VMSI Edges to 57.4 as Breadth Firms, Tactical Hedging Further Fades, July 17, 2025 | VICA Research — Volatility & Market Sentiment Index

VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning — helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus.

Institutional-grade signals — opened by design to those who think ahead.

#VMSI #InstitutionalFlow #MarketSignals #RiskEdge #VICAResearch #SmartCapital #ConvictionIndex #VolatilityRadar #PortfolioStrategy

Weekly Snapshot

Major Index Closes — July 17, 2025

S&P 500: +0.54% | Nasdaq: +0.75% | Dow: +0.52% | VIX: −3.73%

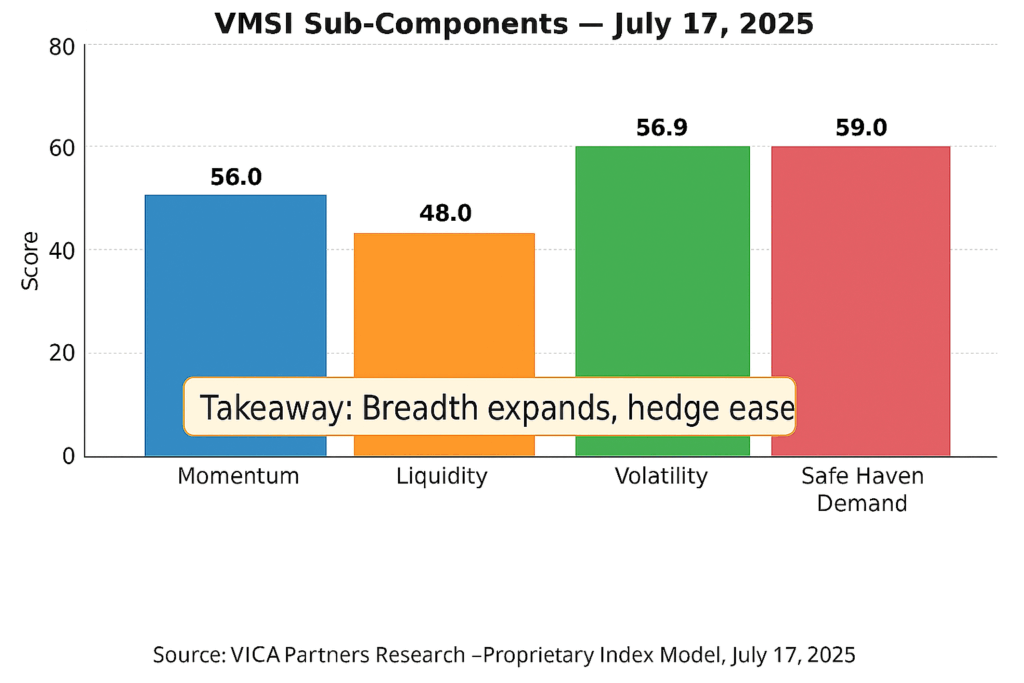

VMSI Sub-Components

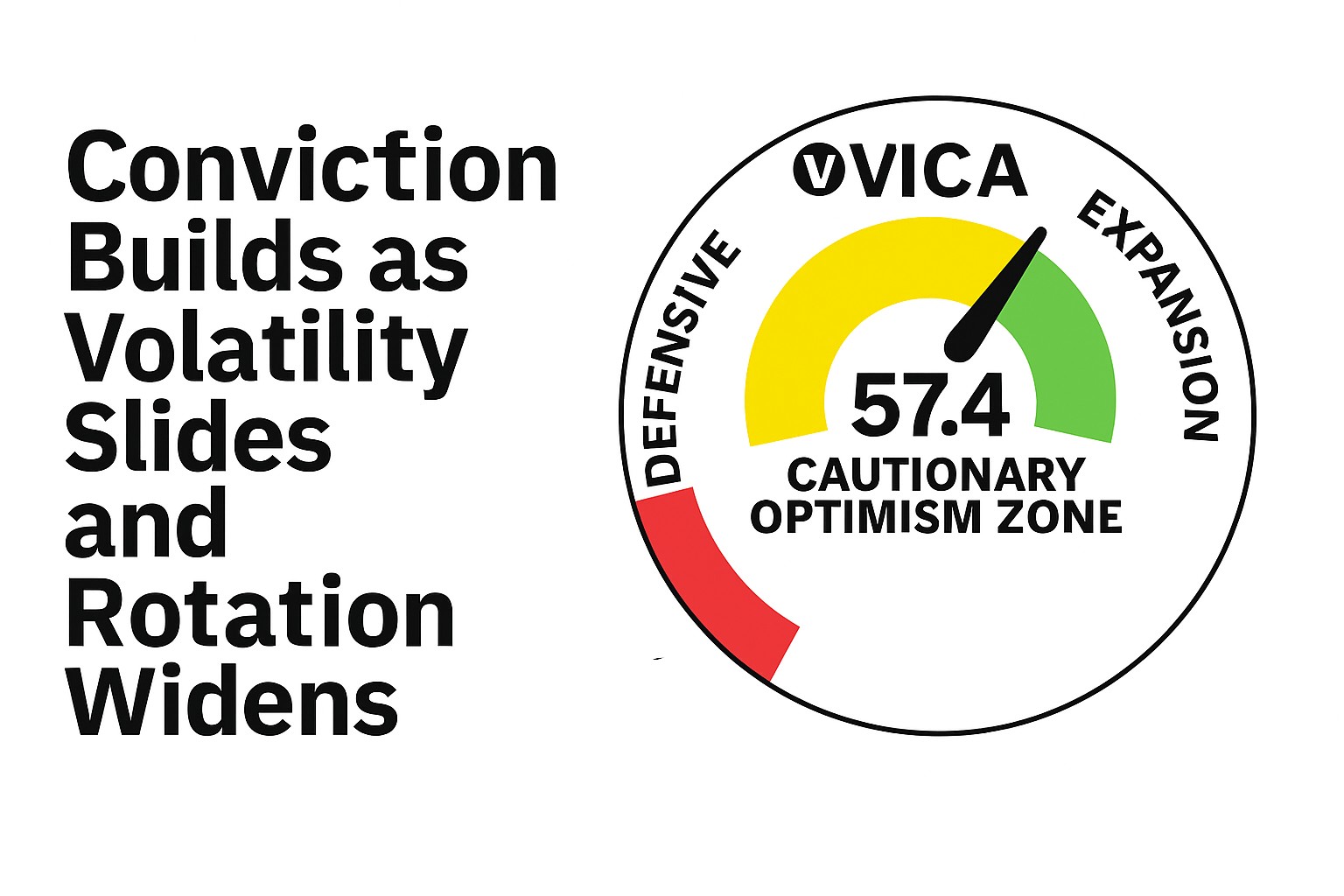

VMSI Gauge – July 17, 2025

VMSI Gauge – Composite Score Distribution

VMSI: 57.4 — firmly within the Cautionary Optimism zone.

Volatility compression continues while positioning is steadily expanding across cyclical sectors.

Strategic Insight: Institutions remain in control of the rotation, increasingly confident in re-risking with risk-adjusted exposure. Hedging activity is now tactical and opportunistic, not defensive.

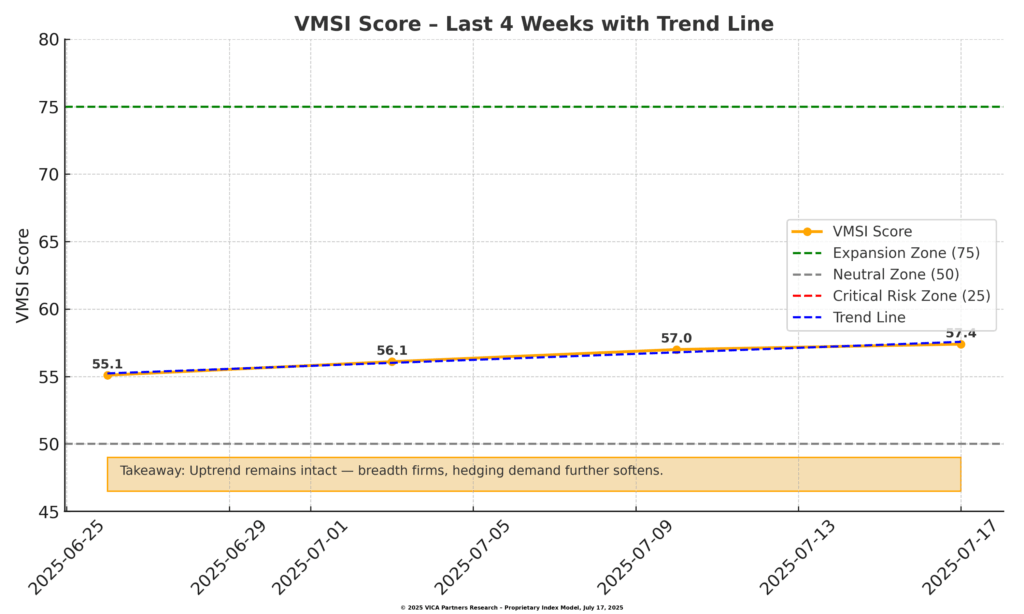

VMSI Trendline – 4-Week Progression

55.1 → 56.1 → 57.0 → 57.4

VMSI Score Timeline – 4-Week View

Positioning Insight: Capital deployment remains deliberate and broad-based. Momentum is spreading beyond tech into industrials and discretionary names.

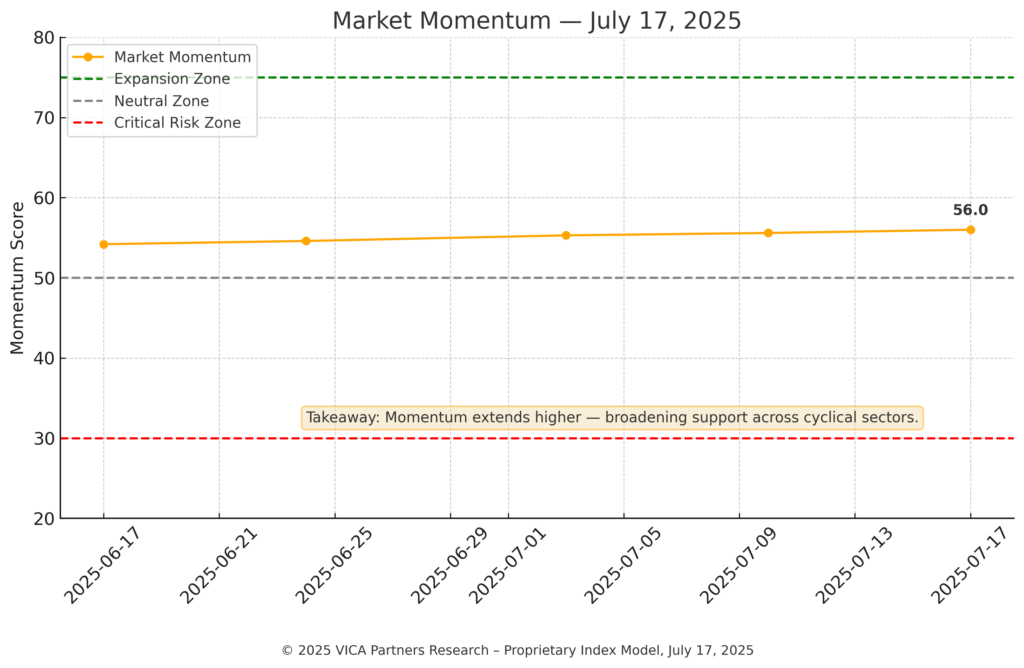

Market Momentum

VMSI Sub-Component – Momentum Line

Flow Signal: Leadership has expanded to cyclical groups, with increased mid-cap and equal-weight participation. Risk-on posture has matured — no longer chasing, but reinforcing strength.

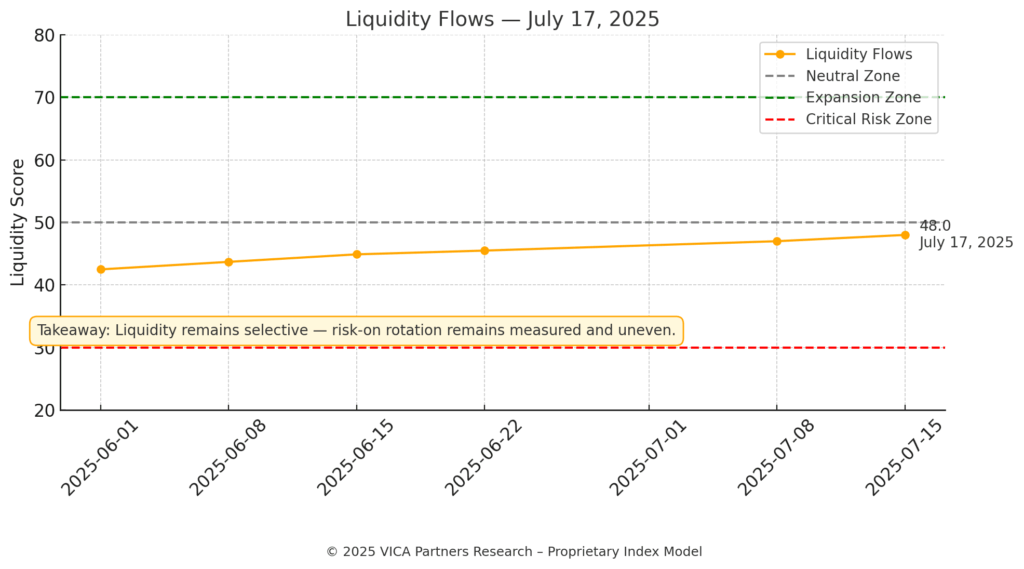

Liquidity Flows

VMSI Sub-Component – Liquidity Line

Allocation Cue: Liquidity flows remain disciplined. High-yield spreads are still tight, but fund flows suggest selectivity rather than acceleration.

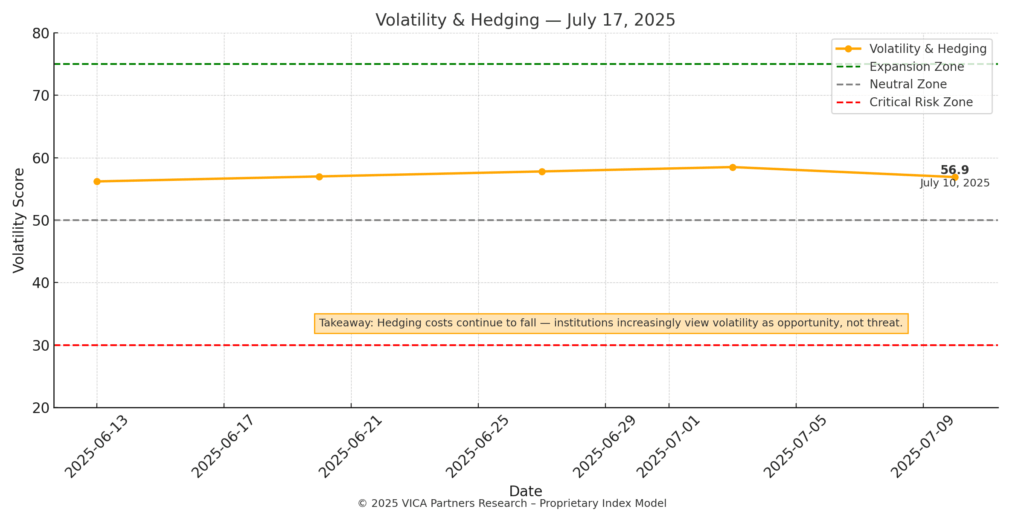

Volatility & Hedging

VMSI Sub-Component – Volatility & Hedging

Risk Pulse: Hedging costs are at multi-month lows. Downside overlays remain in place but are no longer increasing — consistent with stabilizing risk appetite.

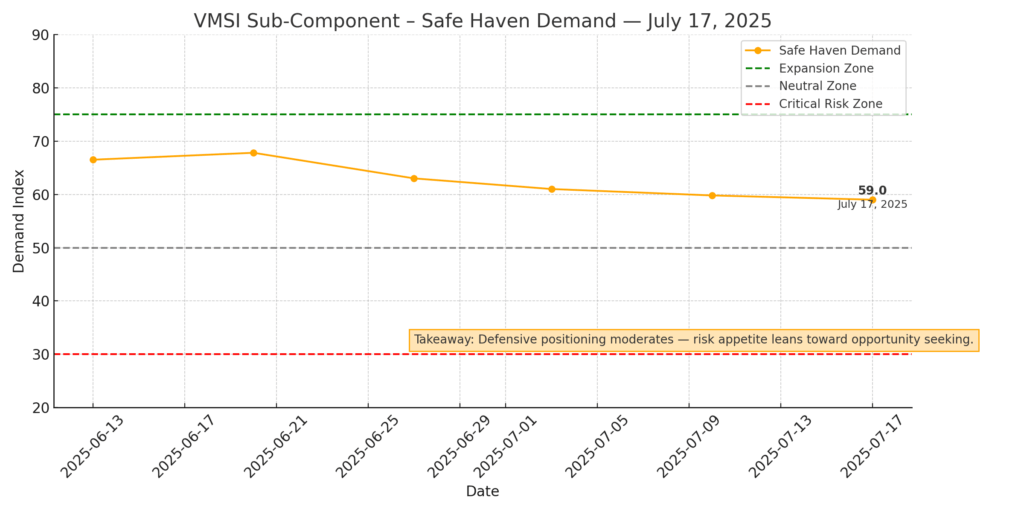

Safe Haven Demand

VMSI Sub-Component – Safe Haven Demand

Capital Preference: TIPs and duration products remain flat; gold flows have eased. Institutions are holding defensive sleeves steady but clearly favoring return-seeking risk.

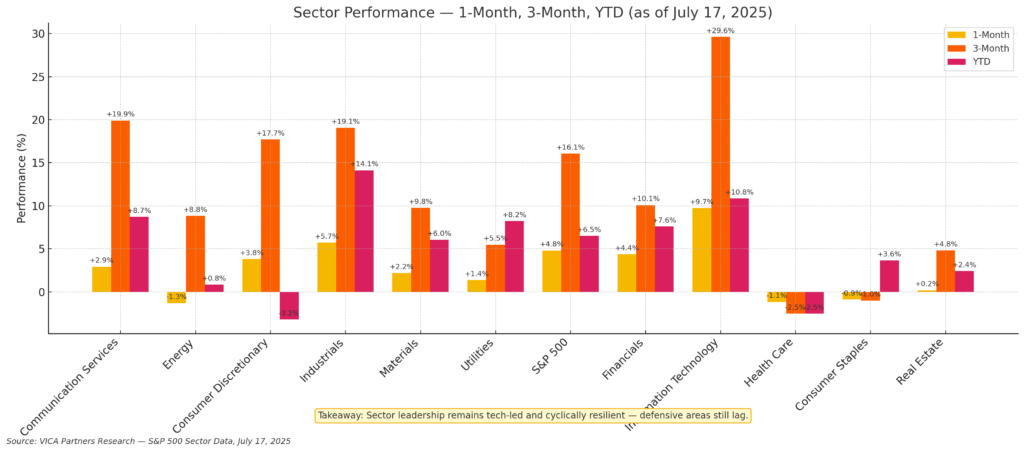

Sector Rotation View

Sector Performance — 1-Month, 3-Month, YTD — July 17, 2025

Rotation Signal: Capital continues to shift into capital goods, semis, and financials. Energy and defensives lag. Equal-weight indices outperforming top-heavy peers.

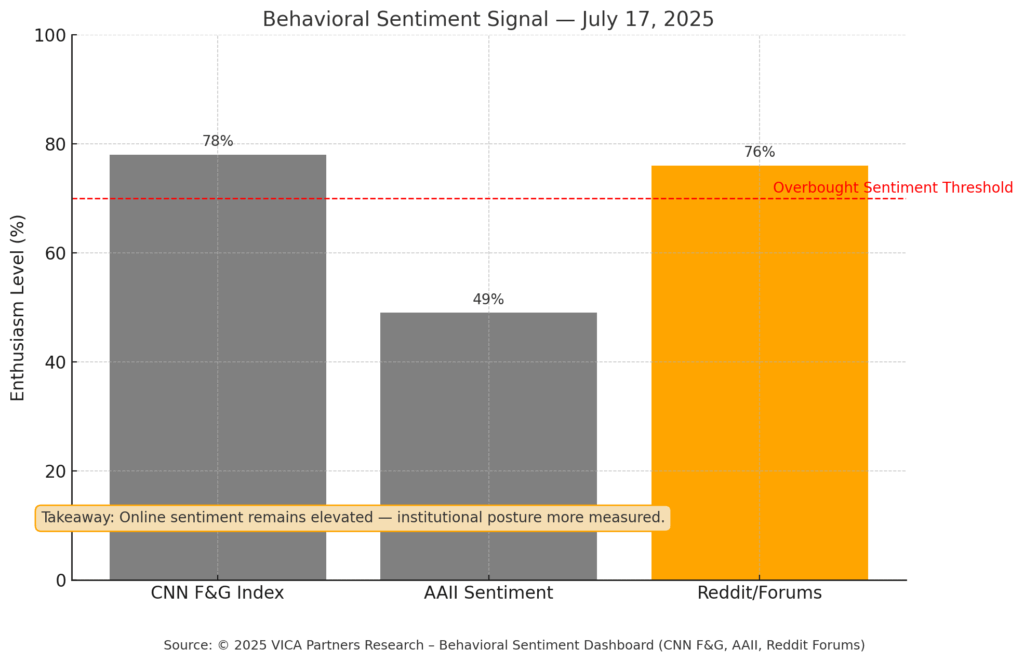

Sentiment Divergence

Behavioral Sentiment Signal

Behavioral Read: Retail exuberance remains high, but institutional positioning is grounded and rotational. Smart money is pacing moves with improving macro clarity.

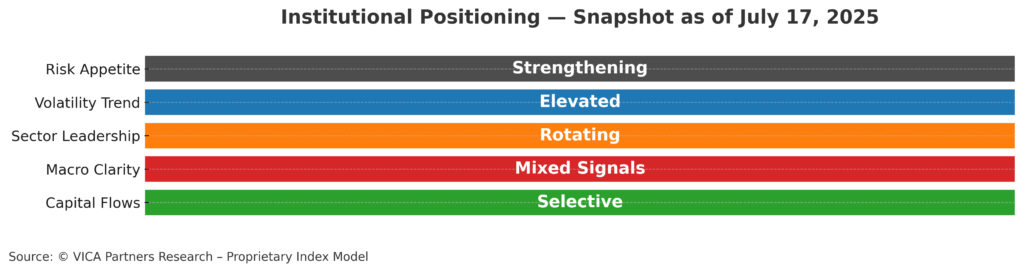

Institutional Positioning Grid – July 17, 2025

Institutional Positioning Table

Tactical Read: Portfolio posture is extending into mid- and small-caps. Institutions are leaning into rotation — risk-aware, but no longer hesitating.

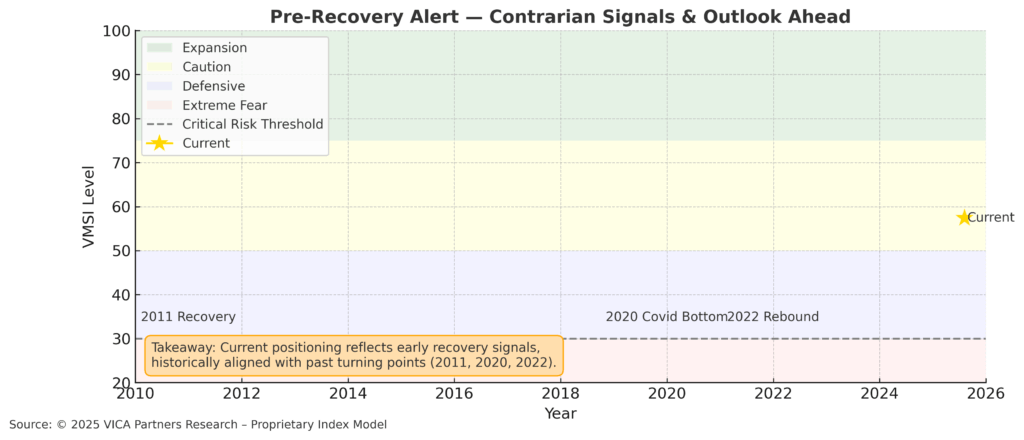

Historical Recovery Zone

Recovery Overlay – 2011, 2020, 2025

Historical Echo: The current band resembles prior “confirmation zones” — VMSI suggests a rising probability of full-cycle expansion ahead.

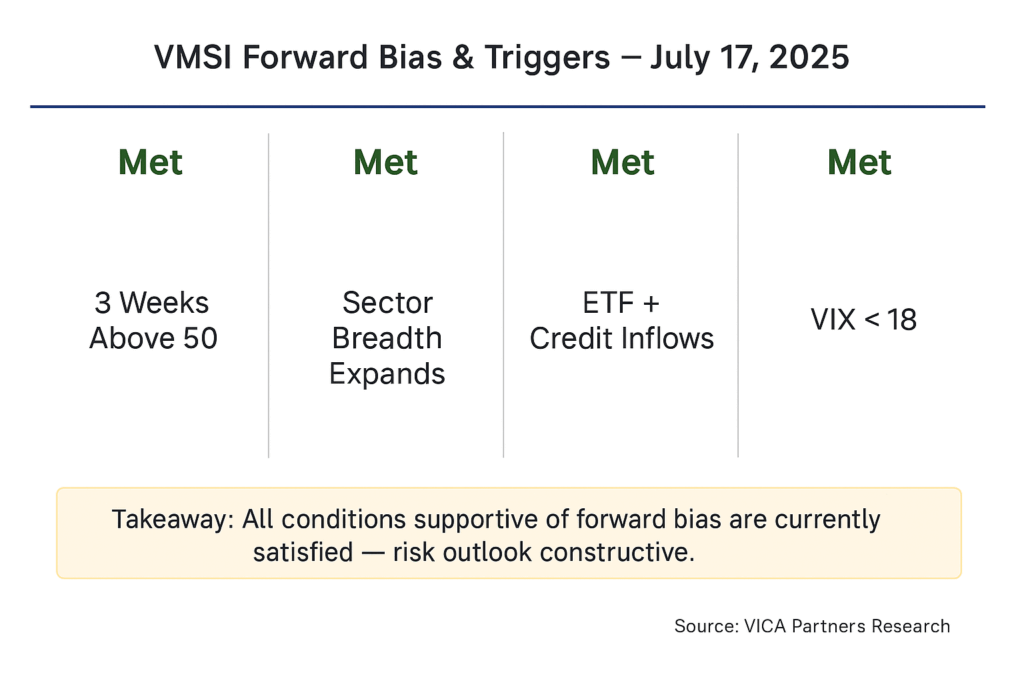

Predictive Outlook – What Comes Next

VMSI Forward Bias & Triggers – Updated for July 17, 2025

Key Triggers to Monitor

- VIX remains below the 18-level threshold (confirmed)

- High-yield credit spreads remain tight

- SOXX / VTWO relative strength confirms trend

- Sector breadth still lacking a definitive breakout

Base Case (70%): Institutions continue extending exposure into cyclicals with tactical hedging overlays. Alternate Case (30%): Macro stressors (Fed misstep, inflation, geopolitics) could reintroduce downside hedges short-term.

About VMSI

Index Scale:

🔴 0–25: Critical Risk

🟠 26–49: Defensive

🟡 50–74: Cautionary Optimism

🟢 75–100: Expansion / High Conviction

Note: VMSI© is a composite index built from multiple market signals, not a simple VIX reading; it reflects institutional trading behavior across historical, real-time, and forward-looking conditions via a proprietary algorithm.

© 2025 VICA Partners. All rights reserved.

This report is for informational purposes only and does not constitute investment advice. Unauthorized reproduction prohibited. A portion of proceeds supports global technical education in finance, engineering, and data science.