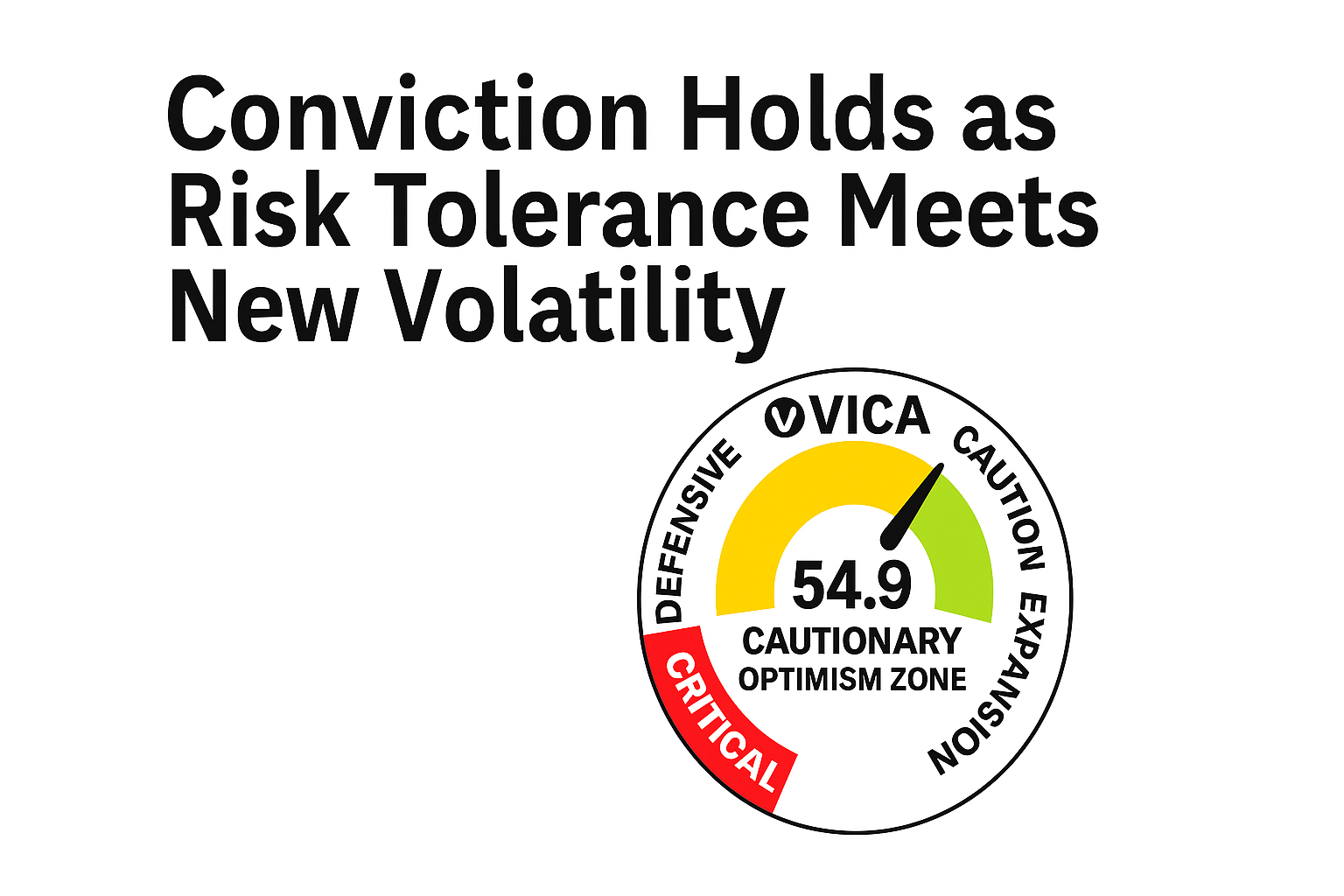

VMSI Slips to 54.9 as Institutional Appetite Maintains Course Despite Uptick in Hedging Costs

June 19, 2025 | VICA Research — Volatility & Momentum Signal Index

| VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning — helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus.

Institutional-grade signals — opened by design to those who think ahead.

Weekly Snapshot

Major Index Closes – June 18, 2025:

🔴 S&P 500: 5,980.87 (−0.03%) | 🟢 Nasdaq: 19,546.27 (+0.13%) | 🔴 Dow: 42,171.66 (−0.10%) | 🔴 VIX: 21.94 (+8.94%)

VMSI Sub-Components

⬛ Momentum: 52.9 | 🟨 Liquidity: 44.7 | 🟥 Volatility: 61.7 | 🟨 Safe Haven Demand: 60.3

VMSI Gauge – June 19, 2025

VMSI Gauge – Composite Score Distribution]

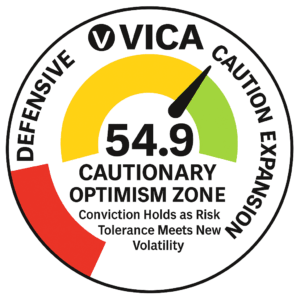

The composite VMSI score ticked slightly lower to 54.9, signaling a slight tempering of momentum yet remaining in the Cautionary Optimism Zone.

Strategic Insight: Institutions remain engaged — while hedging costs rise, directional allocation remains measured and intact.

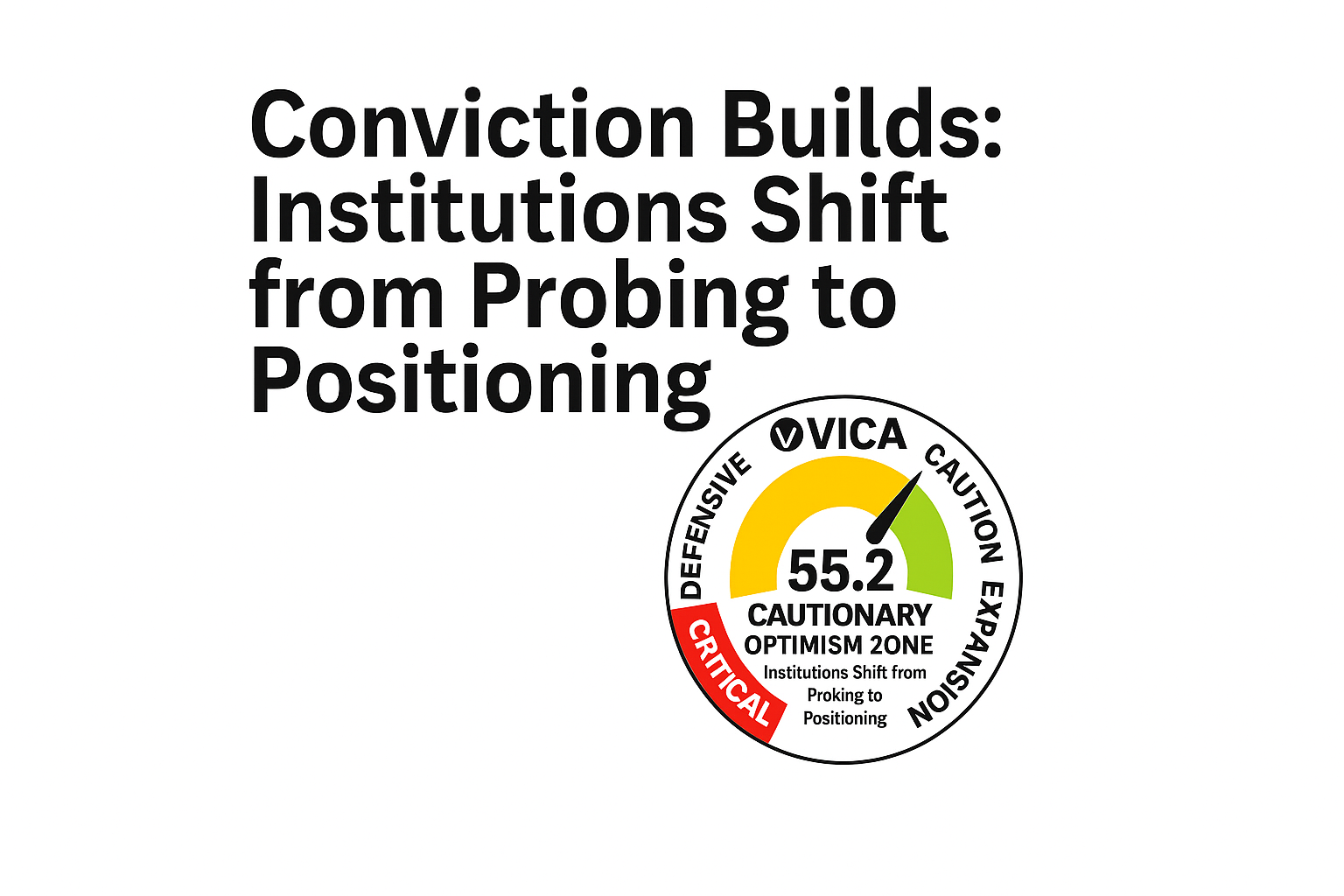

VMSI Trendline – 4-Week Progression

47.4 → 49.2 → 52.7 → 55.2 → 54.9

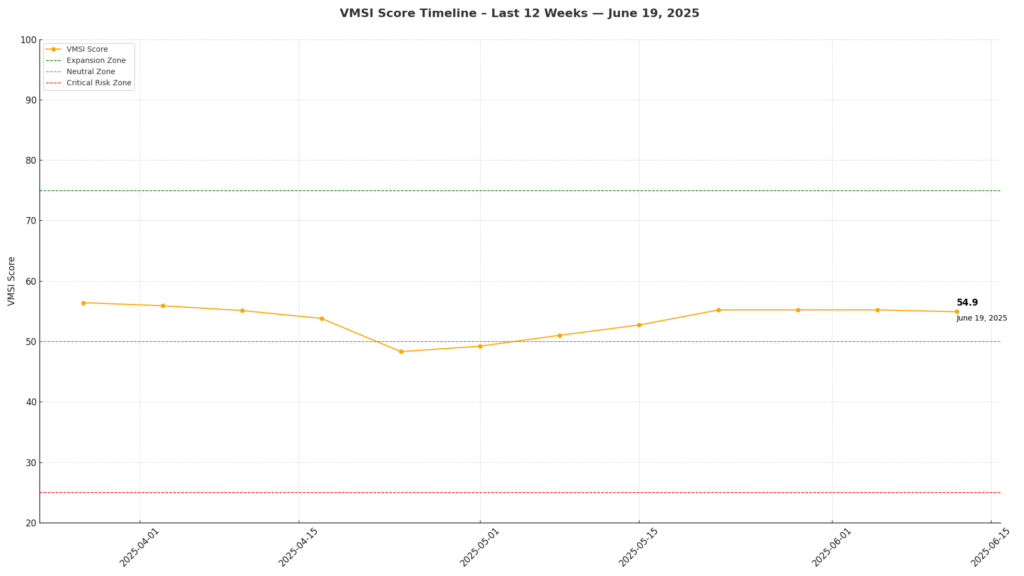

VMSI Score Timeline – 12-Week View

Positioning Insight: The pause is tactical, not structural — capital continues to rotate with a deliberate, higher-conviction lens.

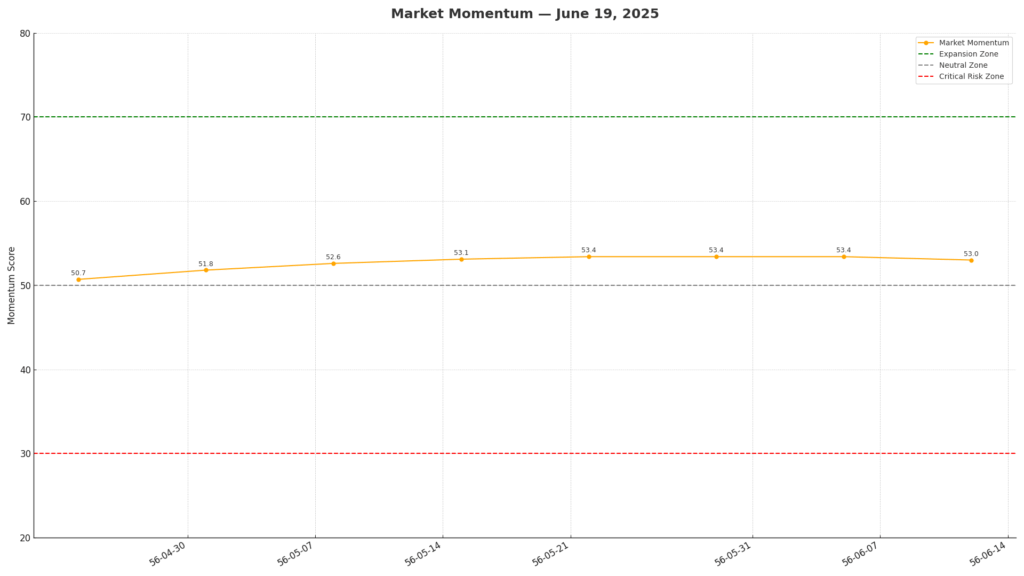

Market Momentum

⬛ Momentum Score: 52.9

VMSI Sub-Component Scores – Momentum Line

Flow Signal: Tech and discretionary sectors continue to attract rotation. SOXX maintains leadership while VTWO and XLF follow.

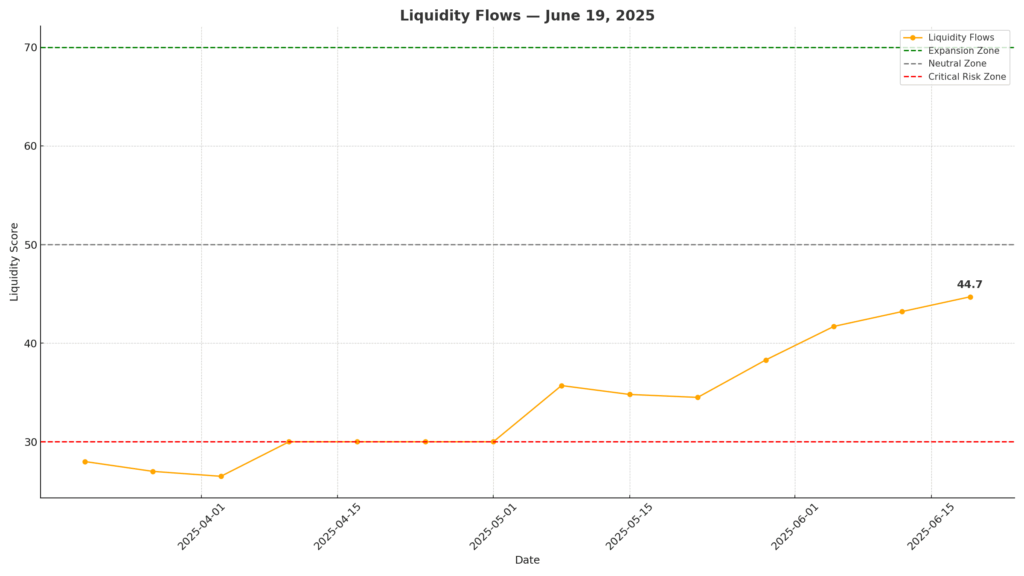

Liquidity Flows

🟨 Liquidity Score: 44.7

VMSI Sub-Component Scores – Liquidity Line

Allocation Cue: Bond market inflows are holding, but fresh liquidity remains measured. LQD and HYG flows are consistent, not aggressive.

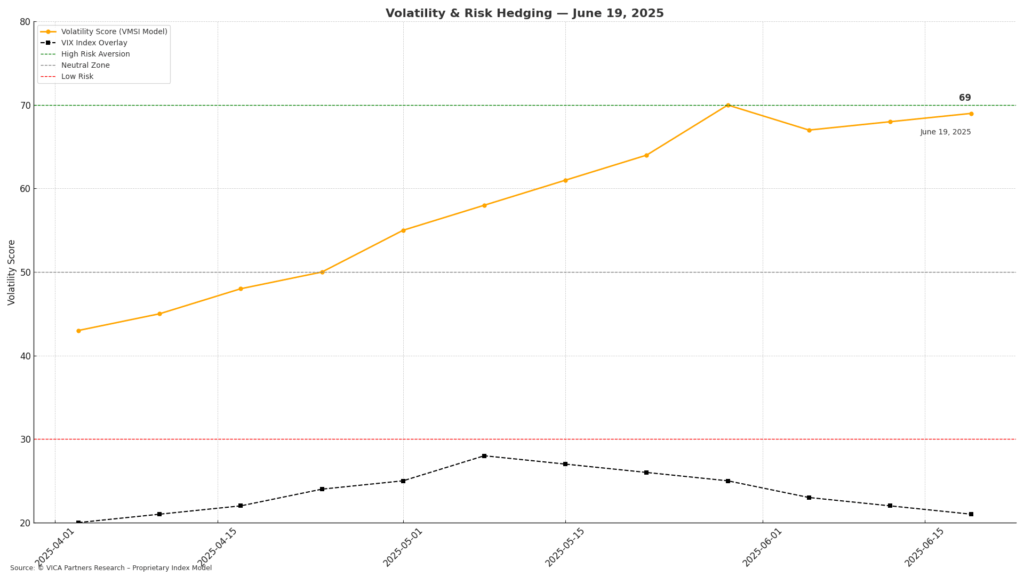

Volatility & Hedging

🟥 Volatility Score: 61.7 | VIX: 21.94

VMSI Sub-Component Scores – Volatility & Hedging

Risk Pulse: Options pricing and MOVE Index suggest a return of hedging interest. Institutions are not retreating — but are rebalancing their convexity.

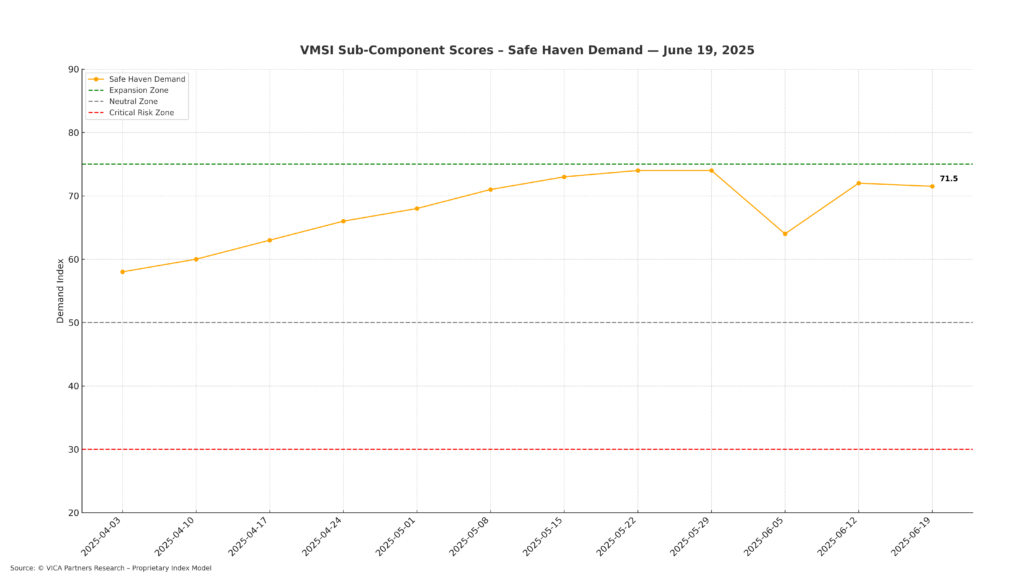

Safe Haven Demand

🟨 Safe Haven Score: 60.3

VMSI Sub-Component Scores – Safe Haven Demand

Capital Preference: GLD demand remains sticky. Treasury positioning remains firm, though off highs. A sign of dual-positioning: defense with upside optionality.

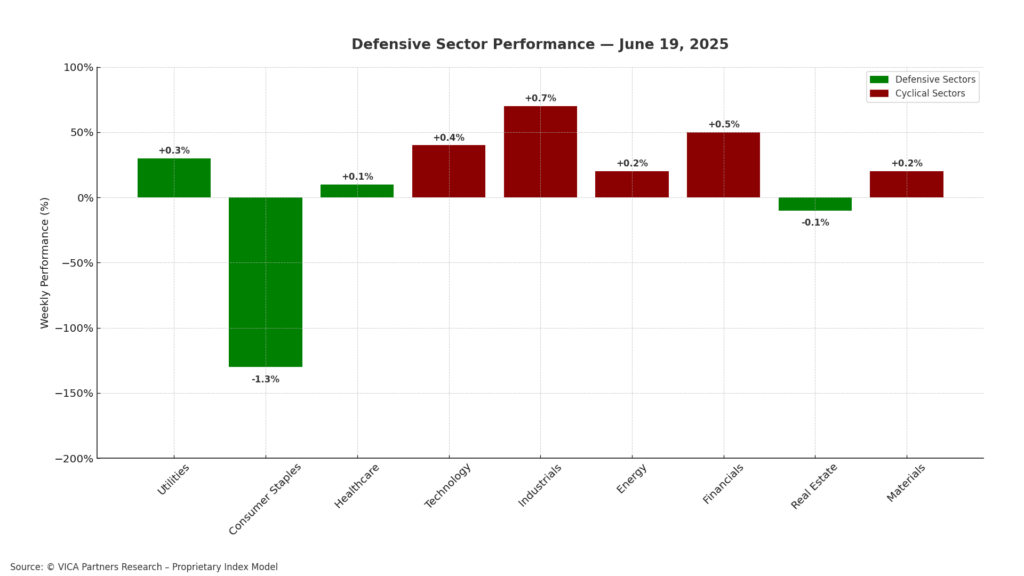

Sector Rotation View

Defensive Sector Rotation

Rotation Signal: XLF, XLI, and tech continue to benefit from rotation out of defensives. XLU and staples are flattening.

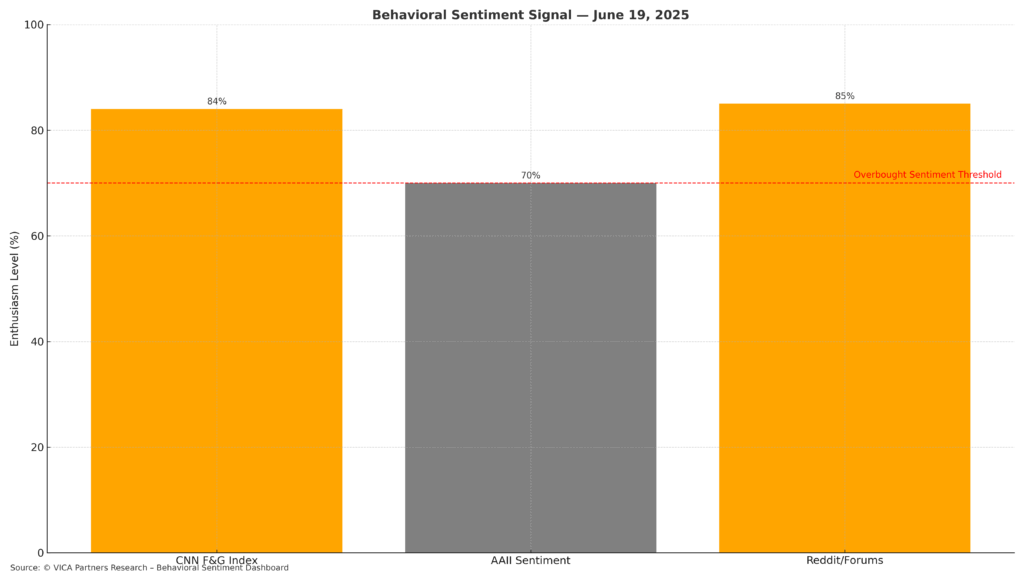

Sentiment Divergence

Behavioral Sentiment Signal

Behavioral Read: Retail euphoria persists. Institutional flows remain restrained but directional. A soft divergence persists — not extreme, but notable.

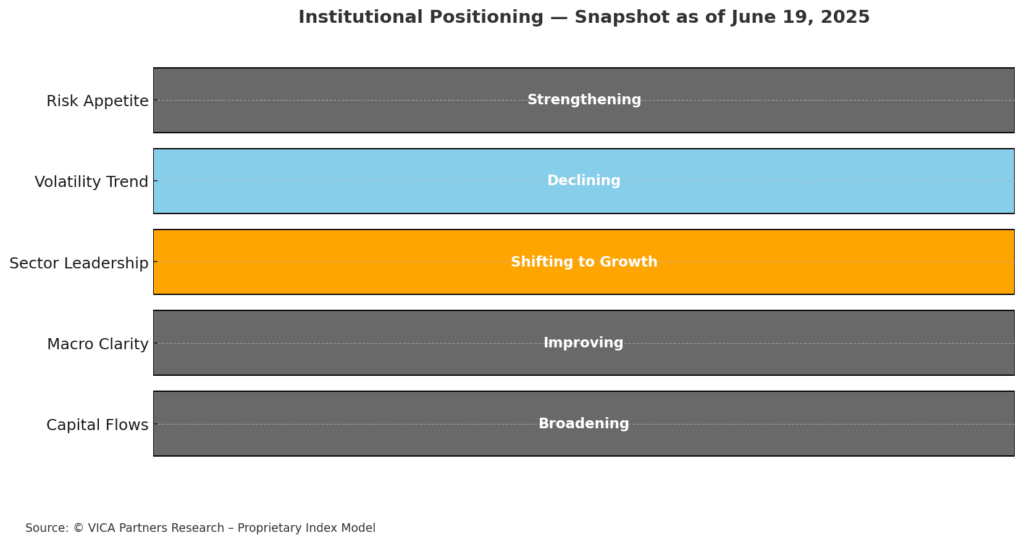

Institutional Positioning Grid – June 19, 2025

Institutional Positioning Table

| Metric | Status |

| Risk Appetite | ⬛ Strengthening |

| Volatility Trend | 🟥 Rising |

| Sector Leadership | ⬛ Tech/Cyclicals |

| Macro Clarity | 🟨 Holding |

| Capital Flows | 🟨 Gradual |

Tactical Read: Institutions are leaning in, but starting to pay for protection — a typical mid-phase posture.

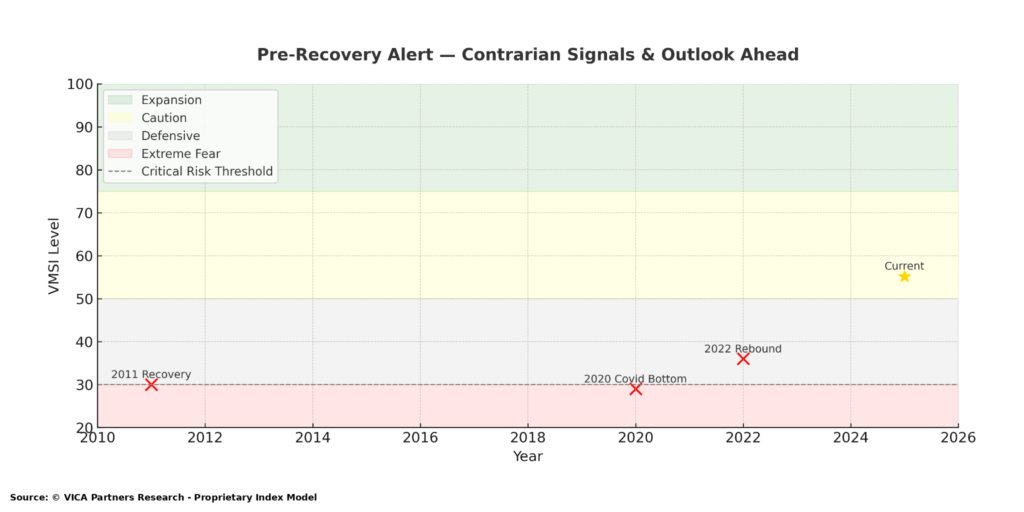

Historical Recovery Zone

Recovery Zone Overlay – 2011, 2020, 2025

Historical Echo: Current levels are consistent with past pivot points toward more aggressive asset allocation — but still early-stage.

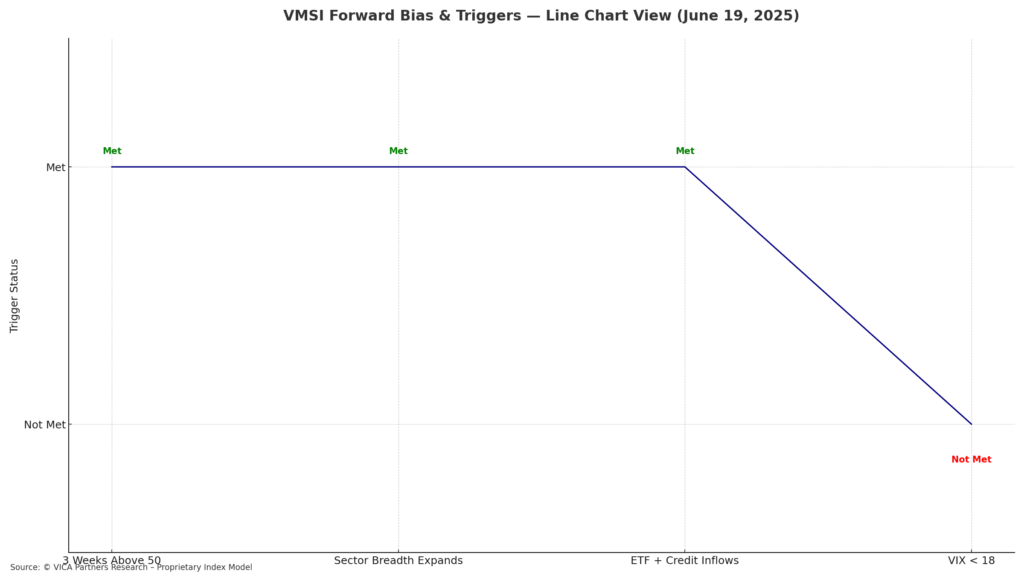

Predictive Outlook – What Comes Next

VMSI Forward Bias & Triggers

Forward Bias: Conditions remain favorable, but volatility must settle. A pause in score does not mean retreat — watch breadth and credit.

Key Triggers:

- VIX stabilizes below 20

- Credit inflows (LQD/HYG) resume

- SOXX holds leadership

- XLF and XLI retain upward slope

Base Case (68%): Continued moderate allocation with defensive overlays

Alternate Case: Further VIX spike could pause or unwind positioning

About VMSI

The VICA Market Sentiment Index (VMSI©) tracks capital flows, volatility positioning, and sentiment alignment to guide institutional risk exposure and tactical asset allocation.

Index Scale:

🔴 0–25: Critical Risk Zone

🟠 26–49: Defensive

🟡 50–74: Cautionary Optimism

🟢 75–100: Expansion / High Confidence

Tags

#VMSI #InstitutionalFlow #MarketSignals #RiskEdge #VICAResearch #SmartCapital #ConvictionIndex #VolatilityRadar #PortfolioStrategy