June 12, 2025 | VICA Research — Volatility & Momentum Signal Index

VICA Partners Research’s VMSI © tracks how institutional capital is repositioning — delivering signalover sentiment for portfolio decision-makers navigating risk, flow, and macro regime shifts.

VMSI Holds at 55.2 as Capital Broadens Re-Risking Footprint

Weekly Snapshot

Major Index Closes – June 12, 2025:

🟢 S&P 500: 6,017.46 (-0.08%) | 🟢 Nasdaq: 19,582.87 (-0.17%) | 🟢 Dow: 42,722.00 (-0.34%) | 🔴 VIX: 17.86 (+0.60)

VMSI Sub-Components:

🟢 Momentum: 53.4 | 🟡 Liquidity: 45.1 | 🟡 Volatility: 58.5 | 🟡 Safe Haven Demand: 61.2

VMSI Gauge – June 12, 2025

VMSI Gauge – Composite Score Distribution]

The VMSI settled at 55.2, holding steady in the Cautionary Optimism Zone. The re-risking trend remains intact, though momentum is flattening.

Strategic Insight: Institutions are sustaining their shift toward deliberate exposure — conviction is stable, yet calculated.

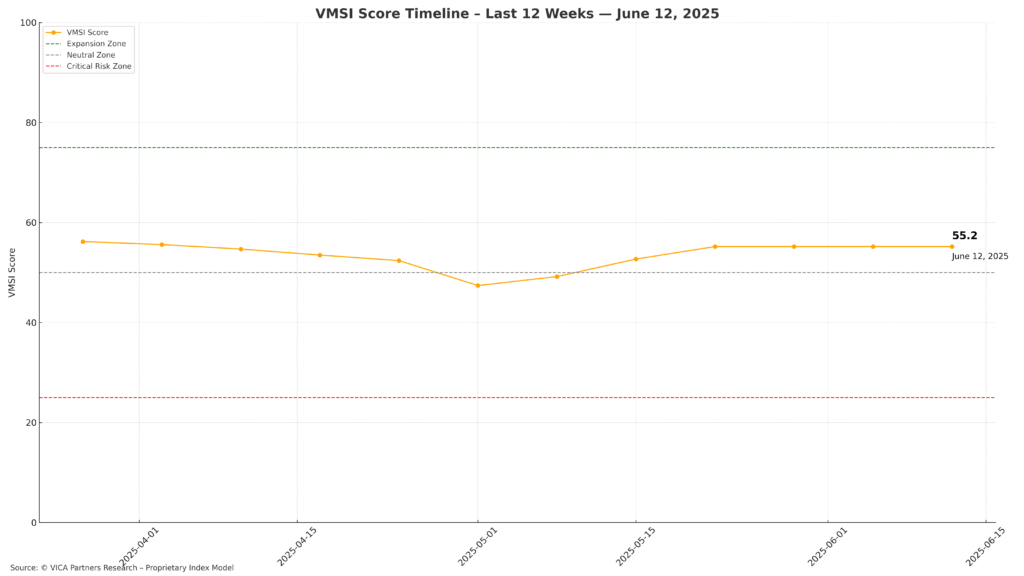

VMSI Trendline – 4-Week Progression

47.4 → 49.2 → 52.7 → 55.2

VMSI Score Timeline – 12-Week View]

The fourth consecutive week above 50 reinforces institutional re-engagement. The pace of ascent is moderating slightly, but the directional trend remains constructive.

Positioning Insight: The capital base is staying in motion — allocators are progressively widening exposure across sectors, without overextension.

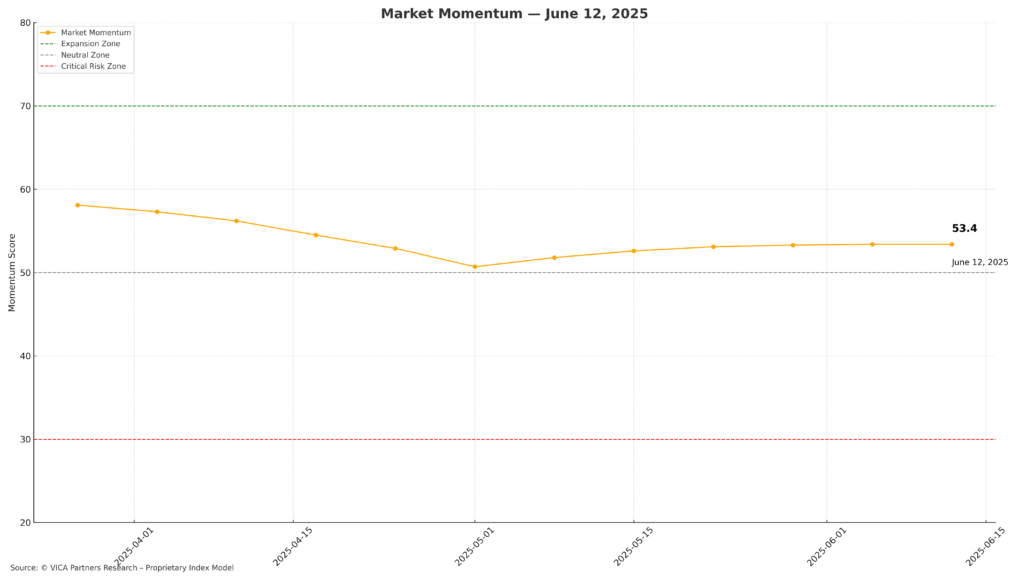

Market Momentum

Momentum Score: 53.4

VMSI Sub-Component Scores – Momentum Line]

Semiconductors (SOXX) maintain leadership. Small caps (VTWO) and discretionary sectors are catching rotation flow.

Flow Signal: Accumulation continues — breadth is firming, led by cyclical beta and tech.

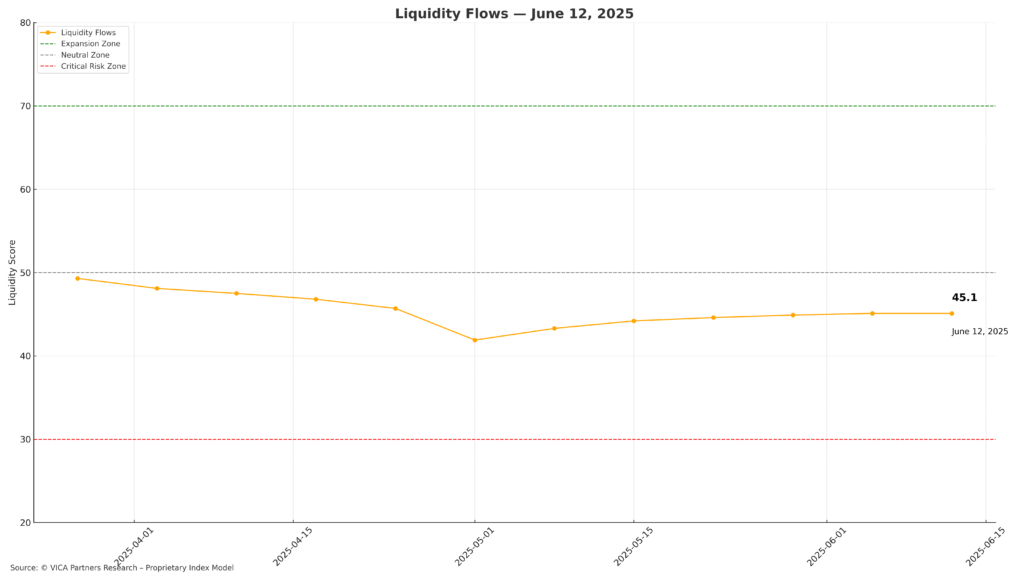

Liquidity Flows

VMSI Sub-Component Scores – Liquidity Line

Liquidity Score: 45.1

LQD and HYG flows are positive but unspectacular. Treasury yield softening points to stable demand.

Allocation Cue: Institutions are allocating gradually — capital is present, but not flooding in.

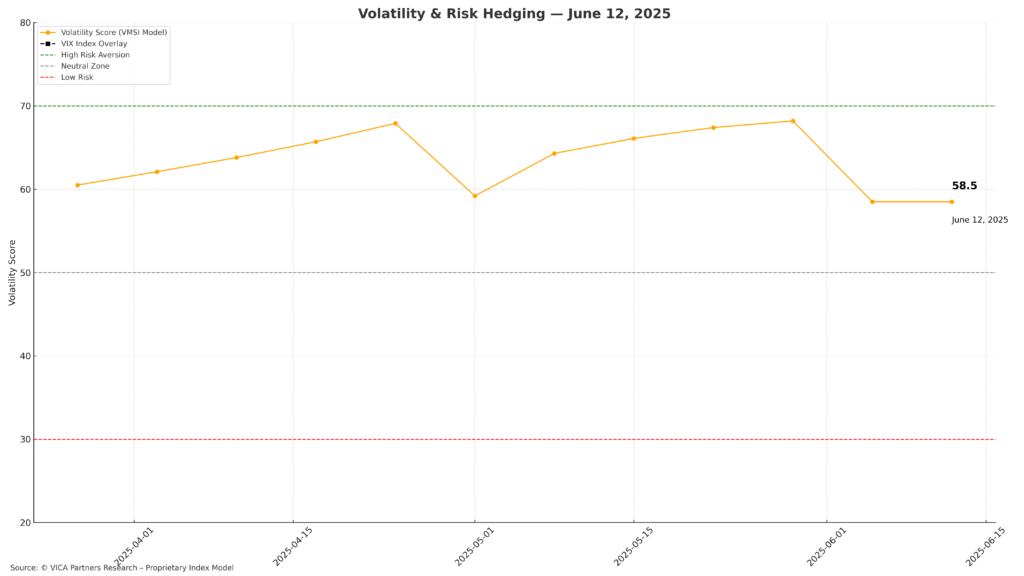

Volatility & Hedging

VMSI Sub-Component Scores – Volatility & Hedging

Volatility Score: 58.5 | VIX: 17.86

MOVE Index drops below 90 while VIX holds under 18. Hedging activity is rolling off gradually.

Risk Pulse: Institutions are pricing in calm — risk is being absorbed tactically.

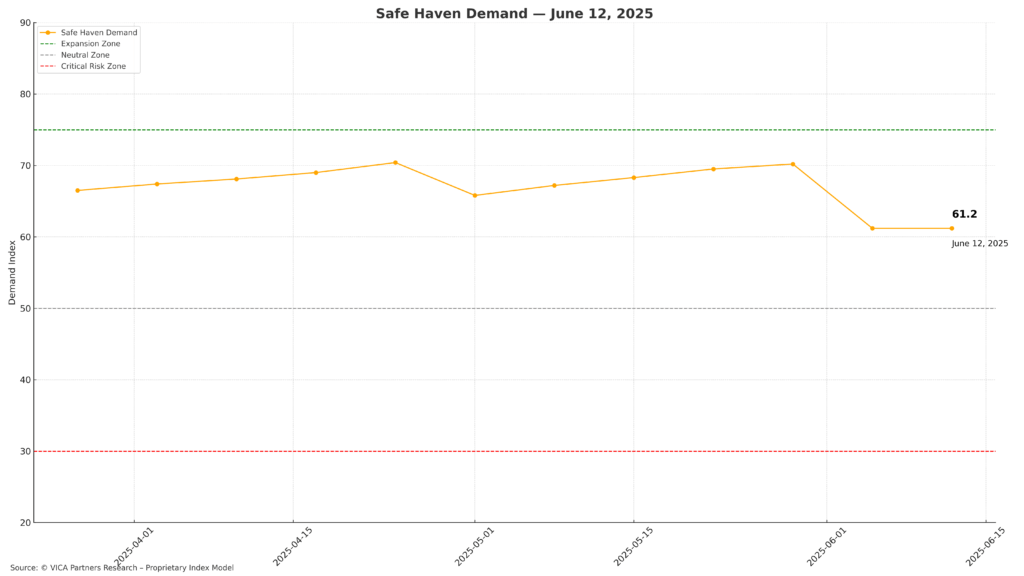

Safe Haven Demand

VMSI Sub-Component Scores – Safe Haven Demand

Safe Haven Score: 61.2

GLD continues to attract capital. Treasury demand is easing but remains firm relative to risk.

Capital Preference: Allocators are maintaining exposure to defensive yield, while exploring risk-linked carry.

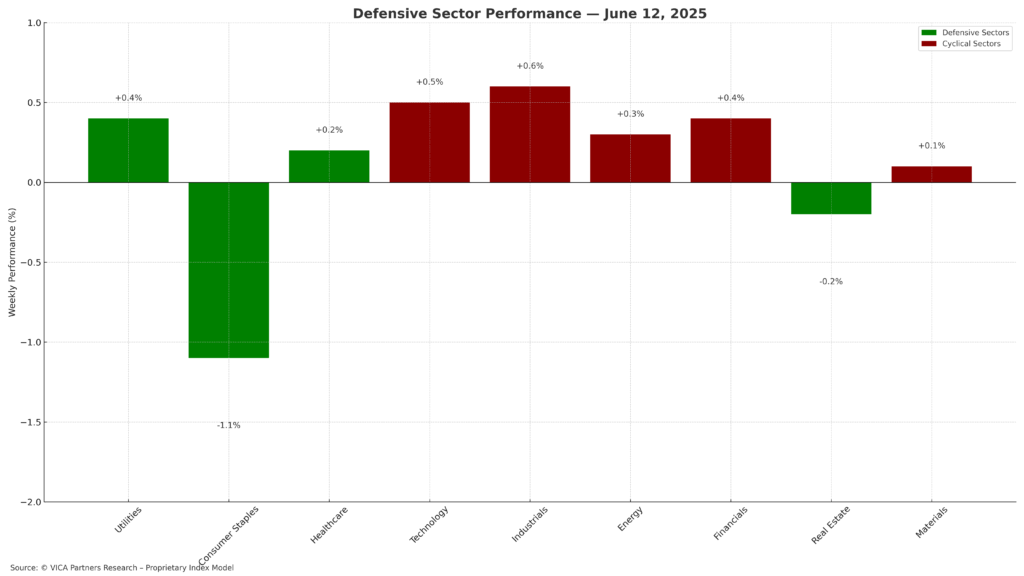

Sector Rotation View

Defensive Sector Rotation

Defensives (XLU, Staples) are flattening. Rotation flows are targeting XLF, XLI, and tech.

Rotation Signal: Rotation is real — leadership is shifting from safety to early-growth and cyclical corridors.

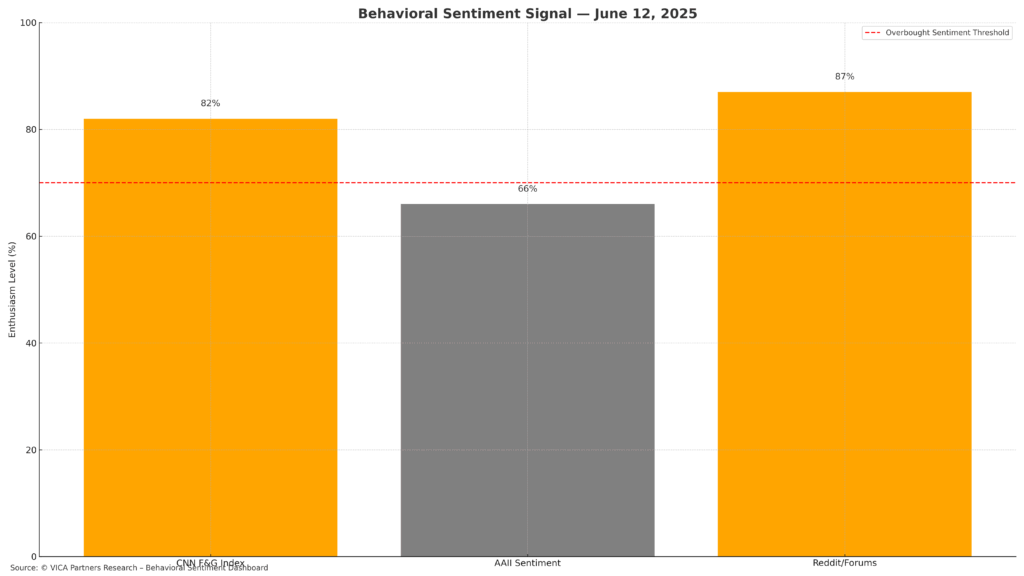

Sentiment Divergence

Behavioral Sentiment Signal

Retail sentiment remains buoyant. Institutional flows are methodical.

Behavioral Read: The emotional retail tilt remains misaligned with measured institutional execution — a volatility pocket may emerge.

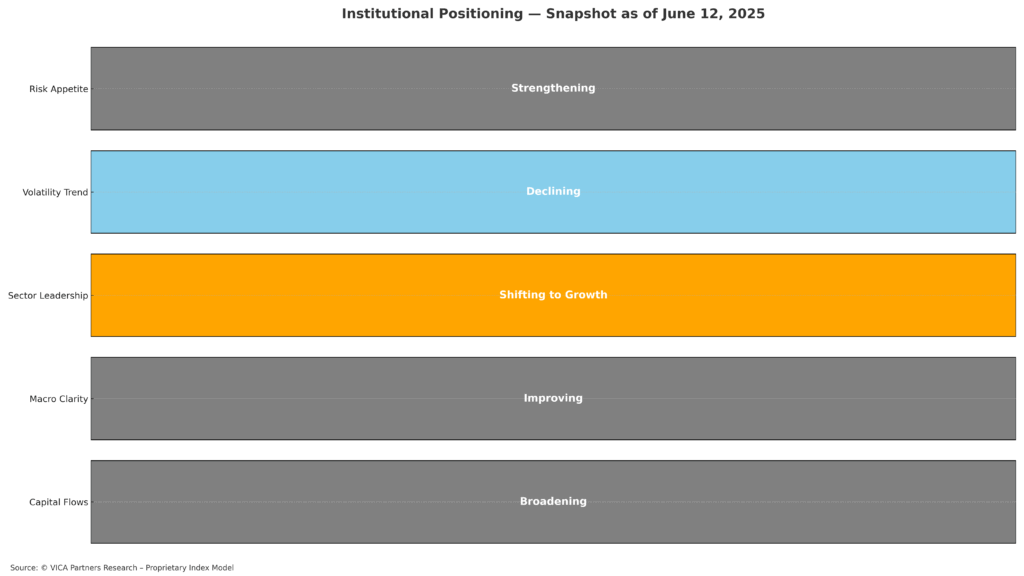

Institutional Positioning Grid – June 12, 2025

Institutional Positioning Table

| Metric | Status |

| Risk Appetite | 🟢 Strengthening |

| Volatility Trend | 🟢 Declining |

| Sector Leadership | 🟢 Growth Focused |

| Macro Clarity | 🟢 Stabilizing |

| Capital Flows | 🟡 Gradual |

Tactical Read: Institutional positioning is holding steady — posture is constructive, yet still selectively risk-aware.

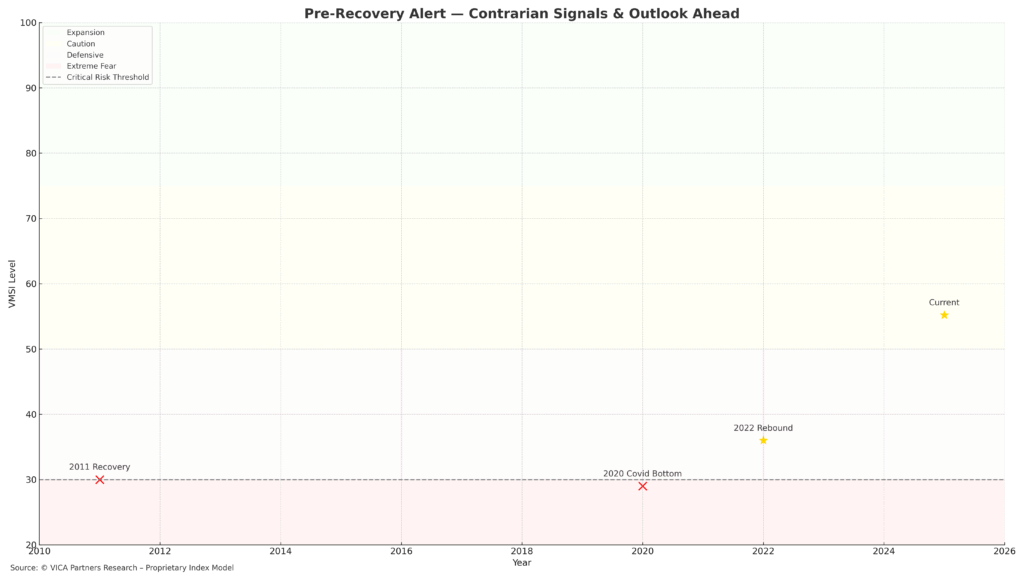

Historical Recovery Zone

Recovery Zone Overlay – 2011, 2020, 2025

VMSI remains in the same zone that preceded major allocation expansion in prior cycles.

Historical Echo: This score band has historically marked the front edge of sustained portfolio rotation.

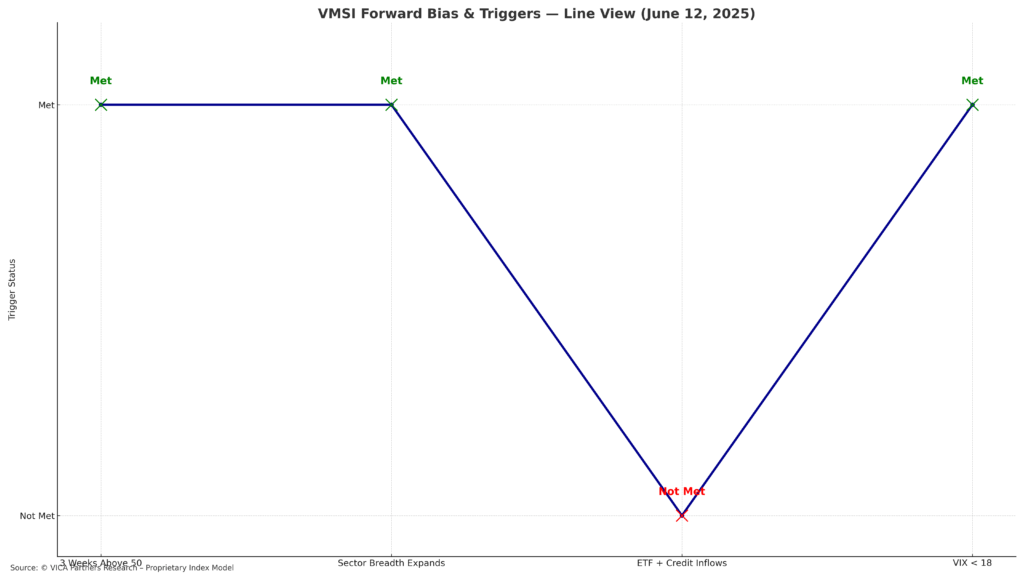

Predictive Outlook – What Comes Next

VMSI Forward Bias & Triggers

Indicators support ongoing engagement, though acceleration has paused.

Forward Bias: Unless interrupted, capital is likely to maintain upward posture — but we watch for macro-induced flattening.

Key Triggers:

- VIX holds below 18

- SOXX and VTWO sustain leadership

- Credit inflows remain stable

- Sector breadth does not narrow

Base Case (68%): Continued moderate equity and credit allocation over next 2–3 weeks

Alternate Case: Shock event (inflation, Fed) causes positioning to stall

About VMSI

The VICA Market Sentiment Index (VMSI©) is a proprietary institutional signal that tracks capital flows, volatility positioning, and sentiment alignment to guide tactical allocation decisions.

Index Scale:

🔴 0–25: Critical Risk Zone

🟠 26–49: Defensive

🟡 50–74: Cautionary Optimism

🟢 75–100: Expansion / High Confidence

Disclaimer

This report and VMSI© are proprietary to VICA Partners. Unauthorized reproduction is prohibited.

A portion of proceeds supports global technical education in finance, engineering, and data science.

VMSI: Know Where Smart Capital Is Moving — and Why

Built for tactical allocators, VMSI delivers signal over noise as institutions shift from defense to deliberate re-engagement.

#VMSI #MacroStrategy #SmartCapital #VolatilitySignals #RiskRotation #VICAResearch