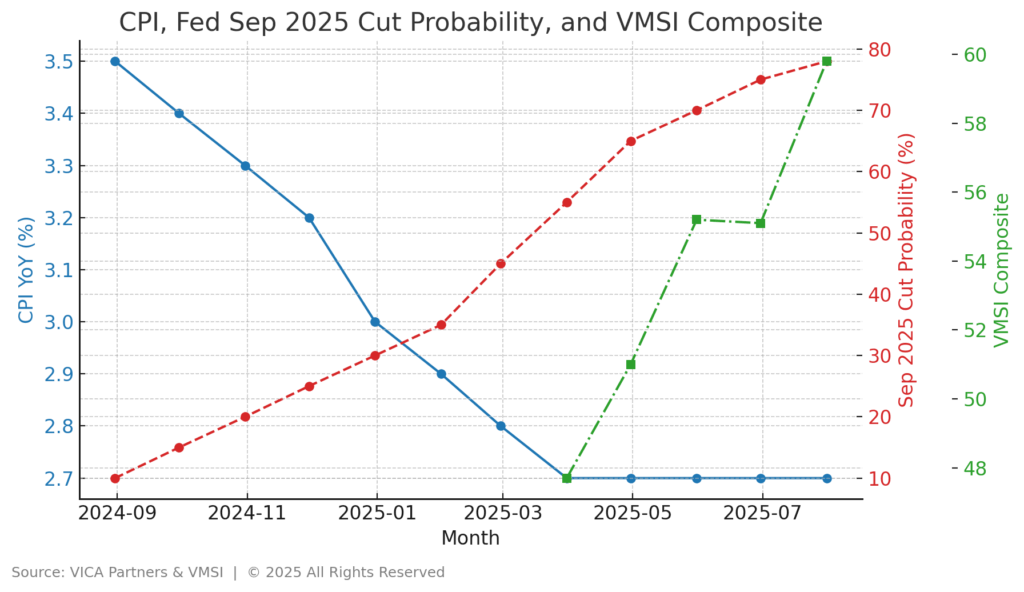

July CPI: +0.2% MoM, 2.7% YoY (unchanged from June).

Core CPI: +0.3% MoM, 3.1% YoY.

Key Data Points from July CPI

- Shelter: +0.2% MoM, +3.7% YoY – still the largest sticky component.

- Medical care services: +0.8% MoM, +4.3% YoY – accelerating for a second month.

- Energy: -1.1% MoM, -1.6% YoY – gasoline down 9.5% YoY.

- Food: flat MoM, +2.9% YoY – grocery prices slightly softer.

- Airline fares: +4.0% MoM after a flat June.

- Used cars & trucks: +0.5% MoM, +4.8% YoY.

Institutional Expectations

- No surprises: CPI came in line with consensus and macro desk models.

- Fed funds futures: ~75% probability of a September 2025 rate cut already priced before this release.

- Breakevens & swap curves: consistent 2.5–2.7% headline CPI expectation since Q2.

- Sticky services: Shelter and medical care expected to keep core above 3% into Q4.

- Goods disinflation: Used cars, apparel, and household goods follow the expected softening path.

Positioning Already in Place

- Fixed income: Duration extension trades in Treasuries and high-grade credit.

- Equities: Large-cap growth benefiting from lower discount rate expectations; cyclicals gaining tactical bid.

- Private credit: Shifting toward floating-rate protection as cut cycle approaches.

Forward Focus for Investors

- August CPI (Sep 11 release) – final read before the September Fed meeting.

- Fed September decision – base case: 25bps cut with data-dependent forward guidance.

- Services inflation – watch shelter and medical care for signs of persistence.

- Liquidity & credit spreads – early warning indicators for stress.

Bottom line:

This release is confirmation, not a turning point. The path toward a September rate cut remains intact.

CPI, Fed Sep 2025 Cut Probability, and VMSI Composite

Disclaimer:

This document is for informational purposes only and does not constitute investment advice or an offer to buy or sell any security. All information is believed to be accurate at the time of publication but is subject to change without notice. Past performance is not indicative of future results. © 2025 VICA Partners & VMSI. All rights reserved.