“Empowering Financial Success” Vica Partners Group

Unlocking Market Insights: September 15th, 2023

Global Markets

-

Japan’s Nikkei 225: +1.10%

-

Hong Kong’s Hang Seng: +0.75%

-

China’s Shanghai Composite: -0.28%

-

France’s CAC 40: +0.96%

-

Germany’s DAX: +0.56%

-

London’s FTSE 100: +0.50%

US Markets

-

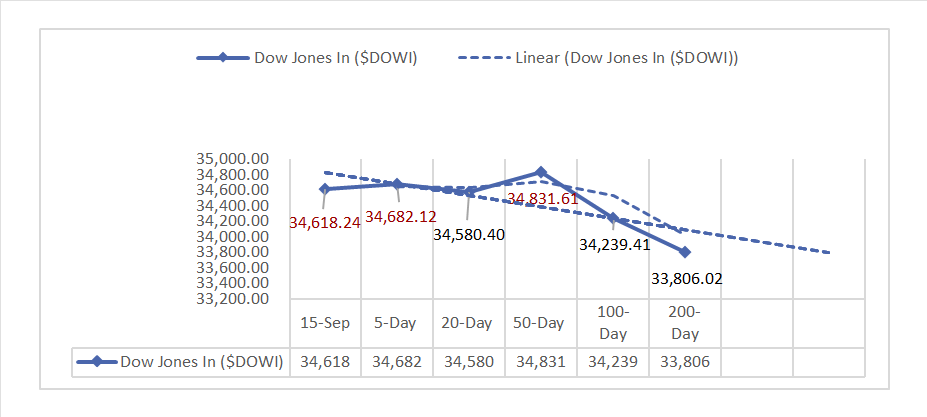

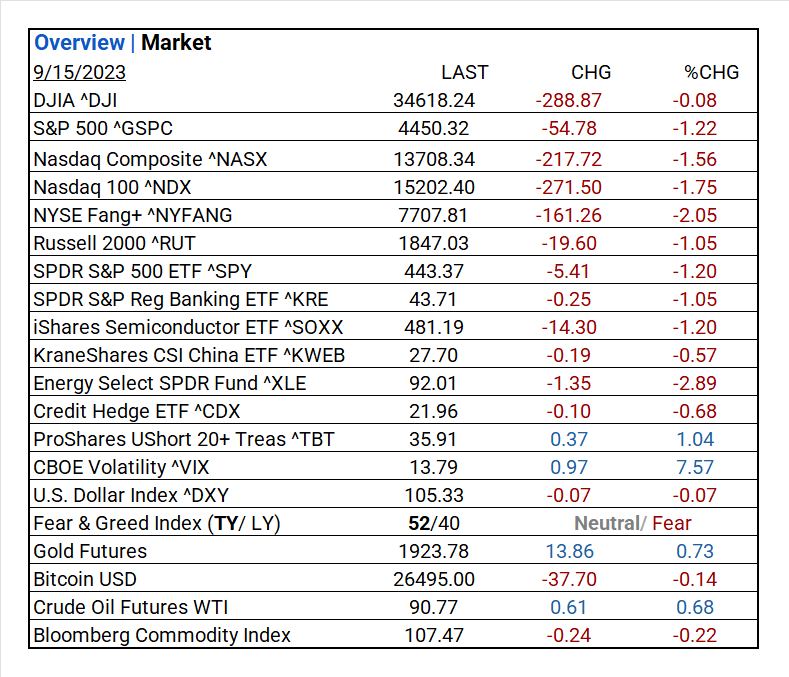

DJIA (^DJI): 34,618.24 (-0.08%)

-

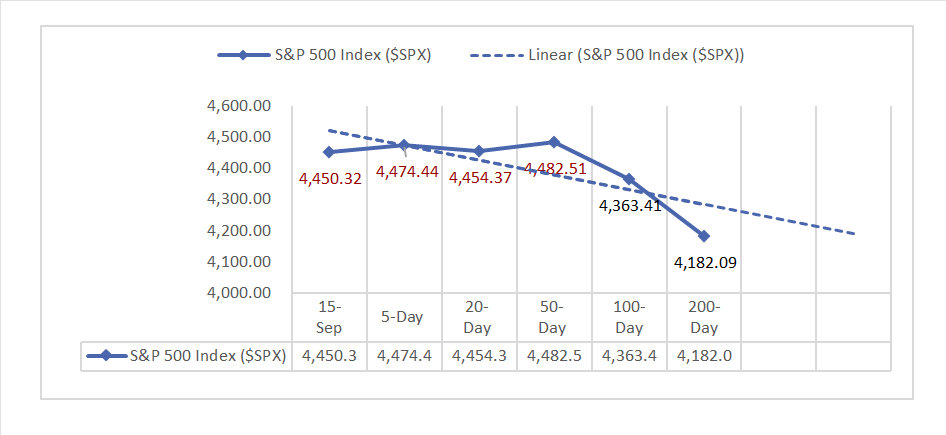

S&P 500 (^GSPC): 4,450.32 (-1.22%)

-

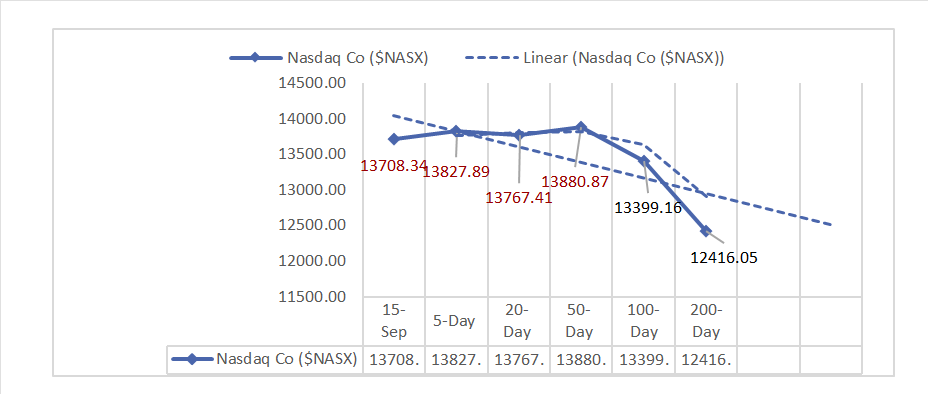

Nasdaq Composite (^NASX): 13,708.34 (-1.56%)

Market Highlights

-

Major US indices posted declines.

-

ETFs such as SPDR S&P 500 ETF, SPDR S&P Regional Banking ETF, and iShares Semiconductor ETF saw declines.

-

ProShares UltraShort 20+ Treasury ETF showed an increase.

-

Market volatility, measured by the CBOE Volatility Index, increased significantly.

-

The U.S. Dollar Index experienced a slight decline, with the Fear & Greed Index indicating a neutral to fearful sentiment among investors.

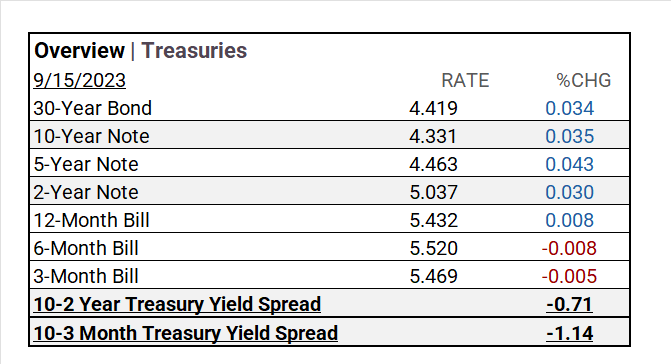

Currency and Treasury Yields

-

U.S. Dollar Index (^DXY): -0.07%

-

Treasury yields mostly up

Commodities

-

Gold Futures: +0.73% to $1,923.78

-

Bitcoin USD: -0.14% to $26,495.00

-

Crude Oil Futures WTI: +0.68% to $90.77

-

Bloomberg Commodity Index: -0.22% at 107.47

US Economic Data

-

NY Empire State Manufacturing Index (Sept): 1.9 (vs. consensus -10, prior -19)

-

Import/Export Prices (Aug): Imports -3%, Exports -5.5% (prior: Imports -4.6%, Exports -8%)

-

Industrial Production (Aug): YoY 0.2%, MoM 0.4% (prior: YoY -0.2%, MoM 1%)

-

Manufacturing Production (Aug): YoY -0.6%, MoM 0.1% (prior: YoY -0.7%, MoM 0.5%)

-

Preliminary Michigan Consumer Sentiment (Sept): 67.7 (consensus 69.1, prior 69.5)

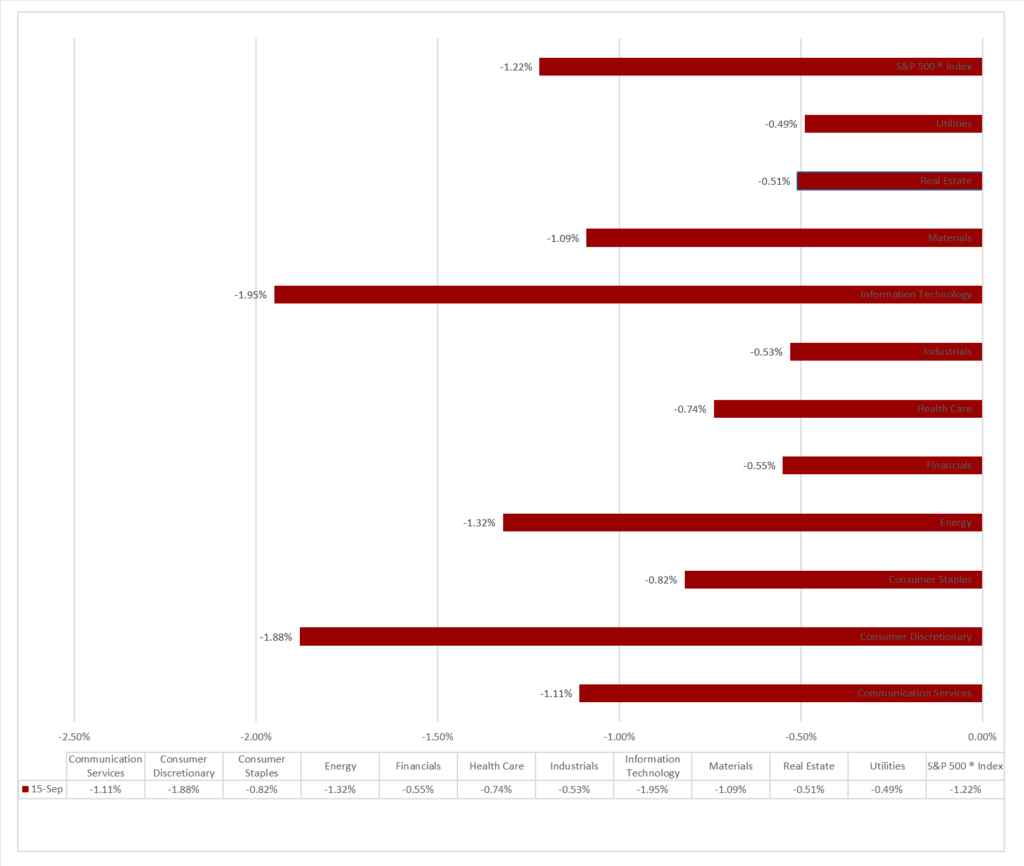

Indices, Sectors, Factors, and Treasuries

-

S&P 500 and Dow Jones showed declines.

-

All 11 S&P 500 sectors experienced declines. Utilities: -0.49% outperformed/ Information Technology: -1.95% lagged

-

Standout performers include Hotel & Resort REITs, Passenger Airlines, Consumer Finance, and Automobile Components.

-

Energy sector led monthly performance, followed by Information Technology and Communication Services.

US Treasuries

-

Yields showed various movements.

-

Yield spreads indicated some inversion.

Exchange-Traded Funds (ETFs)

Declines:

-

SPDR S&P 500 ETF (^SPY): -1.20%

-

SPDR S&P Regional Banking ETF (^KRE): -1.05%

-

iShares Semiconductor ETF (^SOXX): -1.20%

-

KraneShares CSI China ETF (^KWEB): -0.57%

-

Energy Select SPDR Fund (^XLE): -2.89%

-

Credit Hedge ETF (^CDX): -0.68%

Positive Performer:

-

ProShares UltraShort 20+ Treasury (^TBT): +1.04%

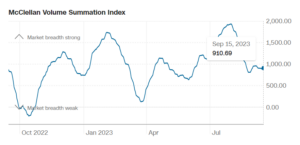

Market Indicators

-

CBOE Volatility Index (^VIX): +7.57% to 13.79

-

Fear & Greed Index: 52/40 (Neutral to Fearful Sentiment)

-

Market Breadth Indicator: The McClellan Volume Summation Index analyzes the volume of rising shares compared to falling shares on the NYSE. A low or negative value indicates a bearish signal.

Factor Charts

Earnings

-

Q1 ’23: 79% of companies beat analyst estimates by an average of 6.5%.

-

Q2 Forecast: Predicted decline of <7.2%> in S&P 500 EPS.

-

Fiscal year 2023 EPS remained flat YoY.

-

Q2 Seasonal Actuals yet to be reported.

Notable Earnings Today

-

Beat:

-

Miss:

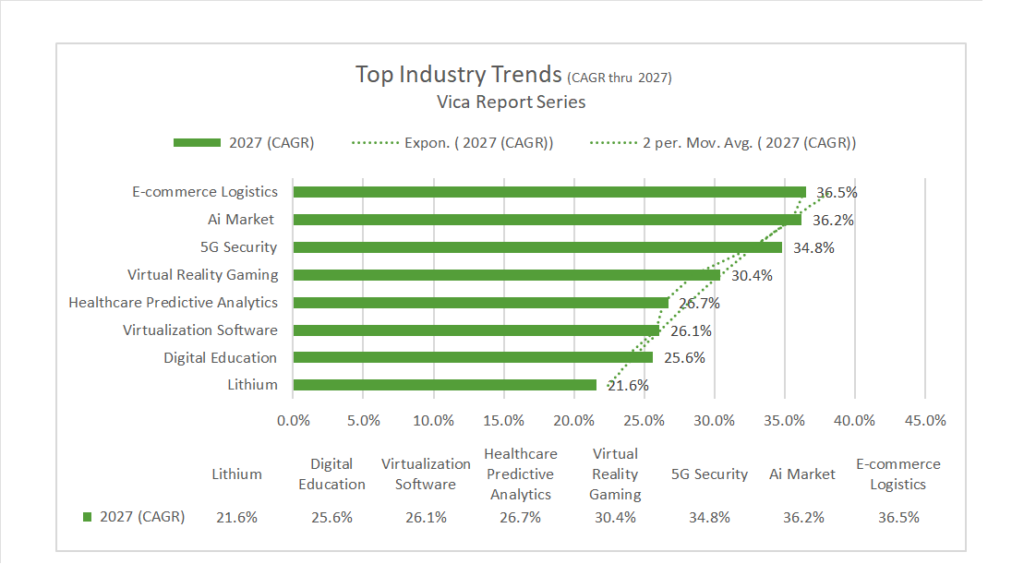

Strategies for Success in September 2023

Key Trends

-

August/September historically have lower ROI.

-

Energy sector expected to advance, especially services.

-

Real Estate REITs offer opportunity.

-

Passenger Airlines and Travel remain robust.

-

^NYFANG Index and Mega Cap Tech expected to remain strong.

-

Current economic signals are mixed, with energy prices causing pricing problems. Oil futures may exceed $100 a barrel into Q4.

Your Guide to Economic Trends in 2023 and Beyond

Economic Forecast

-

Federal Reserve no longer predicts a recession, but Vica Partners forecasts a potential recession.

-

Factors include Fed tightening, rising oil prices, overvalued stock markets, and a strong dollar.

-

Market bottoms tend to occur amid negative news and deflationary signals.

-

Rising interest rates and consumer debt are significant concerns.

-

Expect Information Technology company valuation adjustments.

-

Look to Utilities and Health Care sectors for gains.

-

Moderate shift from Growth to Value stocks.

Economic Forecast

Key Points

-

The Federal Reserve faces limitations in its ability to control inflation, given the complexities of today’s highly automated global economy.

-

A 2% inflation target may no longer be realistic, and there is potential for a base rate exceeding 3% to support initiatives such as wage increases, energy transition, operational efficiency enhancements, and safeguarding against deflation.

News

Company News/ Other

-

TikTok Fined by Irish Regulator Over Misuse of Children’s Data – WSJ

-

Rising Rates Make Big Companies Even Richer – WSJ

Energy/ Materials

-

Hedge Funds Hiked Bullish Oil Bets to 15-Month High on OPEC+ Cuts – Bloomberg

-

Indigo Ag Attracts $250 Million to Scale Up Carbon Capture – Bloomberg

Real Estate

-

Next China: The Biggest Risk – Bloomberg

Central Banks/Inflation/Labor Market

-

US Consumer Prices Jump, Straining Household Budgets Even More – Bloomberg

-

US Consumer Credit Rises $10.4 Billion, Largely on Credit Card – Bloomberg

Asia/ China

-

China’s economic data breakdowns show signs of life amid prevailing doom-and-gloom outlook – SCMP