TECHNICAL ANALYSIS

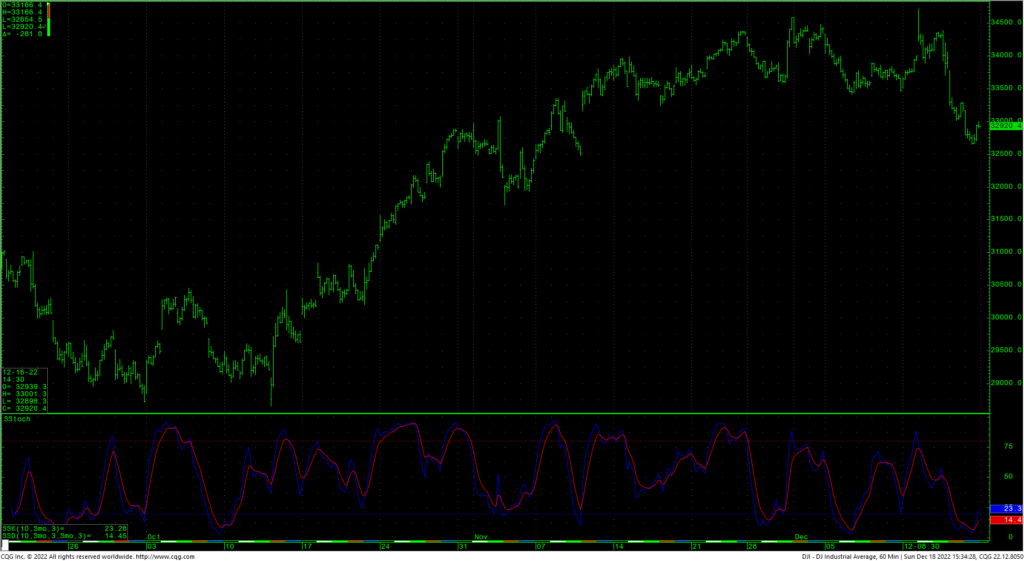

The DJIA traded a massive outside week down with prices setting a new trading high Tuesday and then swooning 2057.7 points to close in the bottom portion of the week’s range for a total decline of 1.66%. As we pointed out in last week’s update, the hourly chart was showing a rounded top formation and that ”lower prices are in the immediate future.” At this point, the hourly is now deeply oversold and the market has dropped near to a very pivotal level of short-term support that runs from 32473 through 32400.

Dow Jones Industrial Average Hourly HLC

That area remains pivotal support with one more minor spot at 32343. A breakdown under 32343 opens counts to critical short-term support of 32867/32850. A breakdown with closes under 32850 set up 32099 with longer-term potential toward 31727/31686. Closes under 31686 will open counts into the 30972/30960 level with support of 31423 and 31160.

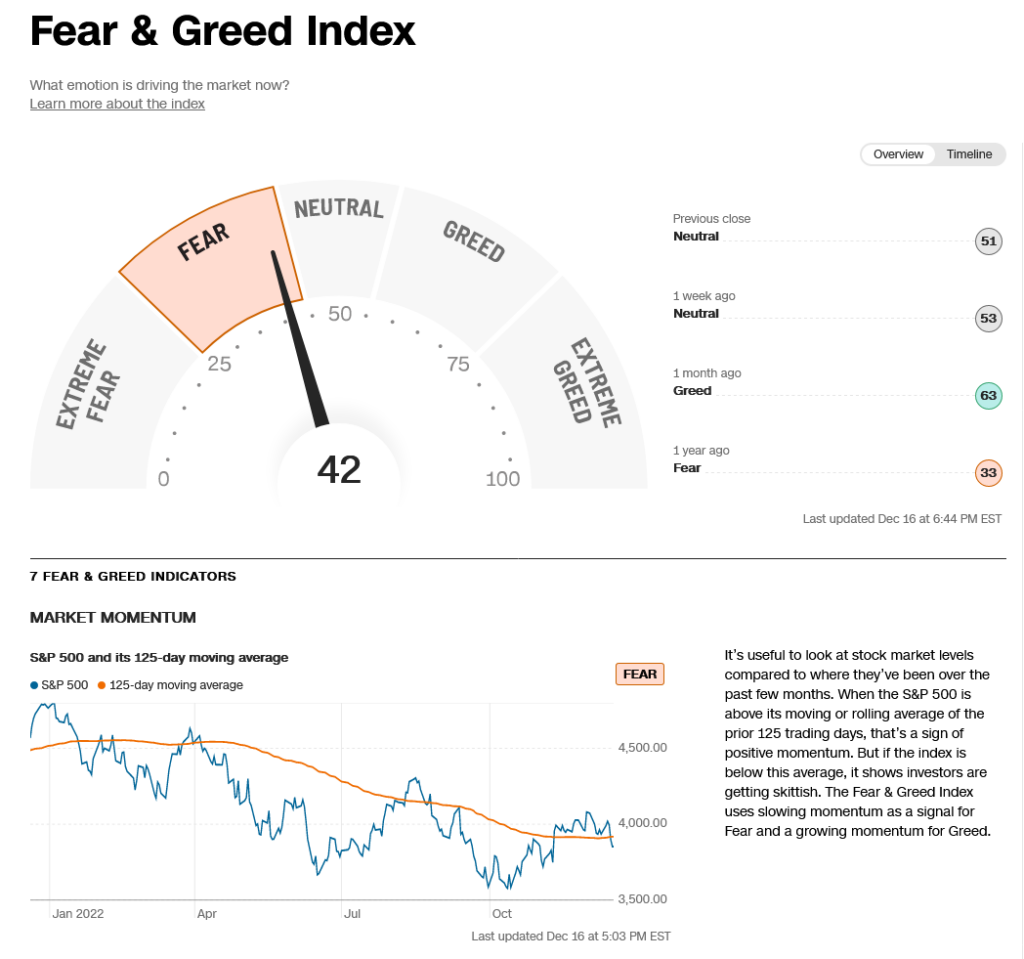

CNN Fear & Greed Index

Dow Jones Industrial Average Weekly HLC

Resistance is 33000 and 33140/33188. A drive above 33188 should test 33290/33296 with potential to short-term pivotal resistance at 33440/33450. Closes back over 33450 are near-term friendly and suggest a drive to 33683 with resistance at 33608/33626. A close over 33683 sets up critical short-term resistance at 33926/33940. Closes over 33940 are bullish and set up a move to 34197/34226. Above 34226 will test 34400 with a shot at the recent highs at 34712.

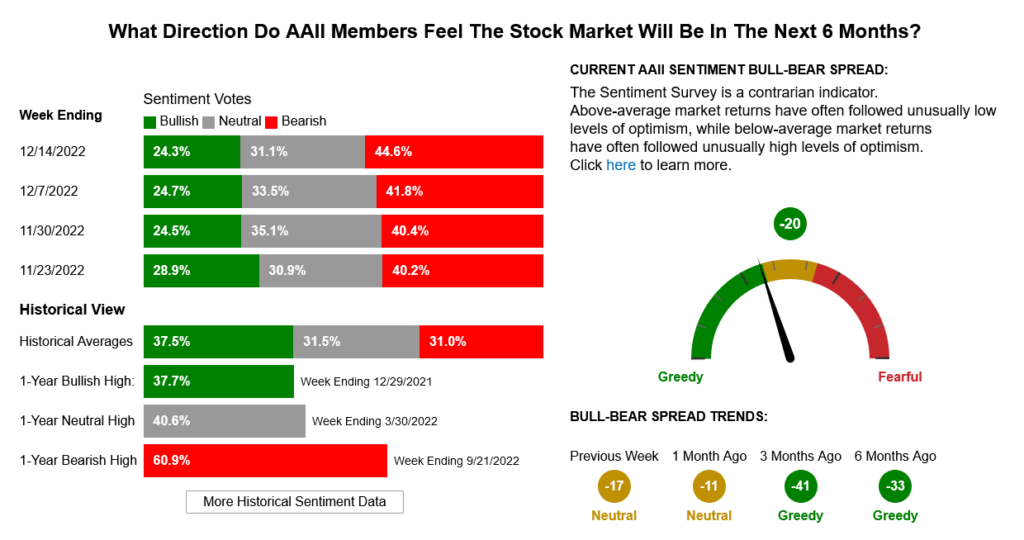

AAII Investor Sentiment Survey

Resistance

- 33000 **

- 33140/33188 *** ↑

- 33290/33296 *** ↑

- 33367 **

- 33440/33450 *** ↑

- 33683 *** ↑

- 33926/33940 *** ↑

- 34197/34226 *** ↑

- 34400 **

- 34700/34712 *** ↑

Support

- 32800 *** ↓

- 32654 **

- 32473/32400 *** ↓

- 32343 **

- 32324 *** ↓

- 32170 **

- 32099 ***

- 31727/31686 *** ↓

- 31423 ***