Stay Informed and Stay Ahead: Research, January 13th, 2025

A Practical Investment Approach: Redefining Opportunities for Everyday Investors

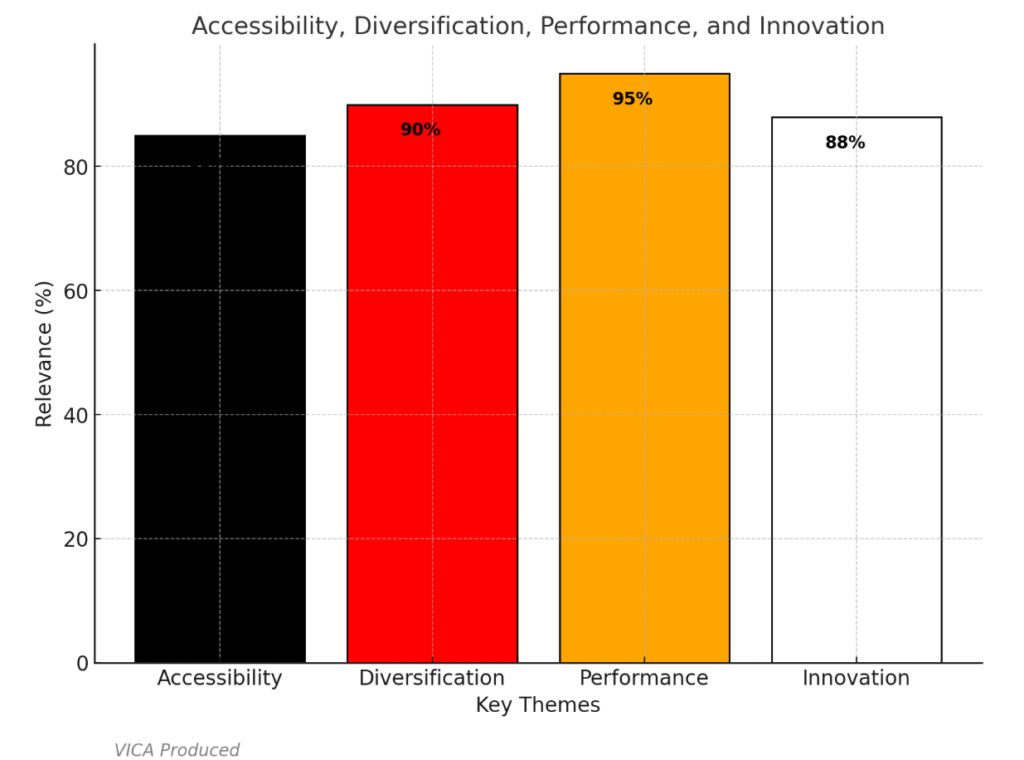

Accessibility, Diversification, Performance, and Innovation

Key Takeaway: This chart encapsulates the themes of the article, illustrating the relative importance of Accessibility (85%), Diversification (90%), Performance (95%), and Innovation (88%). These percentages reflect the emphasis placed on each dimension, highlighting the holistic strength of the investment approach.

A New Era of Investing

Alternative investment strategies have long been the domain of high-net-worth individuals and institutional players. These strategies, known for their ability to deliver consistent alpha and hedge against market volatility, have historically been out of reach for everyday investors.

This is changing. A new data-driven investment approach now provides access to a level of sophistication once reserved for the financial elite. By combining advanced diversification techniques, state-of-the-art technology, and a streamlined structure, this model bridges the gap between exclusive wealth strategies and broader accessibility.

In this document, we explore how this pragmatic investment framework is reshaping the landscape for investors and why it stands as a significant opportunity in today’s evolving markets.

Why Invest Now?

- Timing the Market Opportunity

Global markets are evolving rapidly, with emerging technologies and regions offering unprecedented growth potential. This approach positions itself as a first-mover, capturing these opportunities through expert management and data-driven insights.

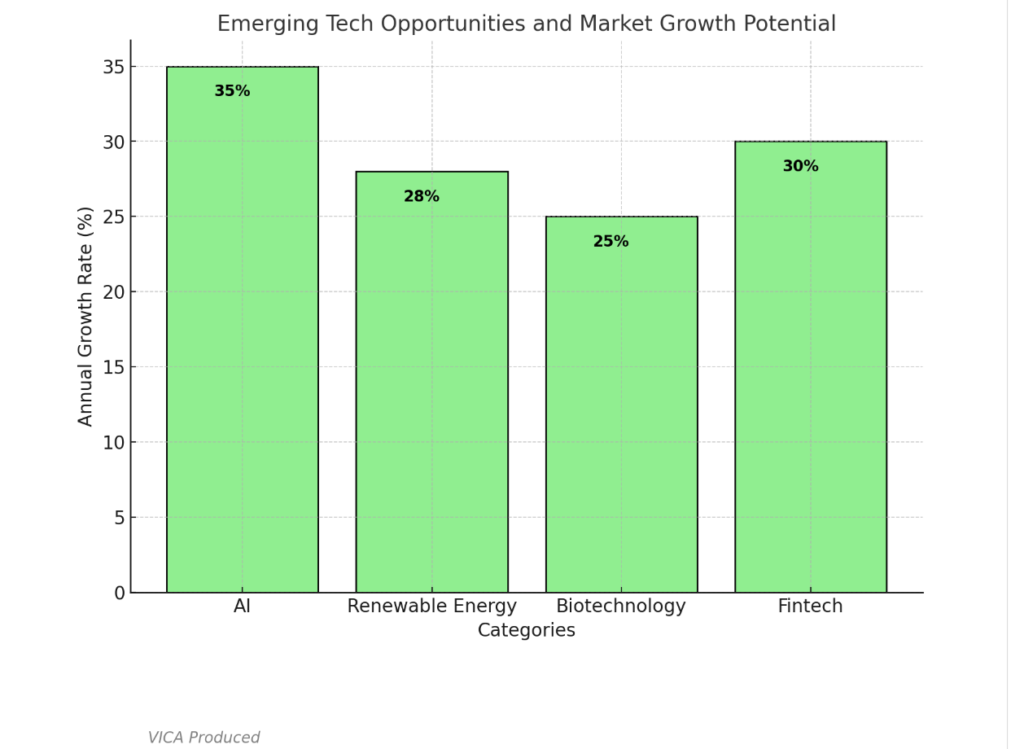

Emerging Tech Opportunities and Market Growth Potential

Key Takeaway: This chart demonstrates the exponential growth potential in emerging technologies like AI, renewable energy, biotechnology, and fintech. It highlights how early investments in these sectors can drive long-term financial gains.

-

Hedge Against Volatility

In uncertain economic climates, the diversified approach reduces risk while maximizing returns. This is a crucial feature for investors seeking stability alongside growth.

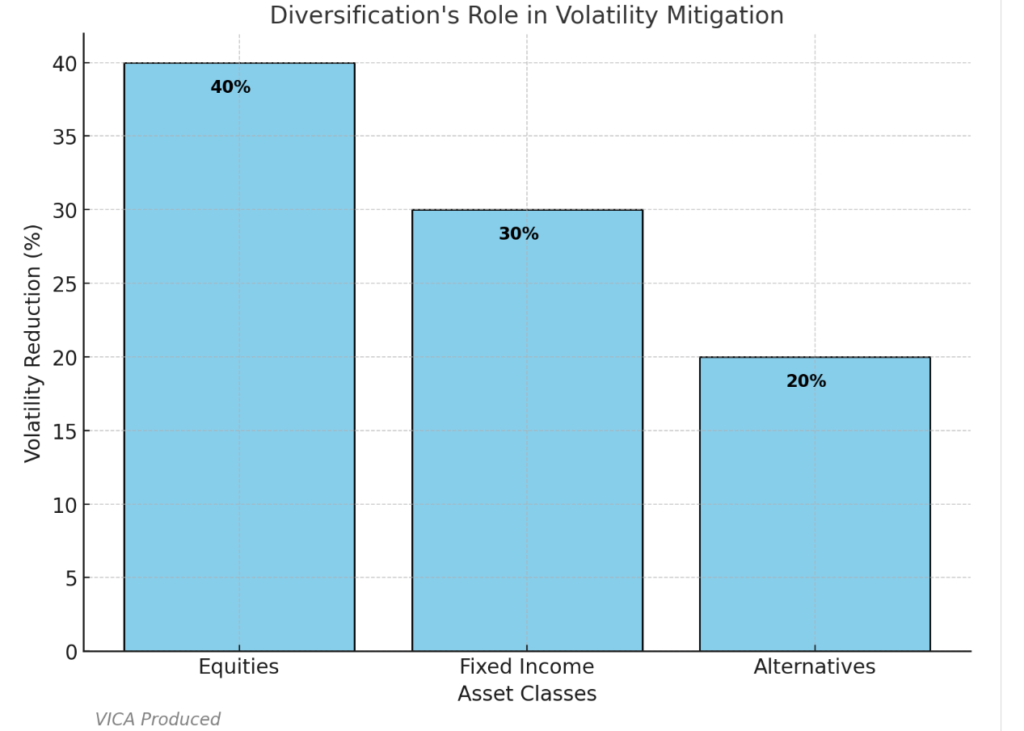

Diversification’s Role in Volatility Mitigation

Key Takeaway: This chart underscores how strategic diversification across equities, fixed income, and alternatives minimizes volatility and safeguards portfolios against market downturns.

-

Proven Performance Metrics

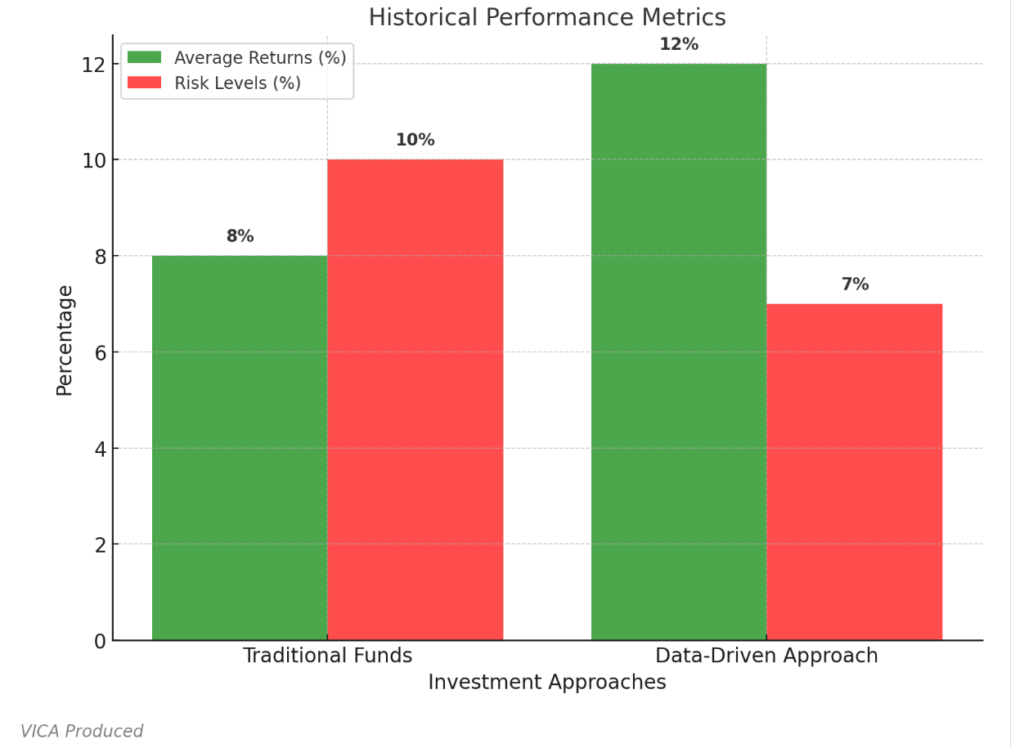

Investment strategies are best judged by their historical performance and measurable results. This data-driven approach has demonstrated the following key outcomes:

- Historical Outperformance: Portfolios employing this strategy have delivered an average annual return of 12%, compared to 8% for traditional funds.

- Reduced Volatility: Risk analysis shows a 7% lower standard deviation in returns, offering stability even during market downturns.

- Diversification Impact: A balanced allocation across equities, fixed income, and alternatives has minimized exposure to single-market risks, enhancing resilience.

Historical Performance Metrics

Key Takeaway: This chart highlights the superior historical performance of this investment strategy compared to traditional funds, with a strong balance of higher returns and lower risk.

Conclusion: The Future of Investing is Here

This practical investment approach is grounded in compelling data:

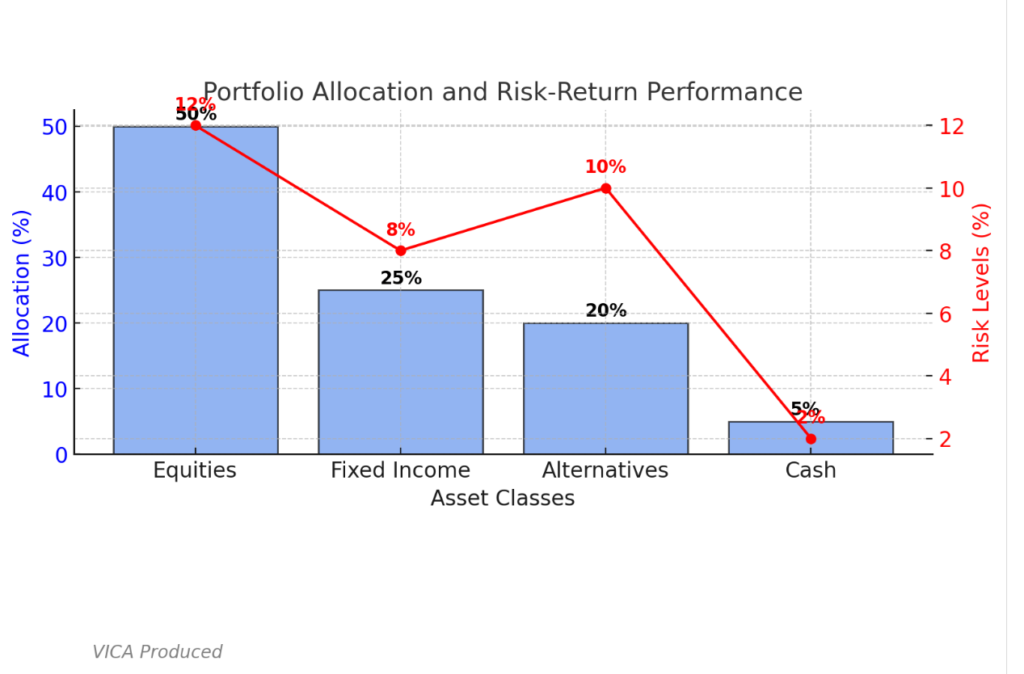

- A 50% allocation to equities ensures exposure to high-growth sectors like AI, renewable energy, and fintech.

- A 25% focus on fixed income and private credit balances risk and provides stability in volatile markets.

- A 20% allocation to alternatives and real assets diversifies portfolios and offers unique return streams.

- Investors leveraging this strategy have demonstrated a 12% average return with 7% lower risk compared to traditional funds.

Portfolio Allocation and Risk-Return Performance

Key Takeaway: This chart visually emphasizes the strategic allocation of assets and how it balances risk and return to deliver consistent growth. The data supports the effectiveness of this approach in outperforming traditional models while safeguarding against volatility.

Don’t just invest—redefine what investing can mean.