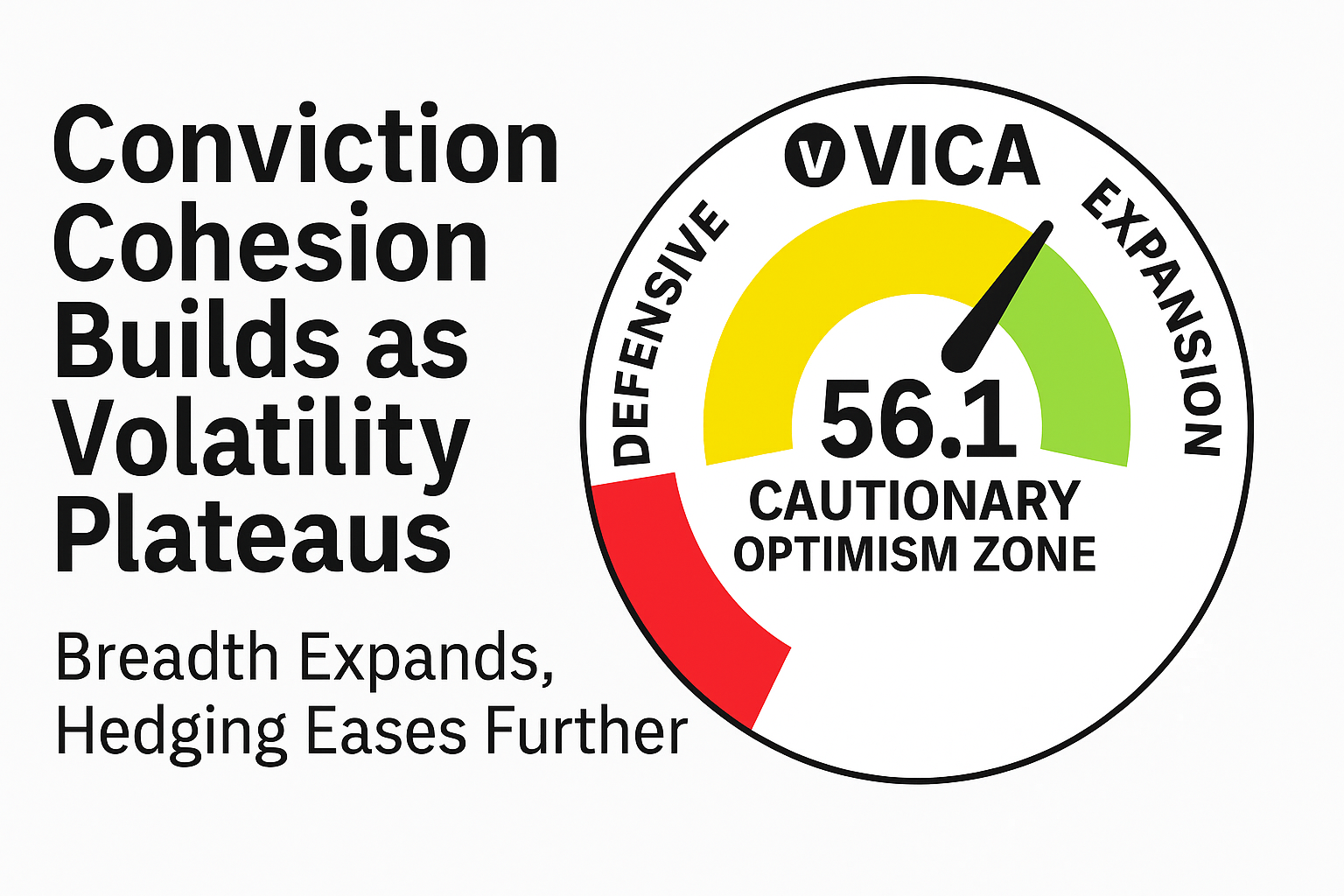

VMSI edges to 56.1 as breadth expands, hedging eases further

July 3, 2025 | VICA Research — Volatility & Market Sentiment Index

VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning — helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus. Institutional-grade signals — opened by design to those who think ahead.

Weekly Snapshot

Major Index Closes – July 3, 2025

S&P 500: 6,279.35 (+0.83%) | Nasdaq: 20,601.10 (+1.02%) | Dow: 44,828.53 (+0.77%) | VIX: 16.38 (−1.56%)

VMSI Gauge – July 3, 2025

VMSI Gauge – Composite Score Distribution

VMSI: 56.1 — firmly within the Cautionary Optimism zone.

Breadth has expanded modestly and volatility risk has eased, signaling a growing but still risk-aware institutional footprint.

Strategic Insight:

Institutions are shifting from reactive hedging toward proactive allocation, balancing a wider risk footprint with measured exposure pacing.

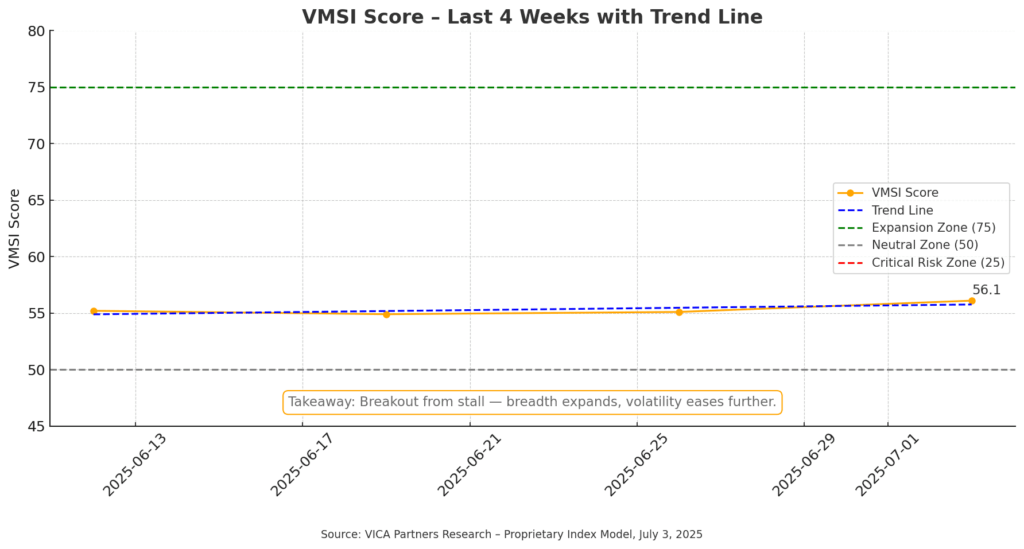

VMSI Trendline – 4-Week Progression

55.2 → 54.9 → 55.1 → 56.1

VMSI Score Timeline – 4-Week View

This week’s upward move breaks a three-week holding pattern, supported by leadership broadening and reduced tail risk premiums.

Positioning Insight: Capital is incrementally redeploying — slow but deliberate. Institutions are extending exposure with continued hedging overlays.

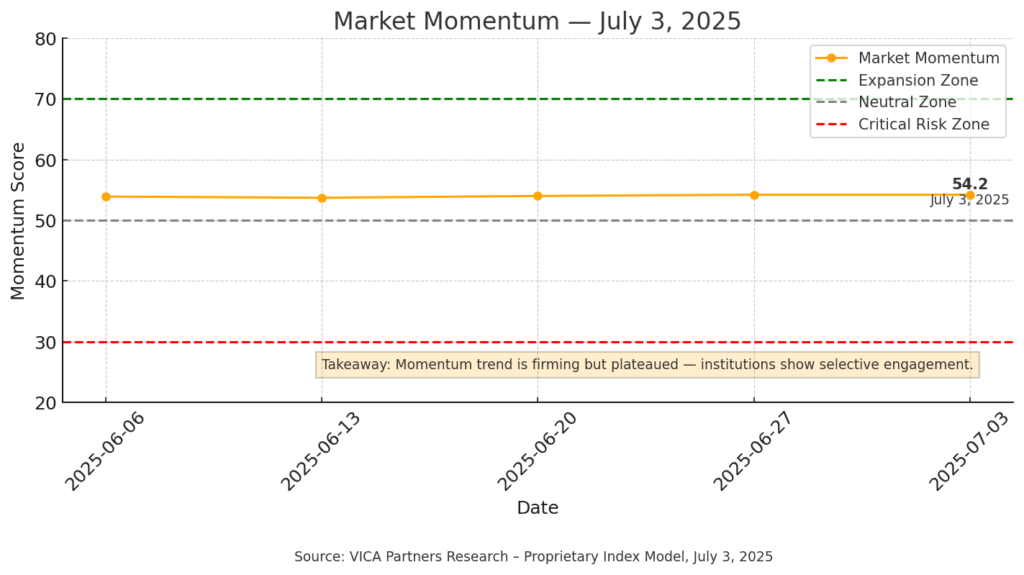

Market Momentum

VMSI Sub-Component – Momentum Line

Leadership remains in semis, tech, and industrials. Small caps and equal-weight indices post solid participation.

Flow Signal: Risk-on posture remains intact. Participation is growing beyond a few megacaps, but with tempered velocity.

Liquidity Flows

VMSI Sub-Component – Liquidity Line

HYG flat. LQD modestly lower. BKLN improves. Credit spreads remain stable, reflecting selective capital pacing.

Allocation Cue: Liquidity remains present but isn’t expanding materially — allocators are positioning for selective opportunity, not a cycle turn.

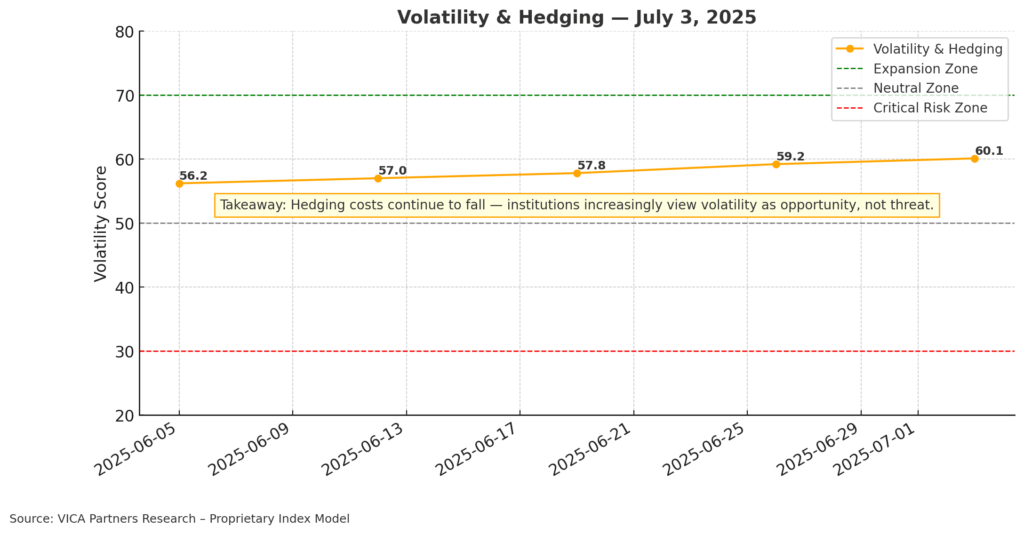

Volatility & Hedging

VMSI Sub-Component – Volatility & Hedging

MOVE and VVIX both trend lower. Hedging is still active but becoming more tactical than defensive.

Risk Pulse: Hedging costs continue to fall — institutions increasingly view volatility as opportunity, not threat.

Safe Haven Demand

VMSI Sub-Component – Safe Haven Demand

Gold, TIPs, and duration products are seeing reduced inflows. Institutional positioning suggests less urgency to hedge inflation or volatility shocks.

Capital Preference: Hedge allocation is stabilizing — not unwinding, but no longer expanding.

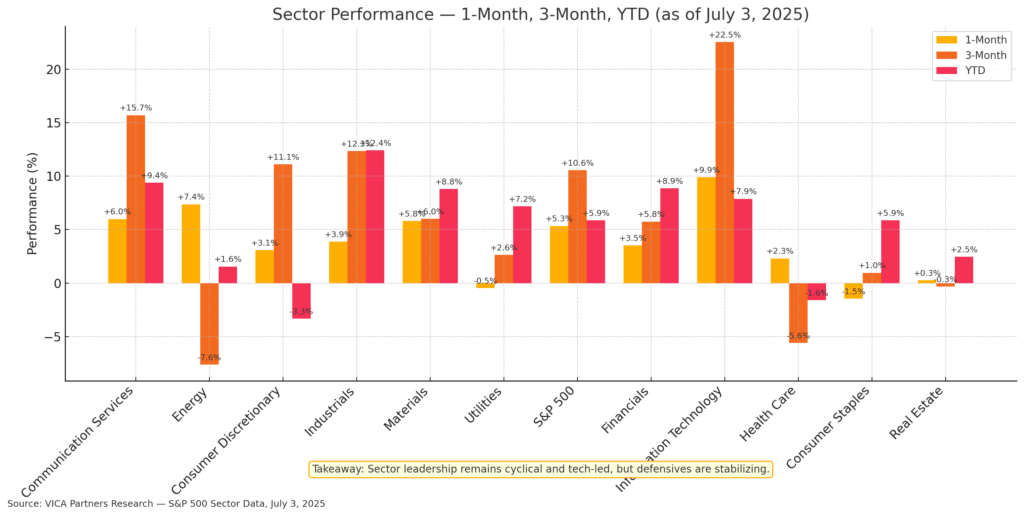

Sector Rotation View

Sector Performance — 1-Month, 3-Month, YTD — July 3, 2025

Industrials, Financials, and Comm Services continue to rotate higher. Energy lags. Small and mid-caps contribute.

Rotation Signal: Capital is broadening into growth-cyclicals, signaling rising conviction beneath volatility moderation.

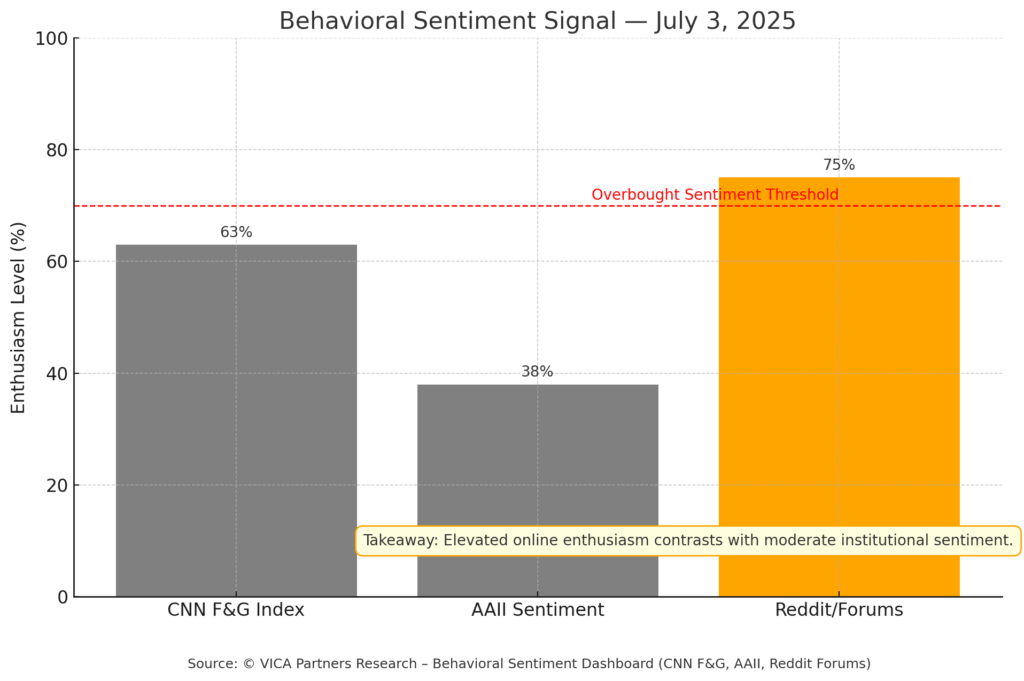

Sentiment Divergence

Behavioral Sentiment Signal

Retail positioning remains exuberant. Institutional flows are gradually reasserting control with tighter portfolio targeting.

Behavioral Read: The dislocation between institutional and retail posture is narrowing. Institutions are starting to lead rotations again.

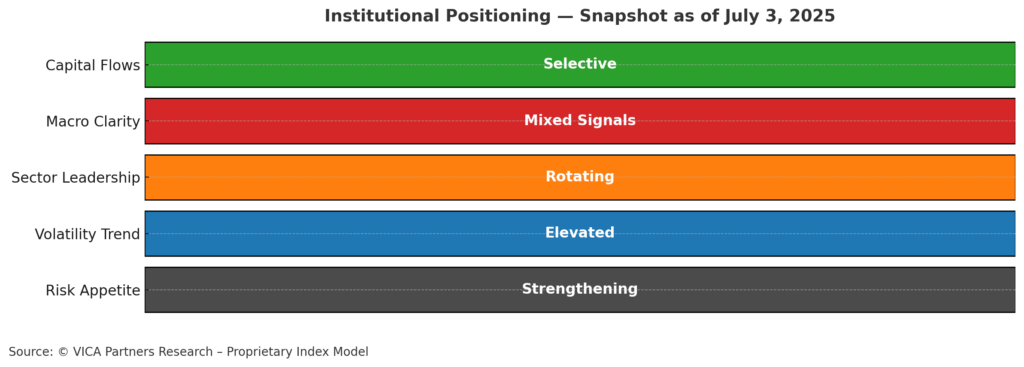

Institutional Positioning Grid – July 3, 2025

Institutional Positioning Table

Tactical Read: Institutions are building positioning beneath the surface, rotating methodically and maintaining macro awareness.

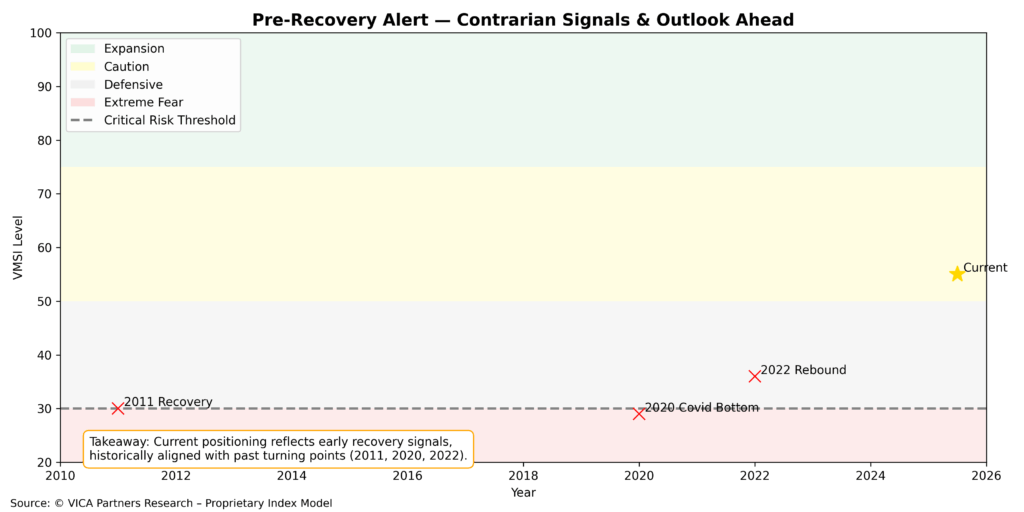

Historical Recovery Zone

Recovery Overlay – 2011, 2020, 2025

The current score band continues to echo prior re-risking zones — especially the slow-roll turnarounds of 2011 and Q2 2020.

Historical Echo: A breakout from this band has historically coincided with full-cycle allocation shifts. Institutional signals suggest they’re watching for confirmation before accelerating.

Predictive Outlook – What Comes Next

VMSI Forward Bias & Triggers – Updated for July 3, 2025

Volatility signals continue to compress. Breadth improvement and credit stability support tactical expansion — but confirmation is still needed.

Key Triggers to Monitor

-

VIX remains below the 18-level threshold

-

High-yield credit spreads remain tight

-

SOXX / VTWO relative strength still neutral

-

Sector breadth lacks decisive breakout

Base Case (70%): Tactical exposure deepens into mid-cap and cyclical equities if volatility remains subdued. Alternate Case (30%): A macro surprise (rates, inflation, or geopolitics) could halt rotation and reintroduce defensive hedging.

About VMSI

Index Scale:

🔴 0–25: Critical Risk

🟠 26–49: Defensive

🟡 50–74: Cautionary Optimism

🟢 75–100: Expansion / High Conviction

Note: VMSI© is a composite index built from multiple market signals, not a simple VIX and investor sentiment reading; it reflects institutional trading behavior across historical, real-time, and forward-looking conditions via a proprietary algorithm.

© 2025 VICA Partners. Unauthorized reproduction prohibited.

A portion of proceeds supports global technical education in finance, engineering, and data science.

This report is for informational purposes only and does not constitute investment advice.