“Empowering Your Financial Success”

Daily Market Insights: October 13th, 2023

Global Markets Summary:

Asian Markets:

- Nikkei 225 (Japan): -0.63%

- Shanghai Composite (China): -0.64%

- Hang Seng (Hong Kong): -2.45%

US Futures:

- S&P Futures: opened @ 4360.49 (+0.25%)

European Markets:

- FTSE 100 (London): -0.60%

- CAC 40 (France): -1.42%

- DAX (Germany): -1.55%

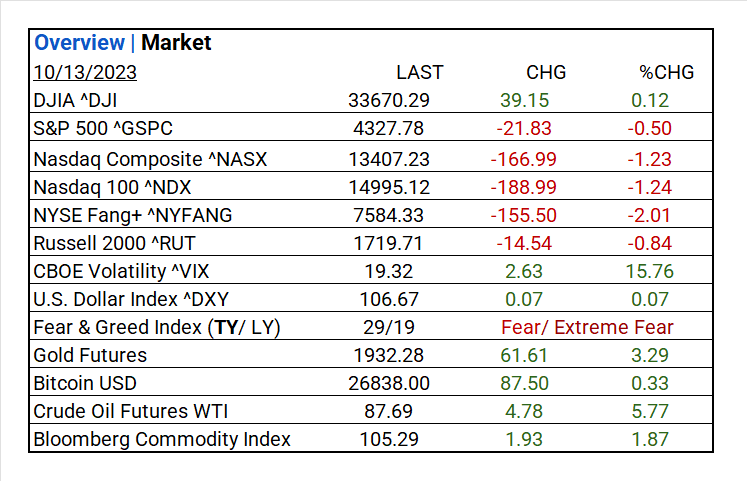

US Market Snapshot:

Key Stock Market Indices:

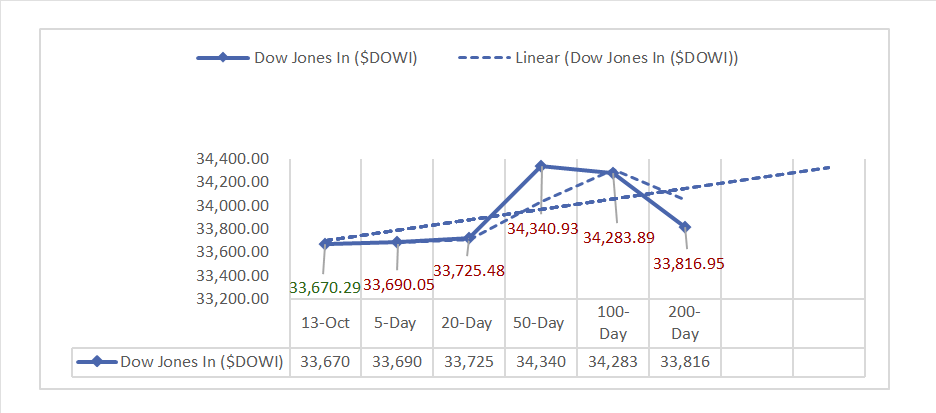

- DJIA ^DJI: 33,670.29 (+39.15, +0.12%)

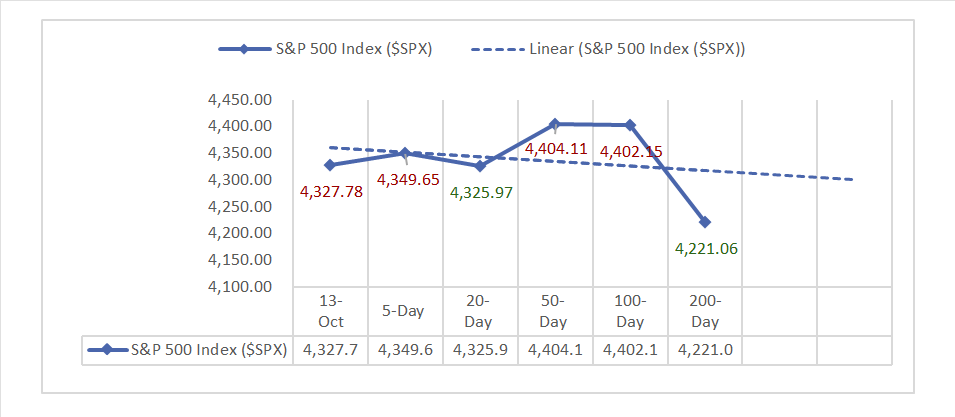

- S&P 500 ^GSPC: 4,327.78 (-21.83, -0.50%)

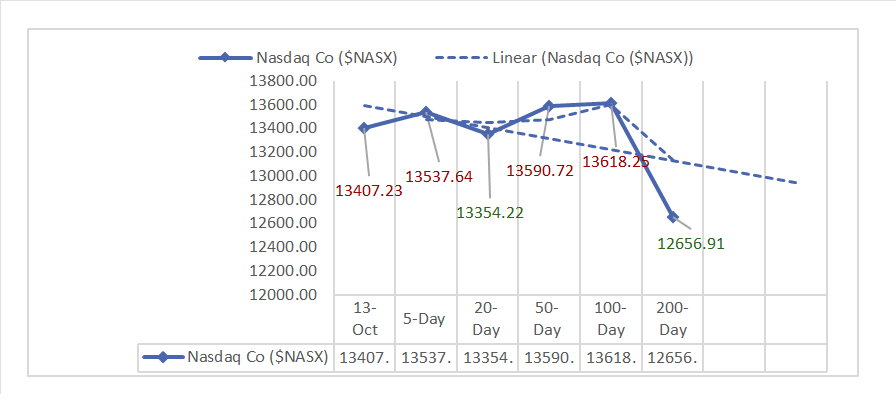

- Nasdaq Composite ^NASX: 13,407.23 (-166.99, -1.23%)

- Nasdaq 100 ^NDX: 14,995.12 (-188.99, -1.24%)

- NYSE Fang+ ^NYFANG: 7,584.33 (-155.50, -2.01%)

- Russell 2000 ^RUT: 1,719.71 (-14.54, -0.84%)

Market Insights: Performance, Sectors, and Trends:

- Economic Data: In September, the Import Price Index was below the consensus at 0.1%, while the Index Minus Fuel decreased to -0.2%. Preliminary Consumer Sentiment for October fell to 63, missing the consensus of 67.4, following a prior month value of 68.1.

- Market Indices: Major U.S. indices showed mixed results: DJIA gained 0.12%, while S&P 500, Nasdaq Composite, Nasdaq 100, NYSE Fang+, and Russell 2000 declined.

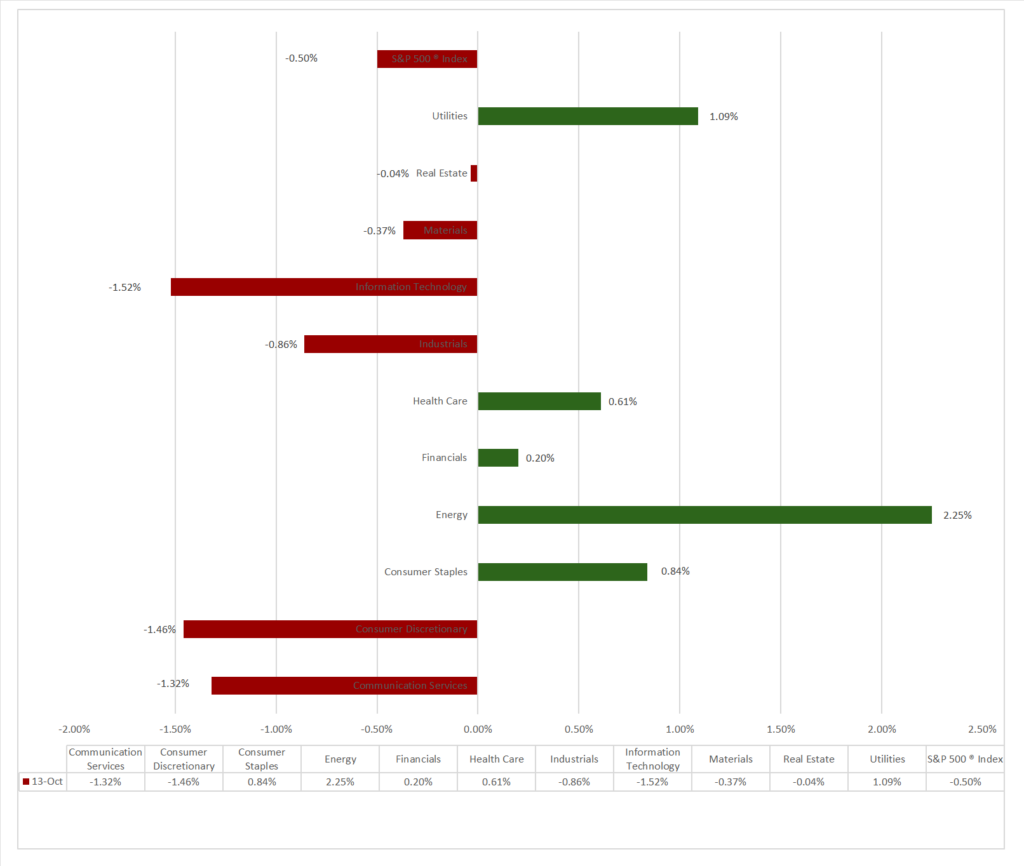

- Sector Performance: 6 of 11 sectors fell, Energy (+2.25%) outperformed, while Information Technology (-1.52%) lagged. Top Industry: Oil, Gas & Consumable Fuels (+2.39%).

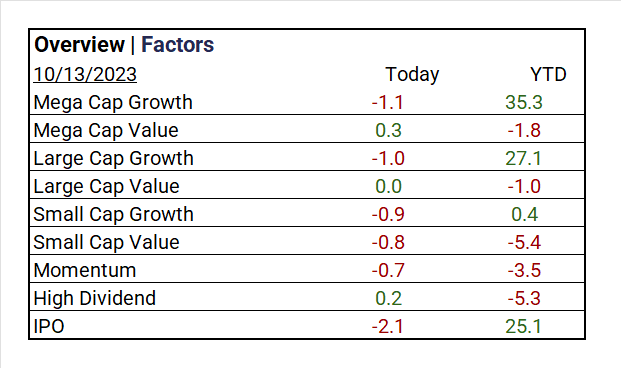

- Factors: Value tops Growth, IPO’s (-2.1%) lag.

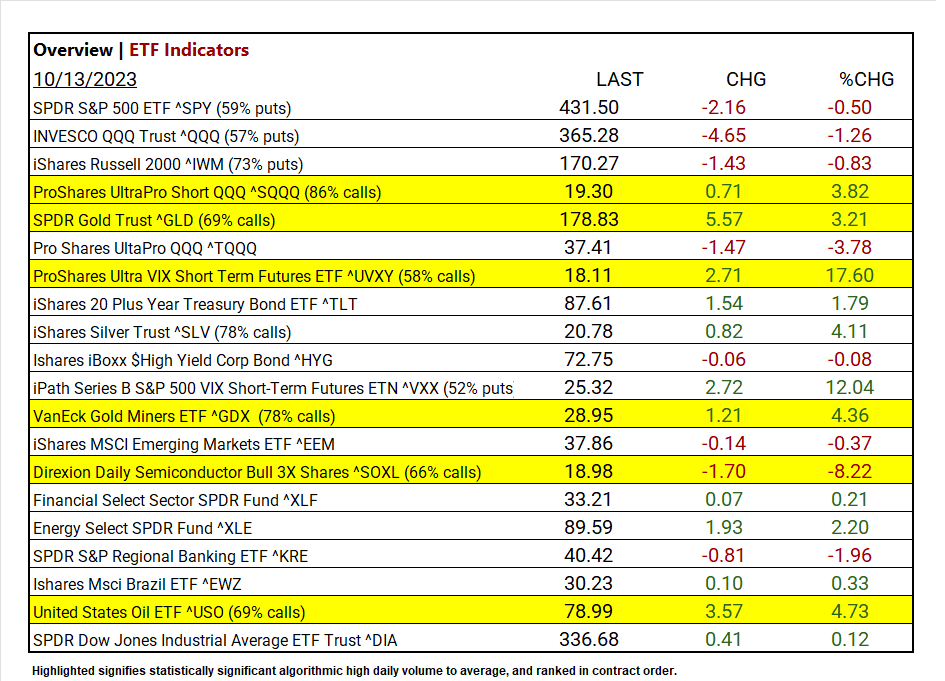

- Top ETF: ProShares Ultra VIX Short Term Futures ETF ^UVXY +17.60%.

- Worst ETF: Direxion Daily Semiconductor Bull 3X Shares ^SOXL -8.22%.

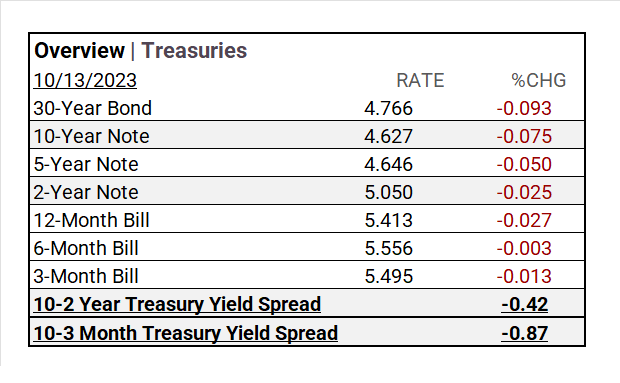

- Treasury Markets: U.S. Treasury yields dropped: 30-Year Bond at 4.766% (-0.093) and 10-Year Note at 4.627% (-0.075). Spreads narrowed, 10-2 at -0.42 and 10-3 Month at -0.87.

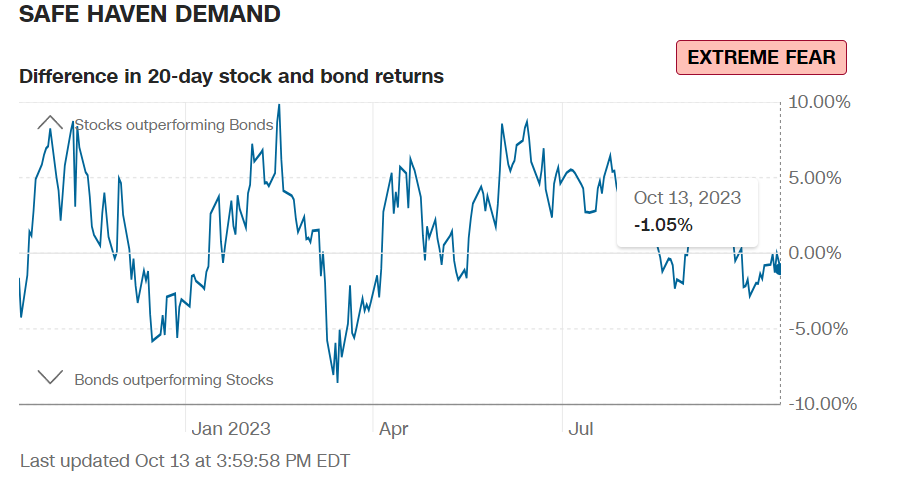

- Currency and Volatility: The U.S. Dollar Index up, CBOE Volatility jumps +15.76%, and the Fear & Greed reading: Fear.

- Commodity Markets: Gold prices and Oil surge, Bitcoin rises, and the Bloomberg Commodity Index gains.

Sectors:

- 6 of 11 sectors fell, Energy (+2.25%) outperformed, while Information Technology (-1.52%) lagged. Top Industry: Oil, Gas & Consumable Fuels (+2.39%), Health Care Providers & Services (+1.81%), and Insurance (+1.45%).

Treasury Yields and Currency:

- US Treasury yields declined across maturities, with the 30-Year Bond decreasing to 4.766% (-0.093) and the 10-Year Note falling to 4.627% (-0.075). Yield spreads tightened, with the 10-2 -0.42 and the 10-3 Month at -0.87.

- The U.S. Dollar Index ^DXY: 106.67 (+0.07, +0.07%)

Market Volatility and Sentiment:

- CBOE Volatility ^VIX: 19.32 (+2.63, +15.76%)

- Fear & Greed Index (TY/LY): 29/19 (Fear/ Extreme Fear).

Source: CNN Fear and Greed Index

Commodities:

- Gold Futures: 1,932.28 (+61.61, +3.29%)

- Bitcoin USD: 26,838.00 (+87.50, +0.33%)

- Crude Oil Futures WTI: 87.69 (+4.78, +5.77%)

- Bloomberg Commodity Index: 105.29 (+1.93, +1.87%)

Factors:

- Value tops Growth, IPO’s (-2.1%) lag.

ETF Performance:

Top 3 Best Performers:

- ProShares Ultra VIX Short Term Futures ETF ^UVXY +17.60%

- iPath Series B S&P 500 VIX Short-Term Futures ETN ^VXX +12.04%

- United States Oil ETF ^USO +4.73%

Top 3 Worst Performers:

- Direxion Daily Semiconductor Bull 3X Shares ^SOXL -8.22%

- Pro Shares UltaPro QQQ ^TQQQ -3.78%

- SPDR S&P Regional Banking ETF ^KRE -1.96%

US Major Economic Data

- Import Price Index: September 0.1%, (Consensus 0.5%), Prior Month: 0.5%

- Import Price Index Minus Fuel: September-0.2%, Prior Month: -0.1%

- Consumer Sentiment Preliminary: October 63, (Consensus 67.4), Prior Month: 68.1

Earnings:

- Q1 ’23: 79% of companies beat analyst estimates.

- Q2 Forecast/Actual: Predicted <7.2%> FY 2023 S&P 500 EPS decline; FY 2023 EPS flat YoY. By 7-28, 51% reported Q2 2023, results; 80% beat EPS estimates, above 5-year (77%) and 10-year (73%) averages. Earnings exceeded estimates by 5.9%, slightly below the 5-year (8.4%) and 10-year (6.4%) averages.

- Q3 Forecast: 116 companies in the index have issued EPS guidance for Q3 2023, Of these 116 companies, 74 have issued negative EPS guidance and 42 have issued positive EPS guidance. The percentage of S&P 500 companies issuing negative EPS guidance for Q3 2023 is 64% (74 out of 116), which is above the 5-year average of 59% but equal to the 10-year average of 64%. Eight of the eleven sectors are expected to see year-over-year earnings growth, with Communication Services and Consumer Discretionary leading the way. Conversely, three sectors, mainly Energy and Materials, are expected to experience earnings declines.

Notable Earnings Today:

- Beat: UnitedHealth (UNH), JPMorgan (JPM), Wells Fargo&Co (WFC), Progressive (PGR), Citigroup (C)

- Miss: BlackRock (BLK), PNC Financial (PNC), Ryohin Keikaku Co (RYKKY)

Resources:

- What’s Expected in October

- Vica Partners Economics Forecast

News

Investment and Growth News

- Microsoft’s Activision Buy Extends Nadella’s Decade of Deals – WSJ

- Huawei Drives $34 Billion China Stock Boom in Rare Hot Trades – Bloomberg

- JPMorgan and Citi Pass Pain to Hedge Fund Shorts- Bloomberg

Infrastructure and Energy

- The Oil Price Has a Safety Valve. Gas Doesn’t – WSJ

- Miner Expanding in Europe Wants More Aid for EV Battery Materials – Bloomberg

Real Estate Market Updates

- Deutsche Bank CEO Says Hard Times Ahead for Commercial Real Estate –Bloomberg

Central Banking and Monetary Policy

- This Inflation Report Won’t Let the Fed Declare Victory – WSJ

- World’s Higher-for-Longer Rate Era Stokes Worry –Bloomberg

International Market Analysis (China)

- China inflation: 4 takeaways from September’s data as consumer prices remained flat –SCMP