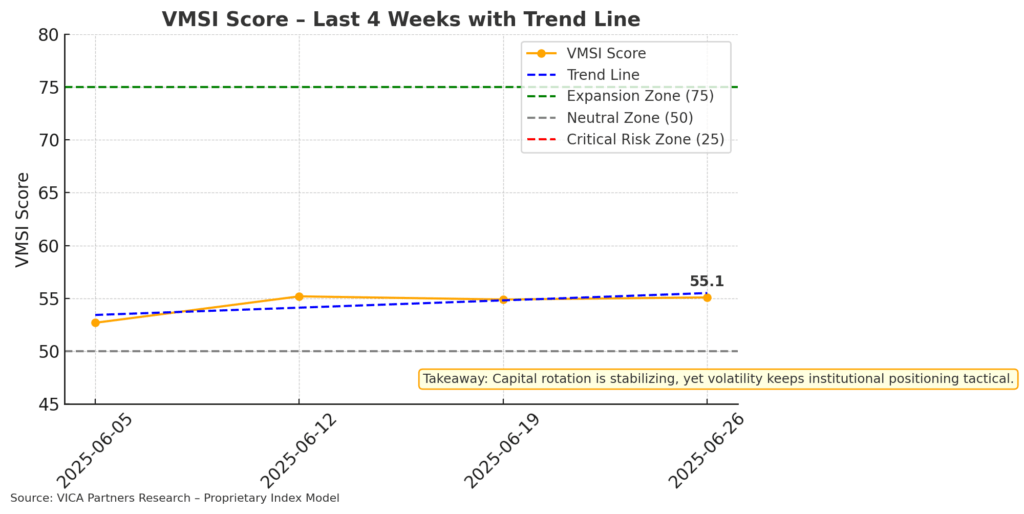

VMSI Trendline – 4-Week Progression

52.7 → 55.2 → 54.9 → 55.1

VMSI Score Timeline – 4-Week View

A modest gain following last week’s softening. Momentum and risk appetite remain active, though hedging sensitivity is ticking up.

Positioning Insight:

The re-risking footprint remains measured — breadth is narrow, but allocations continue under targeted frameworks.

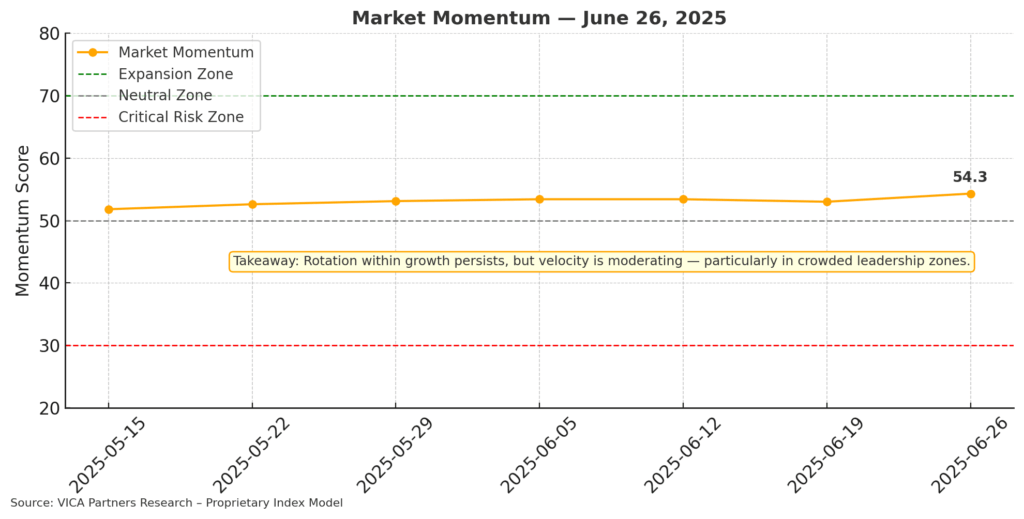

Market Momentum

🟩 Momentum Score: 54.3

VMSI Sub-Component – Momentum Line

Small caps and semis lead, though beta appetite is moderating. Discretionary flows remain steady.

Flow Signal:

Rotation within growth persists, but velocity is moderating — particularly in crowded leadership zones.

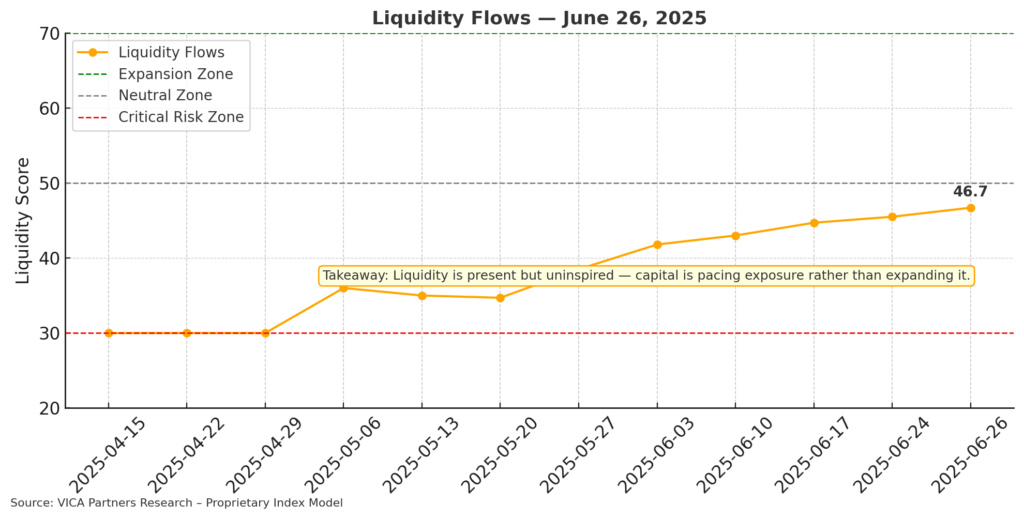

Liquidity Flows

🟨 Liquidity Score: 46.7

VMSI Sub-Component – Liquidity Line

IG and HY flows are steady, but not forceful. Treasury demand is mixed.

Allocation Cue:

Liquidity is present but uninspired — capital is pacing exposure rather than expanding it.

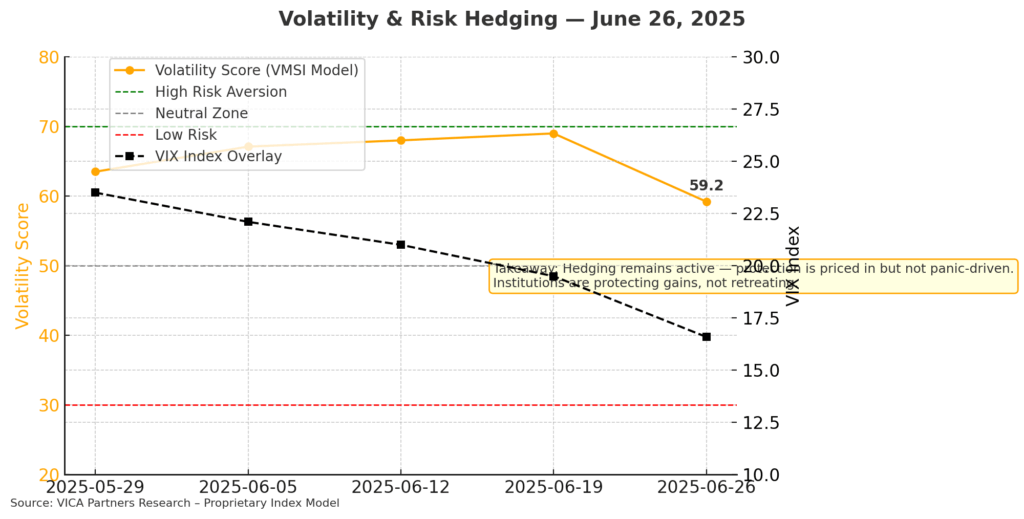

Volatility & Hedging

🟥 Volatility Score: 59.2 | VIX: 16.39

VMSI Sub-Component – Volatility & Hedging

MOVE at 91.24 has eased modestly.

Risk Pulse:

Hedging remains active — protection is priced in but not panic-driven. Institutions are protecting gains, not retreating.

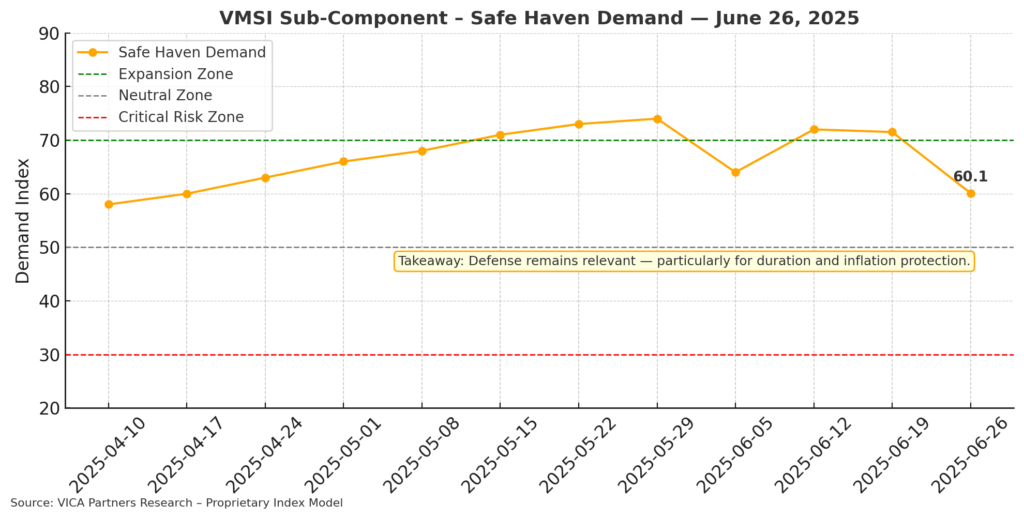

Safe Haven Demand

🟨 Safe Haven Score: 60.1

VMSI Sub-Component – Safe Haven Demand

Gold demand holds. Treasury demand lifted slightly in response to macro noise.

Capital Preference:

Defense remains relevant — particularly for duration and inflation protection.

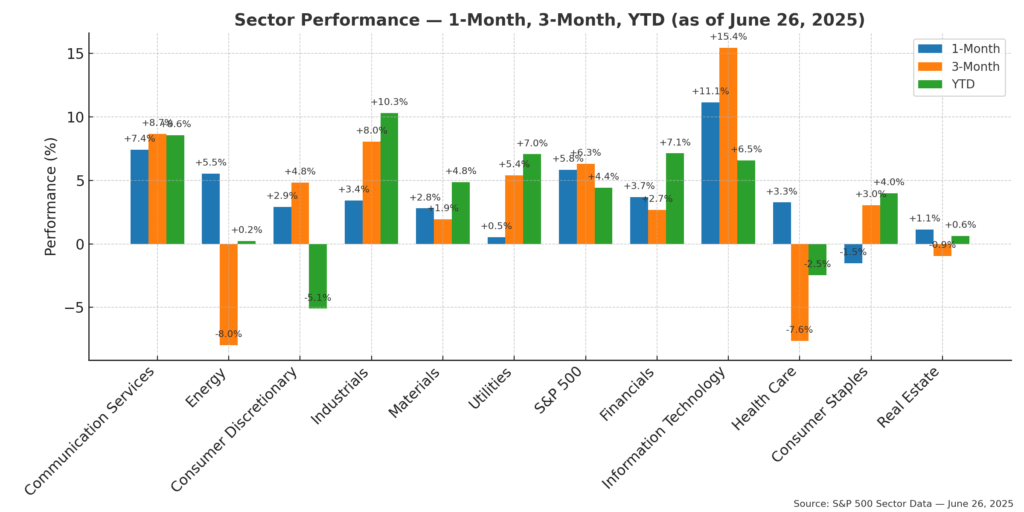

Sector Rotation View

Sector Performance — 1-Month, 3-Month, YTD — June 26, 2025

Solid rotation is emerging beneath the surface: June 26 data shows capital flowing steadily into cyclical leadership zones. Communication Services, Energy, and Industrials all posted >1 % daily gains, supported by strong 1- and 3-month performance trends. Consumer Discretionary and Financials also firmed.

Defensive sectors (Utilities, Health Care, Staples) are holding ground, but lag in relative strength. Real Estate turned red, suggesting select trimming.

Rotation Signal: Institutions are shifting weight into early-cycle and growth-sensitive sectors while maintaining ballast in duration and staples. Breadth is widening — a constructive backdrop if macro stability holds.

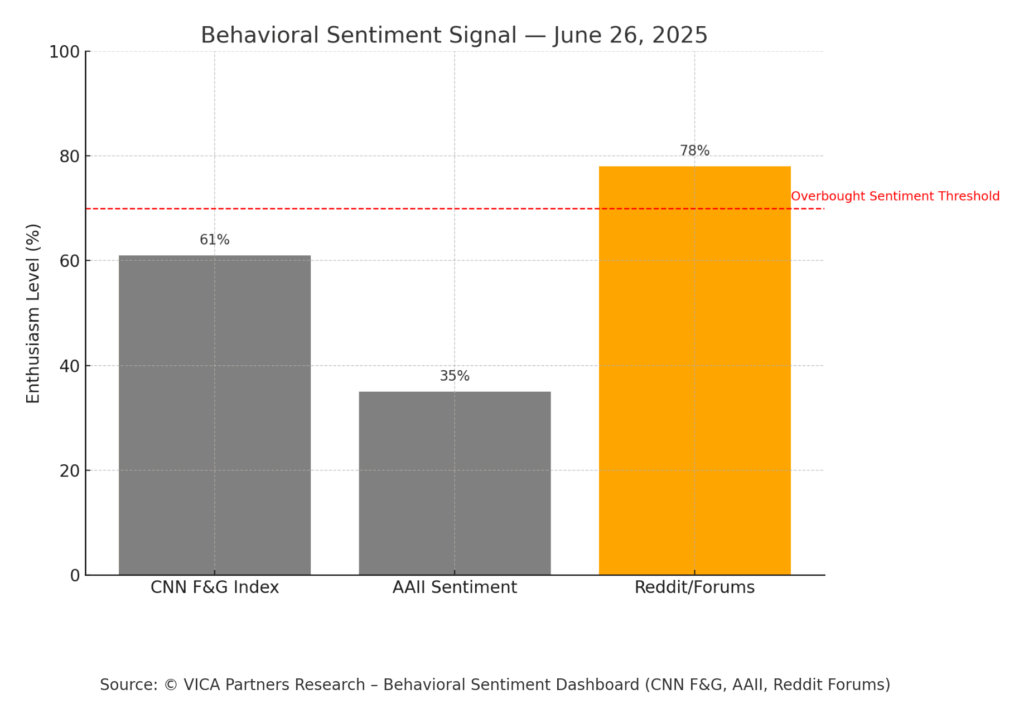

Sentiment Divergence

Behavioral Sentiment Signal

Retail euphoria persists despite macro caution. Institutions diverge with calculated flows.

Behavioral Read:

Risk of behavioral dislocation is rising. Institutions show signs of portfolio stress-testing.

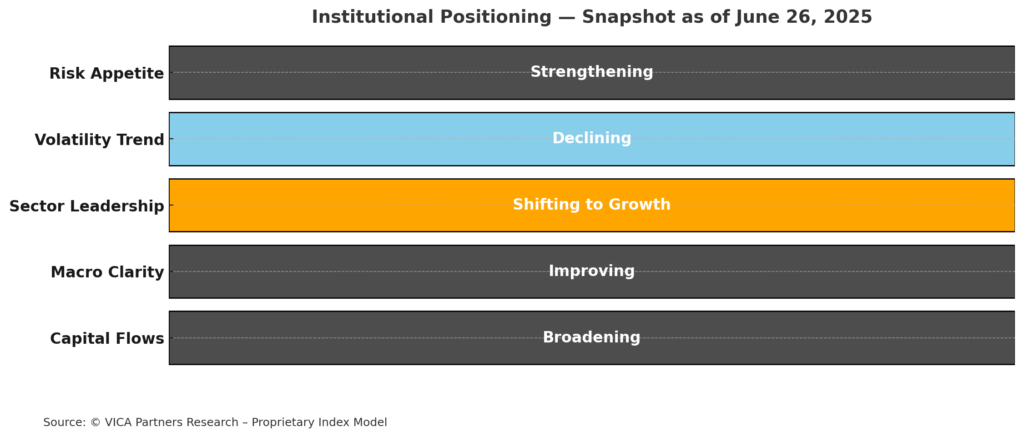

Institutional Positioning Grid – June 26, 2025

Institutional Positioning Table

Tactical Read:

Institutions remain engaged, but posture tilts toward vigilance over expansion.

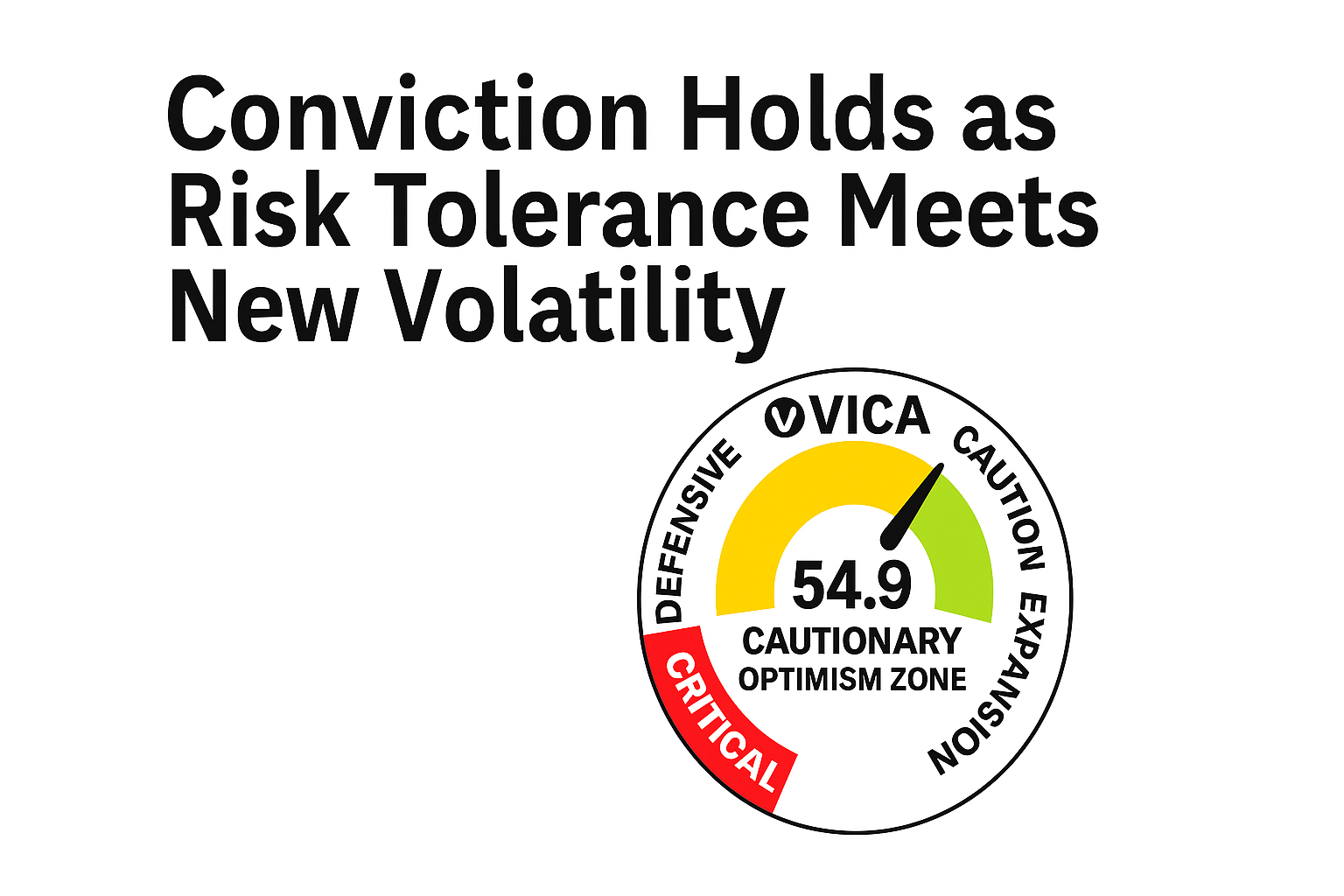

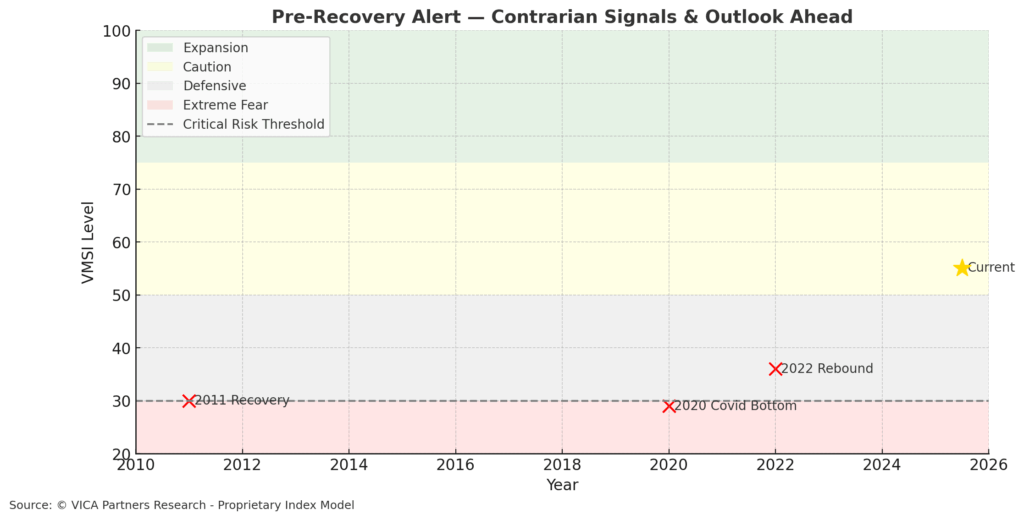

Historical Recovery Zone

Recovery Overlay – 2011, 2020, 2025

Current score band aligns with past re-risking inflection zones — echoing 2011 and early 2020.

Historical Echo:

Momentum often pauses within this range before major shifts. The next 1–2 weeks may be pivotal.

Predictive Outlook – What Comes Next

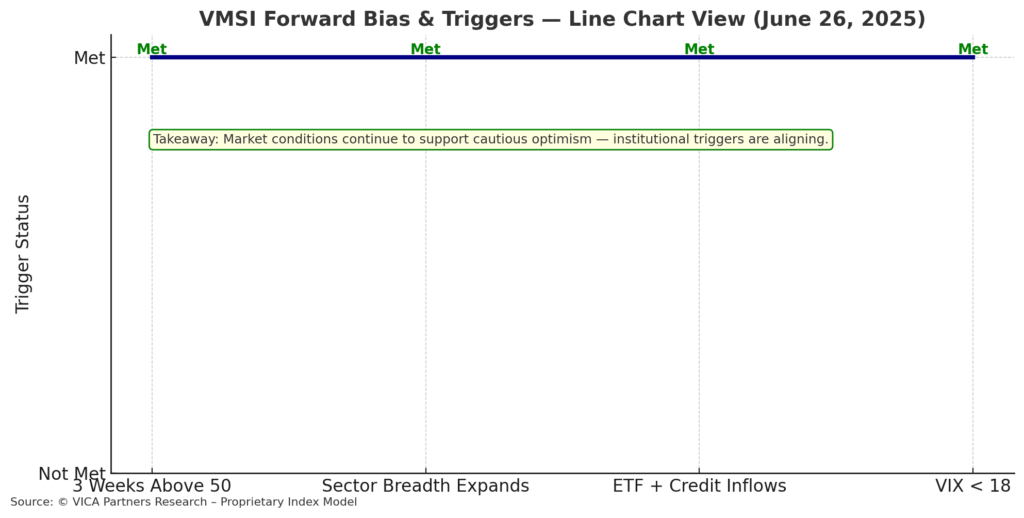

VMSI Forward Bias & Triggers – Updated for June 26, 2025

Market signals are shifting toward moderate confidence. Volatility has eased, with the VIX now firmly under the 21.5 trigger, signaling near-term calm. Institutions remain active, yet selective — watching for confirming signals in credit spreads and sector breadth.

Forward Bias: Positioning is expected to remain cautiously engaged. With volatility receding, allocators have room to expand exposure — if macro shocks remain muted.

Key Triggers to Monitor:

- ✅ VIX < 18 now confirmed

- SOXX / VTWO relative strength stability

- HY credit trend resilience

- Broader sector breadth improvement

Base Case (70%): Institutions maintain tactical engagement. Momentum spreads into cyclicals if macro clarity improves. Alternate Case (30%): Surprise inflation or geopolitical catalyst prompts sudden hedging or pause in rotation.

About VMSI

The VICA Market Sentiment Index (VMSI©) is a proprietary signal tracking institutional capital flow, hedging posture, and sentiment alignment. Designed to guide portfolio-level decisions with clarity and discipline.

Index Scale:

- 🔴 0–25: Critical Risk

- 🟠 26–49: Defensive

- 🟡 50–74: Cautionary Optimism

- 🟢 75–100: Expansion / High Conviction

This report and VMSI© are proprietary to VICA Partners. Unauthorized reproduction prohibited.

A portion of proceeds supports global technical education in finance, engineering, and data science.

Disclaimer:

This report is for informational purposes only and does not constitute investment advice, an offer to sell, or a solicitation to buy any security. VICA Partners makes no guarantees regarding the accuracy or completeness of the data. Market conditions may change, and VMSI metrics should not be the sole basis for investment decisions. Consult a qualified advisor before making financial choices.