“Empowering Your Financial Success”

Daily Market Insights: October 12th, 2023

Global Markets Summary:

Asian Markets:

- Nikkei 225 (Japan): -0.32%

- Hang Seng (Hong Kong): Closed

- Shanghai Composite (China): Closed

US Futures:

- S&P Futures: opened @ 4380.94 (+0.09%)

European Markets:

- FTSE 100 (London): +0.32%

- DAX (Germany): -0.23%

- CAC 40 (France): -0.37%

US Market Snapshot:

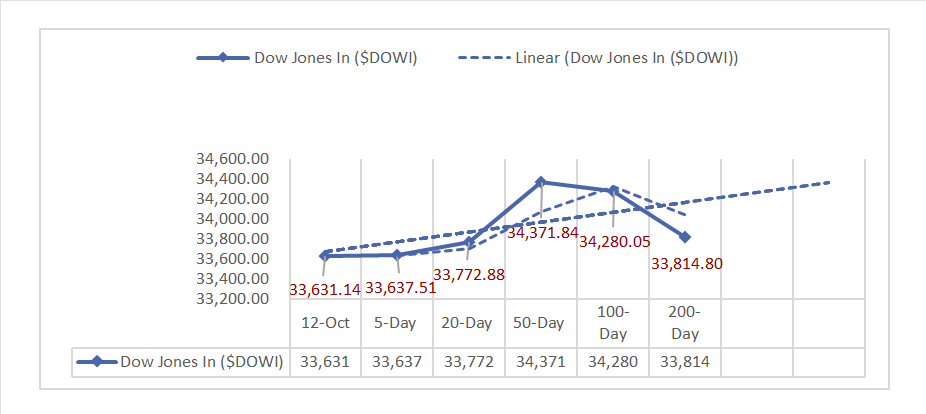

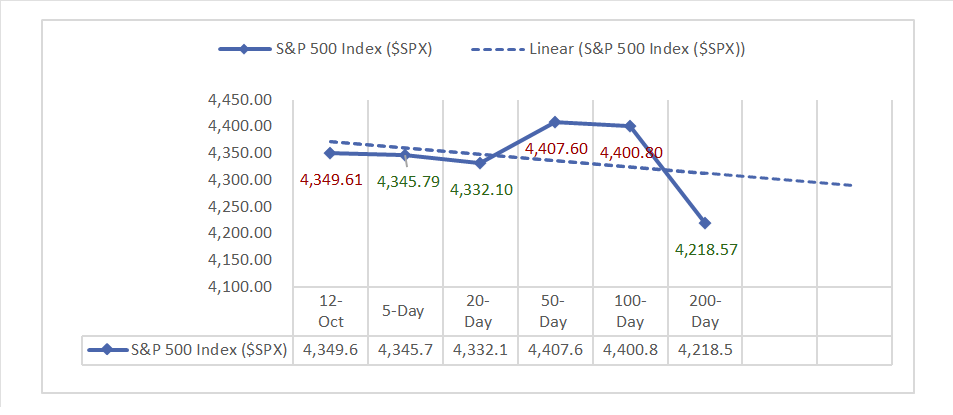

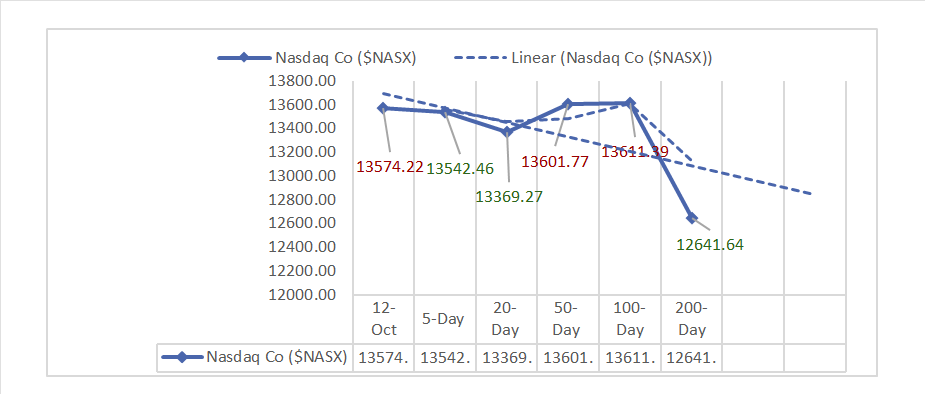

Key Stock Market Indices:

- DJIA ^DJI: 33,631.14 (-173.73, -0.51%)

- S&P 500 ^GSPC: 4,349.61 (-27.34, -0.62%)

- Nasdaq Composite ^NASX: 13,574.22 (-85.46, -0.63%)

- Nasdaq 100 ^NDX: 15,184.10 (-57.02, -0.37%)

- NYSE Fang+ ^NYFANG: 7,739.83 (-21.48, -0.28%)

- Russell 2000 ^RUT: 1,734.25 (-39.04, -2.20%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: CPI exceeded expectations with a 0.4% monthly increase and a 3.7% year-over-year change. Core CPI matched expectations with a 0.3% monthly change and a 4.1% year-over-year change, while the prior month had a 0.3% monthly change and a 4.3% year-over-year change. Initial claims close to the expected, Continuing claims slightly above.

- Market Indices: Major U.S. stock indices experienced declines, with the DJIA falling 0.51%, S&P 500 down 0.62%, Nasdaq Composite slipping 0.63%, Nasdaq 100 dropping 0.37%, NYSE Fang+ down 0.28%, and Russell 2000 plummeting 2.20%.

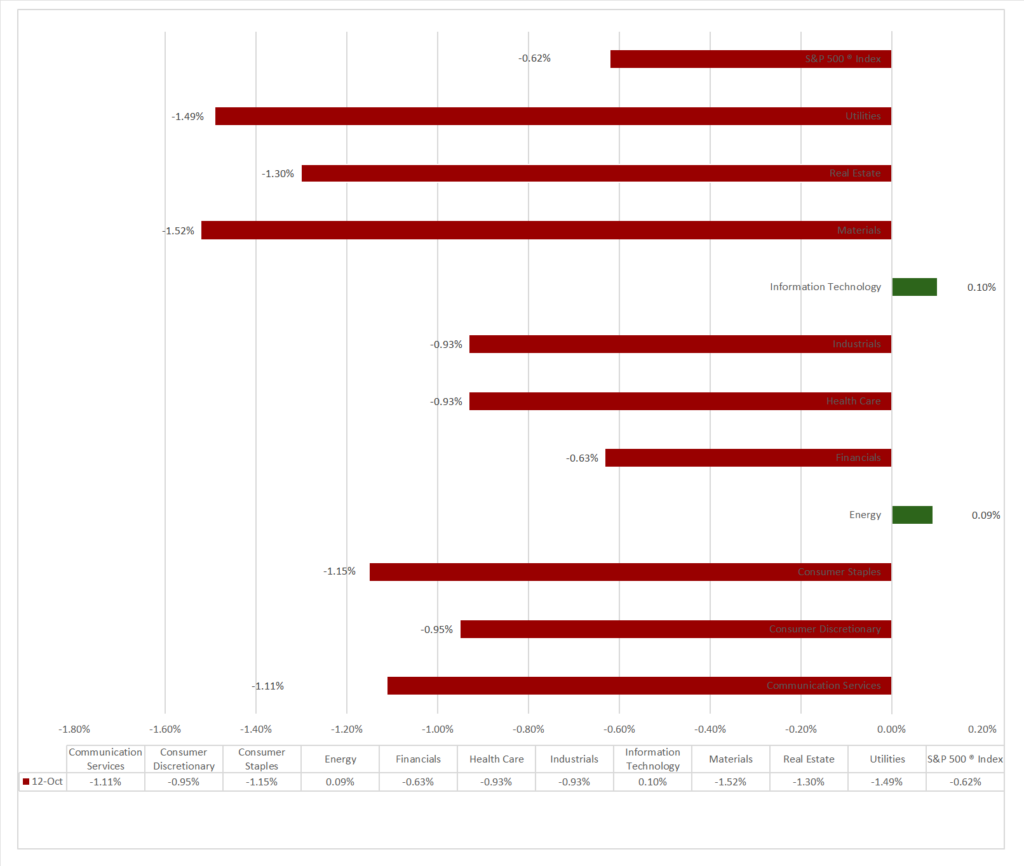

- Sector Performance: 9 of 11 sectors fell, Information Technology (+0.10%) outperformed, while Materials (-1.52%) lagged. Top Industry: Trading Companies & Distributors (+2.84%).

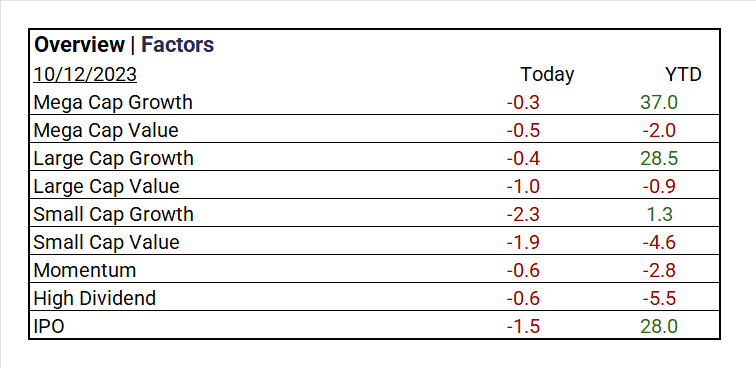

- Factors: Mega Caps lead, Small Cap Value (-1.9%) lag.

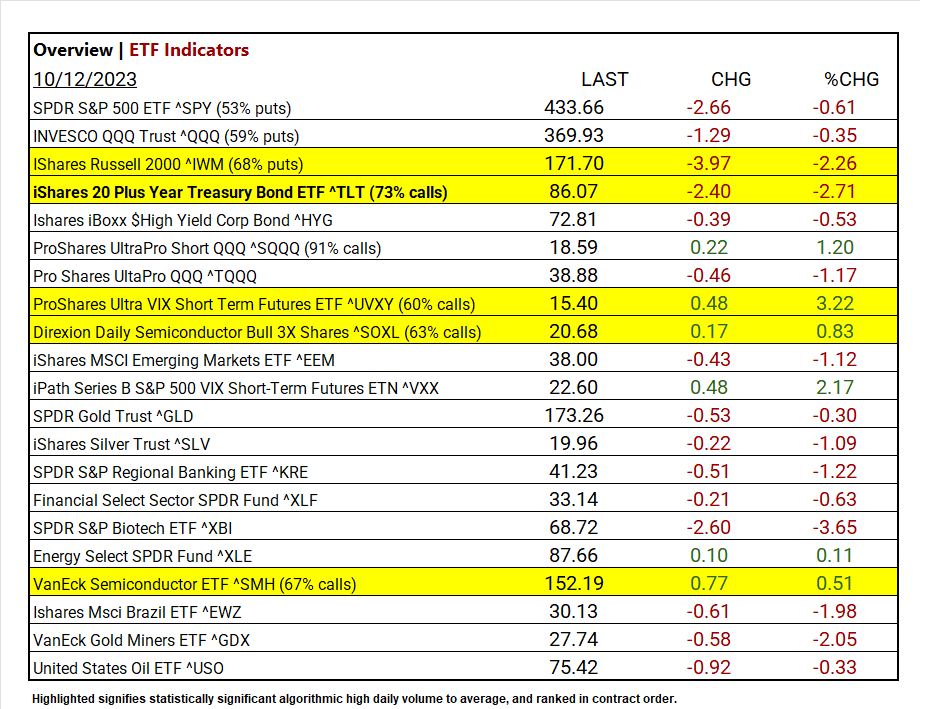

- Top ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY +3.22%

- Worst ETF: SPDR S&P Biotech ETF ^XBI -3.65%.

- Treasury Markets: US Treasury yields declined across maturities which led to tighter yield spreads.

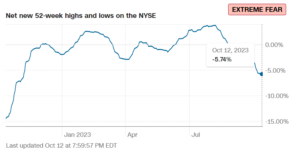

- Currency and Volatility: The U.S. Dollar Index down, CBOE Volatility rose +3.73%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold prices decline, Bitcoin rises, while both Oil and the Bloomberg Commodity Index show gains.

Sectors:

- 9 of 11 sectors fell, Information Technology (+0.10%) outperformed, while Materials (-1.52%) lagged. Top Industry: Trading Companies & Distributors (+2.84%), Semiconductor & Semi Equipment (+ 62%), Technology Hardware, Storage & Peripherals (+0.46%), and Broadline Retail (+0.35%).

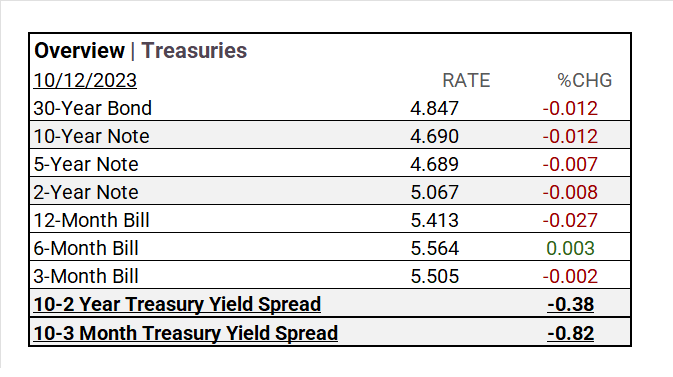

Treasury Yields and Currency:

- US Treasury yields declined across maturities, with the 30-Year Bond decreasing to 4.847% (-0.012) and the 10-Year Note falling to 4.690% (-0.012). This led to tighter yield spreads, with the 10-2 Year Treasury Yield Spread at -0.38 and the 10-3 Month Treasury Yield Spread at -0.82

- The U.S. Dollar Index ^DXY: 106.49 (-0.11, -0.11%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 16.69 (+0.60, +3.73%)

- Fear & Greed Index (TY/LY): 35/15 (Fear/ Extreme Fear).

Source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,871.78 (-3.71, -0.20%)

- Bitcoin USD: 26,817.90 (+67.40, +0.25%)

- Crude Oil Futures WTI: 83.50 (+0.59, +0.71%)

- Bloomberg Commodity Index: 103.36 (+0.32, +0.31%)

Factors:

- Mega Caps lead, Small Cap Value (-1.9%) lags.

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY +3.22%

- iPath Series B S&P 500 VIX Short-Term Futures ETN ^VXX +2.17%

- ProShares UltraPro Short QQQ ^SQQQ +1.20%

Top 3 Worst Performers:

- SPDR S&P Biotech ETF ^XBI -3.65%

- iShares 20 Plus Year Treasury Bond ETF ^TLT -2.71%

- iShares Russell 2000 ^IWM -2.26%

US Major Economic Data

- PPI (Producer Price Index): September: MoM (Month over Month): 0.5% (Consensus: 0.3%), YoY (Year over Year): 2.2% (Consensus: 1.6%), Prior Month: 0.7% MoM and 2% YoY.

- Core PPI (Excluding Food and Energy): September: MoM: 0.3% (Consensus: 0.2%), YoY: 2.7% (Consensus: 2.3%), Prior Month: 0.2% MoM and 2.2% YoY

- MBA (Mortgage Bankers Association) 30-Year Mortgage Rate on October 6: 7.67%, Prior Week: 7.53%

- MBA Mortgage Applications on October 6: 0.6%, Prior Week: -6%

- MBA Purchase Index on October 6: 137.5, Prior Week: 136.6

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- Beat: Infosys ADR (INFY), Fastenal (FAST), Delta Air Lines (DAL)

- Miss: Fast Retailing ADR (FRCOY), Seven i ADR (SVNDY), Walgreens Boots (WBA), Domino’s Pizza Inc (DPZ), Chr Hansen ADR (CHYHY), Commercial Metals (CMC), Alpha Metallurgical Resources (AMR), Smart Global (SGH).

Resources:

- What’s Expected in October

- Vica Partners Economics Forecast

News

Investment and Growth News

- Google Warns the EU That It Will Fight Attempts to Break Up Ad Business – Bloomberg

- TikTok’s global e-commerce expansion plans hit roadblock amid uncertainty from Indonesia’s ban on online shopping via social media – SCMP

Infrastructure and Energy

- Top Ethanol Maker Says States Should Embrace Carbon Pipelines – Bloomberg

- China’s BYD eyes lithium assets in Brazil in EV raw-material push – SCMP

Real Estate Market Updates

- Miami’s Rental Market Roller Coaster Is Headed Downhill – WSJ

- Banks Boost Incentives to Lure Buyers With Office Deals Frozen –Bloomberg

Central Banking and Monetary Policy

- The Fed Is Putting Too Much Faith in Markets – WSJ

- Fed to Keep Rate Hike on Table This Year After Services Prices Rise – Bloomberg

International Market Analysis (China)