July 24, 2025 | VICA Research — Volatility & Market Sentiment Index

| VICA Partners’ VMSI© (Volatility & Market Sentiment Index) isolates where conviction-weighted institutional capital is repositioning — helping investors cut through noise, quantify risk, and front-run structural shifts before they price into consensus. Institutional-grade signals — opened by design to those who think ahead.

#VMSI #InstitutionalFlow #MarketSignals #RiskEdge #VICAResearch #SmartCapital #ConvictionIndex #VolatilityRadar #PortfolioStrategy

Weekly Snapshot

Major Index Closes — July 24, 2025 S&P 500: +0.07% | Nasdaq: +0.18% | Dow: -0.70% | VIX: +0.13%

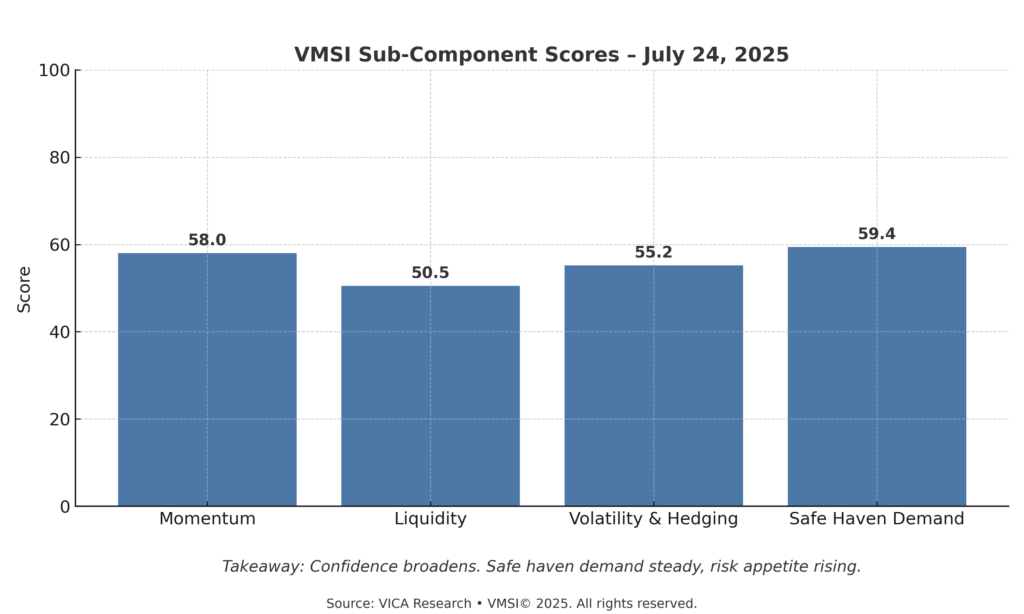

VMSI Sub-Components

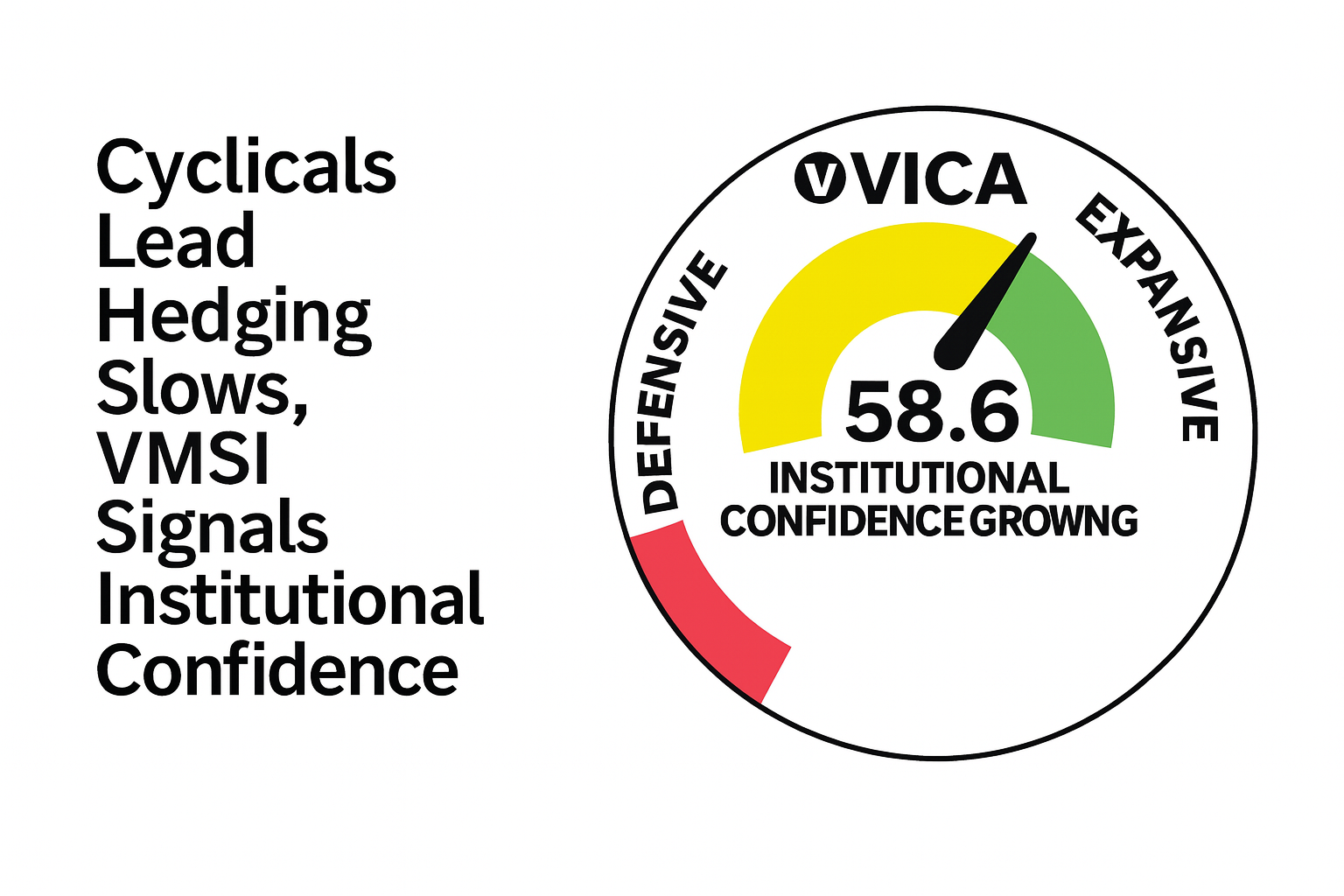

VMSI Gauge – July 24, 2025

| VMSI: 58.6 — firmly within the Cautionary Optimism zone. Volatility compression continues while institutional allocation remains deliberate and increasingly directional. (Insert Chart: VMSI Composite Score Gauge)

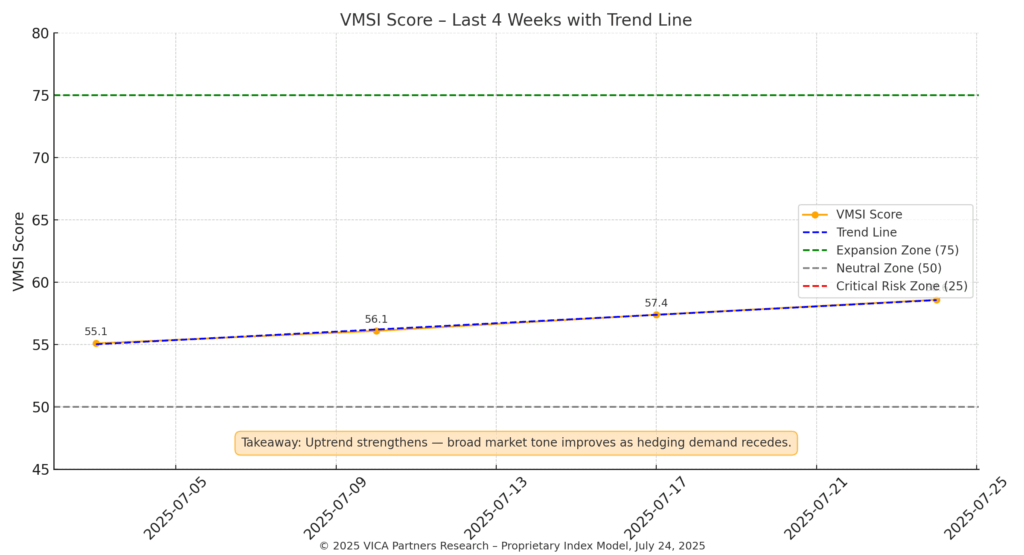

VMSI Trendline – 4-Week Progression

55.1 → 56.1 → 57.4 → 58.6

Positioning Insight: Capital rotation is widening. Institutional flows are sustaining strength across cyclicals with renewed appetite for balanced risk exposure.

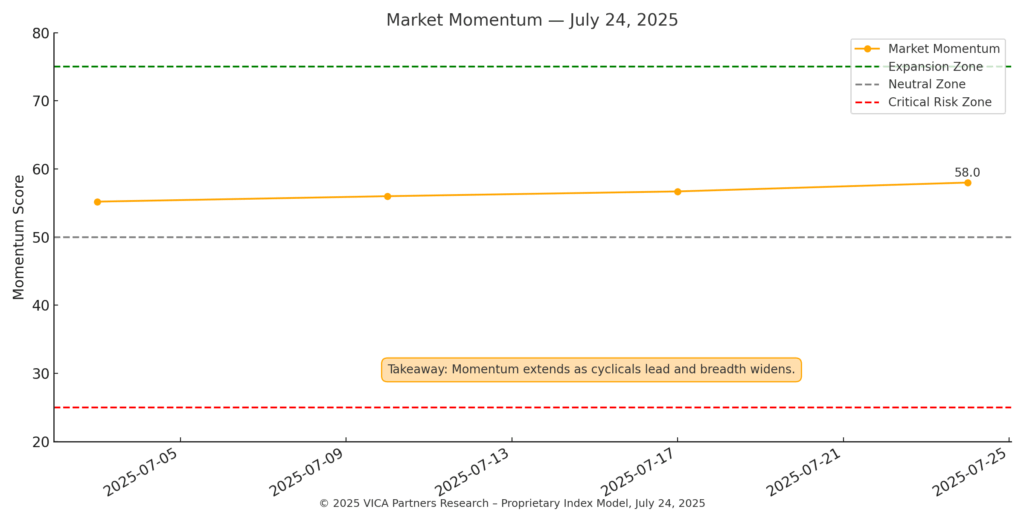

Market Momentum

Flow Signal: Breadth continues to expand beyond megacaps. Equal-weight indices outperform, suggesting maturing leadership from industrials, discretionary, and capital goods.

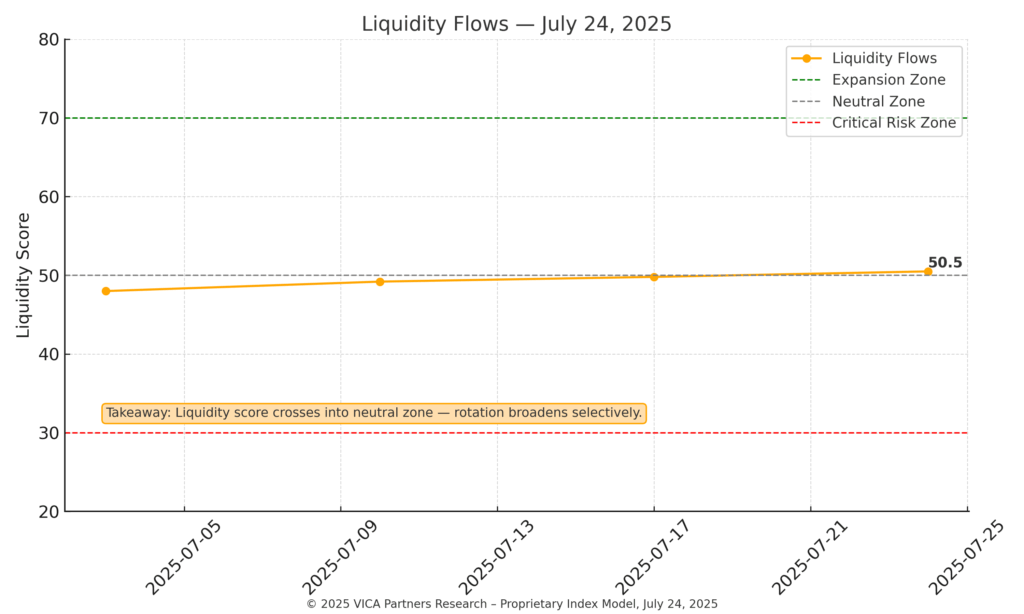

Liquidity Flows

Allocation Cue: Liquidity is steady but cautious. High-yield spreads remain compressed while fund flows reflect opportunistic rotation, not full-on acceleration.

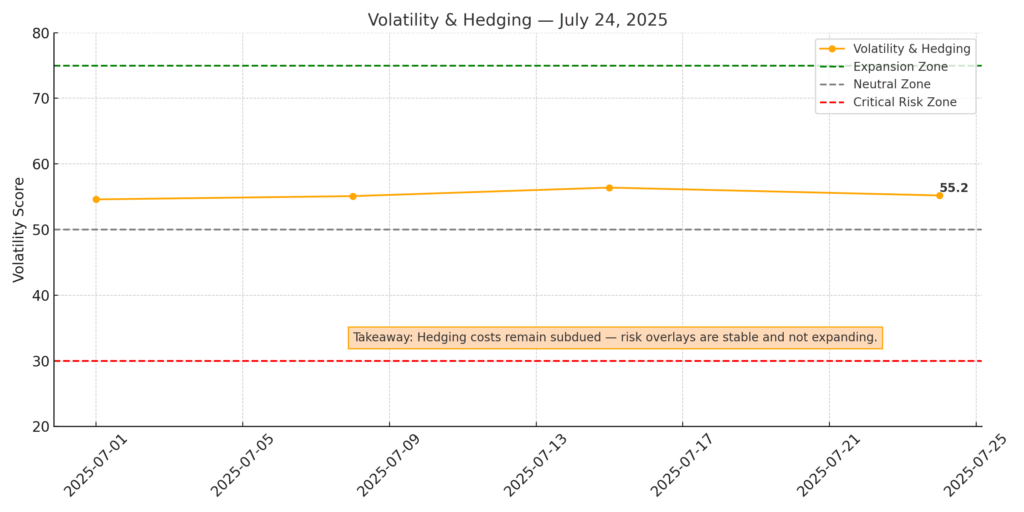

Volatility & Hedging

Risk Pulse: Hedging demand continues to fade. Downside overlays are flat to declining — consistent with declining implied vol and sustained institutional confidence.

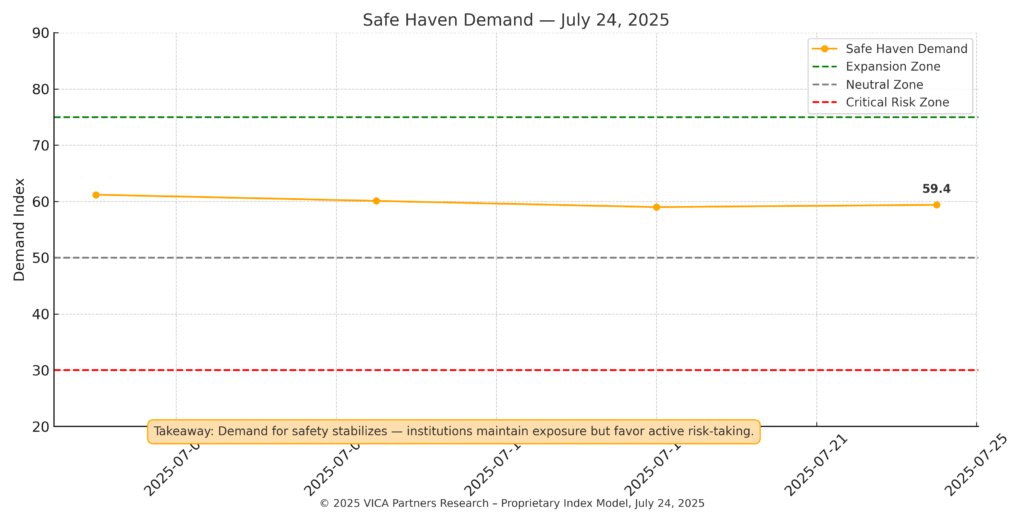

Safe Haven Demand

Capital Preference: Gold, Treasuries, and TIPs allocations remain static. Defensive sleeves are intact but not expanding — risk-on posture is quietly growing.

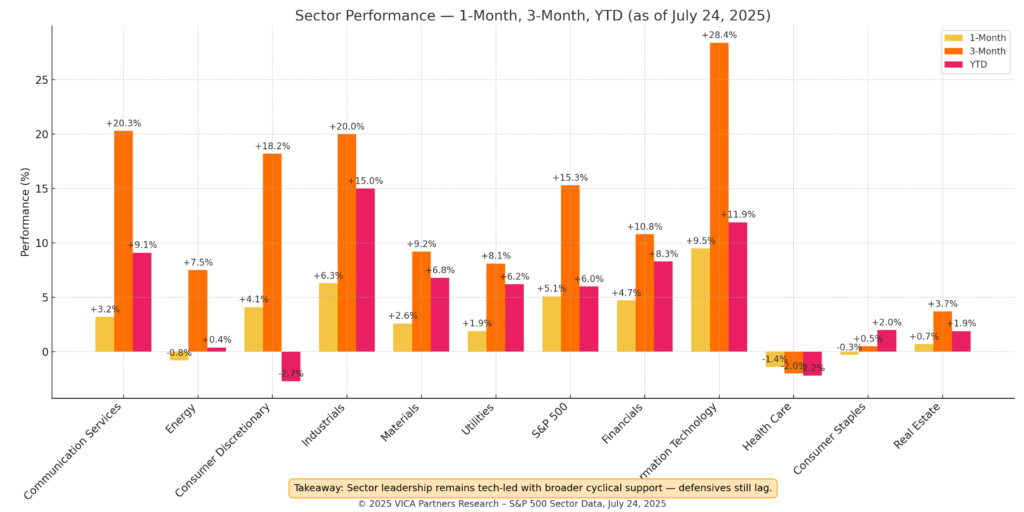

Sector Rotation View

Rotation Signal: Financials, semis, and industrials lead capital flows. Defensive sectors underperform. Notably, equal-weight benchmarks continue to outperform.

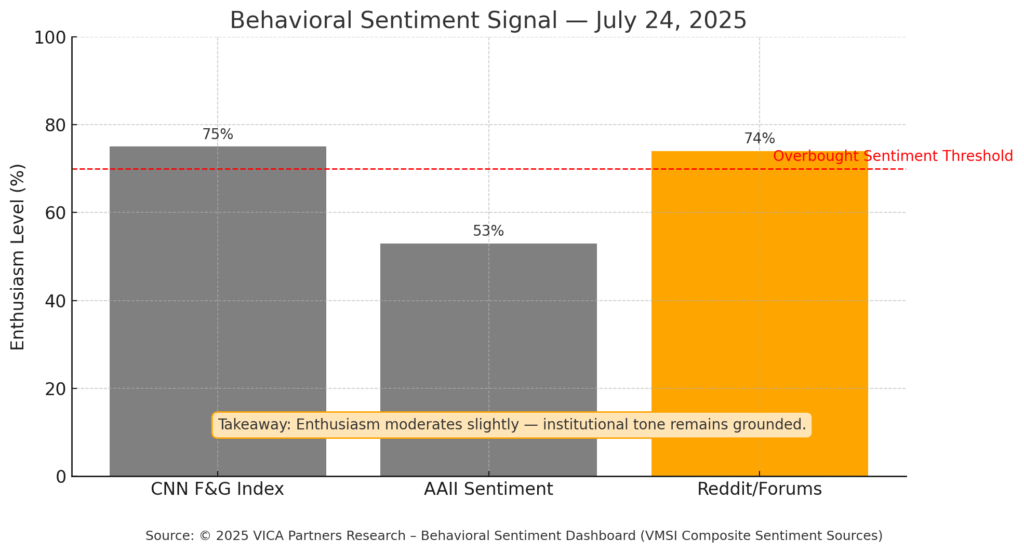

Sentiment Divergence

Behavioral Read: Retail sentiment remains high, but institutions are leading through macro-confirmation. Repositioning continues with calm, calculated resolve.

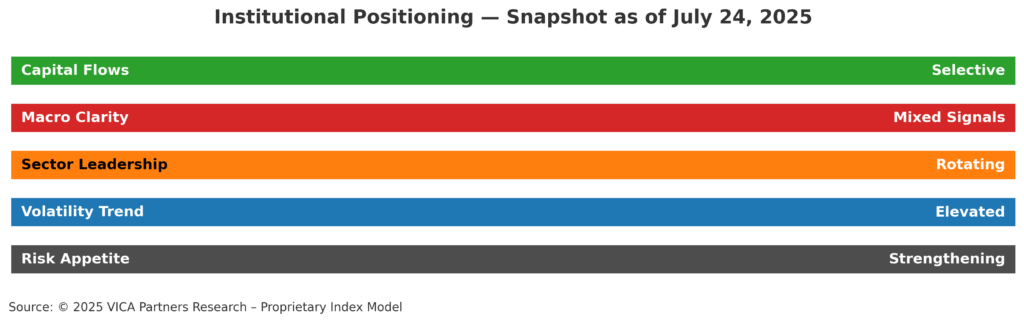

Institutional Positioning Grid – July 24, 202

Tactical Read: Exposure is moving further into mid- and small-caps. Rotation is methodical, not aggressive — indicative of conviction, not just risk-seeking.

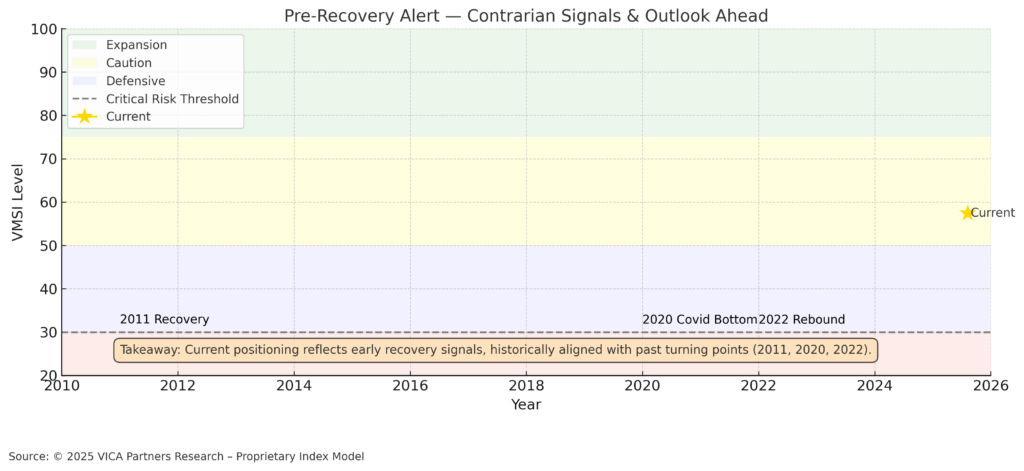

Historical Recovery Zone

Historical Echo: Current VMSI band mirrors post-recovery inflection points in 2011 and 2020. Composite score and sub-components suggest sustainable expansion path if macro remains stable.

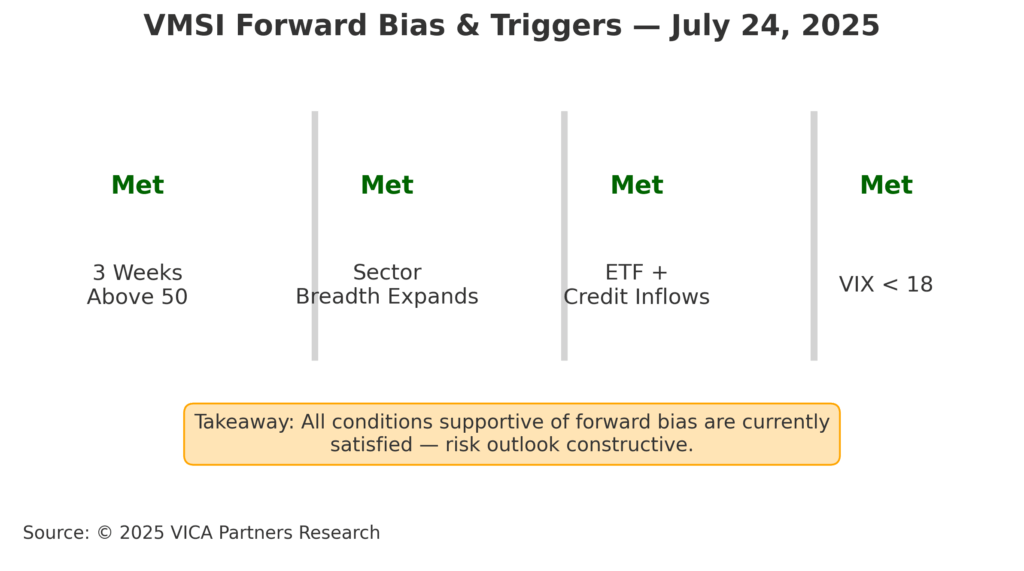

Predictive Outlook – What Comes Next

Key Triggers to Monitor:

-

VIX remains below 18 (confirmed)

-

High-yield credit spreads remain tight

-

SOXX / VTWO relative strength confirms risk rotation

-

Sector breadth continues to firm

Base Case (70%): Institutions continue extending exposure into cyclicals with tactical hedging overlays. Alternate Case (30%): Macro disruptions (e.g., Fed policy, global events) may reintroduce short-term risk hedging.

About VMSI

Note: VMSI© is a proprietary, institutionally oriented composite index built from forward- and backward-looking signals. It is engineered to reflect conviction-weighted positioning across volatility, momentum, liquidity, and sentiment frameworks — designed for institutional portfolio strategy, macro risk management, and capital rotation timing. It is not derived from the VIX or any single input.

© 2025 VICA Partners. All rights reserved. This report is for informational purposes only and does not constitute investment advice. Unauthorized reproduction prohibited.