MARKETS TODAY April 5th, 2023 (Vica Partners)

Good Wednesday Evening,

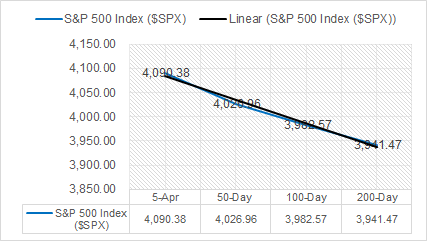

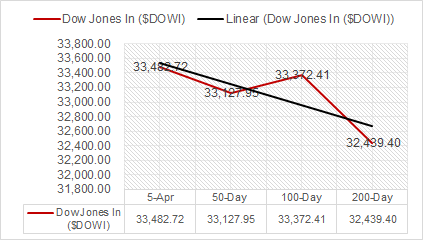

Yesterday, the S&P and DOW extended recent gains with the Nasdaq/ FANG+ declining. Of the S&P 500 sectors Energy and Healthcare outperformed/ Real Estate and Consumer Discretionary underperformed. Gold breaks $2k! Economic jobs data suggested economic activity slowing.

Overnight, Asian markets finished mixed with the Shanghai Composite up 0.49% and the Nikkei 225 up 0.35% while the Hang Seng down 0.66%. Premarket, European markets finished mixed the FTSE 100 gained 0.37%, while the DAX declined 0.53% the CAC 40 declined 0.39%. S&P US futures were trading 0.25% above fair-value.

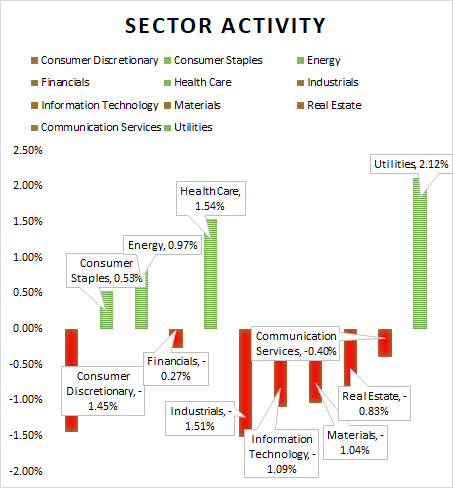

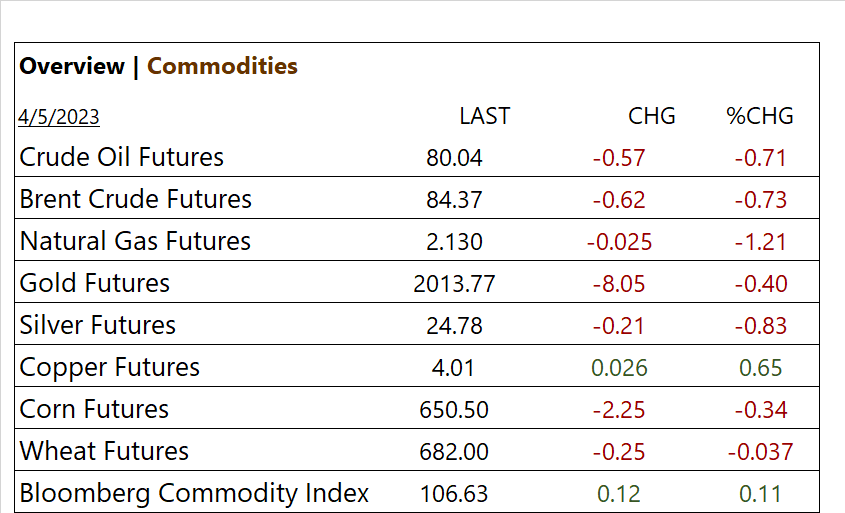

US markets today Key Indices closed lower except DOW. 7 of 11 of the S&P 500 sectors were lower/ Industrials and Consumer Discretionary underperform, Utilities outperforms. Oil futures, Bitcoin and Gold all decline. In economic news, ADP payroll numbers and ISM Services headline numbers came in below expectations.

Takeaways

- Tech pulls back, FANG+ down -2.3%

- Recession concerns as private employers added fewer jobs than expected

- Defensives Utilities and Health Care outperform

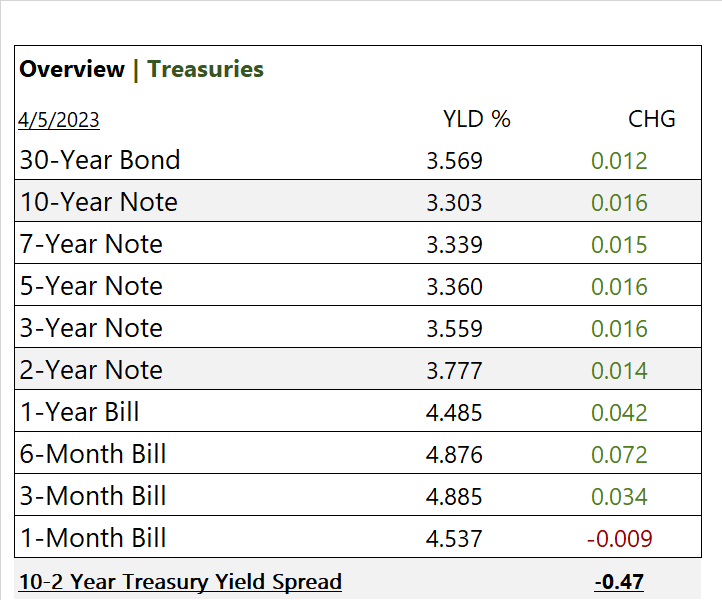

- Yields up afterhours

- Bloomberg Commodity Index steadily rising

Sectors/ Commodities/ Treasuries

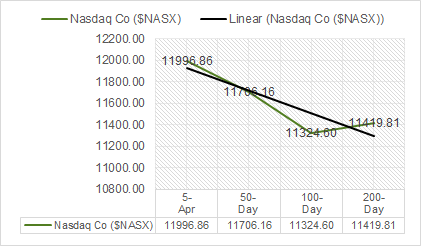

Key Indexes (50d, 100d, 200d)

S&P Sectors

- 7 of 11 of the S&P 500 sectors were lower / Industrials -1.51% and Consumer Discretionary 1.45% underperform, Utilities +2.12% and Health Care +1.54% outperform.

Commodities

US Treasuries

Notable Earnings This Week (bold denotes today)

- + Science Applications (SAIC), MSC Industrial Direct (MSM), ConAgra Foods (CAG)

- – Acuity Brands (AYI), Lindsay (LNN), Dlocal (DLO)

- * Strong support – Baidu Inc (BIDU), Sociedad Quimica y Minera de Chile (SQM), Alibaba Group Holdings (BABA), Qualcomm (QCOM), Vale (VALE), Rio Tinto (RIO), Analog Devices (ADI), Palo Alto Networks (PANW), Toyota Motor Corp (TM), Occidental Petroleum (OXY), United Health Care (UNH), Humana (HUM), Centene (CNC)

Economic Data

US

- ADP employment; period March, act 145,000, fc 261,000, prev. 242,000

- U.S. trade balance; period Feb., act -$70.5B, fc -$69.1B, prev. -$68.7B

- S&P final U.S. services PMI, period March, act 52.6, fc 53.8, prev. 53.8

- ISM services; period March, act 51.2%, fc 54.3%, prev. 55.1%

News

Company News/ Other

- Meta releases AI model that can identify items within images – Reuters

- Oil steadies as economic fears counter OPEC+ cuts, US stock draw – Reuters

Central Banks/Inflation/Labor Market

- Cleveland Fed President Reiterates Central Bank’s Resolve to Fight Stubborn Inflation – WSJ

- ECB Officials Rally Behind Call That Rate Hikes Will Soon End – Bloomberg

China

- Europe Plots a Reset on China – NY Times