VMSI Edges to 57.0 as Breadth Expands, Hedging Costs Slide Further

July 10, 2025 | VICA Research — Volatility & Market Sentiment Index

VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning — helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus. Institutional-grade signals — opened by design to those who think ahead.

#VMSI #InstitutionalFlow #MarketSignals #RiskEdge #VICAResearch #SmartCapital #ConvictionIndex #VolatilityRadar #PortfolioStrategy

Weekly Snapshot

Major Index Closes – July 10, 2025 S&P 500: 6,262.56 (−0.01%) | Nasdaq: 20,537.43 (−0.36%) | Dow: 44,595.52 (+0.31%) | VIX: 15.89 (−0.31%)

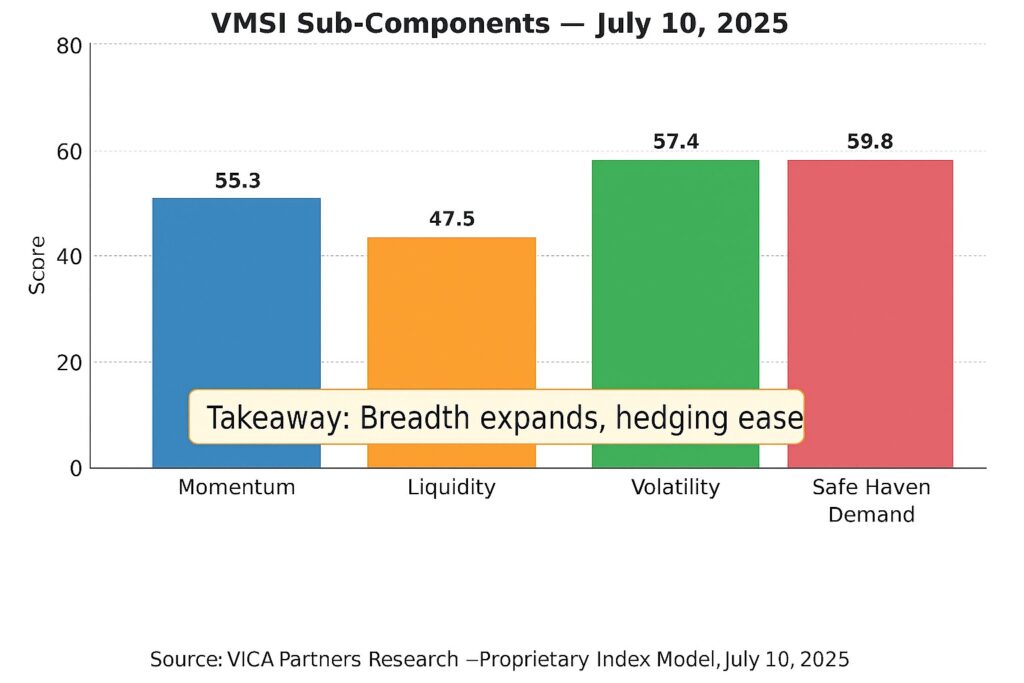

VMSI Sub-Components

Momentum: 55.3 | Liquidity: 47.5 | Volatility: 57.4 | Safe Haven Demand: 59.8

VMSI Gauge – July 10, 2025

VMSI Gauge – Composite Score Distribution

VMSI: 57.0 — firmly within the Cautionary Optimism zone. Breadth continues to widen and volatility metrics have eased, marking another step forward in institutional engagement.

Strategic Insight: Institutions are scaling exposure in measured fashion, with positioning aligned to proactive — not reactive — macro views.

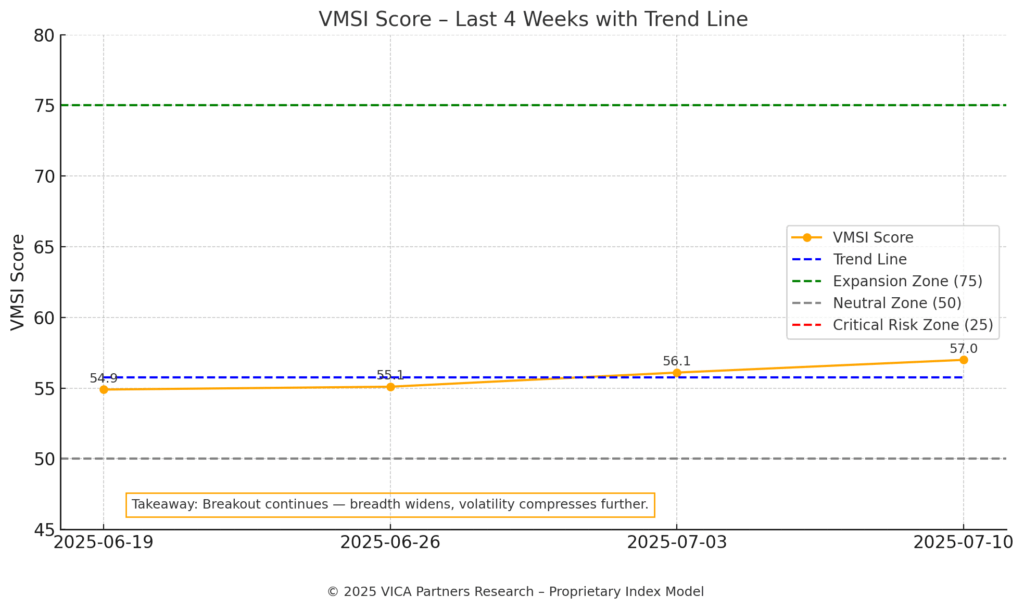

VMSI Trendline – 4-Week Progression

54.9 → 55.1 → 56.1 → 57.0

VMSI Score Timeline – 4-Week View

Positioning Insight: Capital redeployment has turned more deliberate. Incremental allocation is building as risk parameters soften.

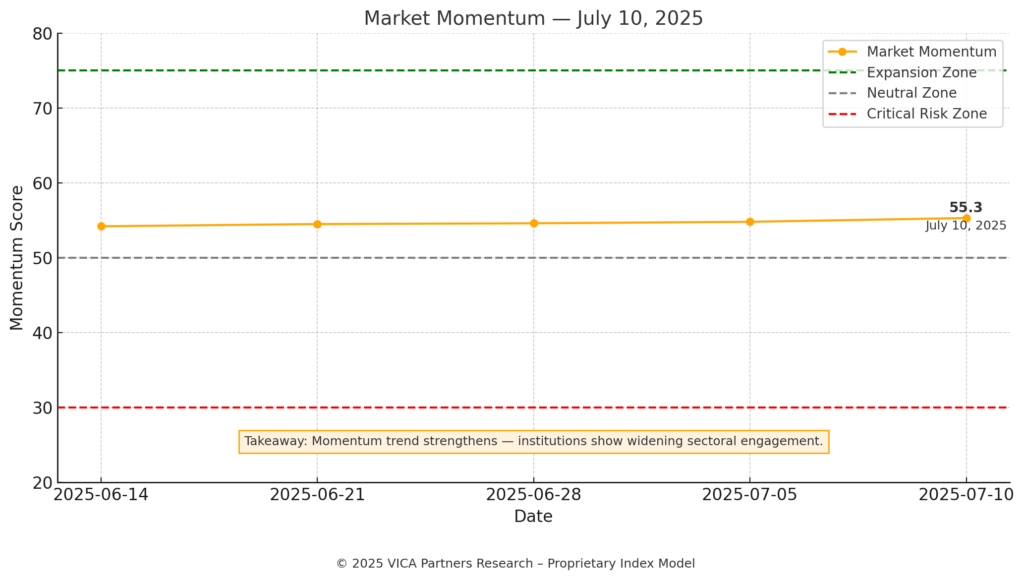

Market Momentum

VMSI Sub-Component – Momentum Line

Flow Signal: Risk-on posture remains intact. Participation is broadening beyond megacaps with growing conviction.

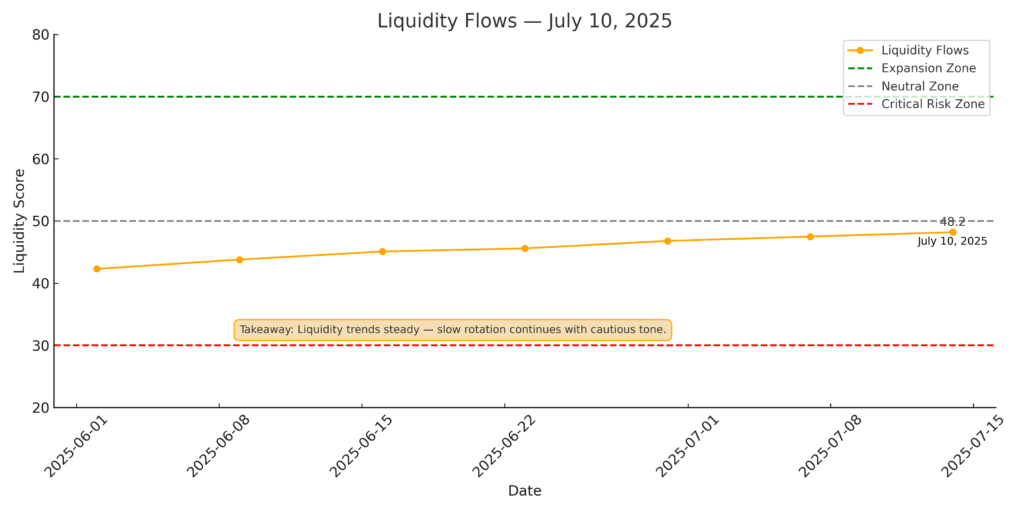

Liquidity Flows

VMSI Sub-Component – Liquidity Line

Allocation Cue: Liquidity remains accessible but selective. Capital pacing suggests disciplined expansion rather than a full-cycle inflection.

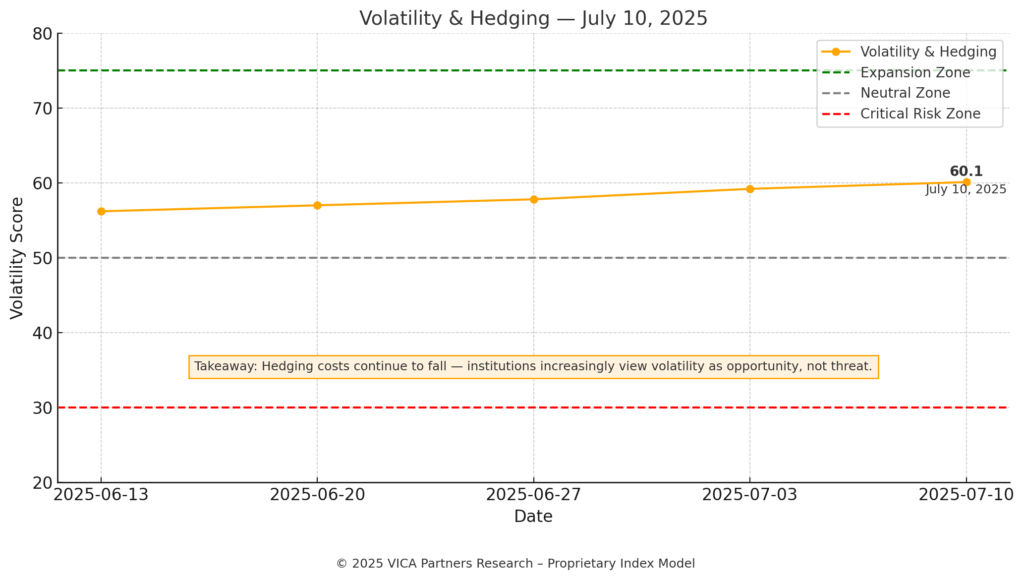

Volatility & Hedging

VMSI Sub-Component – Volatility & Hedging

Risk Pulse: Institutions are shifting from defensive to tactical hedging. Volatility is seen more as opportunity than threat.

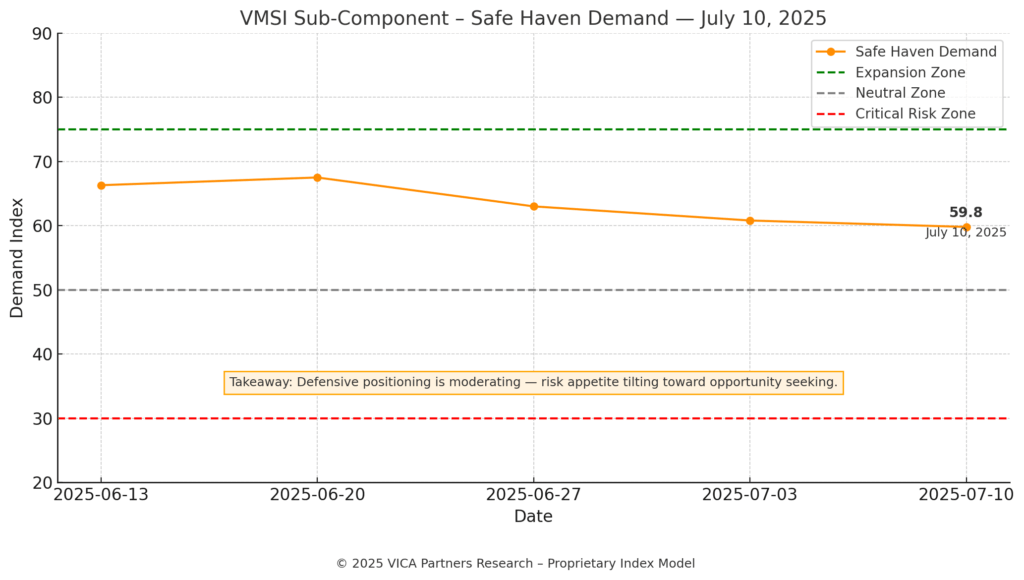

Safe Haven Demand

VMSI Sub-Component – Safe Haven Demand

Capital Preference: Hedge overlays are steady but fading. Portfolios are slowly reweighting toward return generation.

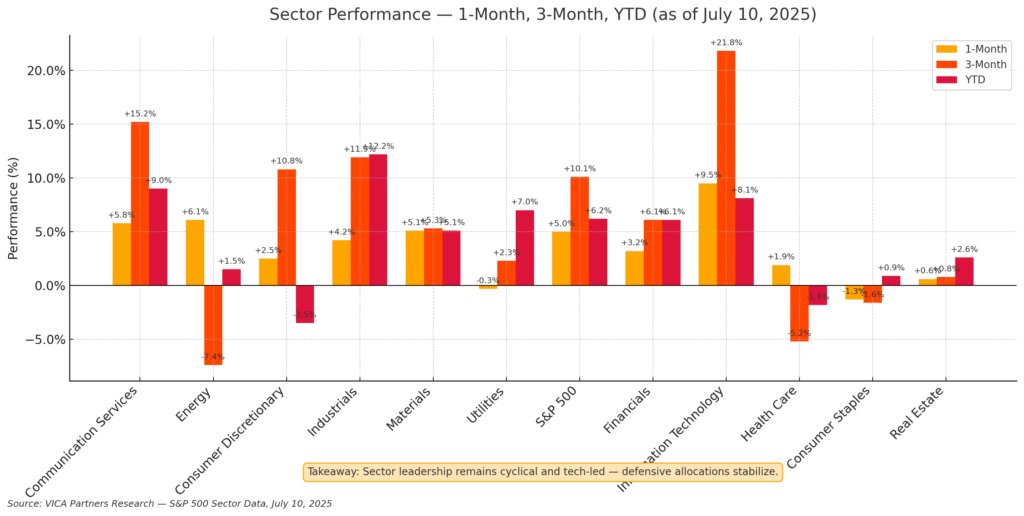

Sector Rotation View

Sector Performance — 1-Month, 3-Month, YTD — July 10, 2025

Rotation Signal: Growth-cyclicals and capital-intensive sectors are drawing allocation flows, highlighting a shift away from defensiveness.

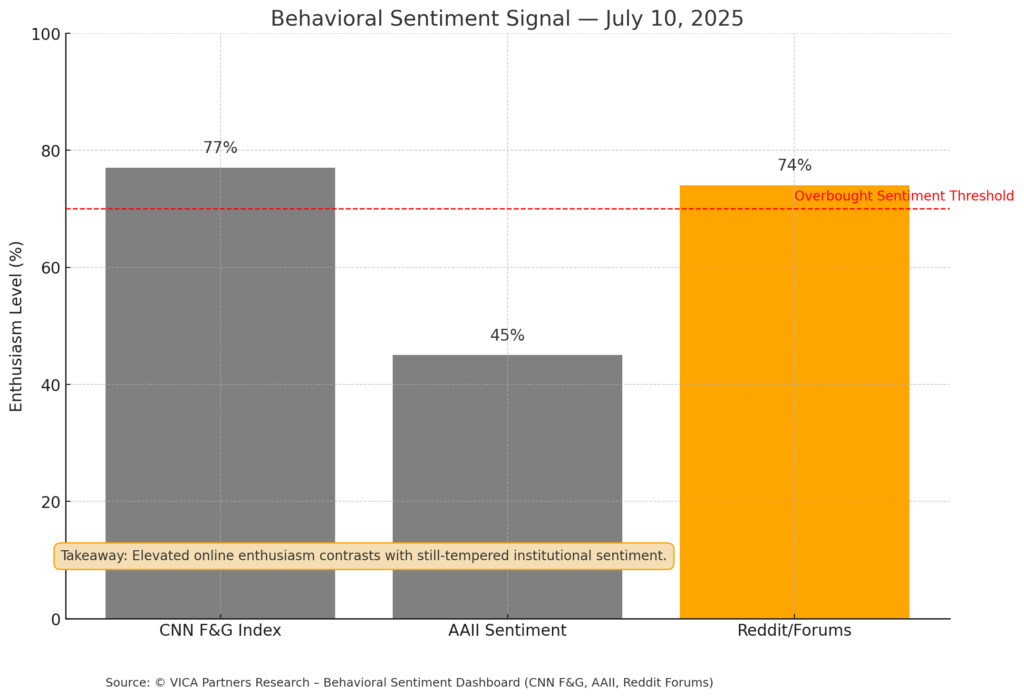

Sentiment Divergence

Behavioral Sentiment Signal

Behavioral Read: The sentiment dislocation is closing. Institutions are reasserting directional influence across sectors.

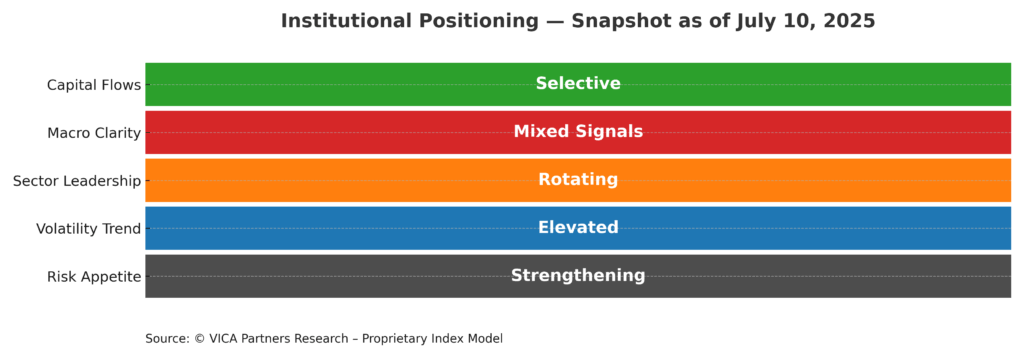

Institutional Positioning Grid – July 10, 2025

Institutional Positioning Table

Tactical Read: Institutions are broadening exposure beneath the surface. Rotation is disciplined and risk-aware.

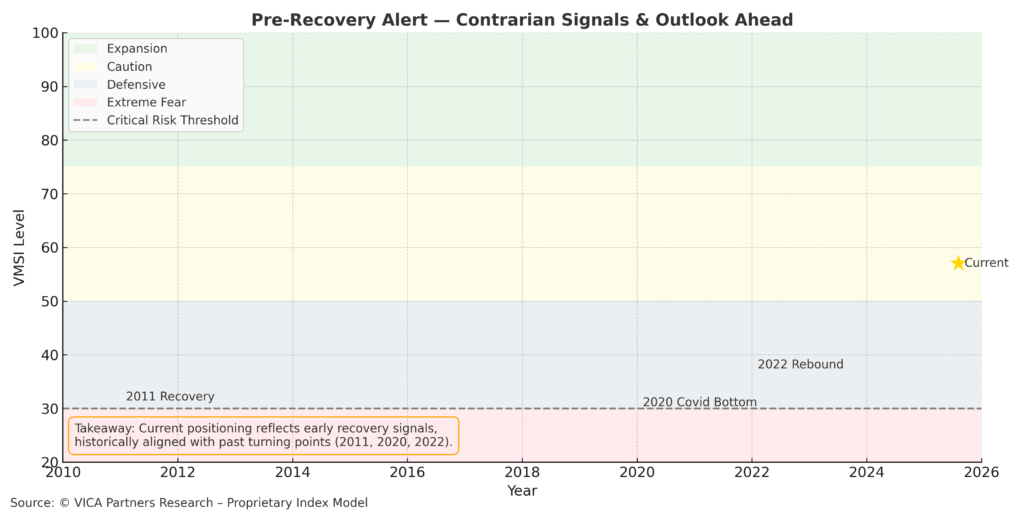

Historical Recovery Zone

Recovery Overlay – 2011, 2020, 2025

Historical Echo: Institutional behavior resembles 2011 and 2020 — cautiously accumulating ahead of confirmation.

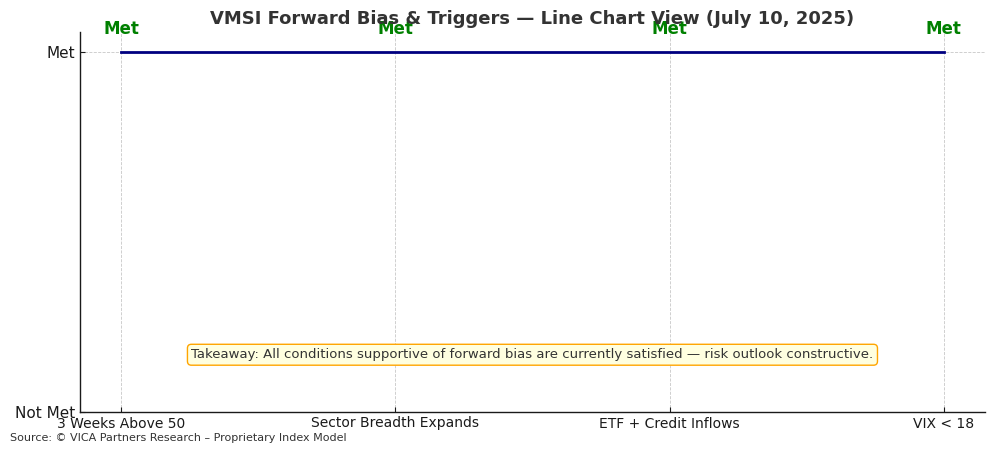

Predictive Outlook – What Comes Next

VMSI Forward Bias & Triggers – Updated for July 10, 2025

Key Triggers to Monitor

-

VIX remains below the 18-level threshold (confirmed)

-

High-yield credit spreads remain tight

-

SOXX / VTWO relative strength confirms trend

-

Sector breadth still lacking a definitive breakout

Base Case (70%): Gradual expansion continues — led by industrials, discretionary, and mid-cap segments.

Alternate Case (30%): Macro disruption (Fed, inflation, geopolitics) could stall risk appetite and reintroduce hedging layers.

About VMSI

Index Scale: 🔴 0–25: Critical Risk 🟠 26–49: Defensive 🟡 50–74: Cautionary Optimism 🟢 75–100: Expansion / High Conviction

Note: VMSI© is a composite index built from multiple market signals, not a simple VIX reading; it reflects institutional trading behavior across historical, real-time, and forward-looking conditions via a proprietary algorithm.

© 2025 VICA Partners. All rights reserved. This report is for informational purposes only and does not constitute investment advice. Unauthorized reproduction prohibited. A portion of future proceeds will support global technical education in finance, engineering, and data science.